Our Ultimate Stock-Pickers' Top 10 Buys and Sells

Funds see value in a diverse range of sectors.

For the past decade, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly and monthly holdings of 26 separate investment managers: 22 managers oversee mutual funds covered by Morningstar's manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As the data from their holdings becomes available, we identify trends and outliers among their holdings as well as meaningful purchases and sales that took place during the period under examination.

In our last article two weeks prior, we walked through our early read on our Ultimate Stock-Pickers' purchasing activity during the fourth quarter of 2021. The piece itself was an early read on individual purchases--focused on high-conviction and new-money buys--that were made during the period, based on the holdings of almost all our top managers. Now that all Ultimate Stock-Pickers have reported their holdings for the period, we think it is appropriate to examine our managers' high-conviction purchases and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers made their buying and selling decisions, we urge investors to analyze securities at current valuation levels before making any investment decisions--we will provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help them along the way.

Morningstar's analysis shows that all the top 10 high-conviction holdings possess either a narrow or wide economic moat and that eight of the top 10 conviction holdings have a wide economic moat. Furthermore, nine of the 10 companies composing the top 10 high-conviction purchases have been granted either a narrow or wide economic moat by Morningstar analysts. Additionally, seven of the 10 companies composing the top 10 high-conviction sales list are considered by Morningstar to be moatworthy.

Considering that many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction stock holdings was largely the same as the prior quarter. As it did the quarter before, Alphabet GOOGL, Google’s holding company, retained the top spot on our list. A majority of the funds that we analyzed (18) held Alphabet. Our Ultimate Stock-Pickers indicate a preference for communication services with three communications companies on our top 10 list. Our Stock-Pickers also continue to hold companies from the technology and financial services sectors. Our current fair value estimates imply that at the time of writing, two of the firms on our top 10 conviction holdings list--Apple AAPL and UnitedHealth UNH--are overvalued as both are trading at about a 30% premium to our fair value estimates. However, the remaining names on our top 10 conviction holdings list all trade at a slight discount to Morningstar fair value estimates.

All the names on our top 10 conviction holdings list were held by at least nine of the funds we looked at. Today, we’ll take a closer look at Microsoft MSFT, which continues to generate sustained interest and remains one of the market’s most popular names.

Wide-moat Microsoft was held by 14 funds at the time of this article’s writing. This medium uncertainty stock currently trades at a discount to Morningstar analyst Dan Romanoff’s fair value estimate of $352. According to Romanoff, the company possesses a wide moat, thanks to sustainable competitive advantages derived from the company’s switching cost as well as the network effect and cost advantage.

Romanoff believes that Microsoft has multiple characteristics that should draw investors’ attention. Microsoft has become one of two public cloud providers that can deliver a wide variety of PaaS/IaaS solutions at scale. Additionally, Microsoft embraced the open source movement and has largely transitioned from a traditional perpetual license model to a subscription model. Finally, Microsoft exited the low-growth, low-margin mobile handset business and is driving Gaming to be more cloud-based. In Romanoff’s view, these factors have combined to drive a more focused company that offers impressive revenue growth with high and expanding margins.

According to Romanoff, Azure, Microsoft’s cloud computing platform, is the centerpiece of the new Microsoft. Even though Romanoff estimates that it is an approximately $30 billion business, it grew at a staggering 50% rate in fiscal 2021. Azure has several distinct advantages, including that it offers customers a painless way to experiment and move select workloads to the cloud creating seamless hybrid cloud environments. Since existing customers remain in the same Microsoft environment, applications and data are easily moved from on-premises to the cloud. Microsoft can also leverage its massive installed base of all Microsoft solutions as a touch point for an Azure move. Azure also is an excellent launching point for secular trends in AI, business intelligence, and Internet of Things, as it continues to launch new services centered around these broad themes.

Romanoff also makes note of the firm’s shift in its traditional on-premises products to cloud-based SaaS solutions. Critical applications include LinkedIn, Office 365, and Dynamics 365, with these moves now beyond the halfway point and no longer a financial drag. Office 365 retains its virtual monopoly in office productivity software, which we do not expect to change in the foreseeable future. Lastly, the company is also pushing its gaming business increasingly toward recurring revenue and residing in the cloud. Romanoff believes that customers will continue to drive the transition from on-premises to cloud solutions and that revenue growth will remain robust with margins continuing to improve for the next several years.

