ARK Invest Turns to an Innovative Fund Structure

After putting active ETFs on the map, Cathie Wood's firm looks toward interval funds.

ARK Invest turned heads a couple of weeks ago when it filed to launch the ARK Venture Fund, which will be a new twist on its “disruptive innovation” approach. The strategy will seek out both public and private companies to invest in, with the foray into private markets a key difference to the firm’s existing funds.

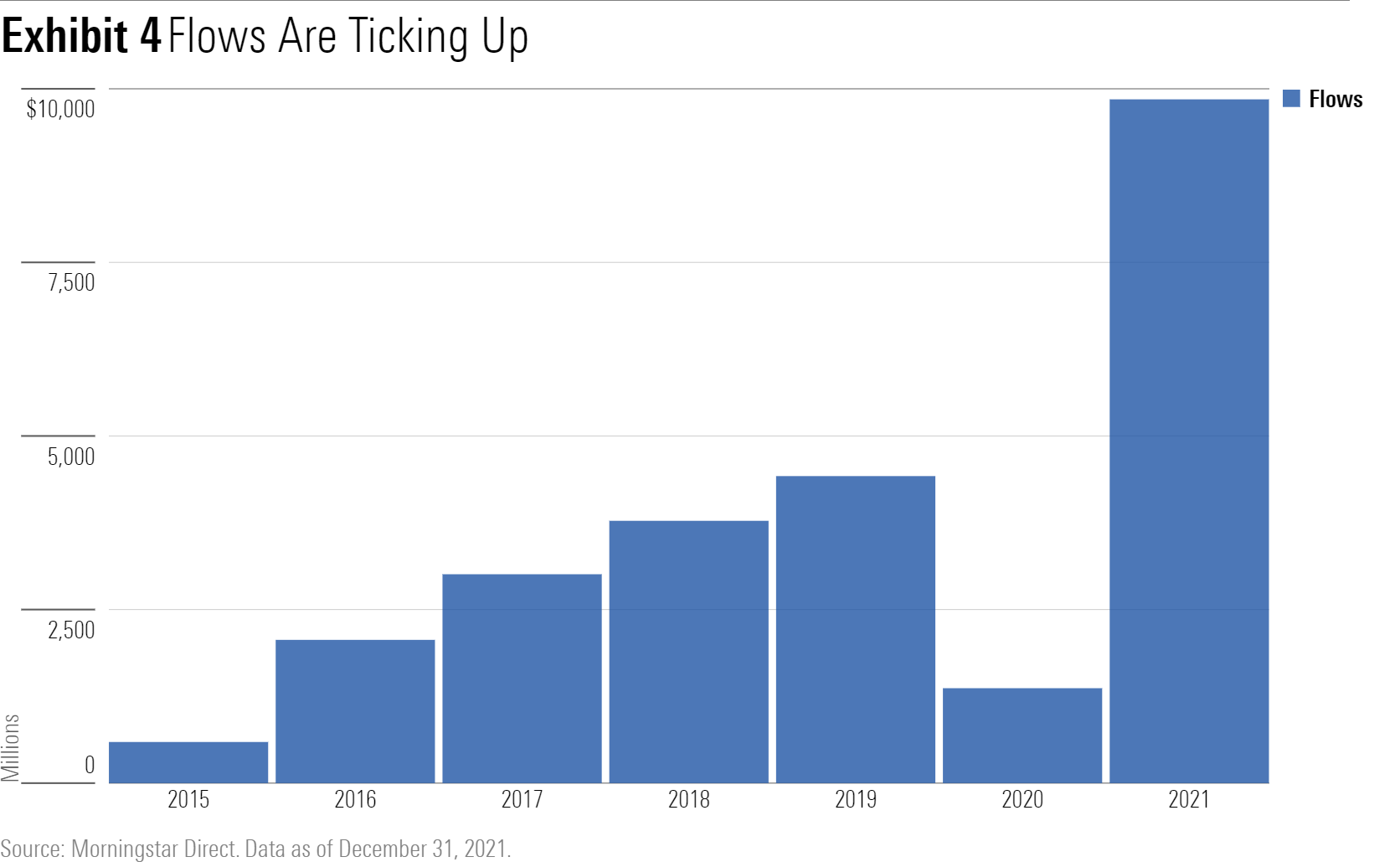

To enable investments in illiquid private companies, the firm is turning to an innovative fund structure: an interval fund. This investment access point has gone through fits and starts over the past several years but has recently surged in popularity, attracting more than $9 billion in 2021. This type of fund offers retail investors access to strategies that would otherwise be out of reach, but it comes with its own set of quirks.

Defining Interval Funds

Interval funds’ distinguishing feature is a lack of daily liquidity. In contrast to open-end exchange-traded funds and mutual funds, interval funds’ shares are not traded on an exchange or over-the-counter. Rather, investors are only able to cash out on a fixed schedule; this is often quarterly but sometimes as infrequently as semiannually or annually.

It’s only during these redemption periods that investors can sell their shares back to the fund company. The total amount of shares that an investor base can sell back to the fund manager during these periods is also fixed and must be between 5% to 25% of outstanding shares. This can be a challenge for investors; if the total redemption amount rises above the limit, shares are redeemed on a pro rata basis. This can leave some investors waiting for the next redemption period. This standard doesn’t apply to new investments, as investors can purchase new shares continuously unless the firm closes its strategy to new investors.

With the hassle of meeting daily redemptions removed, interval fund managers can invest in highly illiquid securities with greater confidence than competitors using a different vehicle. This opens the investable universe to assets that can take significantly more time to sell, including private equity stakes, investments in hedge funds, illiquid debt instruments like catastrophe bonds, and much more. Although managers must still be ready to return cash to shareholders during the predetermined redemption period, they can prepare for these periods by holding a buffer sleeve of liquid securities like public stocks or holding lines of credit from financial institutions.

