Why It’s Important to Retire With Purpose

Retirement isn’t the freedom from work, but the freedom to do your life’s work.

For those who have saved a healthy nest egg, retirement is a dream destination, one where you have loads of free time and zero responsibility. Gone are the days of the 9-5 toil and traffic-riddled commutes. Once you retire, what you do with your day is completely up to you—you have the control. However, while breaking free from routines and having endless choices may sound great on the surface, it can be paralyzing if an investor approaches retirement without a plan.

Some research points to the existence of “retirement risk,” where retiring can boost the risk for heart disease and other medical conditions by 40%. Retirement was also ranked as one of life’s most stressful events. However, experts believe that the dangers of retirement can be mitigated by things like a strong sense of purpose and social connections. In other words: Making sure your finances are in order is just step 1 of preparing to retire, then it’s about making sure your goals and plans for retirement are aligned with your life purpose.

Where do life values fit in financial planning?

Identifying your life purpose may seem like an exercise in guesswork when it comes to financial planning, but there is value in aligning your financial decisions with what you deem important in life. Whether you call it your life purpose, life goals, or life values, these are the things that are your personal requirements to living a fulfilling and meaningful life.

Explained this way, it’s hard to justify not incorporating your life values into your financial plan. There is no logic in spending your money on things that do not make you happy. This concept also extends to retirement—there is no logic in spending your time, money, and resources on things that do not make you happy once you retire. Unfortunately, we don’t often take the time to consider what makes us happy. We bulldoze through goal-setting exercises, and list goals that are top of mind, but miss goals that are truly important to us. Then, we don’t go back and connect those goals to our life values.

For example, let’s go back to the “dream” of retirement. For some, this dream may consist of unlimited free time to play golf. I would argue that this plan is incomplete and not very well thought through. Realistically, golf may only take up a couple of hours per day, so what will this retiree do with the rest of their day? Also, playing golf every day may get tiring. What happens if they get bored? Injured? Need to relocate to a place without a golf course nearby? Poking holes in this retirement “dream” is all too easy and shows how the existing process for retirement life planning leaves many people with unmotivating and unsatisfying goals that can leave them directionless in retirement.

What is your life purpose?

Fortunately, we are not chained to the status quo.

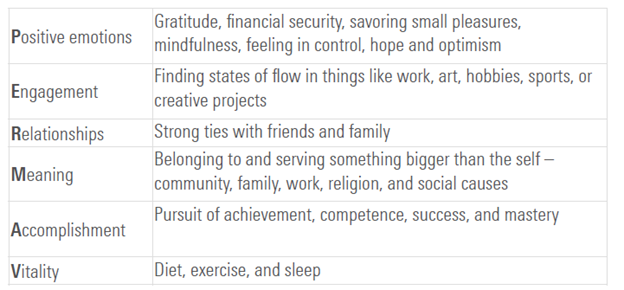

In our recent research, we tested a process to help individuals uncover their life values in the context of their financial goals. The process depends on an existing framework from the field of positive psychology that posits that well-being is composed of several components: positive emotion, engagement, relationships, meaning, accomplishment, and vitality, also known as PERMA-V. We found that asking individuals to consider the PERMA-V framework within the goal-setting process helped them identify goals that were closer to their life values.

PERMA + V

Based on our research, to make sure your financial goals and retirement plans are aligned with what makes you happy, consider the following process:

- First, identify your financial goals. This is harder than it seems, and we suggest using an exercise to help you work past top-of-mind goals.

- Consider the PERMA-V framework. After carefully thinking about each of these categories, write down any additional goals that come to mind.

- Now it’s time to ask yourself some hard questions. Take a look at your Step 2 goals. These goals may start to look like your life values. With these values in mind, consider your financial goals. Are all of your financial goals working toward achieving your life values? Are any life values unaccounted for? How can you continue working toward those life values in retirement?

As an example, let’s go back to the retiree who wants to play more golf in retirement. Playing golf can be considered a financial goal because it requires some degree of financial stability (membership fees, equipment costs, and an absence of employment income). Upon further digging, this retiree may realize that playing golf is actually related to their life values of vitality (pushing themselves to improve their skills and stay healthy) and maintaining meaningful relationships (meeting up with friends and loved ones on the golf course). With these values in mind, more opportunities open for this retiree. If golfing every day doesn’t work out, their life values can also be satisfied by going on daily walks with their children, volunteering at an animal shelter to give dogs in need their daily walks, or joining a local running club. By connecting their values to their financial goals and retirement plans, this retiree can align their activities to their life purpose, hopefully leading them to a fulfilling and meaningful life.

Going through an exercise like this can help you identify areas where your spending, saving goals, and financial plans aren’t aligned with your life values. As a result, it can help you redirect before you waste too much precious time. Keeping these values in mind can also provide a constant North Star, one that doesn’t change once you go through a dramatic life event like retirement. Knowing what makes you happy and what you value most in life can help keep you on track, even when you are confronted with the time, flexibility, and freedom that retirement provides.

How to Balance Your Lifestyle and a Safe Withdrawal Rate in Retirement

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)