Proxy Voting: Where Does Your Fund Manager Stand on ESG Issues?

As environmental and social proposals proliferate, fund managers are outlining their voting intentions in greater detail.

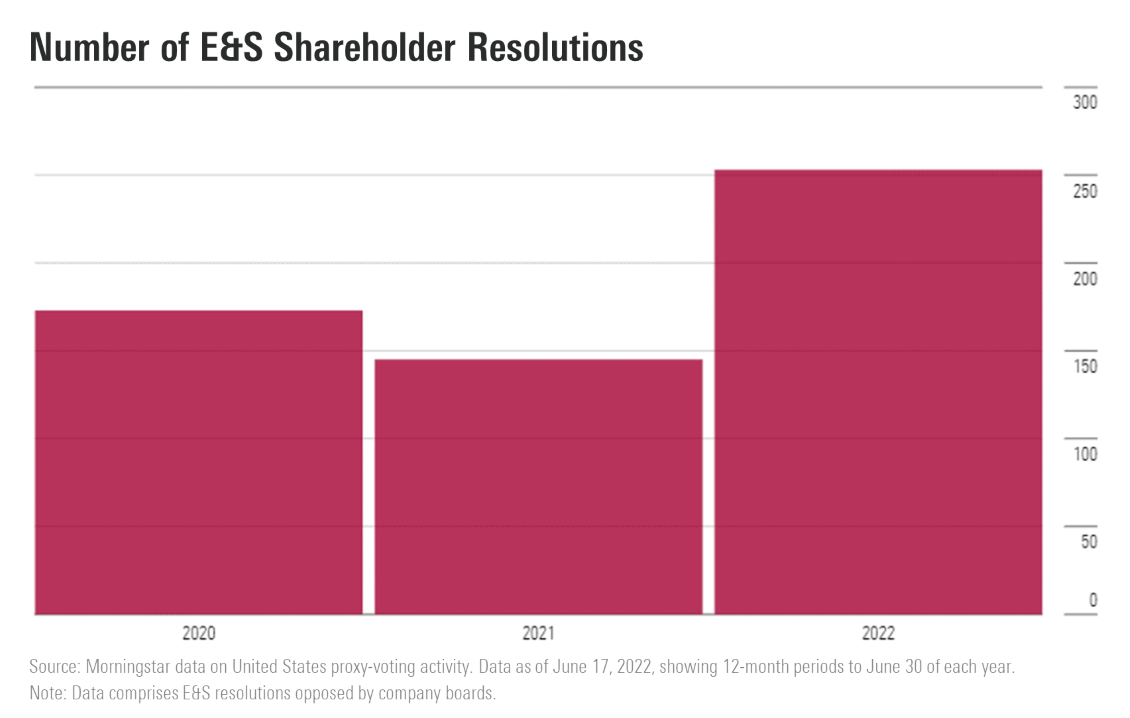

This year’s proxy-voting season has just ended, and there have been some huge changes in trends, both in the number of shareholder proposals and their levels of support.

We’ve seen a sharp increase in the number of shareholder proposals on environmental and social, or E&S, themes this year. There were more than 250 E&S shareholder resolutions opposed by company boards in the year to June 2022, compared with 145 in the same period last year. The lifting of Trump-era restrictions on such shareholder proposals at the end of 2021 has been a key catalyst behind this increase.