The Landscape

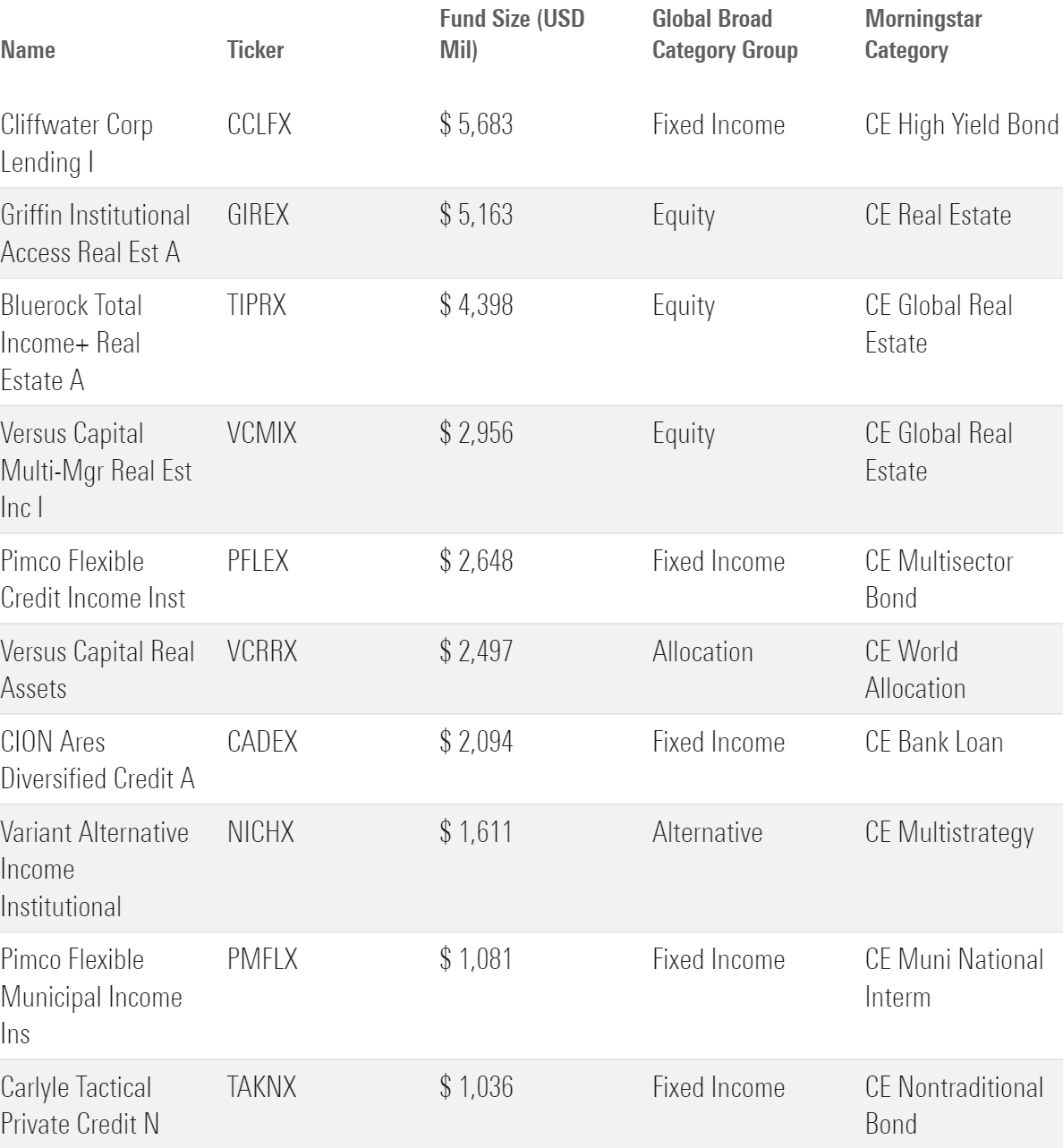

Despite the potential for these funds to offer new investment strategies to a wider audience, ARK Venture Fund will join a rare crowd when it launches. Just two of the 70 interval funds available in the United States invest with a private/public equity mandate. Of course, interval funds aren’t a perfect match for pure private equity--where investor money can be locked up for upward of 10 years--which may explain the barren landscape. ARK’s intentions to combine both liquid public equity and illiquid private equity largely solves that challenge, with the team able to sell the public equity to meet investor demand during redemption periods. In the event of a rush to the exits, and with public equity sold down, the remaining asset class mix could be materially skewed to these illiquid holdings, but the team would have several quarters to deal with the implications of that. ARK will allow for 5% of shares to be redeemed on a quarterly basis.

