Stock Market Falling Deeper Into Undervalued Territory

Stocks have retreated since hitting fair value at end of July and are now looking very undervalued on historical perspective.

Key Takeaways

- Current Market Valuation Has Only Been This Undervalued 12% of Time Since 2011

- Magnificent 7 Earnings Roundup

- Utility Stocks Very Undervalued, but Probably Not for Long

- Economic Outlook: Growth Stronger Than Expected, but It Will Slow

The stock market peaked on July 31, just briefly touching our fair value composite, and has slid ever since. There are three main reasons for this pullback.

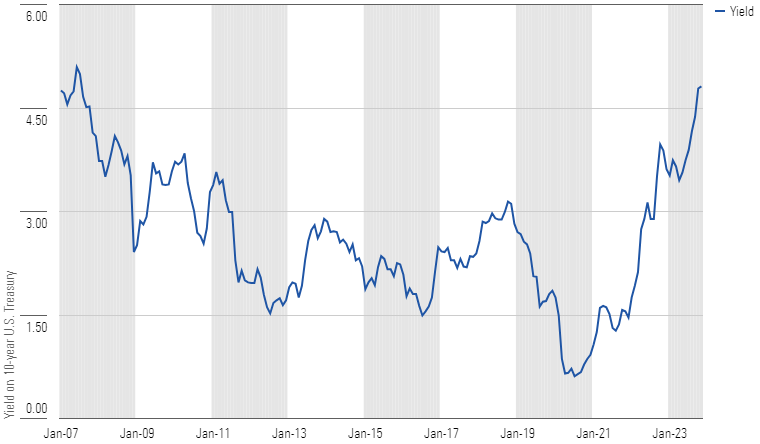

First, long-term interest rates have risen substantially in a short period of time. Between July 31 and Oct. 31, the yield on the 10-year U.S. Treasury has risen 64 basis points to 4.82% and had hit as high as 5.00% in mid-October. These are the highest interest rates that Treasuries have traded at since 2007, and have become increasingly attractive to investors, many of whom have begun to increase their fixed-income allocations at the expense of reduced equity allocations.

Yield on 10-year U.S. Treasury

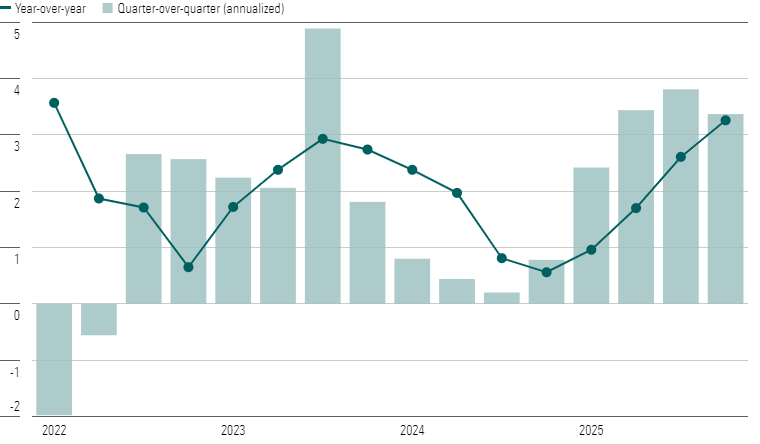

Second, while third-quarter gross domestic product was much more robust than expected, the market continues to expect that tight monetary policy, high interest rates, and rising lending standards will take their toll on the economy. The only question is, How much and how fast? While our base case remains no recession, we recently lowered our projection for real GDP in 2024 to 1.4%. According to our projections, we forecast the rate of GDP growth will decelerate sequentially until bottoming out in the third quarter of 2024 and then begin to accelerate thereafter.

GDP Growth, Quarterly Forecast

Lastly, already heightened geopolitical risks have worsened and cast a negative sentiment across the equity markets. Investors are keeping a close eye on the conflict between Israel and Hamas, and are watching for any potential contagion to other regional actors.

