Testing Your Equity Strategy Themes With the Stock Ownership Analysis Notebook

Use the Stock Ownership Analysis Notebook to find themes in your stock positions.

The number of thematic funds has ballooned in recent years. Meanwhile, the number of publicly traded companies has declined. As a result, the contents of thematic strategies often match the theme about as well as paisley matches plaid.

We did a deep dive into water funds in August 2021 and found that most of them offered straightforward equity exposure. Though there are a few stocks that offer more direct exposure to the water theme than others, for the most part, these funds invest in companies that have limited exposure to water-related businesses like filtration or distribution.

One way we discovered this was to look at what investment strategies owned water funds’ top holdings. Looking at the broad ownership of stocks can offer insights about how other investors (and thus the broader market) think about it, and what they think is driving their returns. That evidence can indicate if a strategy is reaching beyond its stated mandate. For example, if a value fund had several big positions that also appeared as large-growth fund holdings, it would not be a pure-value strategy.

One of the biggest water funds we looked at was Invesco Water Resources ETF PHO, which claims to invest in companies that create products designed to conserve and purify water for homes, businesses, and industries. Let’s put that to the test.

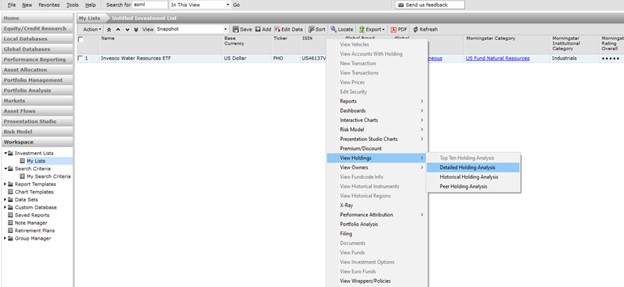

First, we can check the underlying holdings of this exchange-traded fund by bringing it into a new investment list, right-clicking on it, and navigating to the detailed holding analysis option.

- source: Morningstar Analysts

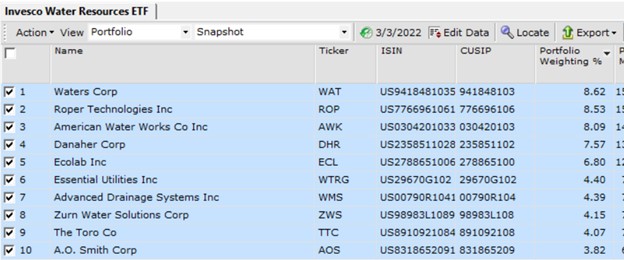

This brings up the full holdings of the fund, as well as some data on the positions. Select the top 10 holdings by clicking and dragging down the list of tickers, which will highlight these cells.

- source: Morningstar Analysts

Once highlighted, press ctrl+C to copy the cells, and paste them into a blank Excel or Word document, so that you have a list of the top 10 tickers.

Now, let’s see who else owns these companies. On its surface, this seems like a unique portfolio. But a list of other funds that hold some of these stocks can provide useful information about what other types of investors are buying the stock.

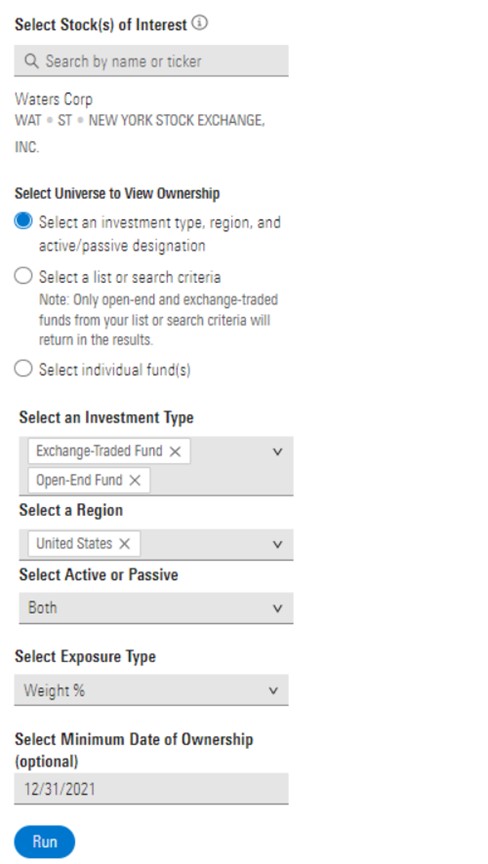

To do so, start in Analytics Lab and find the Stock Ownership Analysis tool. This notebook searches Morningstar’s equity ownership database to find which open-end funds or ETFs own the specified stock. You’ll find several fields you can modify, similar to below.