Romanoff assigns Microsoft a stable moat trend, given the firm’s strong position in the software industry, its monopoly in office productivity software, and the lack of competitors that threaten its main sources of economic moat--switching costs, network effect, and cost advantage.

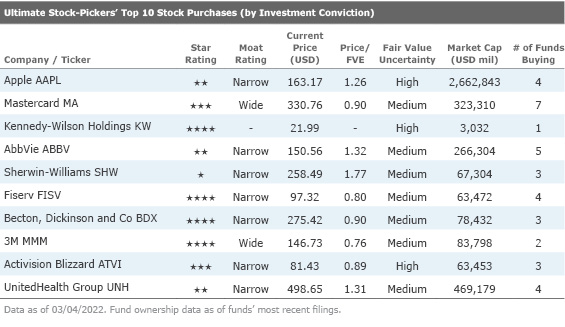

As we previously mentioned, our Ultimate Stock-Pickers' top 10 conviction stock purchases list is primarily composed of names that have been given moats by Morningstar equity analysts. The distribution of names is quite varied. We found that our Ultimate Stock-Pickers made three purchases in the healthcare sector, two in the technology sector, two in the consumer cyclical sector, and one each in the financial services, real estate, basic materials, industrials, and communication services sectors. One company that stood out to us was 3M MMM, a multinational conglomerate well known for its research and development laboratory.

Wide-moat rated 3M currently trades at about a 24% discount to Morningstar analyst Joshua Aguilar’s fair value estimate of $192. In summary, 3M is organized into four business segments: safety and industrial, transportation and electronics, healthcare, and consumer. Nearly 50% of the company’s revenue comes from outside the Americas, with the safety and industrial segment constituting a plurality of the firm’s net sales. Many of the company’s 60,000-plus products touch and concern a variety of consumers and end markets.

Aguilar views 3M as a GDP-plus business as it can remain ahead of GDP based on its suite of innovative products that are a byproduct of its R&D efforts. His wide moat rating on the company is based on its intangible assets and cost advantage, as he believes 3M is an innovative powerhouse that leverages its R&D platform across multiple product categories, with byproducts that include patents, brands, and proprietary technology. While litigation fears are an overhang on 3M’s stock, Aguilar believes that litigation fears are overblown and the market somewhat fails to appreciate 3M's short-cycle nature that benefits during the early stage of recovery.

Aguilar believes that 3M’s strategies allow it to maintain its leadership position. He notes that at its core, 3M is a materials science company. The firm's legion of engineers improves everyday products down to their basic chemistry. For example, 3M's microreplication technology, which has been around since the 1960s, was originally used in overhead projectors. That technology has now been adapted into multiple use cases, including making signs brighter, reducing friction in aerospace applications, and more recently, is being developed for vaccine delivery as an alternative to hypodermic needles. The firm's proprietary secrets are closely held as 3M rarely grants licenses, yet its technology is difficult to imitate. As a result, 3M typically charges a 10% to 30% price premium relative to the market. According to Aguilar, 3M's ability to adapt its technology into multiple use cases also gives it economies of scope, which helps reduce overall unit costs, evident in its superior gross margins.

Further, Aguilar expects the firm can grow its top line by over 4% in the medium term thanks to broad-based strength, even as respirator sales now become a near-term headwind. With the more recent acquisitions of workflow solutions provider MModal and negative wound care solutions provider Acelity, Aguilar expects the firm can capitalize on the stable and ever-growing healthcare market. Healthcare benefits from multiple positive secular trends, including an aging population, greater access to care, as well as rising incidence of chronic disease and surgical procedures.

Lastly, Aguilar notes that 3M hasn't grown intrinsic value over the past four years by his measure, which he attributes to a combination of self-inflicted wounds and pandemic-related headwinds. Even so, Aguilar believes the firm is well positioned in some higher-growth markets.

