Tesla Shareholder Meeting Results: What Have We Learned?

Strong support for changes to environmental, social, and governance practices means Tesla’s board has some key decisions to make.

Last week’s annual shareholder meeting at Tesla TSLA set a number of important markers for the proxy year ahead.

Environmental and social themes continue their rise up the corporate agenda, and perennial governance issues such as board composition and executive compensation remain a key feature. This is true at Tesla and for public companies globally.

Here we take a deep dive into the level of shareholder support for proposals filed at Tesla and highlight three key takeaways for the new proxy year.

Some Way to Go on Governance

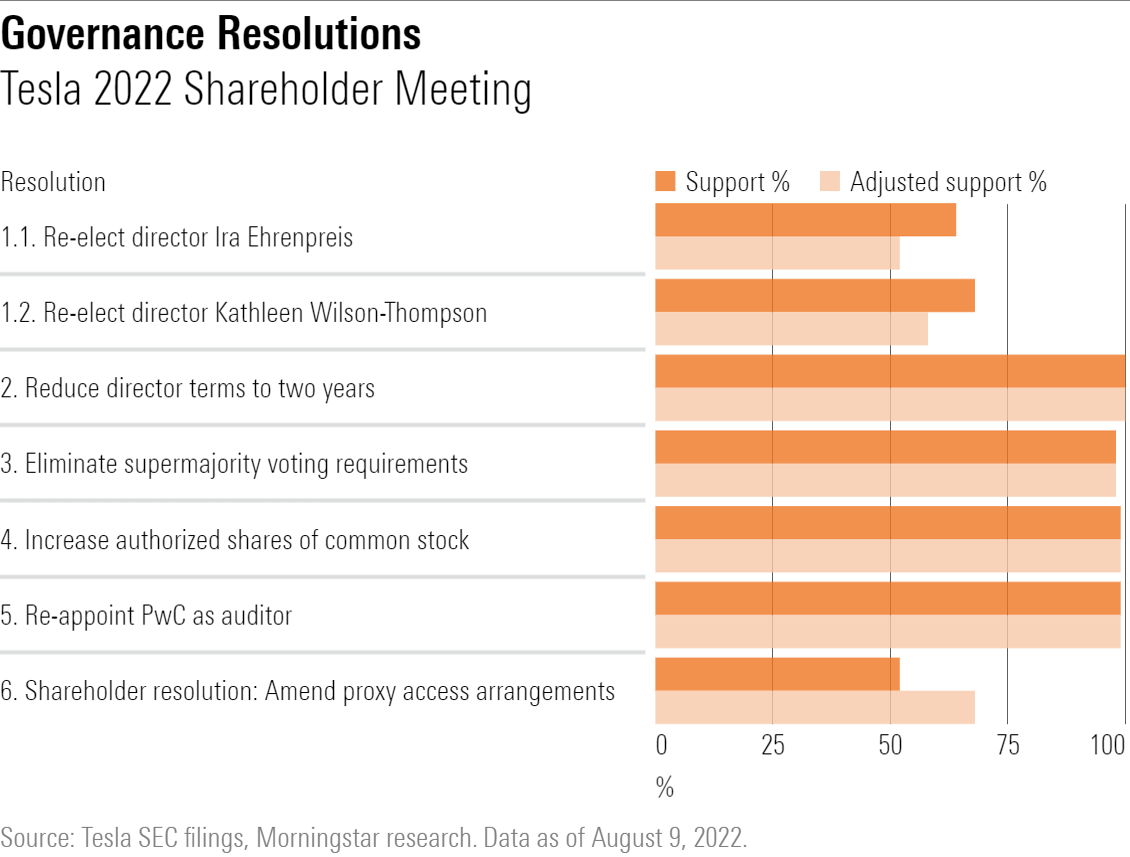

In our preview of the Tesla shareholder meeting, we noted that eight of the 13 proposals were shareholder resolutions: two environmental, five social, and one governance. The governance resolution was the only one to gain the required shareholder support to pass (more on that later). However, it’s also worth taking a close look at the results for the management proposals, where shareholders have also indicated a desire for change.

The sole governance-related shareholder resolution aimed to improve proxy access at the company—that is, to allow large, long-term Tesla shareholders, or groups owning more than 3% of the company’s equity, to nominate directors.

This proposal was supported by 52% of shareholder votes, or 68% of independent shareholders if we adjust the numbers to exclude CEO Elon Musk’s stake. (We assume Musk voted all his shareholding of around one sixth of the company in line with the board’s recommendation, supporting all the management resolutions and rejecting all the shareholder resolutions.)

The Tesla board argued against the proxy access resolution, stating that “the proposal provides no safeguards against stockholders seeking to use proxy access to nominate directors who will act only in their individual interests. … Indeed, this proposal could be exploited by corporate raiders solely to effect a change of control.”