- source: Morningstar Analysts

Here, I’ve chosen to look at Waters WAT, the top holding in the Invesco Water Resources ETF. I’m going to look at both ETFs and open-end mutual funds in the United States. I’m interested in both active and passive funds since many thematic strategies track an index, and so are considered passive. You can select exposure type--weight percentage, shares, or market value. Though it's interesting for some purposes, selecting shares or market value will often just show some of the biggest firms by assets under management. For example, the index fund behemoths BlackRock, Vanguard, and State Street will appear as large shareholders for nearly every company. Searching by "Weight %" allows you to find funds that have a high percentage of their assets in a specific stock, which is a good way to measure a manager’s conviction in a position, and thus its importance to the strategy.

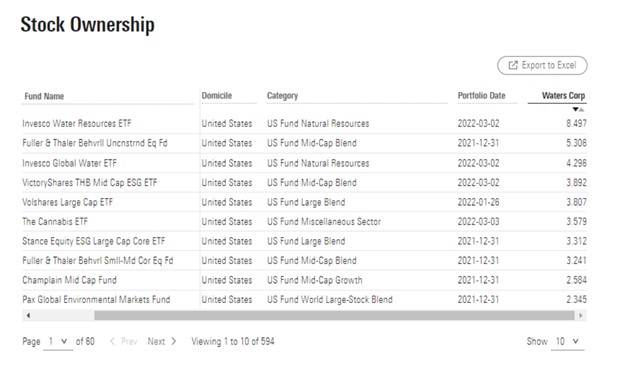

Running the notebook presents a list of funds that hold a high percentage of their assets in Waters.

- source: Morningstar Analysts

The two Invesco water strategies are the only two water funds that hold the stock at a high weight, though there are a couple of ESG-focused strategies on the list. Given that there are more than 65 water strategies globally, it’s surprising that Invesco is the only firm that holds the stock at a significant size. Looking at the company’s financial reports shows why. The company sells drugmakers tools to analyze molecules; the instruments have some ancillary water-testing applications, but not enough to break out in the firm's financial reports. The company named after founder Jim Waters otherwise has little exposure to water.

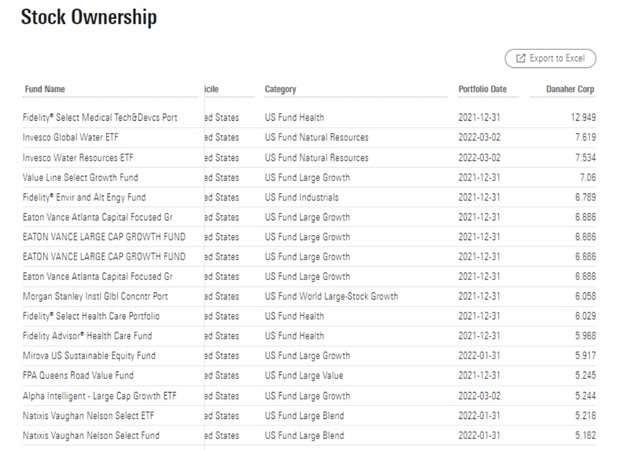

Another interesting position is Danaher DHR.

- source: Morningstar Analysts

Here too, Invesco is the only firm with more than a 5% weight in its water fund. In fact, the company, which gets 80% of its revenue from its healthcare segment, is more likely to appear in a strategy in the healthcare Morningstar Category.

This approach can be taken to any thematic fund, or any stock. I recently looked at a rare earth mining company called Mountain Pass Materials MP and ran it through the tool.

- source: Morningstar Analysts

The company appears in many different thematic ETFs, which gives me some idea what other investors are thinking about the stock and what might influence its performance moving forward. The exposure to materials ETFs makes sense, but I was interested to see it pop up in a disruptive materials ETF, as well as a robotics and automation ETF. The company’s rare earth metals appear in several advance manufacturing processes, including robotics, which explains the inclusion.

Knowing who else owns a stock can tell you something about it and funds that own it, but, ultimately it’s just one point in the matrix of information investors need to build before buying stocks and funds.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)