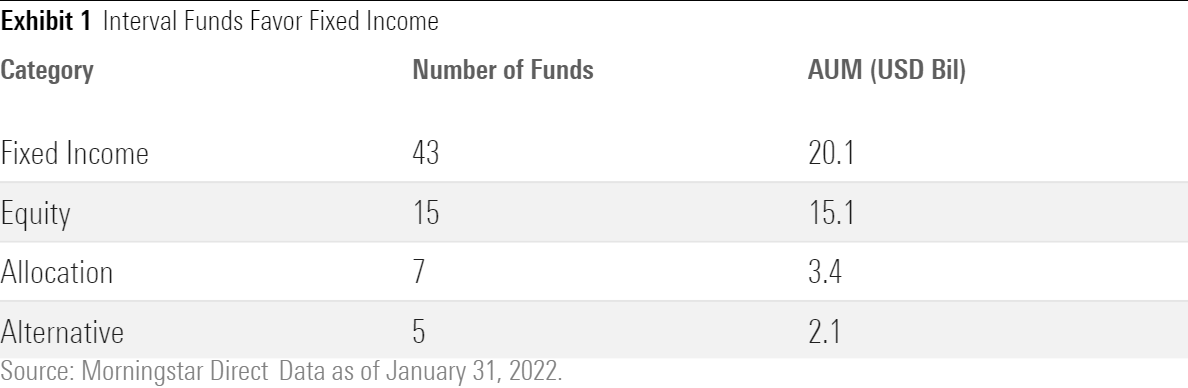

Fixed-income strategies are far more common in the interval fund market. Of the 70 interval strategies currently available, 43 of them are fixed-income remits, and they contain half of the assets in the space. The approaches vary, from straightforward municipal-debt offerings like Pimco Flexible Municipal Income PMFLX to more specialty, private-credit strategies like Cliffwater Corporate Lending CCLFX.

Esoteric yield-based strategies are also a good fit for the interval fund wrapper. Pioneer offers two catastrophe-bond strategies, which trade with low correlations to traditional assets. Many of the strategies classified as alternatives are also yield-heavy, like Variant Alternative Income NICHX. This strategy pushes into areas like litigation finance, music royalties, and trade finance that are still relatively niche parts of the market.

Of the 15 equity interval funds, 11 are real-estate-focused. The interval fund wrapper allows for easier access to direct real estate, as well as illiquid REITs. Real estate is a sizable position in two of the seven allocation strategies, too, including Principal Diversified Select Real Asset PDSYX, which not only holds direct real estate but also investments in private funds like timberland and infrastructure strategies. Although not common, investments in private funds are another advantage of the interval fund structure, allowing further access to unique strategies otherwise not available.

Benefactors of the Low-Rate Regime

Although the $40 billion invested in interval funds represents a fraction of the $300 billion closed-end fund market, two key investment trends are a tailwind for the space moving forward: the hunt for yield and the move to private markets.