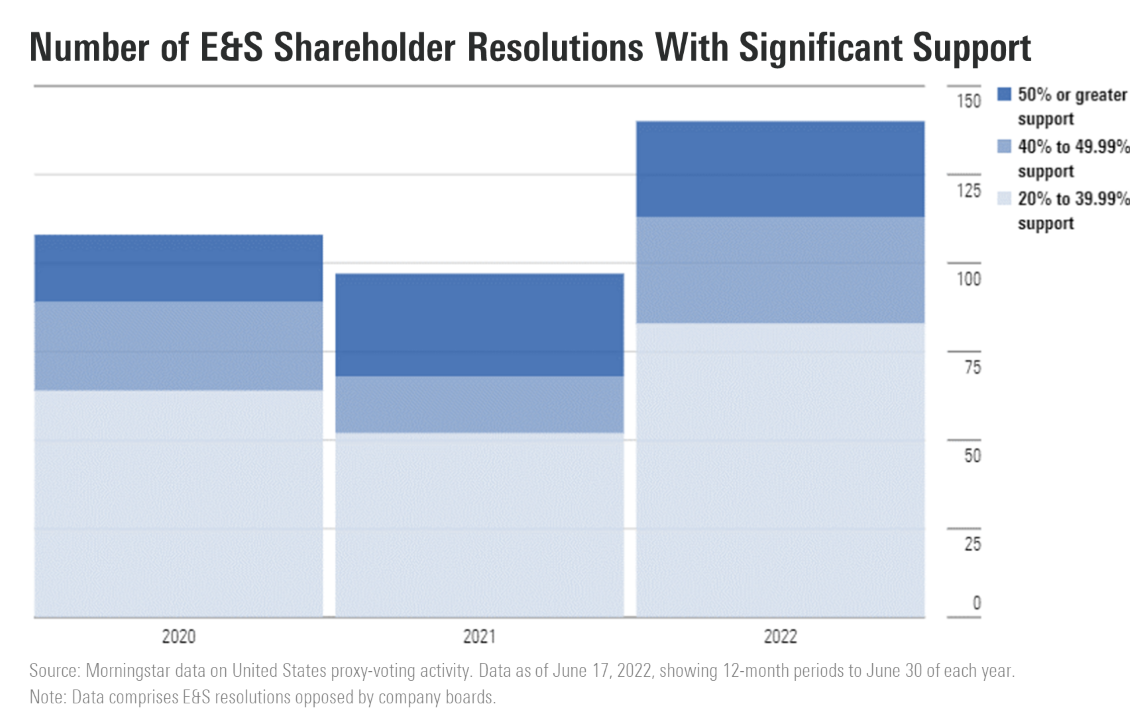

The number of these proposals gaining significant shareholder support is also on the rise. Out of this year’s resolutions, 140 gained the support of more than 20% of shareholders and 27 actually gained majority shareholder support.

