Technology Stocks: Strength Continues in Q1, Resulting In Few Obvious Buying Opportunities

Our top picks in the tech sector are Adobe, Cognizant Technology Solutions, and STMicroelectronics.

After a strong 2023, tech continued to perform well in the first quarter of 2024. Though semiconductor companies remain pressured, software and services generally reported solid results. We still believe fundamentals are less important than investor expectations around Federal Reserve interest rate cuts this year. Tech was the best-performing sector in both 2023 and the past quarter. We see no consistent performance differentiation among market capitalization tranches, and themes have become harder to identify. We remain confident in secular tailwinds like cloud computing, artificial intelligence, and the long-term expansion of semiconductor demand. But after a strong run for these stocks since the beginning of 2023, we see fewer obvious buying opportunities.

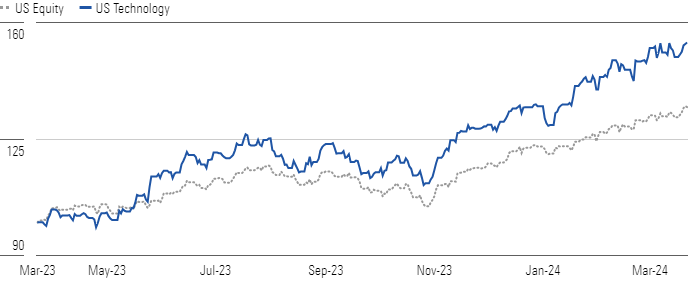

Technology Continues to Outperform Into March 2024

The most important force we currently see across technology is generative AI. Software companies are developing and incorporating next-generation AI capabilities into their solutions, cloud providers are introducing new services and ramping capacity, and semiconductor firms (notably Nvidia NVDA) are experiencing surging demand for AI and data center chip applications.

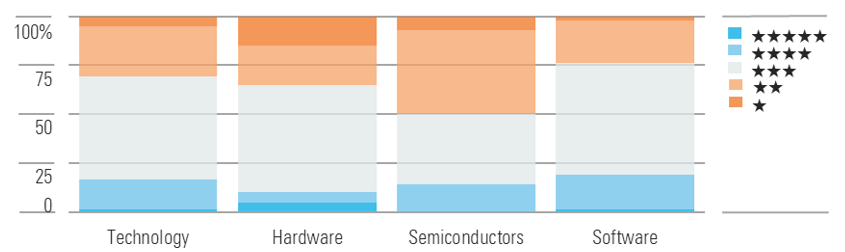

Majority of Technology Stocks Appear Slightly Overvalued

The Morningstar US Technology Index is up 54% on a trailing 12-month basis, compared with the US equity market being up 34.6%. Over the past quarter, the US equity market was up 9.7%, while tech was up 14.2%. The median US technology stock is slightly overvalued, with little margin of safety. We see semis and hardware as overvalued and software as fairly valued.

