Tax Risk Is Growing for Companies. Trouble Ahead for Cisco Systems, Microsoft?

Tighter tax regulations, shareholder demands, mean that boards—and investors—should beware.

Corporate tax risk is rising, based on a study of shareholder and government proposals by Morningstar Sustainalytics.

The topic of corporate tax accountability has yet to reach celebrity status in the sustainability world. According to one estimate, tax havens collectively cost governments USD 500 billion to USD 600 billion a year in lost corporate tax revenue. That’s posing risks for companies like Cisco Systems CSCO and Microsoft MSFT, both of which hold their annual general meetings in the coming days and face demands for tax transparency from shareholders.

Taxation is gaining ground as a significant topic for broader society, issuers, investors, and lawmakers. In 2023, we’ve seen increasing cooperation and progress in adapting the global tax system to the digital economy and tackling corporate tax avoidance; a fast-evolving EU sustainability regulatory backdrop; a greater spotlight on major corporate tax avoidance controversies; and an increased use of investor proxy-voting rights calling for tax transparency.

Countries Are Cracking Down on Tax Avoidance

In 2023, complementing related efforts at the Organization for Economic Cooperation and Development, several countries worked to independently address tax avoidance and improve the integrity of their national tax systems. For example:

- Australia is taking steps toward increasing the integrity of the tax system, offering protection to whistleblowers, and ensuring higher penalties for tax-avoidance scheme promoters;

- Canada is moving forward with a unilateral digital services tax;

- Germany and China have called for more coordination among countries implementing the OECD two-pillar solution and have pledged to help developing nations administer these rules;

- Ireland is developing new rules aimed at reducing tax avoidance by large multinationals;

- Kenya is limiting loopholes for multinationals seeking to avoid taxes;

- The United Kingdom is considering tougher measures against promoters of tax avoidance, which includes enablers and anyone else involved in the supply of tax-avoidance schemes, which often includes umbrella companies;

- The U.S. Internal Revenue Service announced that it is stepping up enforcement efforts to address money owed but not paid, with a focus on several types of taxes, including corporate taxes.

The web of developments and their growing frequency will make it more difficult for companies to effectively manage risks without more robust governance and a new sustainability-oriented philosophy to manage tax affairs.

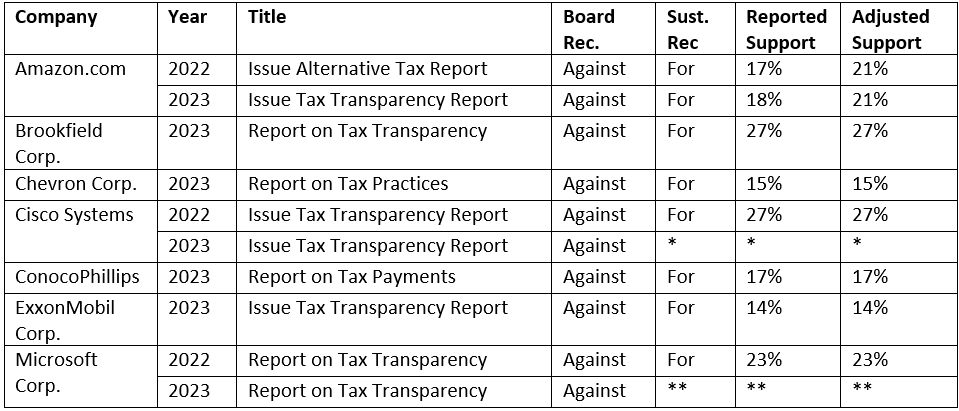

Investors are increasingly exposed to tax-related risks. As a result, the last two years have brought an unprecedented number of shareholder proposals attempting to address these risks. Across 2022 and 2023, 10 tax-transparency-related shareholder proposals were filed at U.S. companies. Those proposals were supported by 19.3% of shares voted on average and adjusting for insider control. This is a significant result given the emerging nature of the issue.

In particular, both Cisco Systems and Microsoft face shareholder votes on Dec. 6 and Dec. 7, respectively, each for the second time. During the previous year, the Cisco proposal won 27% of the shareholder vote. The Microsoft proposal won 23%. Again, these are significant results.

Tax Risk Ahead?

For companies, the importance of good governance and tax transparency is reinforced:

- In March 2023, following accusations by the U.S. IRS of underreporting taxes by USD 10.7 billion for the six years between 2010 and 2015, Amgen AMGN was sued by one of its shareholders in a class-action suit, where the shareholder accuses the company, the CEO, and the CFO of concealing the dispute with the IRS. Amgen believes the allegations are without merit and plans to defend itself against the case.

- In October 2023, Microsoft announced it is subject to the largest audit in the history of the U.S. IRS, which claims the company owes USD 28.9 billion for the years 2004 to 2013.

- In October 2023, TaxWatch estimated that Apple AAPL, Microsoft, Alphabet GOOG, Amazon.com AMZN, Meta META, Cisco, and Adobe ADBE have avoided GBP 2 billion in U.K. taxes.

- In October 2023, the Australian Tax Office recovered approximately AUD 6.4 billion in taxes from mining and fossil fuel large multinationals, including Rio Tinto RIO and Ampol CTXAF.

- In November 2023, an Italian judge ordered EUR 780 million to be seized from Airbnb ABNB related to allegations of tax evasion.

- In November 2023, in the context of the EUR 13 billion EU illegal state aid case involving Apple’s Ireland operations, a recent recommendation by an advisor to the Court of Justice of the EU may trigger a new ruling by the latter.

- In November, the Indian Income Tax Department made public an ongoing investigation into the Indian operations of Apple, Google, and Amazon, regarding potential nonpayment of taxes estimated at USD 600 million.

All these data points suggest that a major shift in thinking about tax transparency may be taking place among issuers and investors. This will play a central role in the sustainability discussion.

We believe boardroom agendas will increasingly include taxation as companies grapple with the ever-changing tax landscape and with stakeholder pressures to become better global citizens. Boards will have to ensure that governance frameworks are sufficiently robust to mitigate the short- and long-term risks. That presents a new challenge. Directors will need the right level of expertise and experience to appropriately value tax risk management and competently monitor tax-related risk factors.

Mihnea Gheorghe and Andrew Spurr are stewardship managers for Morningstar Sustainalytics.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)