The Best Female Portfolio Managers to Invest With Now

These 27 managers have built impressive careers and their results speak for themselves.

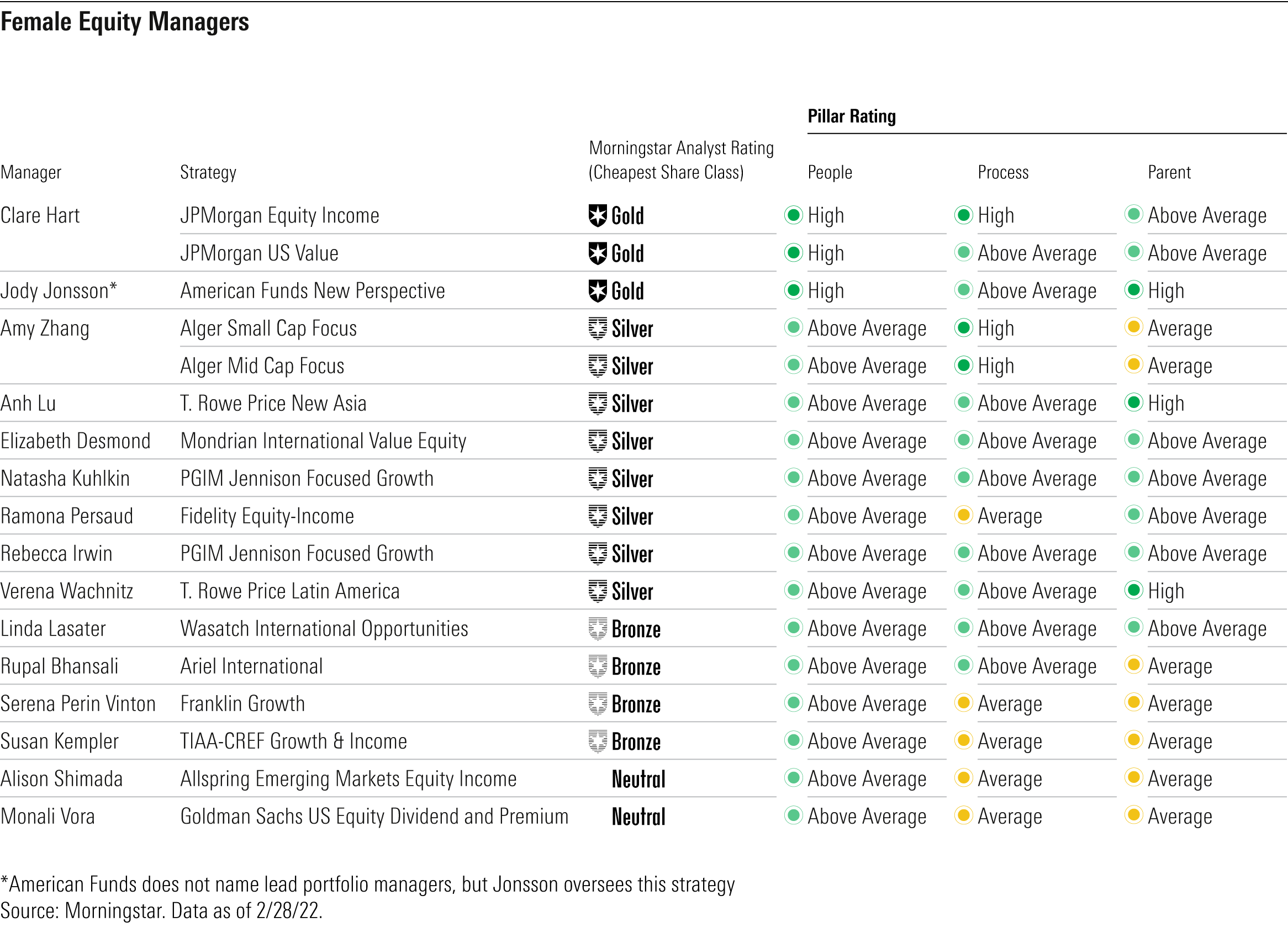

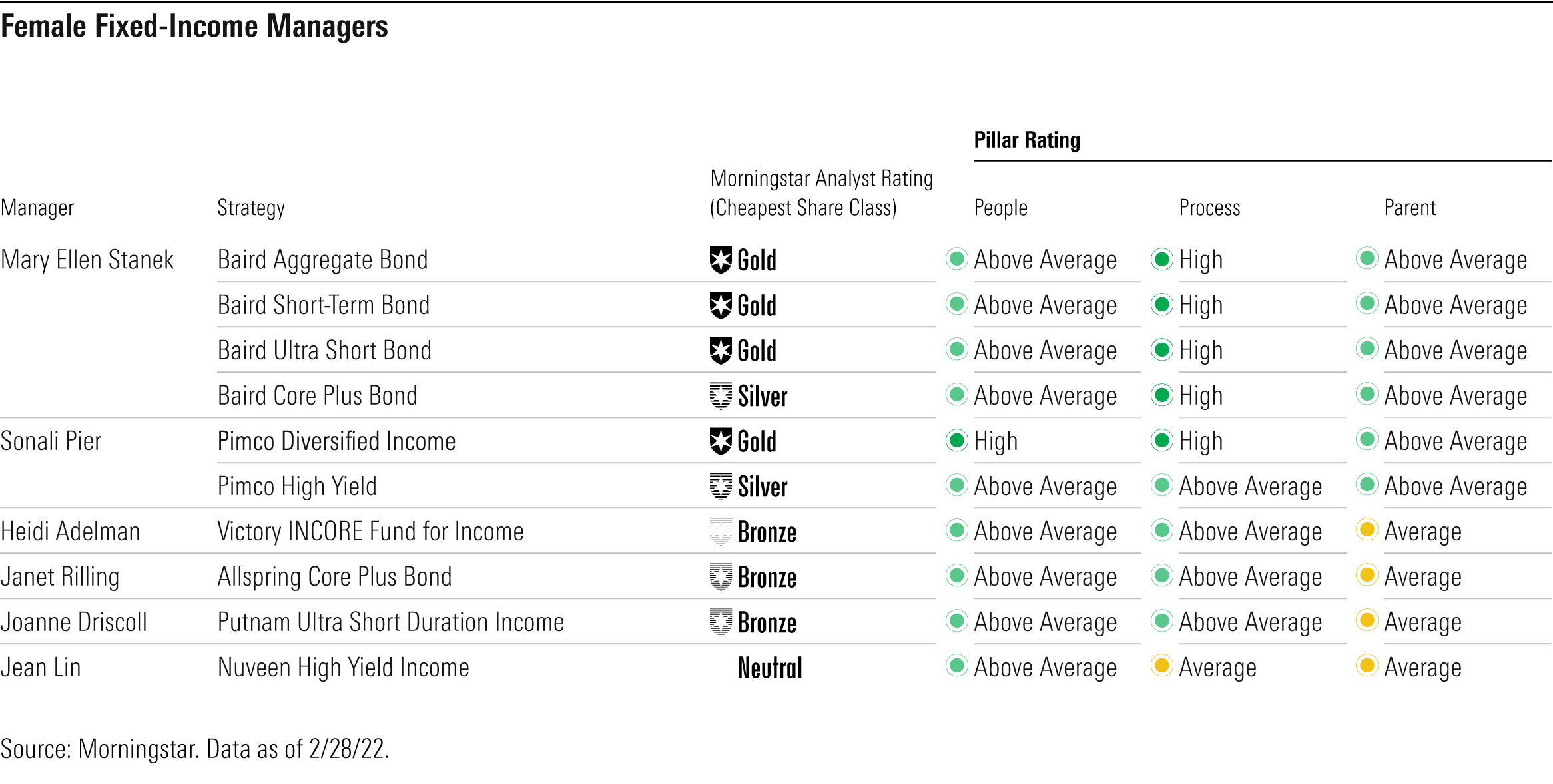

Portfolio managers Clare Hart, Amy Zhang, Mary Ellen Stanek, Erin Browne, Michelle Black, Margie Patel, Sonali Pier, and Suzanne Hutchins may not be household names like other portfolio managers, but their results speak for themselves. In this article we highlight the 27 female portfolio managers that earn High or Above Average People Pillar ratings from Morningstar analysts in the United States.

