Consumer Cyclical Stock Outlook: Despite Macro Headwinds and Near-Term Uncertainties, There Are Ample Opportunities to Invest

We expect strong travel demand to persist, and restaurant sales have held up remarkably well.

This article is part of Morningstar’s Q2 market review and outlook.

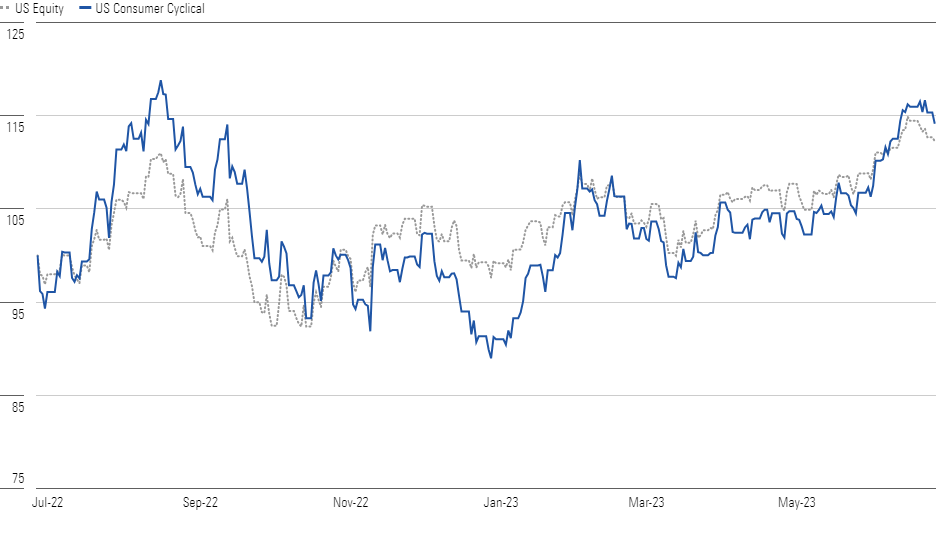

The US Morningstar Consumer Cyclical Index outperformed the broader market in the second quarter, exceeding the market’s 5.4% by 260 basis points. The median stock within the consumer cyclical sector trades at an 18% discount to our fair value estimates, with 52% of our coverage trading in 4- or 5-star territory.

Consumer Cyclical Stocks Outperform the Market’s Gain In Q2

Admittedly, near-term macro headwinds such as elevated inflation, high interest rates, plummeting savings rates, and softer consumer demand have collectively suppressed operators’ profitability in recent quarters. However, we think these forces are disproportionately reflected in the share prices and posit that near-term challenges should abate over a longer horizon, rendering meaningful discounts unwarranted. Apparel and travel and leisure continue to surface as the most undervalued sectors, trading at 45% and 19% discounts to our intrinsic valuations, respectively.

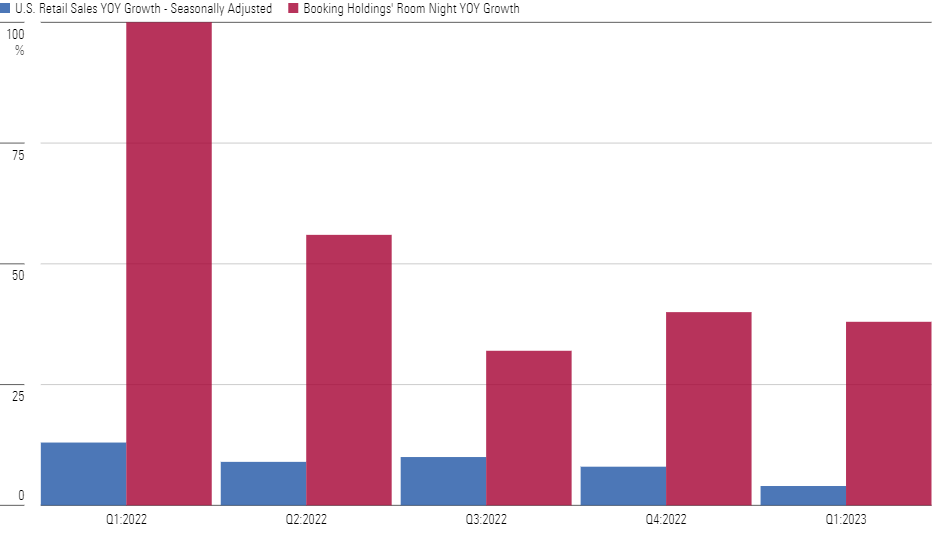

We expect strong travel demand to persist in the back half of 2023, extending the industry’s growth outperformance in recent quarters (when juxtaposed with the more muted U.S. retail sales growth), despite lapping a robust travel recovery in 2022. More concretely, we believe industry tailwinds (human-ingrained desire to travel, service consumption growth, remote work flexibility, and the removal of COVID-19 restrictions in China) will more than offset economic growth headwinds. Further, while leisure and domestic road travel initially sparked the industry recovery, we now anticipate group trips, international travel, and leisure excursions by sea to boost such demand.