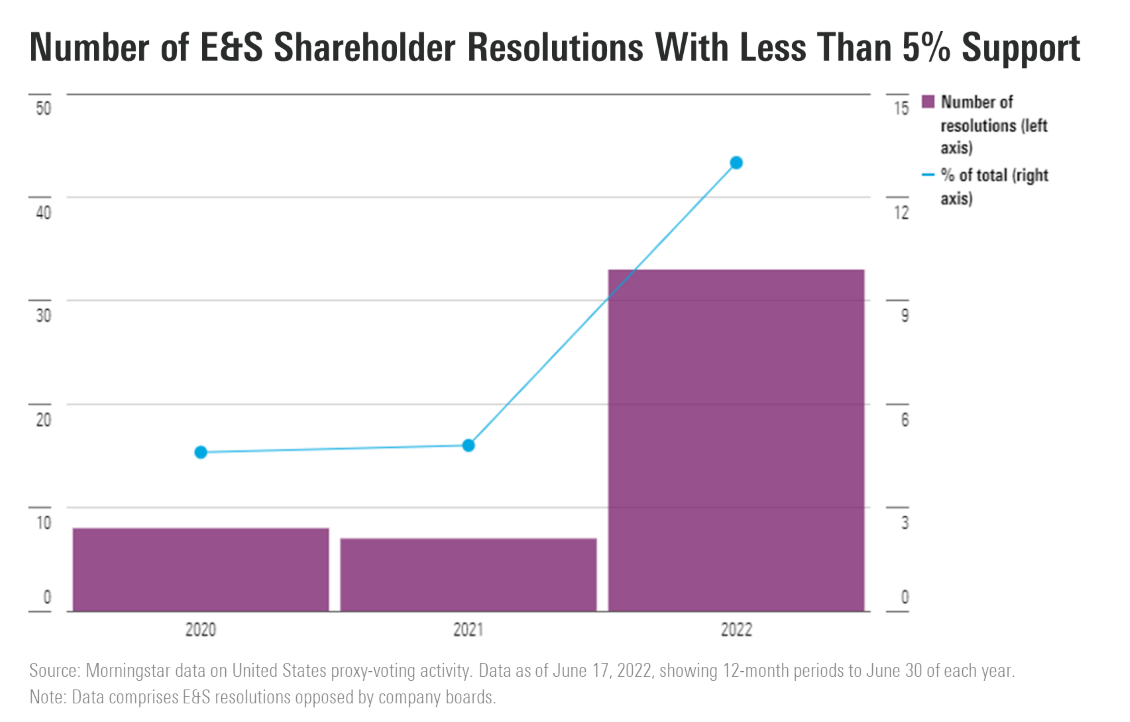

The number of proposals with low support has also grown. BlackRock generated news headlines in May when it announced it was “likely to support proportionately fewer [shareholder resolutions] this proxy season than in 2021″ owing to an increase in the number of proposals perceived as inappropriately prescriptive. The data for the 2022 proxy year suggests this trend covers more than just one asset manager.

This year, the number of E&S shareholder resolutions with a very low level of shareholder support (5% or less) has increased to 13% of the total, up from around 5% in the two previous proxy years.

What Do Proxy-Voting Policies Tell Us About Managers’ Positions on E&S Issues?

The results of these shareholder votes often depend on what is in asset managers’ proxy-voting policies. These policies are typically written by specialist teams at each asset manager who work alongside fund managers to develop policies that best fit the asset manager’s investment objectives.

While proxy-voting policies mainly address governance themes, increasingly they also include guidance on how investors intend to vote on E&S proposals, particularly in key areas like the following:

- Climate change

- Biodiversity and natural capital

- Diversity, equity, and inclusion and human capital management

- Human rights and labor rights

This is a benefit to fund investors: Detailed policies lead to more-predictable voting outcomes for asset managers, and that helps investors make informed choices about which manager’s voting approach best reflects their own E&S priorities.

