4 Undervalued Technology Stocks to Buy Now

This year's selloff in technology shares was so steep it left these companies undervalued.

Technology shares have been some of the hardest hit stocks in the market this year as the economic outlook has become increasingly uncertain.

The selloff in tech stocks saw many companies fall from what had been elevated valuations. The sector now trades at a discount of about 7% to its fair value on average, down from an 18% premium at the beginning of the year.

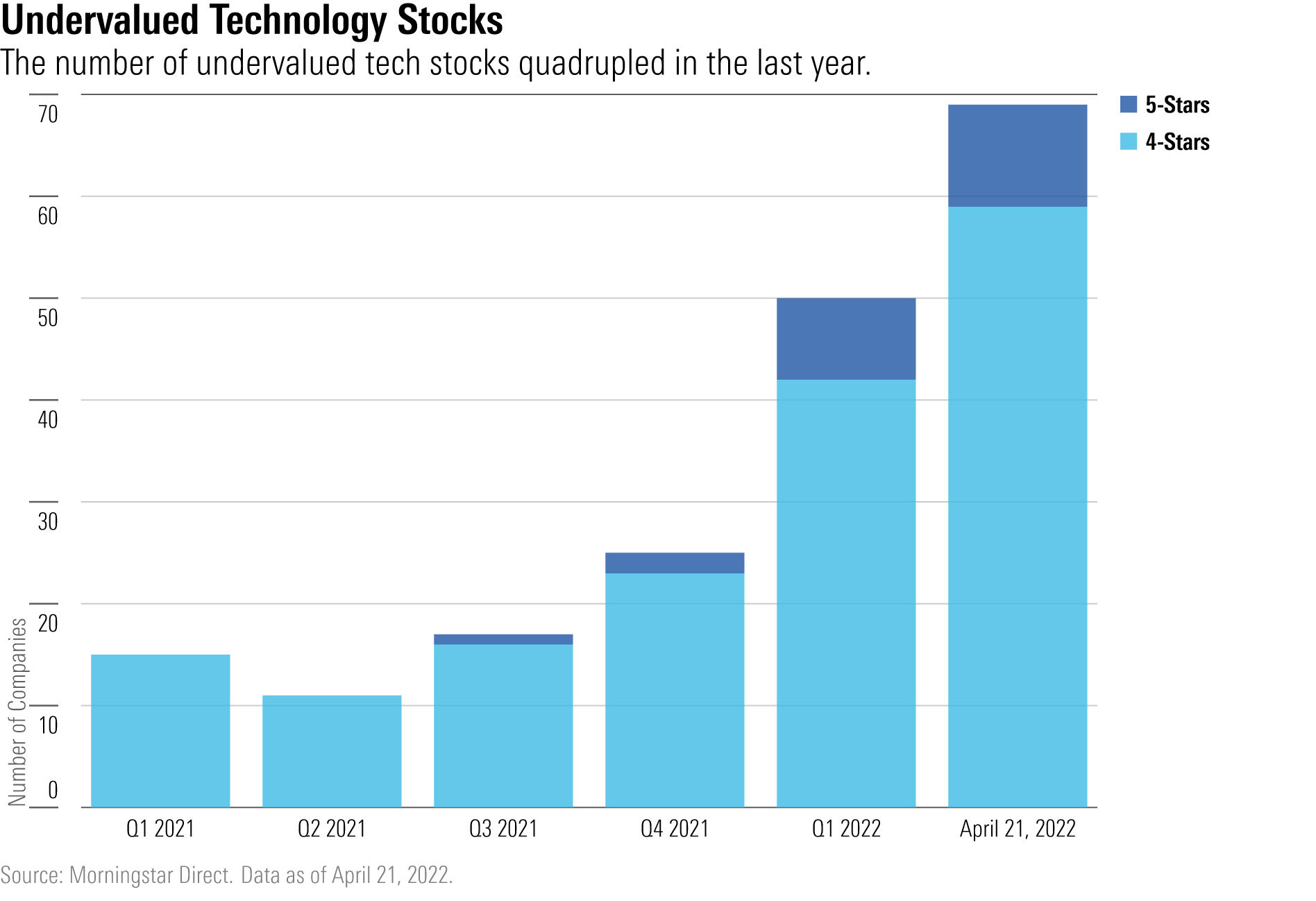

Among those hit hardest were semiconductor stocks. Industry giant Advanced Micro Devices AMD now trades at a price Morningstar analysts see as undervalued. A total of 69 companies, more than half of the 136 U.S.-listed technology stocks covered by Morningstar, are now considered undervalued and have a rating of 4 or 5 stars. Ten of those companies have a rating of 5 stars, including Salesforce CRM and Uber UBER.

That is a more than four-fold increase from a year ago when just 15 technology stocks were considered undervalued. Since then, the appetite of investors for riskier growth stocks has soured as more aggressive interest rate hikes and concerns about a potential recession have dampened investor expectations for the sector.

“Many technology stocks were overvalued in 2020 and 2021, a lot of these stock prices were too high to begin with,” Morningstar’s equity research director for technology Brian Colello says. As the global economy has reopened many investors rotated out of stocks that benefitted from pandemic lockdowns, such as Zoom ZM.

“But the market momentum has swung so far in the other direction that some names are now cheap,” Colello says.