These skilled managers have built impressive careers even as women remain severely underrepresented in portfolio management. In 2021, Morningstar found that women’s representation in portfolio management has come primarily through mixed-gender teams, while sole female managers and all-female teams are still difficult to come across. In the U.S., they account for just 2% of management teams versus 70% for all-male teams. In other countries and regions, particularly smaller fund markets like China, female managers have higher representation.

In honor of International Women’s Day, we showcase a few exceptional female managers below.

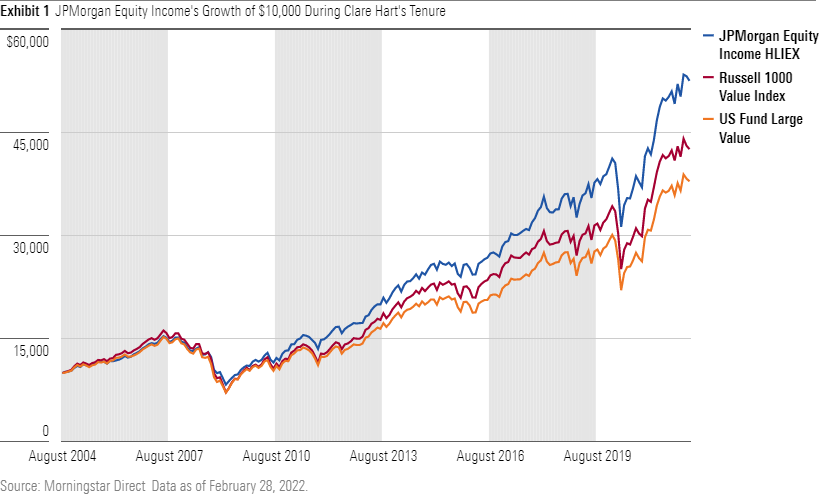

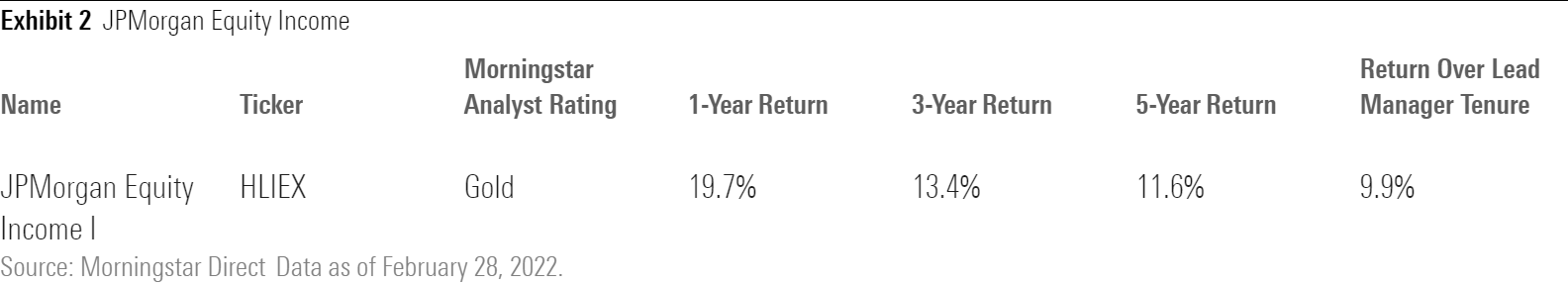

Clare Hart, JPMorgan Asset Management

Clare Hart is one of the industry’s most impressive managers. In 2004, she grabbed the reins of JPMorgan Equity Income HLIEX, whose cheapest share classes earn a Morningstar Analyst Rating of Gold. It has since grown to one of the largest mutual funds managed by a woman and recently closed to new investors. Hart began her career in accounting but pivoted to equity research before joining JPMorgan Chase in 1999. Today, she oversees both JPMorgan Equity Income and JPMorgan US Value VGIIX, which also receives a Gold rating.

