Curious About Sustainable Investing? Start With These 2 Questions

Sustainable investing can feel tricky. Here’s how it can fit into your toolbox.

Sustainable investing began as an appealing new frontier but has become a contentious issue. Regardless, it continues to provide numerous opportunities for investors, many of which may be lost in the fray of negative media attention and contentious political battles. To make matters worse, investors who are curious about sustainable investing must also contend with the complexity behind it. Sustainable investing comes with its own nomenclature, definitions, frameworks, and datasets, and across providers and sources there are sometimes conflicting viewpoints and outright contradictions.

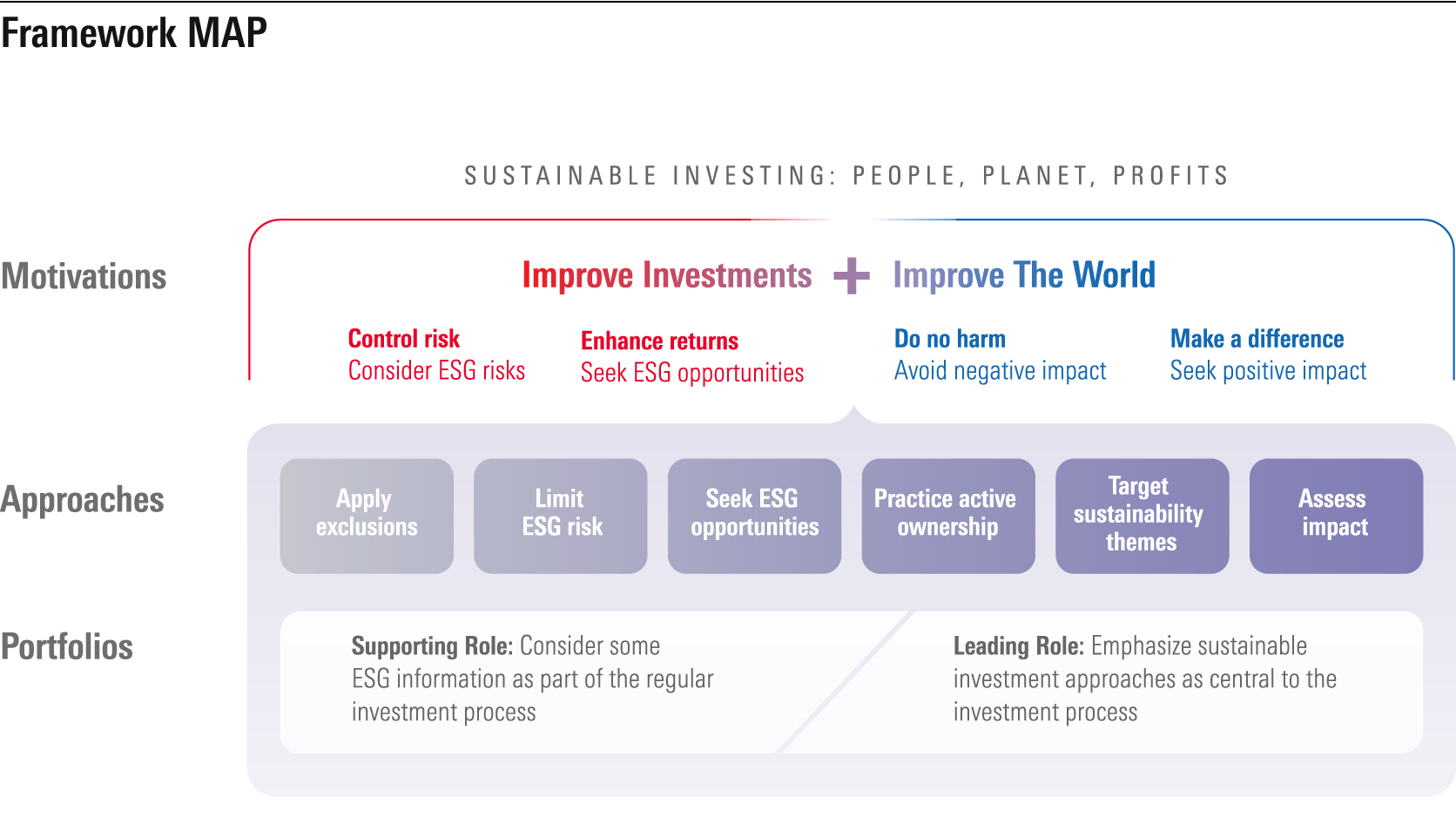

For example, many people only associate sustainable investing with factors that aim to improve the world and lean left politically, but sustainable investing can also mean managing environmental-, social-, and governance-related risks in investments and strategies—which has nothing to do with political orientation. Exhibit 1 displays Morningstar’s framework for thinking about sustainable investing.

