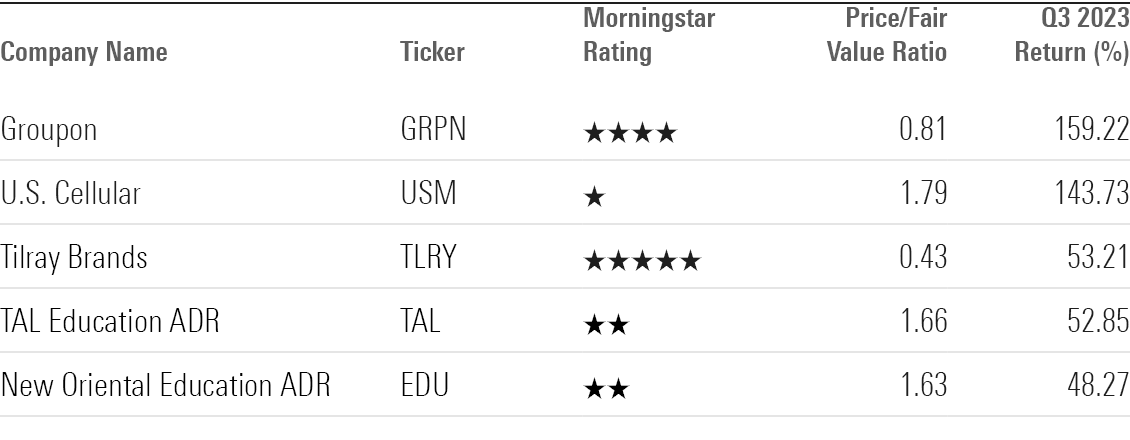

Top-Performing Stocks for Q3 2023

Groupon, Tilray, U.S. Cellular, and energy stocks are among the leaders.

Against the backdrop of a flat stock market, Groupon GRPN staged the biggest rally among U.S.-listed stocks covered by Morningstar analysts, as the e-commerce stock continued to bounce back from a first-quarter collapse.

Groupon’s 159.2% rally came as investors responded positively to new management. Not far behind was the 143.7% jump seen by United States Cellular USM, which surged as the company announced it was exploring “strategic alternatives.”

Top-Performing Stocks of Q3 2023

- Groupon

- United States Cellular

- Tilray Brands TLRY

- TAL Education Group ADR TAL

- New Oriental Education & Technology Group ADR EDU

Among the stocks still considered undervalued by our analysts, Groupon (which carries a Morningstar rating of 4 stars) performed best. Cannabis company Tilray Brands (the third-best-performing stock overall) jumped 53.2% in the third quarter. Its rally came on the news that the U.S. Department of Health and Human Services recommended that the Drug Enforcement Administration reclassify cannabis.

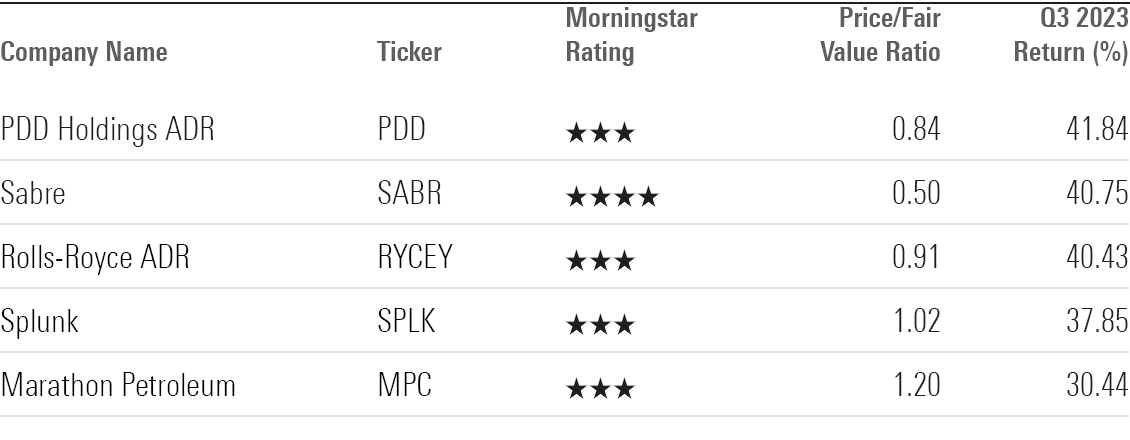

Among stocks that Morningstar analysts classify as having an economic moat (meaning those companies have durable competitive advantages), the best-performing name was internet retailer PDD Holdings PDD, which was up 41.8%. It was followed by travel services company Sabre SABR, which gained 4.80%.