With this being an advisory vote, it is now up to the board to outline to Tesla’s independent shareholders whether and how it intends to address their demand for proxy access—no easy task having come out so strongly against it before the meeting.

Stock Split Passes; Proposals to Bolster Board Accountability Fail

Looking at the management resolutions, a proposal to triple the authorized share count to pave the way for a 3-for-1 stock split passed easily. Tesla’s planned stock split—the second in its history—is seen as a way to bolster the company’s share price by making it easier for investors to trade the stock in smaller quantities.

In contrast, two proposals to cut directors’ terms from three to two years and eliminate supermajority voting requirements did not pass. These resolutions were management proposals intended to address long-standing concerns among Tesla shareholders about director entrenchment at the company, and they have quite a history behind them.

A proposal to eliminate supermajority voting requirements has appeared on Tesla’s proxy card for three years running: twice as a management proposal in 2021 and 2022 following a shareholder resolution in 2020. These proposals were supported by a majority of voting shareholders on all three occasions.

In 2021, there were competing management and shareholder resolutions on the length of director terms. Management proposed a reduction from three years to two. The shareholder resolution proposed a complete declassification of the Tesla board, meaning that all directors would be elected annually.

Despite near-unanimous votes in favor, the two proposals failed this year because they required a supermajority of 66.7% of the total share capital to pass. The count fell just short of this, with 64% of Tesla’s total share capital voted on these two proposals.

