How Often Do You Really Need To Meet With Your Clients?

What the quality and quantity of meetings can mean for advisor-client relationships.

Is there a sweet spot for the cadence of client meetings?

From a numbers perspective, it may be necessary for an advisor to meet with a client only once a year to revise their plan based on any recent updates. But how about from a client’s perspective?

In past research, we have found a positive relationship between advisor-client interactions—whether that be a quick text message, email newsletter, or an in-person meeting—and advisor-client relationships. But does this finding hold for advisor-client meetings? And is there such a thing as too much?

How Often Do Most Clients Meet With Their Financial Advisors?

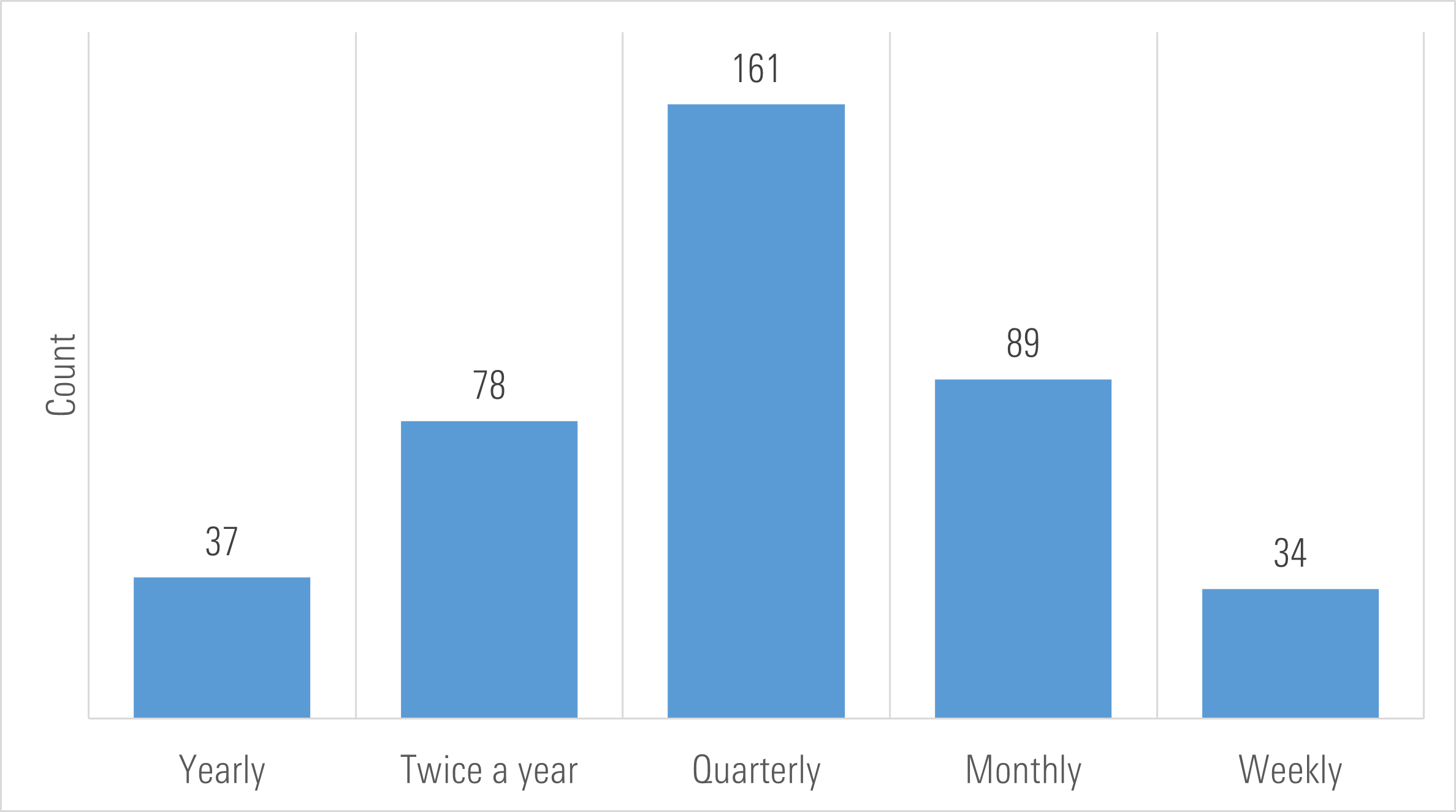

We asked 399 current advisor clients how often they met with their financial advisors and how long their meetings usually take. We also asked these clients how satisfied they were with their advisors. Before we dive into the relationship between these variables, let’s take a look at the participants’ answers.