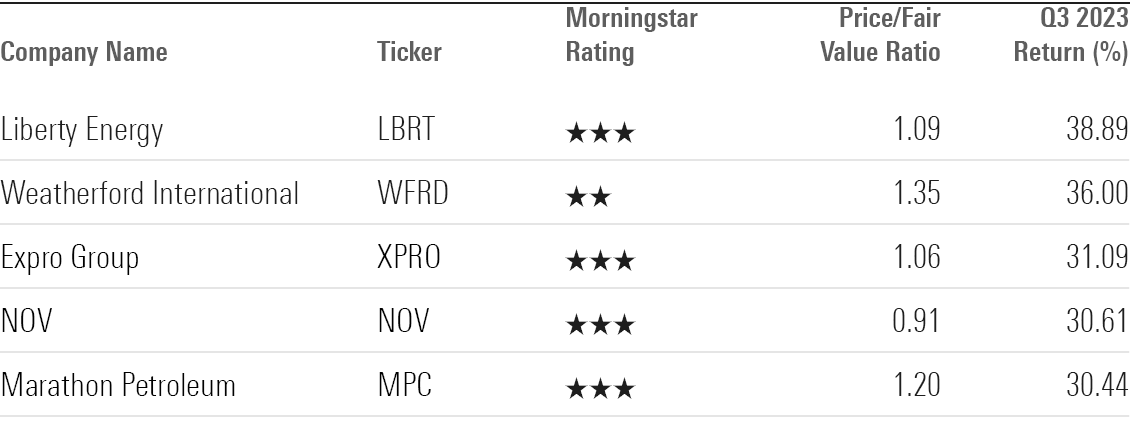

Elsewhere, energy stocks rallied to have the best performance among all sectors in the third quarter with a 12.7% gain. Riding a rise in oil prices, the best performers include oil and gas equipment and services companies such as Liberty Energy LBRT, which rose 38.9% in the third quarter.

Here are the highlights of the third quarter’s top-performing stocks, along with their key Morningstar metrics.

Q3 Top-Performing Stocks

Groupon

- Fair Value Estimate: $19.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

“As a first mover in the local-market daily deals space, Groupon has captured a leadership position, but robust profitability has not followed. While there have been some indications of improvements thanks to the firm’s restructuring plan, we are skeptical about Groupon’s ability to accelerate top-line growth and expand margins over the long run.”

—Ali Mogharabi, senior equity analyst

United States Cellular

- Fair Value Estimate: $24.00

- Morningstar Rating: 1 star

- Morningstar Economic Moat Rating: None

“U.S. Cellular’s business continued deteriorating in the second quarter, but the stock skyrocketed after the firm announced it was exploring strategic alternatives. We believe the firm’s assets have significant value that makes today’s stock move warranted. However, the willingness of the controlling shareholder to accept potential incoming bids, along with other challenges like regulatory and tax issues, make potential outcomes highly speculative. We are maintaining our $24 fair value estimate, which continues to value U.S. Cellular on a standalone basis. We believe the value of the firm if operated independently is lower than it is in the hands of other owners.”

—Matthew Dolgin, equity analyst

Tilray Brands

- Fair Value Estimate: $5.50

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

“On Aug. 30, shares of U.S. cannabis multistate operators rallied around 20% (with Canadian licensed producers up less) following news that the U.S. Department of Health and Human Services recommended to the Drug Enforcement Administration that it reclassify cannabis. Cannabis, along with heroin and ecstasy, is currently listed as a Schedule I drug, which means it is considered to have a high potential for abuse and no medical value. Schedule III drugs are considered less dangerous, with a lower potential for abuse and having some medical value. This reclassification would not necessarily be a panacea for the cannabis industry, but it could be enough to bring some important benefits to U.S. multistate operators, including paying normal tax rates, improved banking access, and potential listing on a major U.S. stock exchange.”

—Kristoffer Inton, equity analyst

TAL Education Group ADR

- Fair Value Estimate: $5.50

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: None

“TAL repositioned itself as a smart learning solutions provider after regulatory changes in 2021 decimated the K-9 academic afterschool tutoring industry. It has since realigned its business focus toward enrichment learning, learning technology solutions, and content solutions. Enrichment learning offers nonacademic programs to students aged 2-18. Technology solutions are business-oriented and provide enterprise-grade technology products and services to learning institutions. Content solutions offer learning content in both paper and digital formats to students.”