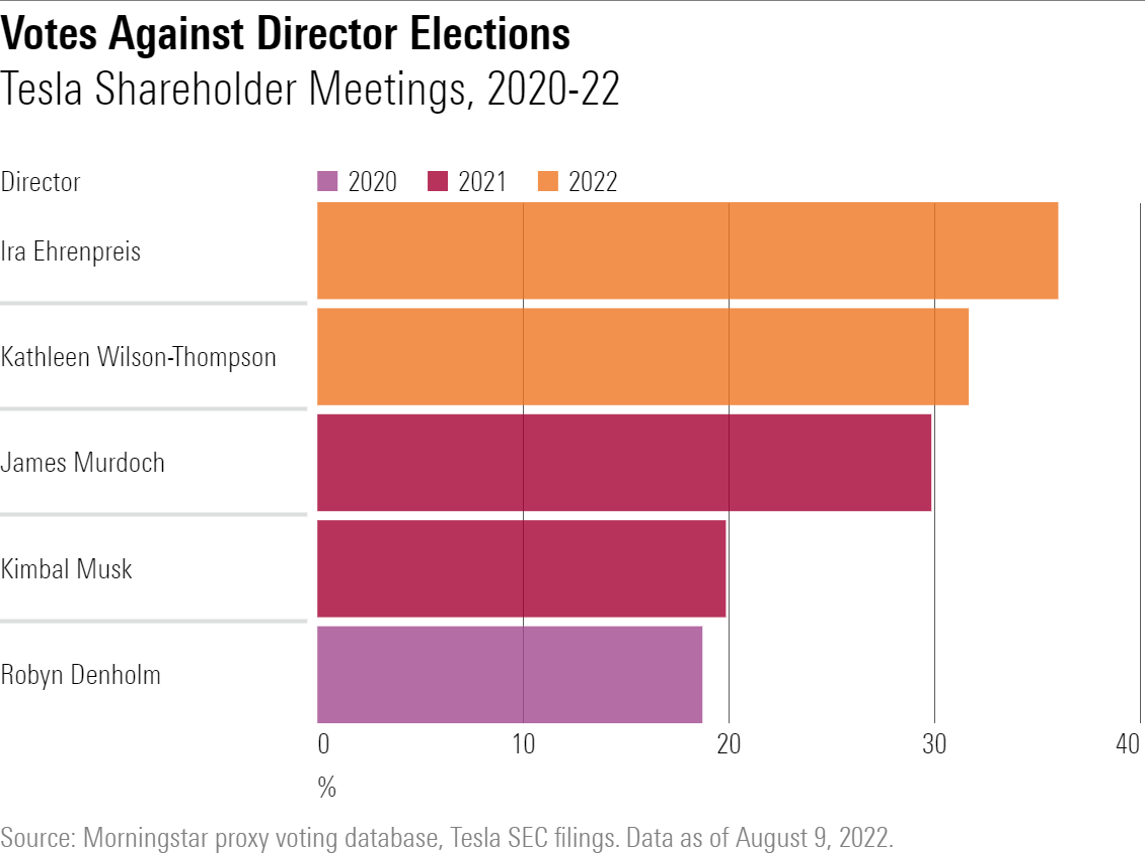

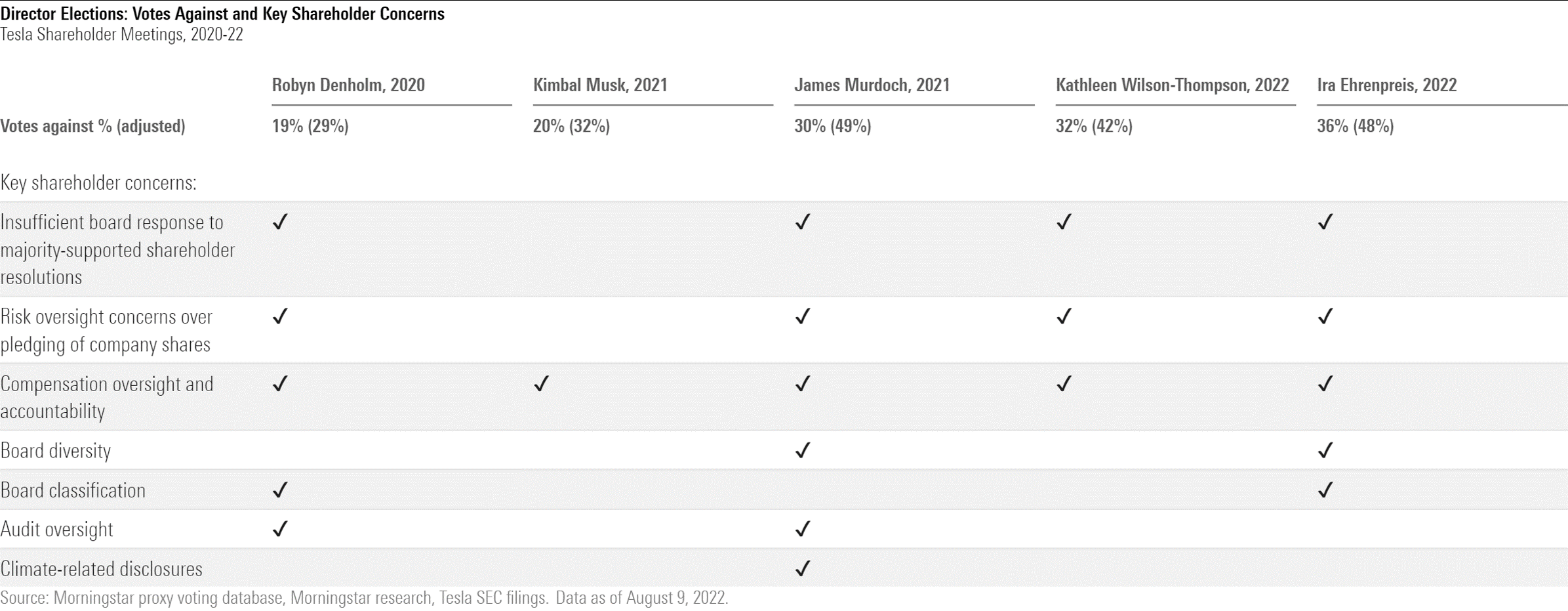

Exasperation about board accountability and responsiveness to shareholder concerns at Tesla was clearly expressed in the votes for the re-election of directors Ira Ehrenpreis and Kathleen Wilson-Thompson this year. While their re-elections were passed at the Tesla shareholder meeting, around one third of voting shareholders rejected their re-election—or more than 40% of independent shareholders on the same adjusted basis mentioned earlier.

This also is not a new theme. As the chart above shows, there has been a recurring record of shareholder dissent over director elections in the past three years. We reviewed the voting rationales of eight large asset managers that disclosed reasons for their votes against Tesla directors.

Expect More Dissent Over Labored Progress on Governance

Shareholder dissent centers on perceptions that Tesla is slow to respond to majority-supported shareholder resolutions, as well as its directors’ practice of pledging the company’s stock as financing collateral, which raises risk-oversight concerns. Asset managers also cite concerns about oversight of management compensation, a lack of board diversity, and reporting and audit oversight issues.

Independent shareholders are unlikely to display infinite patience with Tesla’s labored progress on implementing more shareholder-friendly governance practices. Despite recent volatility, Tesla remains a significant shareholding for many asset managers, so it will be interesting to see how they intend to escalate their concerns.