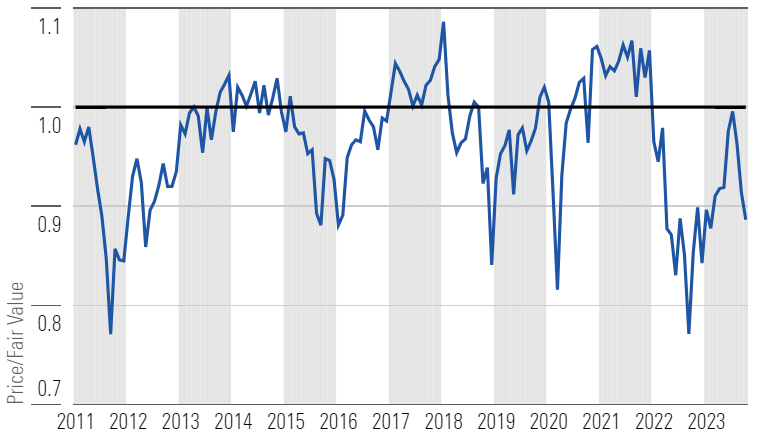

Current Market Valuation Has Only Been This Undervalued 12% of Time Since 2011

In our August 2023 Market Outlook, we noted that the stock market had traded up enough to reach our fair value estimate. We also opined that was a good time to lock in profits and sell those stocks that had become overvalued and overextended. Between July 31 and Oct. 31, the Morningstar US Market Index dropped approximately 8.8%, with 2.5% of the decline occurring in October.

