What to Expect From Target Earnings?

The retailer is expected to report another tough quarter as consumers’ switch to essentials hurts profits.

Target Stock Key Takeaways

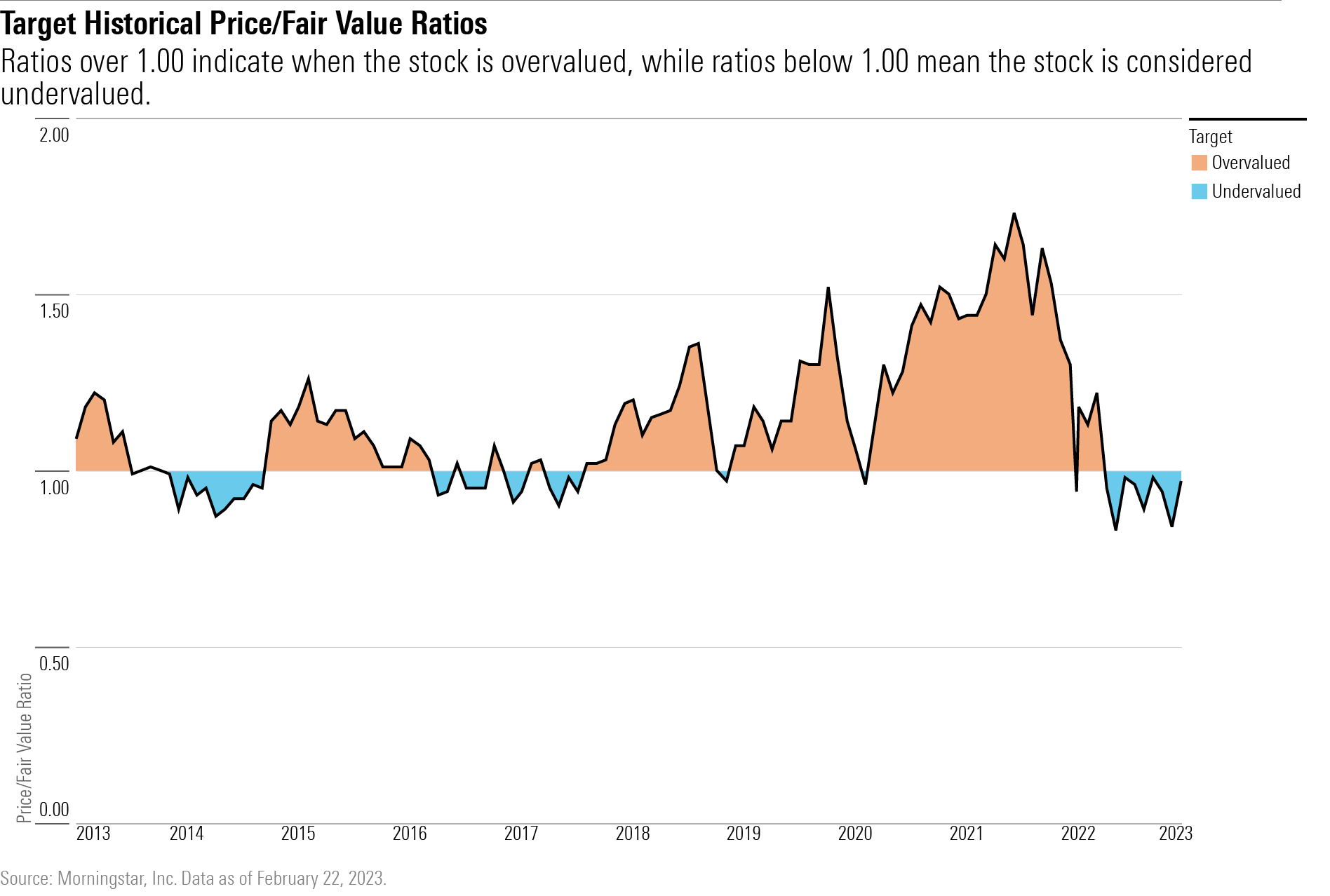

- Fair Value Estimate: $177

- Morningstar Rating: 3 Stars

- Morningstar Economic Moat Rating: None

- Morningstar Moat Trend Rating: Negative

Analysts expect continued pressure on Target TGT earnings as the company faces ongoing headwinds from shifting consumer behavior and persistent price competition.

Target’s recent earnings reports have proved to be land mines for the company’s stock, as the retailer reported earnings misses of over 25% versus expectations for each of the last three quarters. Target stock fell nearly 25% the day it reported 2022 first-quarter results and another 13% when it reported third-quarter results.

Analysts are now expecting another major decline in earnings, with net income for 2022′s fourth quarter estimated to be around $650 million according to FactSet, a sharp drop from the $1.54 billion a year ago.