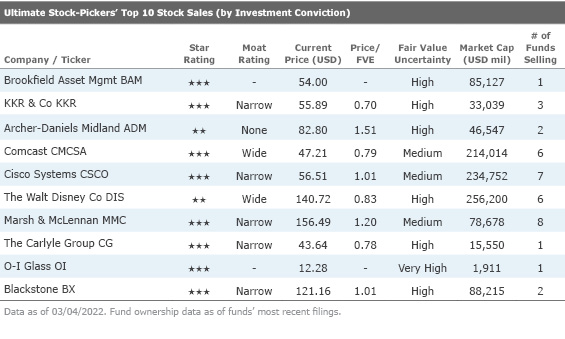

The Ultimate Stock-Pickers’ top 10 conviction sales list contains some new names compared with the previous quarter. Much of the selling activity came from the financial services sector, which contributed to half the names on the conviction sales list. From the list, the consumer and communication services sectors each had two names. Interestingly, when looking at the companies under our coverage, half of the names on the conviction sales list trade at a discount to our fair value estimates. Today we’ll look at Marsh & McLennan Companies MMC, which had eight funds selling according to our latest analysis.

Marsh & McLennan is a professional-services firm that provides advice and solutions in the areas of risk, strategy, and human capital. The company operates through two main segments: risk and insurance services, and consulting. In risk and insurance services, the firm offers services via Marsh (an insurance broker) and Guy Carpenter (a risk and reinsurance specialist). The consulting division includes Mercer (a provider of human resource services) and Oliver Wyman (a management and economic consultancy).

According to Morningstar analyst Brett Horn, Marsh & McLennan’s leading position in the brokerage industry would be difficult to displace, and its sticky customer relationships allow it to benefit from a relatively stable level of insurance transactions, although it does have exposure to the insurance pricing cycle. Horn views Marsh & McLennan’s long-term future as largely resembling its past, with moderate growth and attractive profitability, although the coronavirus has created some near-term ups and downs.

Considering Marsh & McLennan generally takes a percentage of premiums as commission, it is exposed to the direction of the insurance pricing cycle. Horn highlights that in 2019, pricing momentum picked up, and this positive trend accelerated in 2020 as the coronavirus appeared to have acted as an additional spur to pricing. Pricing increases haven't been this strong in almost 20 years. This has boosted growth recently and helped offset the negative impacts the coronavirus had on the more discretionary areas of the business. With discretionary services bouncing back as the pandemic recedes, Marsh & McLennan saw unusually strong growth in 2021 and carries some tailwinds into the year ahead.

However, Horn believes that over the long run, Marsh & McLennan remains tied to a mature insurance industry, and some of its consulting operations are centered on low-growth areas. As such, Horn believes it is inevitable for growth to moderate over time. Considering in the 10 years prior to the pandemic, organic growth was in a range of 3%-5% annually, Horn thinks this figure is more reflective of potential long-term growth.

On the economic moat front, Horn assigns the firm a narrow moat built on switching costs. Marsh & McLennan’s insurance brokerage segment accounts for most of its revenue. Insurance brokers such as Marsh & McLennan are uniquely positioned to serve a necessary risk-management function. Brokers can search the insurance market more efficiently than individual buyers, helping clients compare insurers' skills, financial strengths, and reputation. During the matching process, brokers also help insurers solve problems related to asymmetric information, such as adverse selection and moral hazard. The complexity of these services creates switching costs, as the value of changing providers is not clear to customers and there is perceived value for the client in continuing to work with a broker that has experience in managing their risk.

Horn assigns Marsh & McLennan a stable moat trend. He describes the competitive environment on the brokerage side as relatively stable, with the upper tier of the market settled into a somewhat oligopolistic condition. On the consulting side, the company’s margins have improved markedly in recent years. However, Horn attributes this primarily to management’s moves to aggressively cull low-margin business, rather than an underlying improvement in the competitive position of the segment’s constituent parts. The company is enjoying a tailwind from higher insurance pricing at the moment, but this should prove transitory and doesn’t affect our view of its long-term competitive position.

Disclosure: Justin Pan, Eden Alemayehu, and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)