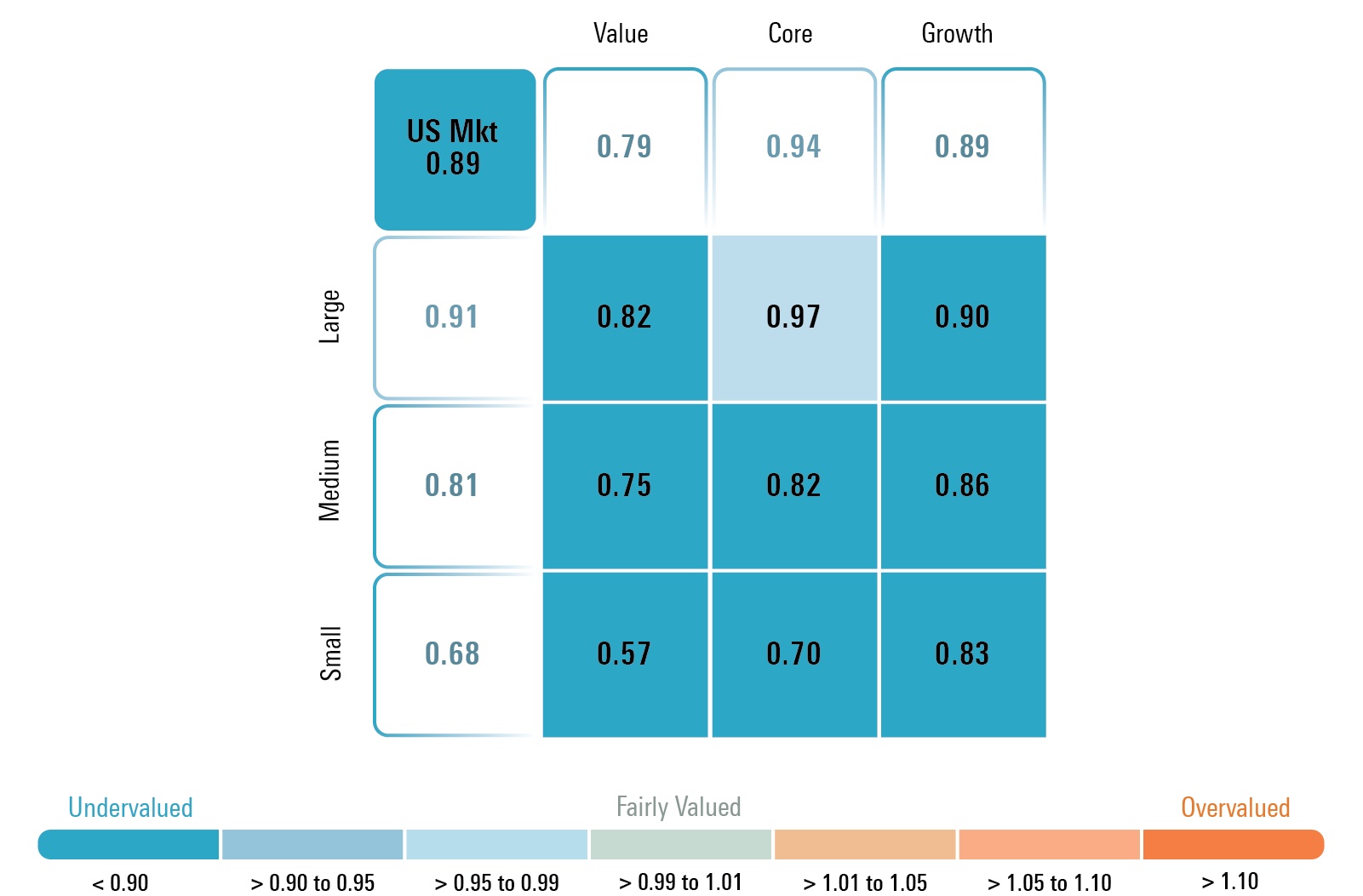

According to a composite of the more than 700 U.S.-exchange-traded stocks that we cover, as of Oct. 31, the U.S. equity market was trading at a price/fair value ratio of 0.89, representing an 11% discount to our fair value estimate. Since 2011, the market has traded at this discount (or more) to our fair value only 12% of the time.

Month End Price/Fair Value of Morningstar’s U.S. Equity Research Coverage

The pullback in October has been relatively broad-based as each of the style categories has fallen by similar amounts. As such, based on our valuations, we continue to advocate for an overweight position in value, underweight in core/blend, and market weight in growth. By market capitalization, large-cap stocks fared better to the downside whereas mid-cap and small-cap took the brunt of the selloff, making those categories even more undervalued compared with our valuations.

Price/Fair Value by Morningstar Style Box Category

The current price/fair value on small-cap stocks is near the greatest discount we’ve seen since 2011. However, the risk to small-cap stocks’ performance over the near term is that we project the rate of economic growth to slow sequentially until third-quarter 2024.

We suspect small-cap stocks will have a difficult time performing until the market begins to price in an economic rebound. In fact, market sentiment is such that we will need a much more “normalized” economic environment before investors become more comfortable going back into smaller-cap stocks. In a slowing (or recessionary) economic environment, institutional investors will have the predilection to hide out in large-cap stocks as opposed to taking the risk of greater earnings volatility inherent in small-caps.

In addition, small-caps will be more negatively affected the longer interest rates stay high. Their debt funding is much shorter duration than large-caps, which can easily issue 10- and 30-year bonds. Large-cap companies had the benefit of being able to term out a substantial amount of their debt in the public bond markets while interest rates were low in 2020 and 2021.

Magnificent 7 Earnings Roundup

Considering that attribution from the “Magnificent 7″ accounts for 68% of the markets’ gains thus far this year, investors are watching their earnings and guidance even more closely than ever.

Alphabet GOOGL

- Morningstar Price/Fair Value: 0.79

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

Revenue and earnings growth were both better than expected, but the stock traded down on concerns that its cloud business is growing more slowly than Microsoft’s MSFT, which may indicate Alphabet is losing market share. We are not concerned. In our opinion, the differential is explained by the type of end client served by Alphabet as compared with Microsoft. We held our $161 fair value estimate unchanged. Alphabet Earnings: Google Search and YouTube Are Strengthening, and Cloud Is Likely to Accelerate

Amazon.com AMZN

- Morningstar Price/Fair Value: 0.88

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

Amazon.com reported good third-quarter results and provided better-than-expected guidance for the fourth quarter. We increased our fair value estimate to $155 per share, from $150. Amazon.com Earnings: E-Commerce Improves, AWS Stabilizes, and Margins Surge

Apple AAPL

- Morningstar Price/Fair Value: 1.16

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

Earnings to be released Thursday evening, Nov. 2.

Meta Platforms META

- Morningstar Price/Fair Value: 0.97

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

We increased our fair value estimate slightly to $322 from $311. Third-quarter results demonstrated strength on all fronts: user growth, engagement, and monetization. The stock pulled back slightly as traders were looking for more cost containment, but the stock quickly rebounded. Meta Earnings: Still Impressive but the Shares Remain Fairly Valued

Microsoft MSFT

- Morningstar Price/Fair Value: 0.94

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

We increased our fair value estimate to $370 from $360. The company is running on all cylinders and exceeded expectations. Microsoft Earnings: All Segments Are Good, With Azure Expected to Remain Strong Throughout 2024

Nvidia NVDA

- Morningstar Price/Fair Value: 0.88

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

Nvidia’s earnings release is scheduled for Nov. 21.