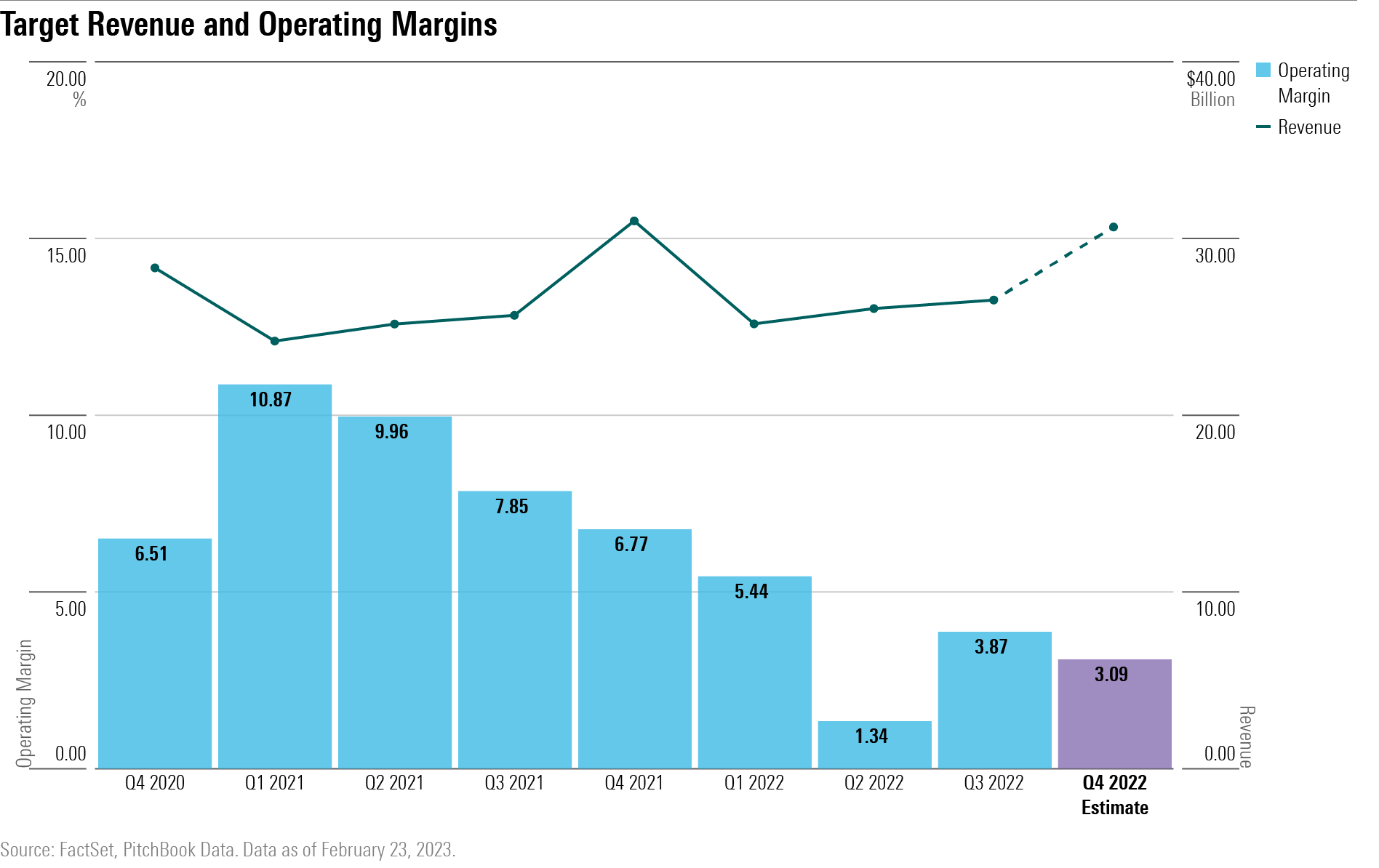

Revenue is expected to hold up, coming in at around $30.65 billion, down 1.1% from a year prior. Same-store sales are expected to fall 1.7% year over year for the first time since the second quarter of 2017.

Target Q4 Earnings Estimates

- Revenue: Down 1.1% year over year to $30.65 billion, according to FactSet.

- Net Income: Down 57.9% year over year to $650 million, according to FactSet.

- Earnings Per Share: $1.40, according to FactSet.

- Operating Margins: 3.09%, down from 6.77% a year prior, according to FactSet.

- Same-Store Sales: A fall of 1.7% in same-store sales, according to FactSet.

Recent challenges to Target’s profits include major price discounts the retailer had to put in place in order to move high levels of inventory. While it will be important for Target to acknowledge if high inventories remain an issue, the greater challenge Target faces is a shift in consumer behavior, Morningstar equity analyst Zain Akbari says in a report.

Target’s sales are usually skewed toward consumer discretionary goods, such as TVs, which make up about 60% of revenue. “Target’s discretionary assortment is considerably more lucrative than its grocery and other essential categories,” says Akbari. “Consumers’ shift away from less essential categories therefore created additional profitability strain.”

This could be reflected in the company’s operating margins, which analysts expect will be under pressure. With operating income expected to come in at $948 million, operating margins could hit 3.09%, down from 3.87% the previous quarter and less than half the 6.77% a year ago.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)