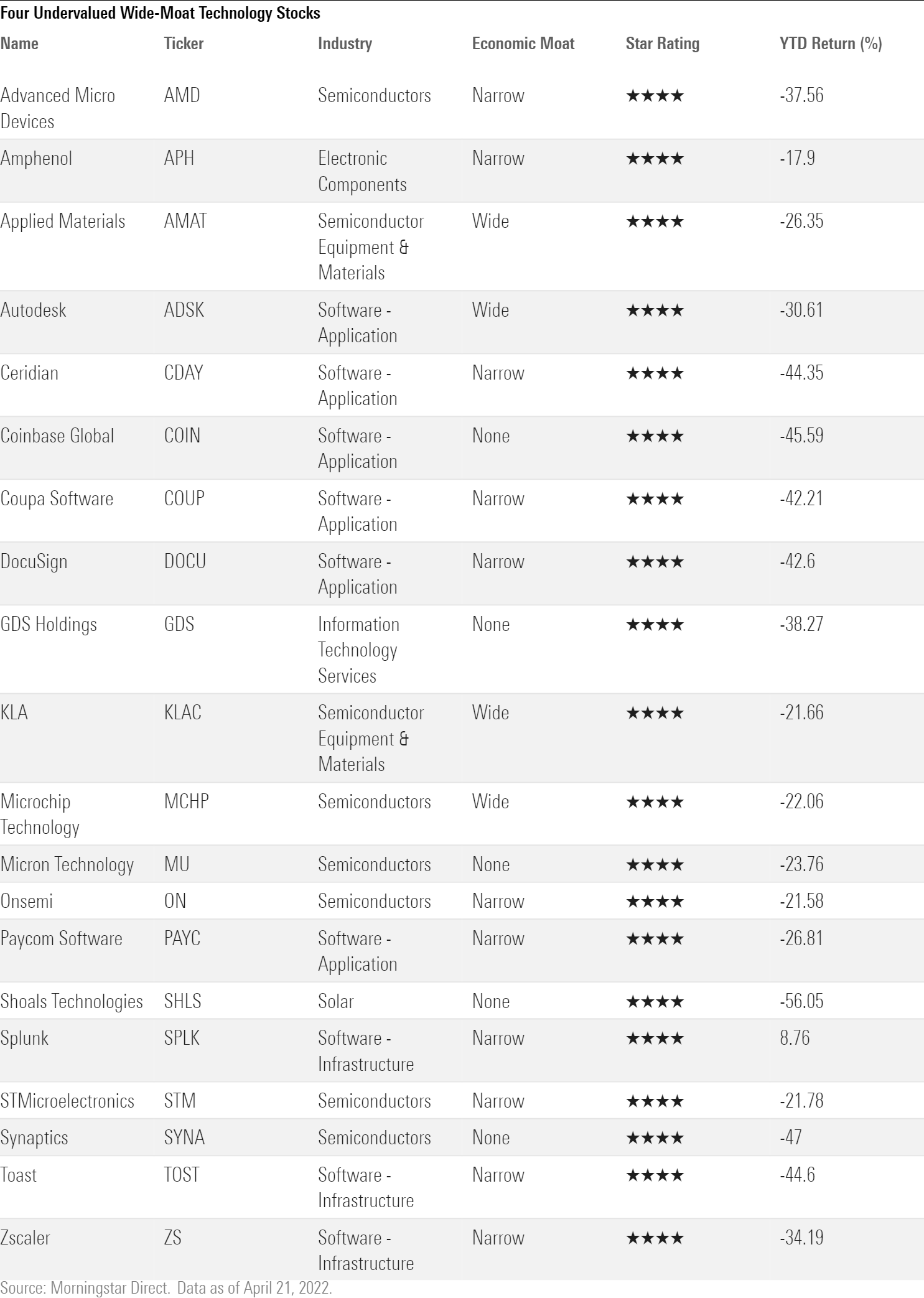

To highlight the most attractive new opportunities in the technology sector, we screened for changes in companies’ Morningstar Star Rating between April 1 and April 21. We also added an economic moat filter to screen for companies with long-term competitive advantages. A list of all the stocks from our screen can be found at the end of the article. Below, we’re highlighting four undervalued wide-moat stocks.

Applied Materials AMAT

Applied Materials supplies tools for nearly every key segment of the semiconductor manufacturing process. Demand for their products is expected to remain robust, with management anticipating expenditures for wafer fab equipment to reach $100 billion this year.

Like many other semiconductor firms, the tool vendor has been struggling with supply chain problems that has been preventing them from meeting demand. Orders have remained strong despite supply shortages, their backlog grew by $1.3 billion to $8 billion in the fourth quarter. While near-term supply chain headwinds are pressuring margins, Morningstar’s technology sector strategist Abhinav Davuluri anticipates them to improve over the course of the year.

Applied Materials is currently trading at a 19% discount to its fair value.

Autodesk ADSK

Autodesk a provider of software for creating designs, models, and renderings is now 15% undervalued as the technology sector continues to selloff.

Potential boons to the company’s business are improving operating leverage, a reduction in advertising and marketing costs due to the growing popularity of its online store. Revenue may also rise as the company’s media and entertainment product group may see an increase in demand as customers consider their needs to participate in the metaverse, Morningstar equity analyst Julie Bhusal Sharma says.