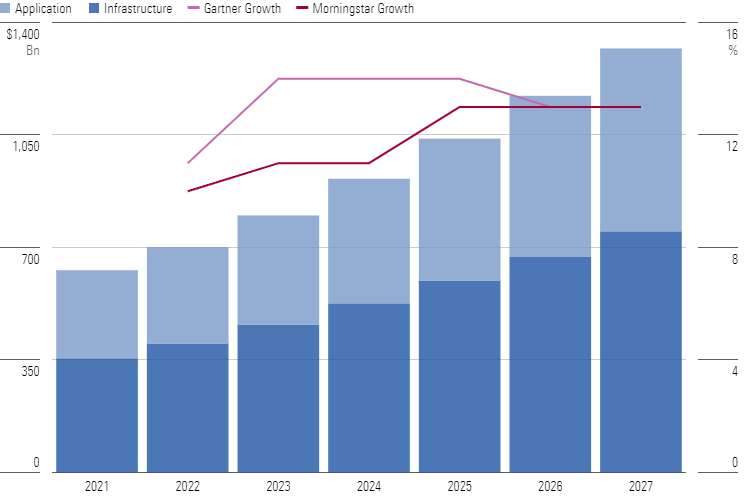

We Expect Soft Demand for Software to Pick Up

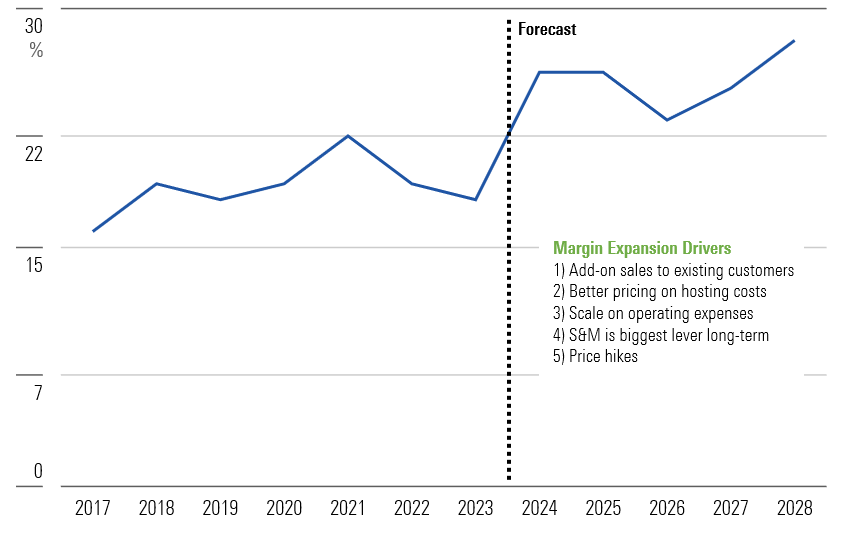

We expect software revenue to grow more than 10% annually through 2027, including approximately 14% in 2024, stemming from existing clients in the form of additional seats and new modules, new vendors and new business formation, and across-the-board pricing. We also see software margins expanding by 25-150 basis points annually over the next five years, as there’s leverage on every expense line, and management teams are highly focused on profitability over the last year or so as growth has slowed.

Software Free Cash Flow Margins Should Continue to Expand

Top Technology Sector Picks

Adobe

- Fair Value Estimate: $610.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

Adobe ADBE has come to dominate content creation software with its iconic Photoshop and Illustrator solutions, both of which are part of the broader Creative Cloud, the clear leading software for creative professionals. Adobe Express is widening the funnel for new customers, which we think bodes well for growth over the next several years. We also see Firefly generative AI models as an important growth driver. Overall, we see plenty of momentum within product innovation, client interest, and revenue creation, and after needlessly messy guidance on the March earnings call, we see the firm’s valuation as attractive.

Cognizant Technology Solutions

- Fair Value Estimate: $94.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

We think Cognizant CTSH is well-positioned to continue pushing its reputation beyond being a back-office outsourcer to higher-value technical offerings—like digital engineering and AI solutions—as well as digital transformation consulting. In our view, smaller IT providers for digital transformation services will be squeezed out because of the consolidation of accounts with larger vendors like Cognizant. We bake in a five-year revenue compound annual growth rate of 8%, an acceleration of 5% over the last five years.

STMicroelectronics

- Fair Value Estimate: $66.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

We like the long-term secular tailwinds in the automotive end market, as ST STM should profit from increased chip content per car, especially in electric vehicles. The company has also achieved nice gross margin expansion in recent years, and we foresee it maintaining these margins in the long run. We are encouraged by ST’s recent forecast for mid-single-digit automotive revenue growth in 2024, especially if the EV market performs a little worse than feared. Overall, we think the near-term risks are baked into current market prices, and we like the potential rewards for investors willing to wait out the cyclical downturn in broad-based semis.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)