Travel Demand Growth Far Outstripped Overall Retail Sales Growth

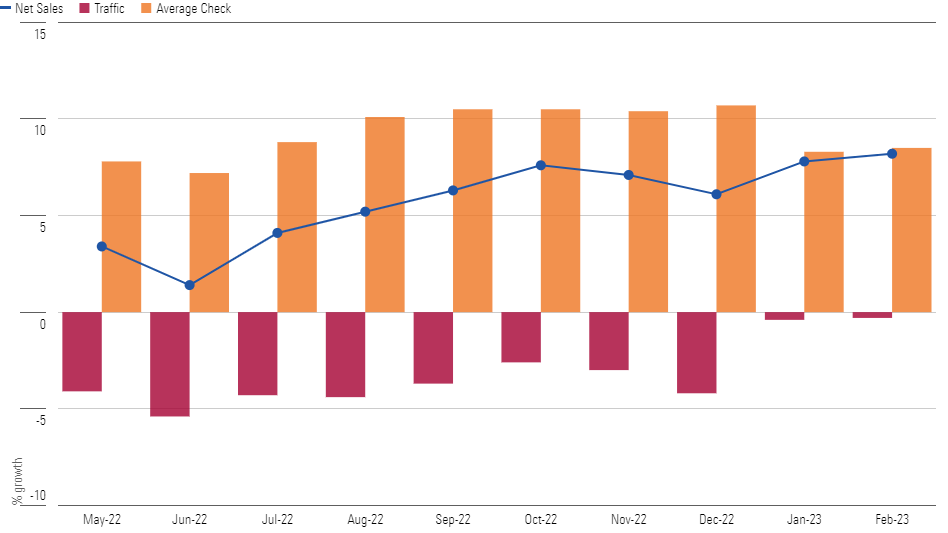

Elsewhere in the services sector, restaurant sales have held up remarkably well, though traffic declines industrywide point to cracks in the armor. We see increasing evidence of check management and expect consumers to trade down from full-service dining occasions and expensive fulfillment methods (like delivery) toward value-oriented brands, disproportionately quick-service restaurants, and even convenience stores. Despite the current backdrop, we think restaurant operators, particularly those in the quick-service realm, would be wise to continue investing in digital capabilities (websites, delivery fulfillment partnerships, and loyalty programs) to solidify their competitive standings and combat high labor costs.

Value-Seeking Consumers Find Favor with Cheaper Quick-Service Options

Top Financial Services Sector Picks

Curaleaf Holdings CURLF

- Fair Value Estimate: $20.00

- Star Rating: 5 stars

- Uncertainty Rating: Very High

- Economic Moat Rating: None

Curaleaf’s shares are on sale, trading at a heady discount to our fair value estimate. Overlooking its pure-play exposure to the attractive U.S. cannabis market, we believe the market is over-indexing limited progress on easing federal prohibition and misinterpreting slower-than-expected growth. A much larger illicit market leaves significant top-line growth potential, and expanding legalization will improve free cash flow yield. Still, having not yet reached positive free cash flow and being unable to trade on a major U.S. stock change, investment in Curaleaf is risky.

Hanesbrands HBI

- Fair Value Estimate: $20.00

- Star Rating: 5 stars

- Uncertainty Rating: High

- Economic Moat Rating: Narrow

We believe Hanesbrands, trading at a deep 77% discount to our $20 fair value estimate, offers a good investment opportunity. We surmise the market has been overly focused on short-term challenges (including the impact of inflation, high interest rates, and softer consumer demand) and underestimated the firm’s potential for free cash flow generation, the popularity of its Champion brand, and its improving mix shift. We anticipate that the company’s strategy to boost Champion and North American innerwear, streamline its portfolio, and engage consumers, along with lower input costs, will improve its profitability after a difficult 2023

VF VFC

- Fair Value Estimate: $60.00

- Star Rating: 5 stars

- Uncertainty Rating: High

- Economic Moat Rating: Narrow

VF’s shares are attractive, trading at a 67% discount to our $60 fair value estimate. We believe investors are fixated on the firm’s challenges, including the slowdown in Vans sales and elevated inventories, but are overlooking its potential for sales growth and margin improvement in the medium term. VF has exposure to the attractive active and outdoor categories, and The North Face achieved 17% constant-currency sales growth in fiscal 2023. While it may take some time for Vans and Supreme to return to sales growth, we believe VF is taking the proper steps and improving the efficiency of its supply chain

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)