AQR's Long Road Back to Average

What a long, strange trip it's been.

From its inception on Oct. 8, 2014, through Friday Jan. 14 2022, AQR Equity Market Neutral QMNIX returned an annualized 2.1%, edging out the average equity market neutral Morningstar Category peer’s rather mediocre 1.4% gain over the same stretch.

A look at the chart over the past seven years reveals a more intriguing story. Over that period, the fund went on an incredible run from its inception to its peak on Jan. 29, 2018, returning a cumulative 43.2% versus the average peer’s 8.7%. From there, it experienced a drawdown that was equally intense, losing 38.7% from its peak through its nadir on Nov. 11, 2020, and putting its original shareholders underwater by 11.8%. It has since snapped back again, capped off by a torrid 12.3% start to 2022 through Jan. 14.

The strategy’s wild ride provides a case study on two important points for liquid alts investors: the role of factors in their performance and the difficulty of holding a truly uncorrelated asset.

Factors Are Our Masters

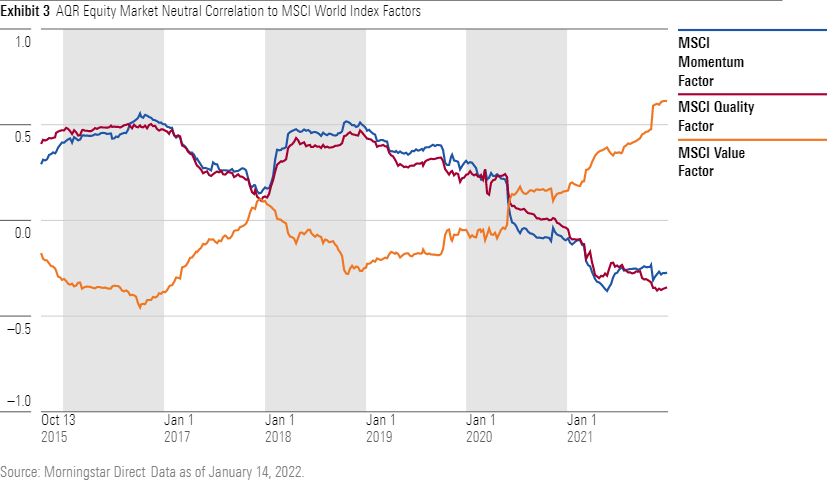

AQR’s quantitative approach centers around exploiting academically proven factors like value, momentum, and quality. These factors capture security-specific features--like a company’s price/earnings ratio or its profitability--that can explain the long-run risk and return of a basket of stocks. AQR’s models score stocks based on how well they compare on these metrics, buying the highest-scoring stocks selling short the lowest-scoring. This description simplifies a complex process that combines the factors with neutral exposure across markets, regions, and sectors. However, the central point is that the fund attempts to produce positive returns by providing balanced exposure to these factors without incurring market risk.

The most well-known factor is value, which is simply the tendency for stocks that are cheap to outperform those that are expensive. The factor has, for long periods of time, been one of the dominant drivers of stock returns, but it can be punctuated by extended periods of underperformance. For example, over the trailing five years ending in December 2021, the MSCI World Index’s 22.3% gain has squashed the MSCI World Value Index’s 14.5% return over the same period.

Quantitative factor funds--like AQR Equity Market Neutral--normally attempt to spread their exposure across a range of factors. This way, the strategy isn’t beholden to the performance of any one signal or group, and the effect of one doesn’t overwhelm the others. In theory, this should provide a steady ride as the uncorrelated signals and removal of market beta allows AQR’s stock-selection models to drive strong risk-adjusted returns. This stability--incurred by being market neutral--allows AQR to further enhance this alpha by leveraging its portfolio up to 5 times.

Clearly, AQR's performance has been anything but steady. Value signals contributed to strong returns in 2016 but hurt performance in 2015 and 2017. In those two years, as by design, strong returns from the strategy's other factor exposures provided enough juice to overcome value's struggles. That changed in 2018, as a terrible year for value coincided with weak years for the strategy's momentum and sentiment signals. Value continued to struggle at historically bad levels in 2019 and 2020, and the firm's exposure to other factors wasn't enough to overcome the losses.