JPMorgan Equity Income has been tough to beat with Hart at the controls. She pairs her accounting background with a quality-focused equity income approach to avoid value traps; targeting companies with attractive dividend yields (at least 2% at purchase) and reasonable valuations. Since Hart took over in August 2004, the 9.9% annualized gain of the fund’s cheapest share class topped the Russell 1000 Value Index by 1.3 percentage points and bested 92% of large-value Morningstar Category competitors.

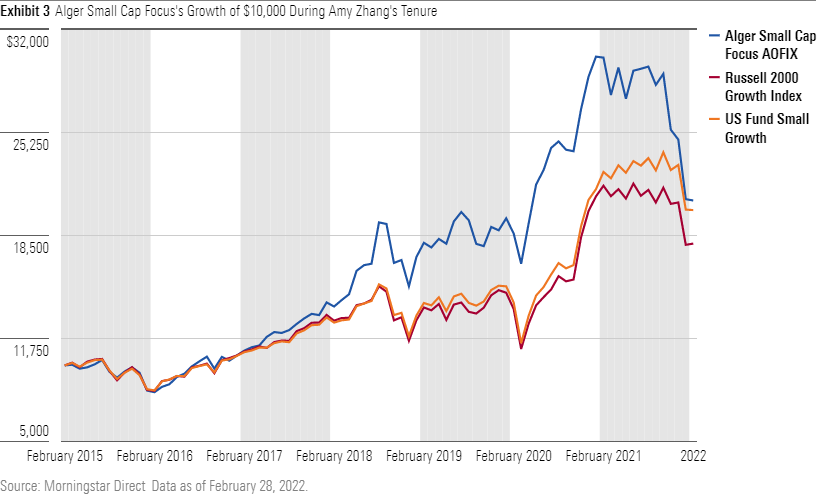

Amy Zhang, Alger

Amy Zhang’s skill and drive have made her tough to beat over her 25-year career. She is the sole portfolio manager for Alger Small Cap Focus AOFIX and Alger Mid Cap Focus AFOIX, which both earn Silver ratings.

Prior to joining Alger, Zhang comanaged Gold-rated Brown Capital Management Small Company BCSSX for a dozen years, helping it build out one of the best records not only in the small-growth Morningstar Category, but among all U.S. open-end funds. In 2015, she stepped out on her own to take over Alger Small Cap Focus and hasn’t looked back since. The fund’s 11% annualized return through February 2022 easily outpaced the Russell 2000 Growth’s 8.7%. Assets under management, meanwhile, have swelled to more than $5 billion from a mere $14 million when she took charge. Zhang has also leveraged that success to venture into larger companies, launching Alger Mid Cap Focus in June 2019.

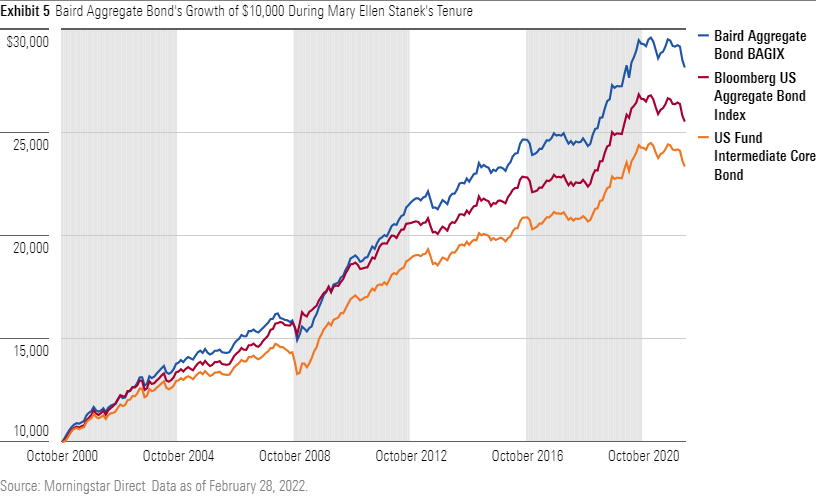

Mary Ellen Stanek, Baird Asset Management

Mary Ellen Stanek is a trailblazer in the fixed-income space. She serves as co-chief investment officer and managing director at Baird Asset Management and steers five of the firm’s strategies, including Gold-rated Baird Aggregate Bond BAGIX and Silver-rated Baird Core Plus Bond BCOIX.