Most clients in our sample met with their advisors on a quarterly basis, but those who didn’t were fairly split between meeting more or less often. In other words, there is a wide range regarding meeting cadence, again signaling that advice on how often to meet with clients is mixed.

How Often Do Clients Meet With Their Advisors?

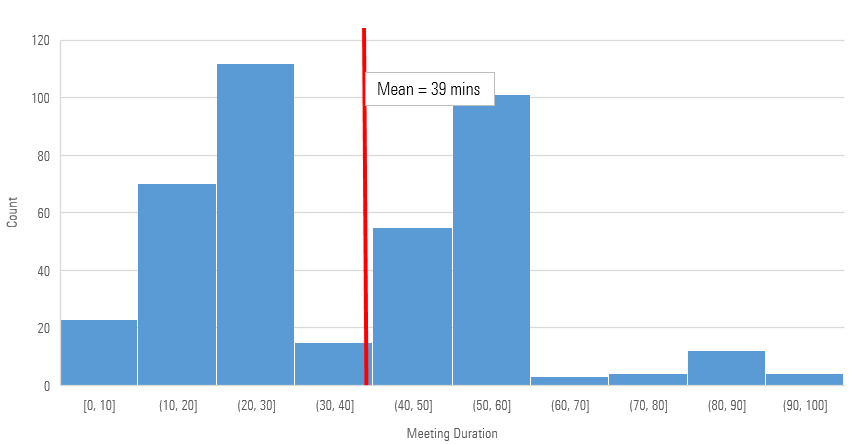

When we asked participants how long their meetings usually were, we again got a wide range of responses. Some clients seemed to meet with their advisors for quick 10-minute conversations, while others met for longer than an hour. The average meeting duration overall was 39 minutes.

Distribution of Meeting Duration

Is Meeting Cadence and Duration Connected to Client Satisfaction?