Though pain came from all parts of the portfolio, value’s effects were most detrimental. Value’s divergence from the rest of the market became so extreme that in November 2019, AQR’s Cliff Asness[1] published a white paper saying that the firm was leaning into the factor; from there, AQR extended value’s weight by 10% in the Equity Market Neutral model up to 33% of the portfolio’s risk budget. It subsequently upped the weight even further, ultimately taking it to 40% in the first part of 2021.

Tilt or Dependency?

As value has regained some ground in 2021 and early 2022, so too has AQR. What has that meant for performance? Over time, AQR Equity Market Neutral’s return profile has become more closely linked to the performance of a single factor: value. Part of this is attributable to AQR increasing those signals within its models, but it also owes to the value factor’s unprecedented volatility. As a result, rather than offering balanced exposure across a broad array of factors, the fund has become a singular bet on value’s resurgence.

While the sizable tilt to value is within the fund’s mandate, the concentration and leverage has led to increased volatility. Since November 2019 (approximately when the value tilt was implemented), the fund’s standard deviation of 10.0% is significantly higher than the average category peer’s 4.4%. More importantly, investors signed up to benefit from AQR’s security selection and timing skills in a product where risk is tightly controlled and unintended consequences are minimized. It’s safe to say that the strategy’s massive performance swings are an unintended consequence.

The fund’s leveraged concentration in value was particularly deleterious in 2020, when it lost 19.5%. Its 5.5% drop during the first quarter hurt, but much of the damage came in the market’s snapback from the pandemic-related drawdown. Value stocks were comparatively pummeled, while expensive, growth-oriented stocks--which AQR is more likely to sell short--rallied in this stretch, exacerbating the challenges faced by the fund. The bet on value-oriented stocks closing the performance gap between growth-oriented stocks finally started to pay out in 2021, as the growth rally fizzled out and signs of value’s long winter coming to an end began to show.

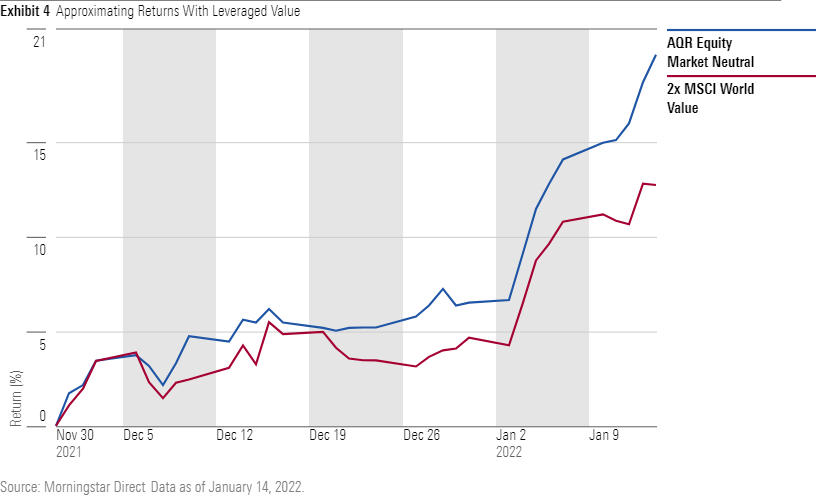

The fund’s performance to start 2022 warrants a special callout. Its 12.3% return over the first 10 trading days of the year is its highest ever 10-day gain--the next closest being an 8.5% return in May of 2021. Three of the strategy’s top four days ever have occurred so far in 2022, and it hasn’t had a down day yet despite choppy trading in equity markets to start the year.

This has coincided with strong performance from the value factor. AQR’s performance can be approximated by simply taking a leveraged bet on value--which is in effect what the team has done. Though this bet has finally begun to pay off, the scars of 2019 and 2020 are still present.