Exhibit 1: Framework MAP

Sustainable Investing Can Be Complicated

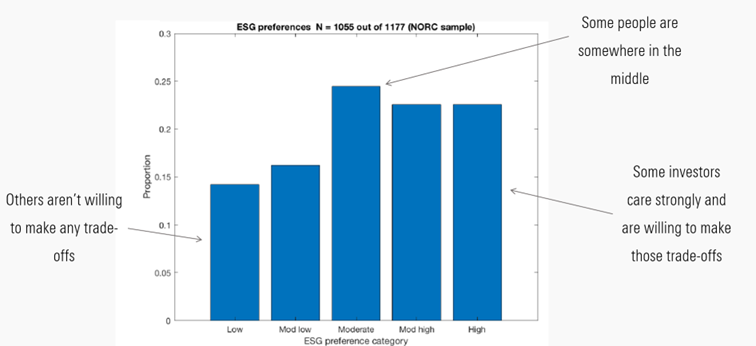

At Morningstar, we’ve examined investor interest in sustainable investing and found a nuanced story. Investor interest in sustainable investing is not all-encompassing but varies depending on the aspect of it that’s in focus. For example, Exhibit 2 displays results from a study where we used a revealed-preferences approach to quantify people’s interest in the “Improve the World” aspect of sustainable investing.

Overall, we found that most people were at least moderately interested in sustainable investing; however, there was a wide range of preferences. Some people were willing to even give up some returns (even though no such trade-off may exist according to some recent research) for the sake of sustainability, while others weren’t willing to make any trade-offs. In other research, we found further evidence of people’s complicated preferences for sustainable investing. For example, we found that how sustainable investing is described can have a negative impact on investing decisions, even prompting some people to invest less in a hypothetical retirement account when sustainable investing information was made salient.

Exhibit 2: Distribution of ESG Preferences

Seeing Sustainable Investing as a Tool in Your Toolbox

All together, these findings don’t necessarily indicate that sustainable investing is on its way out; instead, it means that some facets of the industry may be approaching sustainable investing in an unproductive way. Instead of focusing on sustainable investing on its own, maybe we should be considering how it can be used to help investors get closer to their goals. To answer this question, consider the following process:

1. First, think about your goals and what drives you as an investor. Try using an exercise like this one to guide you through a more-systematic process of discovering and understanding your goals. Don’t be afraid to consider your life values during this step, even though these may not seem immediately tied to your finances. Write your goals and values down, and keep them in sight.

2. Now, take a small step into sustainable investing by considering the following questions:

- Are there any companies (or causes) that appeal to you? Why? What value or goal is this related to for you?

- Are there any companies (or causes) that are aversive to you? Why? What value or goal is this related to for you?

Step 2 can give you some insight into your actual interest in sustainable investing. For example, let’s say you realize Patagonia appeals to you because of the great work they do for the environment. In fact, you even shop exclusively at Patagonia for outdoor gear because of this. In which case, the “targeting sustainability themes” aspect of sustainable investing may be a good fit for you. Or maybe you realize you are averse to Walmart WMT because you believe the increasing number of lawsuits it faces make it a riskier long-term investment. In that case, the “limit ESG risks” aspect of sustainable investing may be worth pursuing. There are myriad different reasons you may have for integrating sustainable investing into your investments.

Keep Your Eye on the Prize

Sustainable investing may feel like a mine field nowadays, but it holds promise for investors. In some ways, it allows people to uphold their values as individuals and achieve their long-term financial goals simultaneously. Moreover, sustainable investing can give investors more reasons to invest and stay invested, which is especially valuable during market volatility. Nonetheless, the industry’s messaging around sustainable investing, and the political battles that have ensued, may have muddled some of these possibilities for investors. To help see the opportunities in sustainable investing, start by focusing on your goals (and maybe even your life values), and then identify how sustainable investing can help you achieve those ends.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)