KLA KLAC

KLA provides systems for yield management and process-monitoring for the semiconductor industry to help manufacturers make sure they are able to correctly produce chips. The company dominates in the industry, claiming about 55% of the market, Davuluri says.

While supply chain issues lowered revenue expectations for the quarter ending March, Davuluri expects the firm to achieve double-digit growth for the sixth consecutive fiscal year.

“KLA is well positioned for the long-term, as chipmakers will require more advanced PDC tools to go with fabrication technologies featuring smaller circuit sizes, new materials, and more process steps,” Davuluri says. Shares are currently 15% undervalued.

Microchip Technology MCHP

Microchip Technology is a leading supplier of microcontrollers, a type of semiconductor that acts as the “brain” for electronic devices ranging from toothbrushes to home appliances. The company reported record revenue of about $1.76 billion in the fourth quarter of 2021, up 30% year over year. While the company has been struggling with supply shortages, revenue is expected to remain robust in 2022, Morningstar's Colello says.

The company has a preferred supply program (PSP) where customer orders can be prioritized if their purchase can't be cancelled.

“Over 50% of Microchip's aggregate backlog is under PSP, so we have confidence that robust revenue will continue through most of 2022,” he says. “We foresee healthy demand for Microchip’s products going forward. As more and more electronic devices become ‘smarter’ and connected to the Internet, Microchip’s MCUs and analog chips stand to benefit.”

Shares are currently 19% undervalued.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)