Tesla TSLA

- Morningstar Price/Fair Value: 0.98

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

We lowered our fair value estimate to $210 from $215 on lower short-term margins as Tesla ramps up its Cybertruck production. However, similar to the Model 3 ramp-up, we forecast automotive profit margins will rebound as production scales up. Our long-term forecasts remain unchanged. After Earnings, Is Tesla Stock a Buy, a Sell, or Fairly Valued?

Where Do We See Some of the Best Opportunities in Today’s Market?

Utilities

Rising interest rates have taken a toll on the utility sector. Through Oct. 31, the Morningstar US Utilities Index has dropped 13.62%, the worst-performing sector this year. In fact, the sector has dropped even more than the Morningstar US 10+ Year Treasury Bond Index, which has fallen 13.17%.

With their high and steady dividend payments, stocks in the utility sector are highly correlated with interest rates and often used by investors as a substitute for fixed income. However, we find utilities more attractive as the dividend payments will rise over time and underlying fundamentals in the sector are better than they have been in decades.

Some of our preferred picks in the sector include:

Entergy ETR

- Morningstar Price/Fair Value: 0.81

- Morningstar Rating: 5-stars

- Dividend Yield: 4.62%

- Morningstar Economic Moat Rating: Narrow

NextEra Energy NEE

- Morningstar Price/Fair Value: 0.71

- Morningstar Rating: 5 stars

- Dividend Yield: 4.48%

- Morningstar Economic Moat Rating: Narrow

Duke Energy DUK

- Morningstar Price/Fair Value: 0.85

- Morningstar Rating: 5 stars

- Dividend Yield: 4.48%

- Morningstar Economic Moat Rating: Narrow

Real Estate

Rising interest rates and generally negative market sentiment regarding valuations across commercial real estate have taken their toll on the real estate sector. The Morningstar US Real Estate Index has fallen by 8.39% through the end of October. While valuations among urban office space remain muddy, we see a significant amount of undervaluation in other areas of the real estate market.

Areas that we think are attractive include:

- Those with defensive characteristics such as healthcare;

- Real estate with improving fundamentals such as Class A malls;

- Value-oriented real estate whose prices have fallen too much; and

- Real estate that stands to benefit from the tailwind brought about by artificial intelligence.

Some of our preferred picks in the sector include:

Ventas VTR

- Morningstar Price/Fair Value: 0.59

- Morningstar Rating: 5 stars

- Dividend Yield: 4.21%

- Morningstar Economic Moat Rating: None

Simon Property Group SPG

- Morningstar Price/Fair Value: 0.74

- Morningstar Rating: 5 stars

- Dividend Yield: 6.76%

- Morningstar Economic Moat Rating: None

American Tower AMT

- Morningstar Price/Fair Value: 0.79

- Morningstar Rating: 5 stars

- Dividend Yield: 3.63%

- Morningstar Economic Moat Rating: Narrow

Digital Realty DLR

- Morningstar Price/Fair Value: 0.94

- Morningstar Rating: 5 stars

- Dividend Yield: 3.86%

- Morningstar Economic Moat Rating: Narrow

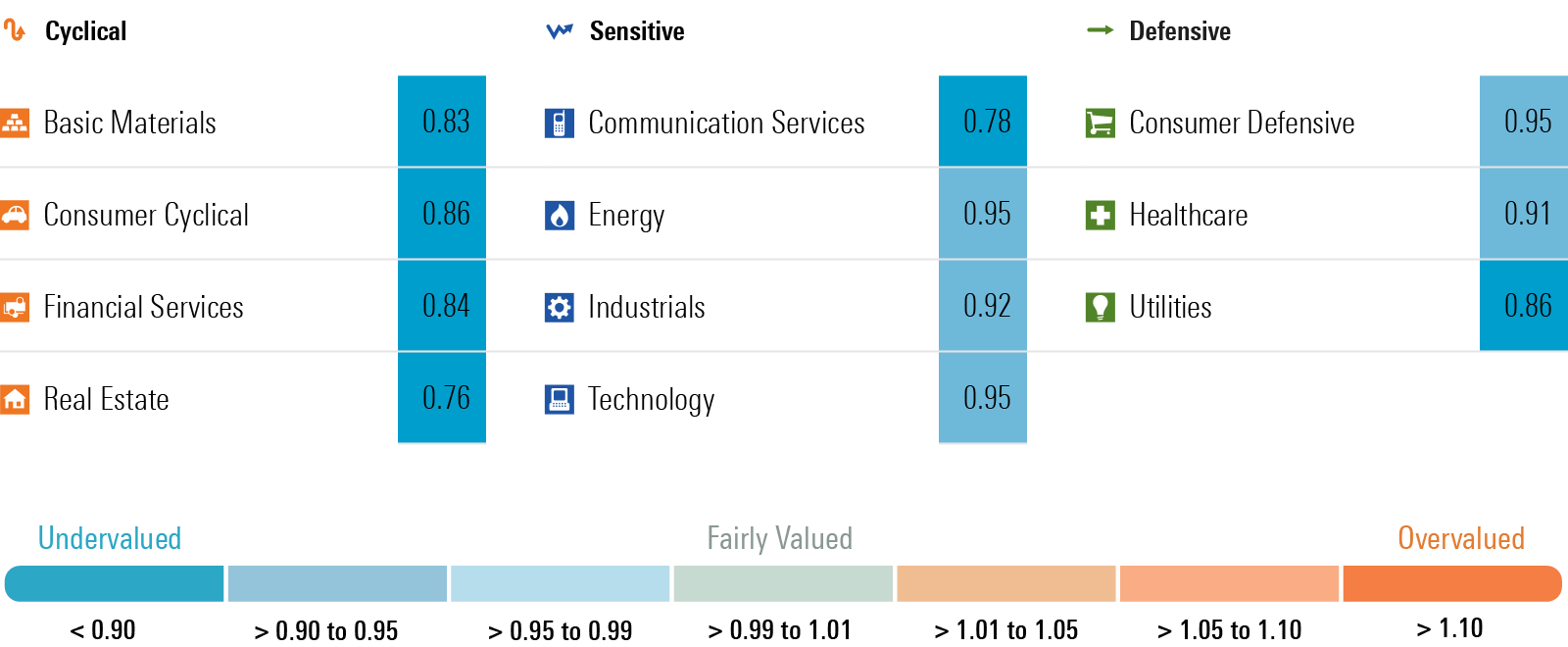

Morningstar Price/Fair Value by Sector

Economic Outlook: Growth Stronger Than Expected, but It Will Slow

Our U.S. economics team has been in the soft landing camp all year, but third-quarter GDP was much higher than even we expected. Yet looking forward, we continue to expect that tight monetary policy, high interest rates, and rising loan standards will take their toll on the economy.

We project that economic growth in the fourth quarter will slow to less than half of that in the third quarter. According to our forecast, we foresee the rate of economic growth will decelerate sequentially until bottoming out in the third quarter of 2024, before beginning to accelerate.

Consumer spending, which has kept the broad economy more resilient to tight monetary policy, appears to be close to being tapped out. Looking forward, spending will slow as:

- Inflation has forced households to eat into savings;

- The impact from higher interest rates has begun to stunt spending;

- Student loan payments are resumed; and

- Geopolitical conflict weighs on consumer sentiment.

Interest-Rate Outlook

The yield on the 10-year U.S. Treasury rose to as high as 5% in mid-October before sliding over the past week. While the bond market may once again test a 5-handle, we wouldn’t expect rates to stay above 5% for long.

Over the past month, we have seen several technical factors put pressure on bond prices. These include:

- The Federal Reserve’s Quantitative Tightening;

- Higher-than-expected U.S. deficit spending; and

- Foreign central banks selling.

Over the next few months these technical factors should ease. The amount of deficit financing will decline over the next two quarters and the amount of foreign selling is expected to decrease.

From a fundamental perspective, with long-term rates at these levels, we expect demand will increase from institutional investors such as insurance companies and pension funds, which will use the higher rates to duration match their liabilities. In our opinion, now is a good time for investors to lengthen the duration of their fixed-income portfolios and lock in these high rates as we forecast the yield curve will decline in 2024.

Our projection for the yield curve to decline is predicated on our assumption that the Fed will reverse course and begin to ease monetary policy in the first half of 2024. With the economy poised to begin slowing and inflation expected to moderate, we think that will provide the room the Fed would need to embark on a more accommodative monetary policy.

We have also noted that we expect Fed officials to start shifting the focus of their messaging to the markets to a more-balanced perspective between inflation and employment. That shift will allow them to move to more accommodative language in early 2024 before they begin to cut interest rates during the first half of 2024.

Correction: This article was corrected on Nov. 3, 2023, to reflect the correct 3-star rating for Tesla.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)