—Cheng Wang, equity analyst

New Oriental Education & Technology Group Inc ADR

- Fair Value Estimate: $36.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: None

“New Oriental’s revenue for its fiscal 2023 fourth quarter (ending May 2023) beat management guidance, but adjusted net income missed the Refinitiv consensus. We suspect there was a large hike in selling and marketing expenses in East Buy (formerly Koolearn). Meanwhile, the new businesses are bearing fruit and are on track to hit mid-double-digit revenue growth in 2024. Demand for overseas-related business and high school tutoring also remained strong, and we think the trend will carry forward to fiscal 2024. New Oriental’s share price gained more than 40% from its June 2023 low and is now 43% above our fair value estimate. We think investors are too optimistic about its growth and margin potential.”

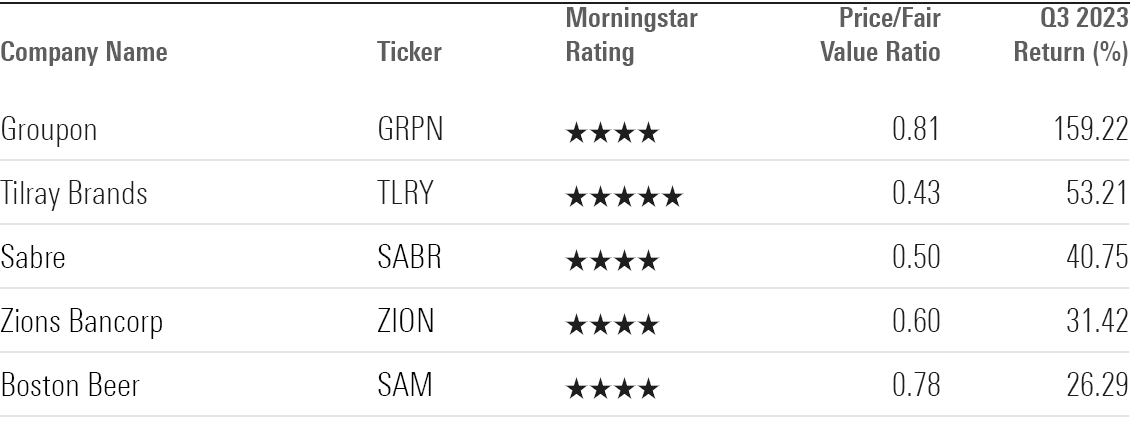

Undervalued Top-Performing Stocks

Undervalued Top-Performing Stocks

Sabre Corp

- Fair Value Estimate: $9.00

- Morningstar Rating: 4 stars

- Economic Moat Rating: Narrow

“Despite material near-term economic and credit market uncertainty, we expect Sabre to maintain its position in global distribution systems over the next 10 years, driven by a leading network of airline content and travel agency customers, as well as its solid position in technology solutions for these carriers and agents. Sabre’s 30%-plus GDS air transaction share is the second-largest of the three companies (behind Amadeus and ahead of privately held Travelport) that together control nearly 100% of market volume. Sabre is also a leader in providing technology solutions to travel suppliers.”

—Dan Wasiolek, senior equity analyst

Zions Bancorp ZION

- Fair Value Estimate: $58.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

“Zions is one of the smaller regional banks that we cover. It is primarily a commercial bank focused on small to midsize businesses in the western United States, where on-the-ground relationships are key. Although it struggled during the financial crisis and the years afterward, it has made meaningful improvements to its credit risk management and operational efficiency. We think the main determinants of the bank’s future success will be the interest rate environment, the stability of its deposit base, and its ability to maintain and improve operational efficiency.”

—Eric Compton, strategist

Boston Beer SAM

- Fair Value Estimate: $497.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

“Though much smaller in size compared with beer behemoths, Boston Beer has thrived thanks to a sharp focus on high-end malt beverages benefiting from premiumization trends. In addition, the firm has demonstrated it can augment its portfolio with offerings that best align with demand tailwinds, and that it can participate early in growth categories to extract high profits ahead of competition. This is exemplified by the string of successes with brands like Truly, Twisted Tea, Angry Orchard, and Samuel Adams building and maintaining top volume shares in their respective categories over extended horizons. The strong unit economics and cash flows that have resulted further enable the firm to quickly pivot its portfolio and distribution focus as new growth vectors emerge. Its 2016 launch of Truly ahead of the hard seltzer volume takeoff was a case in point.”