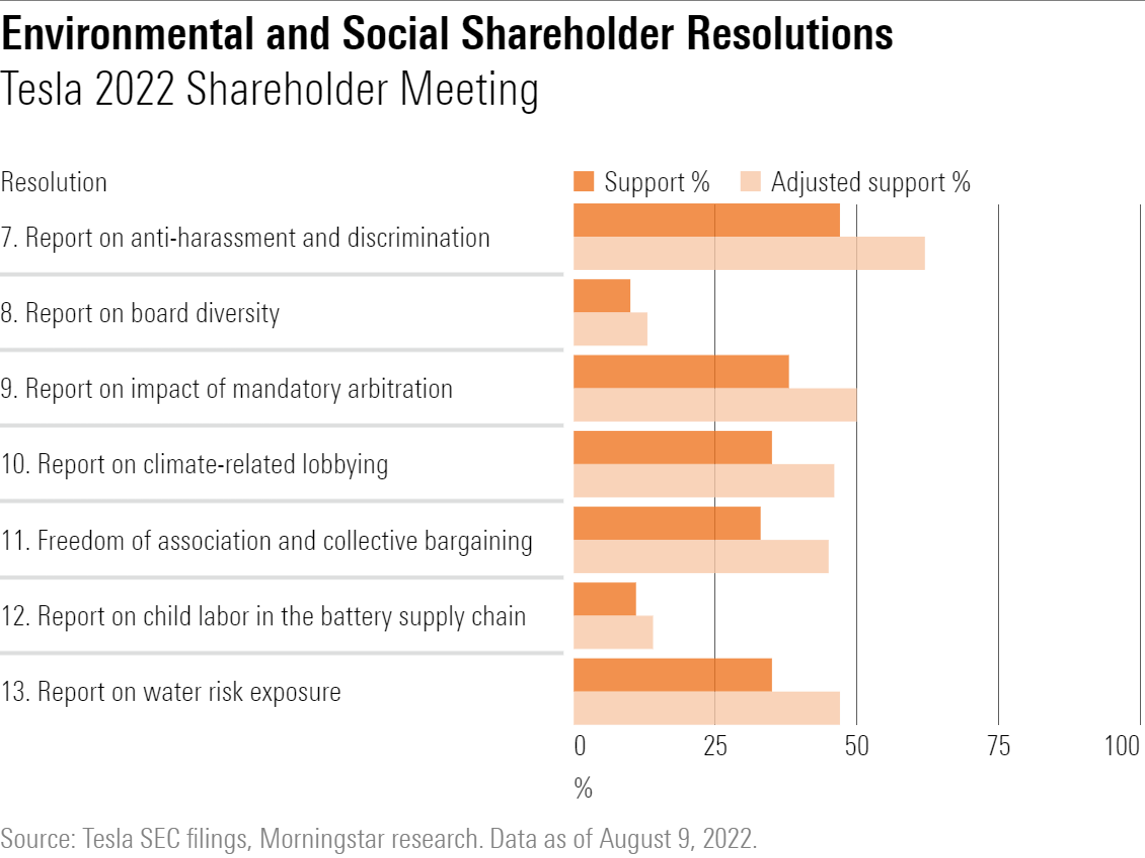

Environmental and Social Resolutions: Strong Support Poses Questions for Tesla’s Board

Although none of the seven shareholder resolutions on environmental and social themes gained outright majority support, five were supported by at least one third of voting shareholders.

As shown on the chart below, two of these resolutions gained majority support from independent shareholders, again adjusting to exclude Elon Musk’s shareholding. Both relate to workplace rights and practices at Tesla: one on anti-harassment and discrimination efforts, and the other on mandatory employee arbitration.

The other three well-supported resolutions—the environmental proposals on water risk and climate lobbying and the social proposal on freedom of association and collective bargaining—received more than 40% support on the same adjusted basis.

These results should also give the Tesla board plenty to think about, as they further add to the list of strongly supported shareholder resolutions that asset managers have accused the company of being slow to implement.

The resolutions on child labor and board diversity reporting received support from only around one tenth of voting shareholders. It’s possible that this was due to shareholder concerns over resolutions seen as “unduly prescriptive,” which we covered in our recent research.

Three Key Takeaways for the New Proxy Year

The results of Tesla’s shareholder meeting largely reflected voting trends seen in the proxy year just ended, but there are important insights useful to investors considering their ESG priorities for the new proxy year. Here are three key takeaways:

- First, the increase in environmental and social resolutions hasn’t dimmed asset managers’ focus on core governance issues such as board independence and oversight. In fact, these are seen as essential elements in ensuring that company management delivers on both financial and operational goals as well as environmental and social objectives.

- Asset managers are continuing to apply scrutiny to shareholder resolutions, rejecting those that constrain management’s ability to decide a company’s strategy, however well-intentioned their objectives may be. This will be an important factor in the context of an expected further increase in shareholder proposals, with the SEC again planning to relax restrictions on which resolutions can be filed.

- The spectrum of requests from filers of shareholder resolutions is widening. Increasingly, environmental resolutions encompass themes much broader than just greenhouse gas emissions, branching into areas as diverse as water risk, biodiversity, deforestation, and environmental policy influence. Social resolutions are also broadening in scope—diversity, equity, and inclusion remains a key theme, but proposals on worker rights and protections are increasingly coming to the fore.

In such a dynamic environment, asset managers’ voting and engagement policies and practices will need to continue to adapt to the new reality.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)