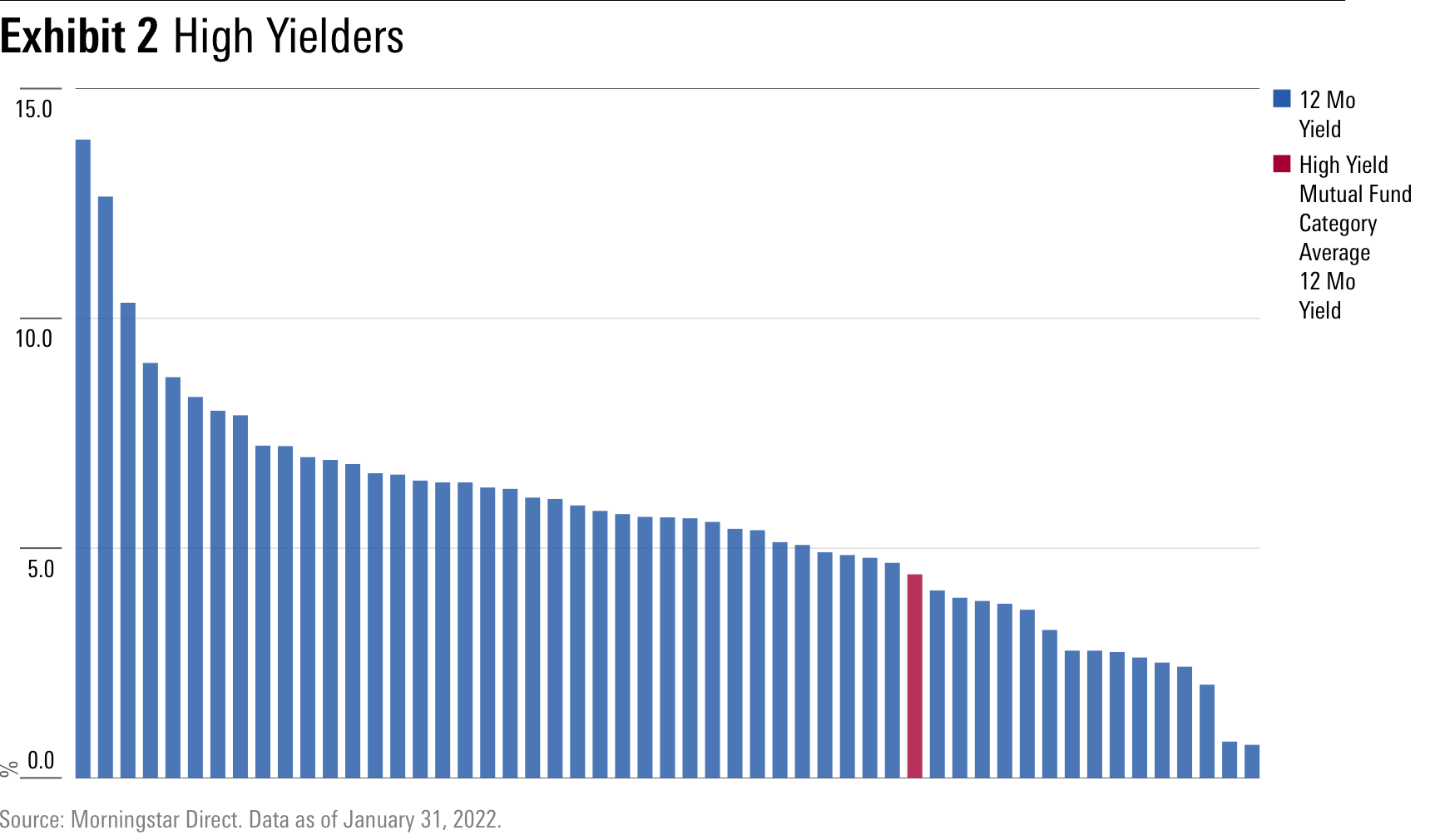

The search for income has been at the forefront of investors’ minds in an era of low interest rates. Fixed-income managers with yield mandates have been pushed further out on the risk spectrum and into new and developing sectors, where the debt instruments can be complex and thinly traded. Interval funds allow managers to build an entire portfolio of these assets, whereas a manager who needs to worry about meeting daily redemptions must make liquidity a bigger factor. A glance at the trailing 12-month yield for interval funds shows that managers are taking advantage. Of the 53 interval funds with yield data, 38 (72%) have yields higher than 4.5%, which was the average yield of mutual funds in the high-yield bond category.

As detailed above, private equity interval funds have yet to take off, but private credit strategies have had more luck. Four of the top-five fixed-income interval funds in terms of assets under management contain significant stakes in private credit. These strategies also touch the income conundrum; all have yields of 5% or higher. Although some of the extra income that these strategies can generate comes from their ability to access the illiquidity premium, investors also must be mindful that it may represent added risk.

These dynamics helped drive more than $9 billion worth of inflows to interval funds in 2021, more than double the previous high-water mark. Already in 2022, the funds have taken in an additional $1.8 billion in new money, with $640 million of that coming from the Cliffwater Corporate Lending strategy. Asset managers have responded to the newfound demand, with 29 new fund launches in the past three years.

Worth It?

With the ability to access niche investment strategies, interval funds can offer investors exposure to unique return streams that they otherwise couldn’t access. Unfortunately, these funds that toe the line between the public and private markets are often priced closer to their private market peers. Just four funds cost less than 1%, and 32 charge more than 2%.

The institutionalization of private markets is aiding fee transparency and tighter definitions of costs, but these price tags set a high bar for success. Some strategies may clear that hurdle, but the inclusion of interval funds will drive up the costs of an average portfolio. ARK Invest’s move into interval funds will shine a new light on the space, much like how the firm’s success with its active ETFs placed those funds in the spotlight. Here’s hoping that increased attention on the space leads to more affordable options for investors.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)