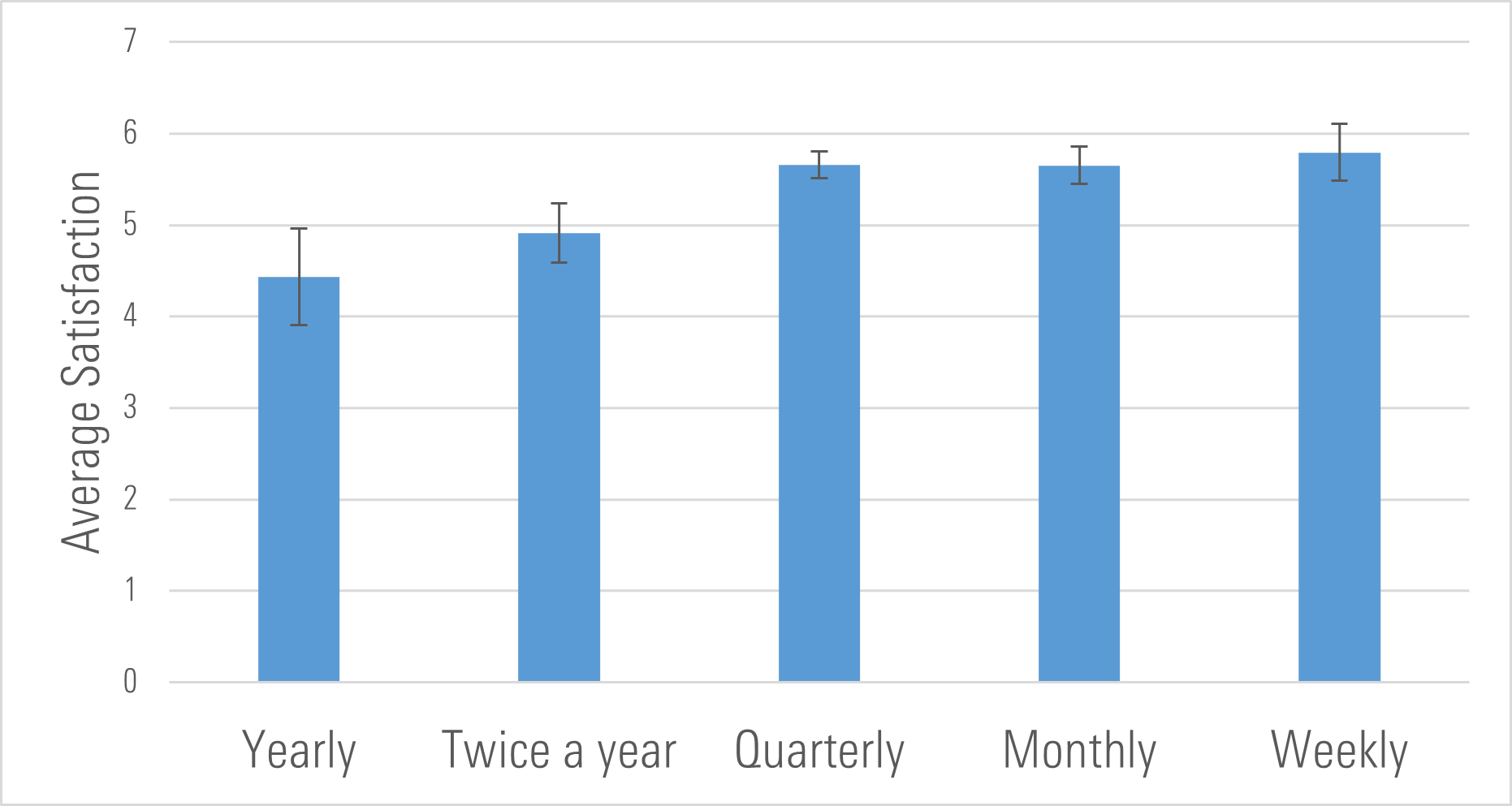

When we looked at the relationship between satisfaction and cadence and satisfaction and duration, we found mixed results.

When it came to the relationship between satisfaction and duration, there really wasn’t much to write about. We found a correlation of just 0.19 between the two variables. These results suggest that how long an advisor meets with a client may not have too much of an impact on that client’s overall satisfaction regarding the relationship.

It also seems like meeting with clients every quarter may be enough for client satisfaction. Although we only found a modest correlation between cadence and satisfaction (r = 0.31), further regression analyses suggest that cadence may affect a person’s satisfaction nonlinearly. The following graph shows that satisfaction does increase the more often clients meet with their advisors, but average satisfaction plateaus after increasing to quarterly visits.

Average Satisfaction by Meeting Cadence

3 Key Takeaways for Advisors

Our results from this simple analysis suggest a few key takeaways for advisors:

- In the absence of other preferences, consider trying out a quarterly meeting cadence. According to our data, in general, many clients may benefit from meeting with their advisors quarterly. This cadence may be especially useful for advisors who are just starting out or are struggling to engage with their clients. However, it’s important to note that every client is different, and advisors should consider their unique preferences when deciding on a meeting cadence.

- Focus on the content of each meeting, not the length. Meetings don’t have to be two hours long to be effective in promoting client satisfaction. Our results suggest that it’s the quality of time with your client that matters not the amount of time. Having a set schedule of what will be covered during the meeting can help keep things on track.

- Make sure to interact with your clients regularly outside of meetings. Regardless of how often you meet with clients, offer regular interactions with them through emails, newsletters, social media, or other forms. When it comes to maintaining a strong advisor-client relationship, staying top of mind is key.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)