Stanek has fostered a collaborative work culture over her remarkable 43-year career. She joined Baird 22 years ago and leads a tight-knit and growing team, which has been stable and instrumental to the firm’s success; Stanek and her team oversaw $130.2 billion in assets as of December 2021. She has also long demonstrated an investors-first mentality. The strategies under Stanek’s purview have consistently been some of cheapest active offerings in their respective categories. Baird Aggregate Bond’s 5% annualized return over Stanek’s tenure through February 2022 topped 92% of intermediate core bond peers. The team’s straightforward, comprehensive, and selective approach differentiates it from its peers. Her disciplined process has helped shareholders top peers without chasing for yield in riskier parts of the fixed-income market.

Erin Browne, Pimco

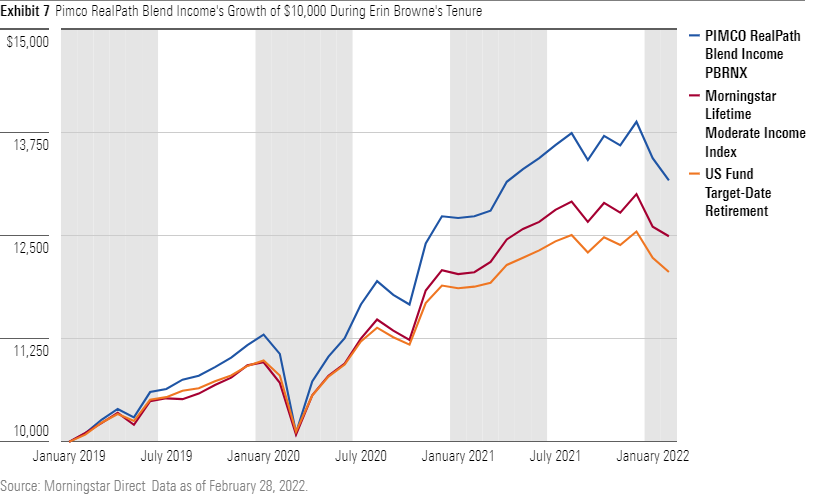

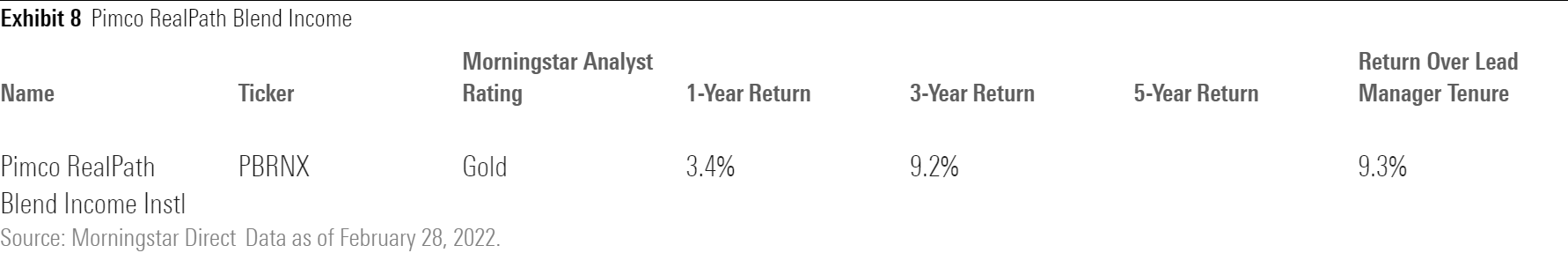

Erin Browne has reinvigorated bond giant Pimco’s multi-asset efforts since joining in 2019. She is head of the firm’s asset allocation group and lead manager of the Pimco RealPath Blend target-date series, which earns a Gold rating.

