Healthcare: Valuations Look Attractive Across Almost All Industries

We think the best healthcare stocks include Illumina, Moderna, and Zimmer Biomet.

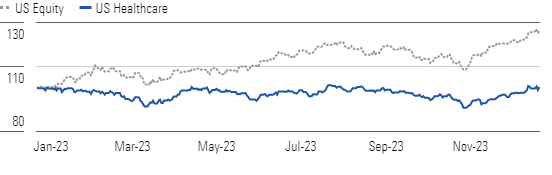

Over the past 12 months, overall U.S. equity has outperformed the Morningstar US Healthcare Index by 26%. Concerns about recessionary pressures appear to have decreased, making this more defensive sector relatively less attractive over the past several months.

Our top picks among healthcare stocks are:

Healthcare Underperformed the Market In 2023

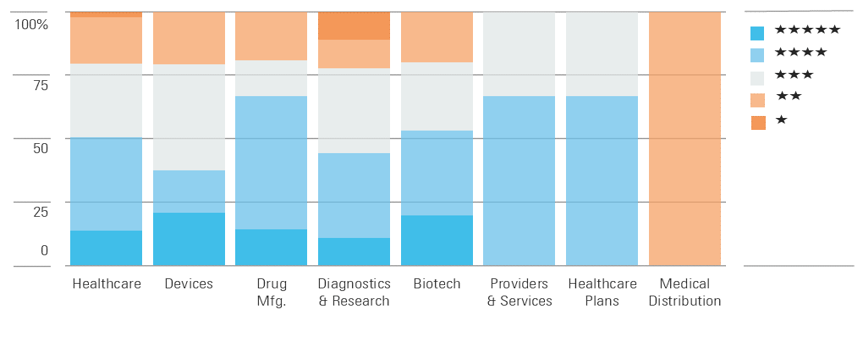

We view the sector as undervalued, with over 50% of healthcare stocks rated 4 or 5 stars. In aggregate, these stocks trade below our overall estimate of their intrinsic value. Besides medical distribution, all industries in this sector look undervalued.

Besides Medical Distribution, Healthcare Industries Look Undervalued

Within the biotech and drug manufacturing group, the market is not fully appreciating innovations in several therapeutic areas, including oncology, immunology, and rare diseases. In the healthcare plan industry, we believe the short-term headwinds of potential pharmacy benefit reforms, Medicaid determinations, and Medicare Advantage deceleration are creating undervalued opportunities, as the industry can offset these challenges over the long run.

In the device and diagnostic industries, we see compelling valuations after falling from a period of over-optimism during the peak of the COVID-19 pandemic. As perceptions normalize across healthcare, we believe the overall sector will increase in value. From a regional perspective, we believe the industry’s largest market in the United States will likely face some volatility during the 2024 election cycle and related political rhetoric, but we are not expecting major fundamental changes for most industries.

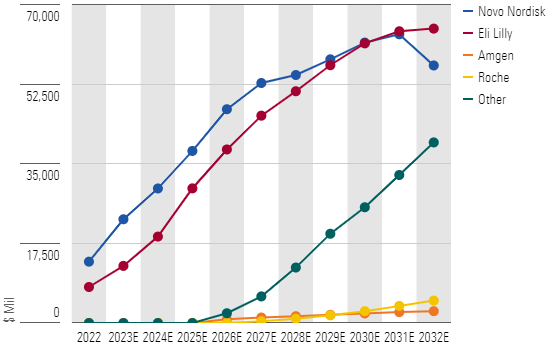

Global Projections of GLP-1 Drug Sales

Eli Lilly LLY and Novo Nordisk NVO hold an excellent position in launching new GLP-1 obesity drugs. While we forecast over $150 billion in global GLP-1 sales by the end of the decade, we see these leading firms as overvalued, with the market likely too optimistic about the stocks. Next-generation obesity drugmakers such as Roche and Pfizer PFE look more attractive. Also, several device stocks have overreacted negatively, as we don’t think the drugs will disproportionately have an impact on device demand.

Top Healthcare Sector Picks

Illumina

- Fair Value Estimate: $228.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Illumina may face more competition in its legacy genomic sequencing technology than it has in the past, but we think the factors that determine its economic moat in genomic sequencing—intangible assets and switching costs for end users—remain intact and should help the firm generate economic profits in the long run, especially considering its new sequencing instruments that are launching. Also, Illumina owns the Grail liquid biopsy assets, which are targeting a nascent exponential technology opportunity for the earlier detection of cancer. It is possible that Illumina will have to divest Grail in 2024, and a tax-free spinoff could be a good way to satisfy regulators while giving Illumina shareholders long-term optionality in the technology

Moderna

- Fair Value Estimate: $227.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

While we have modest expectations for sales of the firm’s COVID-19 vaccine following massive pandemic-fueled demand in 2021 and 2022, we think Moderna’s pipeline of mRNA-based vaccines and treatments is advancing rapidly across multiple therapeutic areas. As of September 2023, Moderna had 43 development candidates in clinical trials. Even if sales dip in 2023-24 ahead of new launches from the pipeline, we’re increasingly confident in the long-term sales trajectory of the firm’s diversified pipeline. We think Moderna’s technology looks well validated in respiratory virus vaccines (RSV vaccine to launch in 2024, Covid/flu combo to launch in 2025), oncology (melanoma launch possible by 2025), and rare diseases (accelerated approvals also possible).

Zimmer Biomet Holdings

- Fair Value Estimate: $175.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

With the addition of smaller competitor Biomet, Zimmer is the undisputed king of large-joint reconstruction. We expect favorable demographics, which include aging baby boomers and rising obesity, to fuel solid demand for large joint replacements, which should offset price declines. However, Zimmer stumbled into a series of pitfalls in 2016-17, including integration issues, supply challenges, and quality concerns, but new management has tackled these issues, and the firm is poised to ramp up its growth.

Top Healthcare Sector Picks Performance

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)