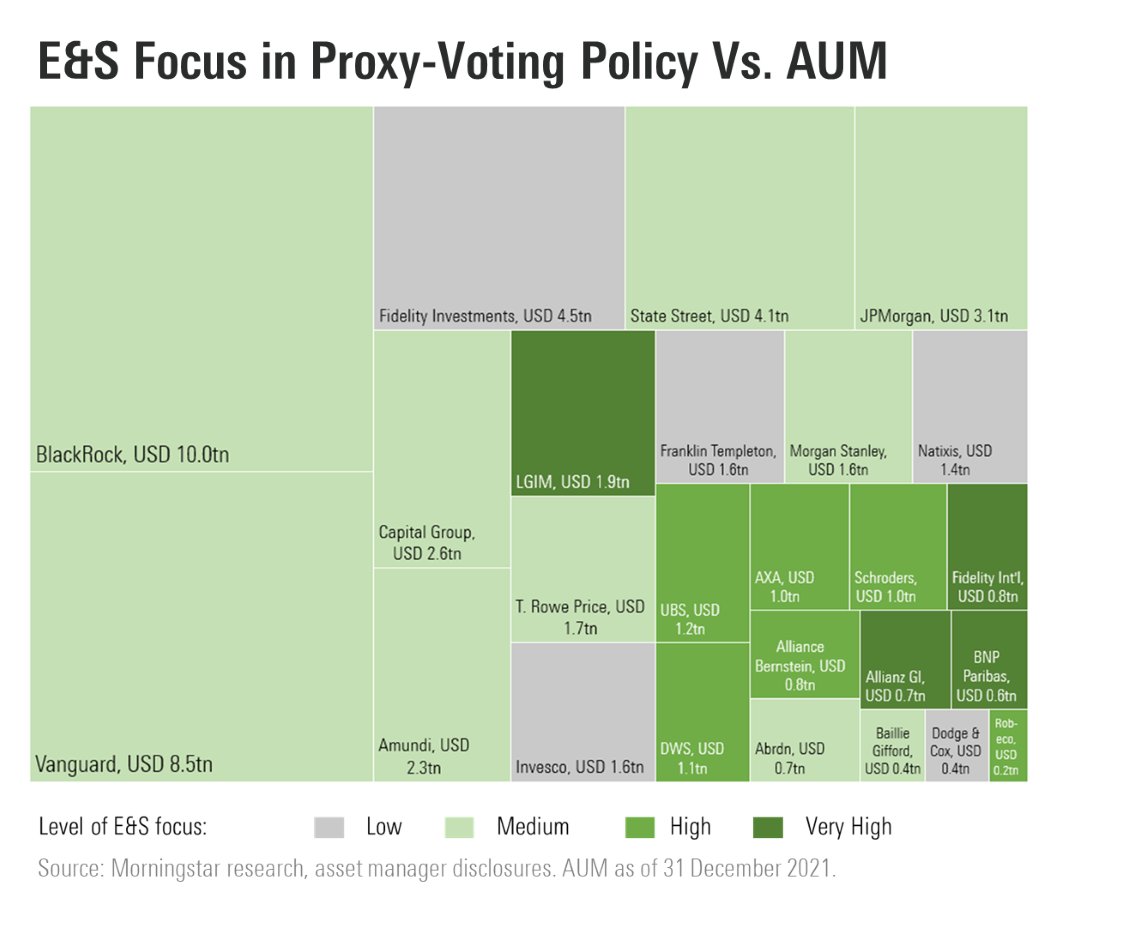

Our latest research paper analyzes the level of focus on these E&S themes in the current proxy-voting policies of 25 asset managers, including 12 based in the United States and 13 based in Europe. They are a representative selection of the largest equity fund managers that we have previously assessed for the Morningstar ESG Commitment Level rating.

Looking at the 25 managers’ current proxy-voting policies, we assessed their overall active ownership philosophies and approaches to shareholder resolutions on E&S themes. We also evaluated each manager’s level of focus on the key E&S themes listed above, considering whether policies on these themes are present and sufficiently specific to give predictable voting outcomes at shareholder meetings. Based on this, we grouped the asset managers in four categories based on their level of focus on E&S themes, from Very High to Low.

The 25 managers have $54 trillion of assets under management, with the U.S. asset managers making up almost three fourths of the total. The “big three” index asset managers—BlackRock, Vanguard, and State Street—account for $23 trillion of AUM; all three have a Medium E&S focus. Managers with a High or Very High E&S focus (shown in dark green on the chart above) account for $9 trillion of AUM. Except for AllianceBernstein, all of those are based in Europe.

What Do the 4 Categories Tell Us About Managers’ Stances on E&S Issues?

The 10 managers with a High or Very High E&S focus in their proxy-voting policy—including Allianz GI, LGIM, UBS, and Schroders—tend to include detailed and specific policies on several climate-related themes and often cover other environmental themes such as biodiversity, natural capital, deforestation, and water usage. They also outline in detail their rationale, targets, and voting intentions for DEI and human capital management issues—advocating for greater female and racial/ethnic representation on boards—and often also have detailed policies for human rights and labor rights.

Managers with a Medium E&S focus—including Amundi, Capital Group, and JPMorgan, along with the big three—often outline their expectations and voting intentions for climate matters, but in less detail than managers with a High or Very High E&S focus. Additionally, it is much rarer to find specific policies for biodiversity issues within this group. Finally, managers with a Medium E&S focus usually have detailed policies on DEI issues—also advocating for greater female and racial/ethnic representation on boards—but offer less detail on human rights and labor rights issues.

Meanwhile, managers with a Low E&S focus—including Fidelity Investments (not to be confused with Fidelity International, which has a Very High E&S focus), Franklin Templeton, and Invesco—tend not to have detailed E&S policies. They often indicate that operational matters are left to management discretion, giving case-by-case consideration of support for shareholder resolutions on E&S issues.

Our research reveals a wide variety of approaches to key E&S themes in asset managers’ proxy-voting policies, and it’s important to remember that proxy-voting policies are only one part of a manager’s overall active ownership strategy. Engagement with investee companies, reporting, and public policy activities are also key factors. However, if fund investors are seeking answers on which asset managers’ actions best reflect their values, proxy-voting policies are a good place to look.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)