Prior to joining Pimco, Browne built an impressive resume. Her previous roles include head of asset allocation at UBS and as a global macro portfolio manager at high-profile hedge fund Point72 Asset Management. Browne now oversees Pimco’s asset-allocation funds and target-date series while serving as a rotating member of the firm’s investment committee. The target-date series balances low costs with active exposure by utilizing passive Vanguard equity funds and the firm’s stalwart active fixed-income funds. The cheapest share class of each vintage has outpaced both its respective Morningstar Category index as well as its S&P Target-Date index over Browne’s brief but promising tenure.

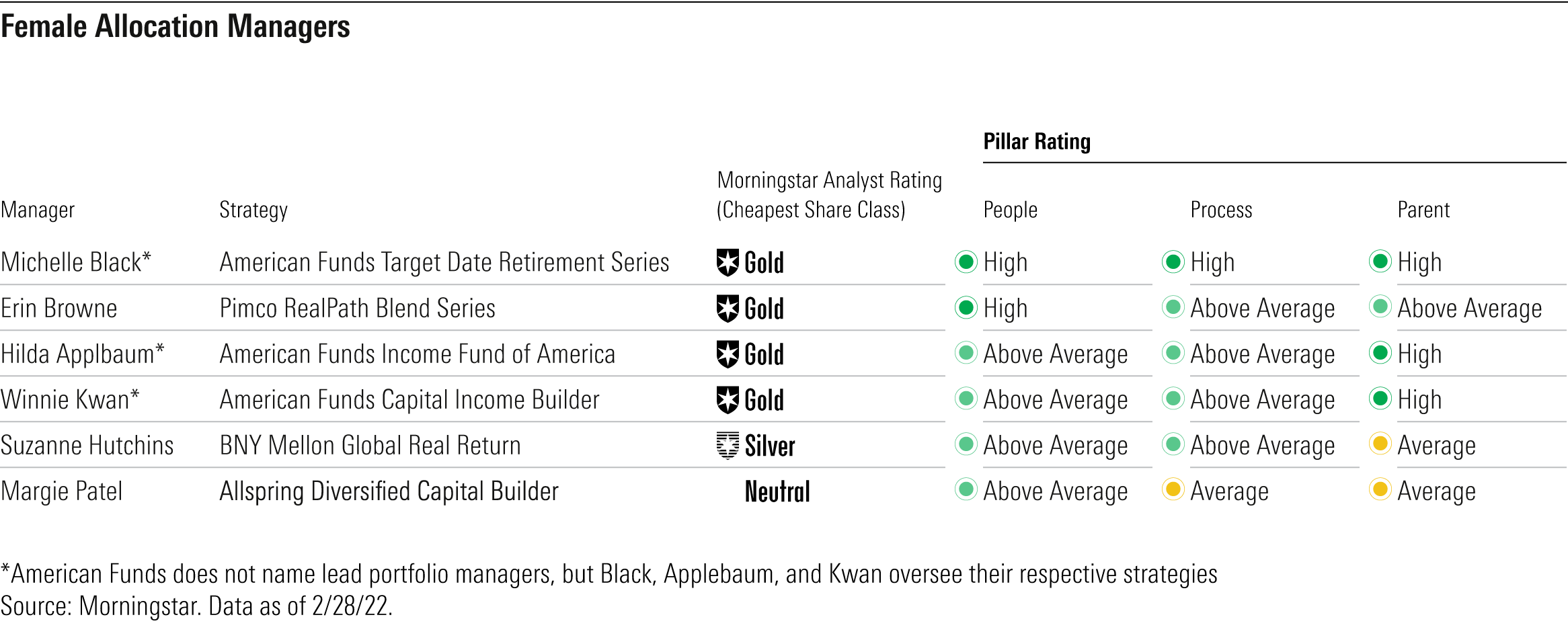

These are just a few of the excellent female portfolio managers under our coverage. Below we list the sole female or team of women managers across the U.S. that earn Above Average or High People ratings, indicating Morningstar analysts’ confidence in the portfolio management team, as well as the strategy. Each of these women’s Morningstar Medalist funds deserves a spot on every investor’s watchlist.

Quantitative Analyst Amrutha Alladi contributed to this report.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)