Uncorrelated Does Not Mean Negatively Correlated

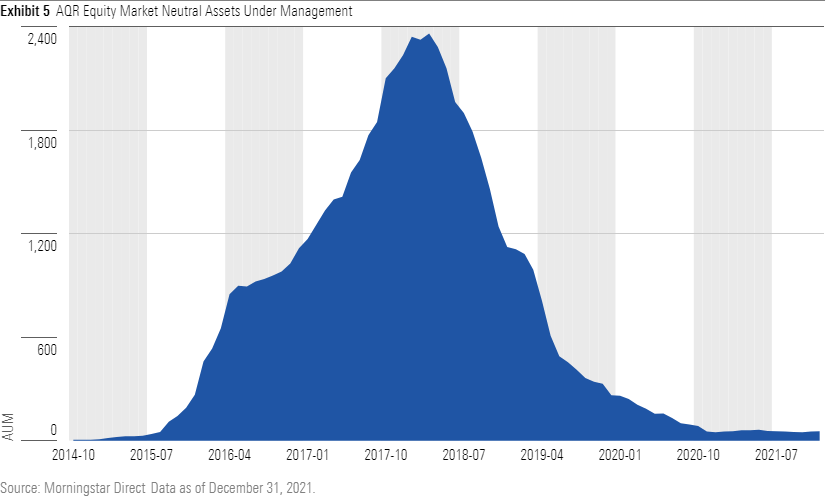

The recent burst of performance has been welcomed by shareholders, but the problem is there aren’t many of them left. A chart of the fund’s assets under management is nearly as remarkable as its performance chart, and it highlights the perils of performance-chasing.

The fund peaked at $2.36 billion in assets in March 2018, shortly after its performance high-water mark. Its bottom of $48.5 million in December 2020 coincided with its performance floor, with only a little over $2.3 million taken in since. Investor returns--which show how much the average investor has made in the fund--were negative through the end of 2021, at negative 0.6%.

Lessons

There are lessons for asset managers, asset allocators, and financial advisors in this saga.

- Investors love the idea of an uncorrelated asset but may not like the reality. Expectations are often for an uncorrelated asset to keep up in good times and act as a hedge in the bad times. Such an asset doesn't exist. Occasionally, uncorrelated assets zig when equity markets zag and provide a boost, but they may also zag along with them. A correlation of zero, which AQR Equity Market Neutral has delivered, means the results of one have no bearing on the other.

- Asset managers must consider investor biases when designing their portfolios. It's difficult for even the most resolute investor to stick with a strategy during a nearly three-year 38% drawdown, exacerbated by the S&P 500's 30.1% return over the same stretch. Strategies that can exhibit such large fluctuations require an extreme amount of investor education, so that shareholders are informed in accepting those risks.

- For advisors, performance-chasing is a common folly. Just as investors in ARK Innovation ETF ARKK piled in near the top of its eye-popping 150%-plus return in 2021 and are now underwater, many AQR investors piled in near the peak of the epic run in the early years. Investment strategies tend to revert to the mean over time, and chasing the top performers seldom leads to good fortune.

- Market-neutral doesn't mean factor-neutral. Many offerings claim to have removed market risk, but the resulting portfolio exhibits larger style, factor, industry, or other bets. In a category where alpha generation is expected to be 2%-3% above cash, and the HFR Event Driven Index is in the same range, strategies performing outside this range warrant close inspection.

Though AQR's performance has begun to bounce back, its assets have not--yet. Investors looking to allocate to the strategy should be mindful of its sensitivity to value and be prepared for what that means for future results.

The factor indexes used in this report are custom benchmarks created by this report's author. They contain 100% exposure to MSCI World Factor Indexes and a 100% short exposure to the MSCI World Index. These long-short benchmarks serve to isolate the effects of the market factors.

[1]Asness, C. 2019. "It's Time for a Venial Value-Timing Sin." AQR. https://www.aqr.com/Insights/Perspectives/Its-Time-for-a-Venial-Value-Timing-Sin

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)