—Dan Su, equity analyst

Top-Performing Moat Stocks

Top-Performing Moat Stocks

PDD Holdings

- Fair Value Estimate: $117.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

“PDD is an e-commerce social platform that encourages users to enjoy lower prices by teaming up to make purchases. Easier sharing of PDD deals with social contacts through Tencent’s social network leads to lower traffic acquisition costs than its peers. PDD aims to offer good value across a wide range of categories and price points. "

—Chelsey Tam, senior equity analyst

Rolls-Royce Holdings ADR RYCEY

- Fair Value Estimate: $2.90

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

“Rolls-Royce holds a prominent position in the global commercial and military aerospace propulsion and power system sectors. Its commercial aerospace segment generates approximately 50% of group sales, and the company is a market leader, with a dominant 58% market share in wide-body aircraft engines. Despite potential headwinds in 2023 such as weaker economic growth in Europe and the U.S., persistent input cost inflation, and supply chain challenges, we are confident about the company’s long-term outlook, given its stronger balance sheet, leaner cost base, performance improvements, and large and young fleet, which ensures continued demand for maintenance, repair, and overhaul services well beyond the next decade.”

—Loredana Muharremi, equity analyst

Splunk SPLK

- Fair Value Estimate: $144.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

“Cisco Systems CSCO has announced its plans to acquire Splunk for $28 billion or $157 per share in cash—a 31% premium to Splunk’s Sept. 20 closing price. With this acquisition, Cisco is aiming to expand its cybersecurity portfolio by integrating Splunk’s security information and event management solution into its broader security solution set.”

—Malik Ahmed Khan, analyst

Marathon Petroleum MPC

- Fair Value Estimate: $126.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

“The combination of Marathon and Andeavor created the largest U.S. refiner, with facilities in the midcontinent, Gulf Coast, and West Coast. Marathon planned to leverage this geographically diverse footprint to optimize its crude supply from North America to reduce feedstock costs while also improving its operating cost structure. It delivered $1.1 billion of a planned $1.4 billion in synergies by year-end 2019, but its focus shifted to capital and cost reductions in 2020 when the COVID-19 pandemic hit. These efforts proved successful, with the company delivering over $1 billion in operating expense reductions. In the near term, its focus remains on delivering more cost and capital improvements.”

—Allen Good, director

Top-Performing Energy Stocks

Top-Performing Energy Stocks

Liberty Energy LBRT

- Fair Value Estimate: $17.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

“Following several quarters of rapid expansion (LIberty’s U.S. rig count nearly doubled between 2020 and 2022), activity will likely remain comparatively subdued through year-end. Management indicated the possibility of idling up to three frac spreads in the second half. We expect Liberty and peers will maintain some pricing power, however. Service firms can activate and idle frac spreads relatively quickly, which facilitates agile responses to varying demand. We expect pressure pumpers will idle portions of their fleets to preserve a level of capacity utilization that keeps pricing power in their favor rather than allow overcapacity to depress prices, as seen in prior cycles. So we think it’s unlikely that Liberty’s pricing power will completely nosedive, though a prolonged reduction in completions activity could lead to decreasing prices over the longer term.”

—Katherine Olexa, analyst

Weatherford International WFRD

- Fair Value Estimate: $67.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: None

“As Weatherford progresses through its internal optimization initiatives, management remains steadfast in its intention to target profitability potential over market share gains across regions. We expect this will stabilize the firm’s through-cycle profitability in an otherwise volatile industry, though the strategy is not without possible drawbacks. Despite the currently favorable pricing environment, we expect price competition will remain prevalent over the long run, and prioritizing higher-margin projects may significantly reduce the number of contracts worth pursuing. It’s also possible that reduced market share may limit cross-selling potential over time. We nevertheless expect demand for oilfield services over the next five years will remain elevated, supporting profitable growth for Weatherford over the near to medium term.”

Expro Group Holdings XPRO

- Fair Value Estimate: $22.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

“Over two-thirds of Expro’s business relies on global drilling and completions activity, and global offshore rig capacity will likely remain near full utilization through at least 2025. Elevated industry demand will support revenue growth and margin expansion for Expro over the next five years, averaging 9% and 18.5%, respectively. Favorable pricing dynamics and internal cost reduction initiatives will be key profit drivers, but we also see opportunities for Expro to add value through newly developed productivity-enhancing service offerings.”

NOV NOV

- Fair Value Estimate: $23.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

“NOV relies on strategic acquisitions to diversify its product portfolio. Wellbore technologies and completion and production solutions split the remaining two-thirds of its current business. As a result, the firm now operates in more traditional oilfield services markets, which are more fragmented and price-competitive. NOV must remain technologically evolved in a rapidly advancing space to stay relevant with contractors. It intends to continue strengthening its technological capabilities through further bolt-on acquisitions, in lieu of in-house research and development. Given the highly competitive nature of the oilfield services market, particularly onshore, we don’t expect future acquisition activity will generate significant value.”

Correction: An earlier version of this piece misnamed the Drug Enforcement Administration.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)