Markets Review/Preview: Eyes on Russia, Jobs Data Ahead

Markets recoup losses as Tenneco and Farfetch gain. Travel and European banks falter.

Geopolitical events will remain front and center as market professionals and individual investors work to decipher the latest news out of Ukraine. The key question will be how ripples from the war in Ukraine will affect global economies and how it impacts the Federal Reserve's decision on interest rates when it meets in March. In the wake of Russia's attack, investors scaled back their expectations for how much the Fed will raise rates. In the bond market, the odds of the Fed increasing the federal funds rate by 0.25 percentage points rose to 88.6% the day after Russia invaded Ukraine from 66.3% prior to the start of the war. Prior to the attack on Ukraine, expectations had been rising that the Fed would boost rates by 0.5 percentage points at its next meeting, according to CME FedWatch. Since Russia invaded Ukraine, "events throw cold water on the extreme hawkishness expressed by some Fed governors," says Ed Yardeni, president and chief investment strategist for Yardeni Research, which provides global investment advice and analysis. "They will likely slow down the pace and deliver 25 basis points in March."

With aggressive sanctions levied against Russia over the weekend, markets are likely to remain extremely volatile. That's especially the case for commodity and currency markets, along with bond markets, where the value of Russian bonds have been collapsing . Closer to home, there will big news on the U.S. economic front, with investors awaiting the latest employment report due Friday, March 4. Fourth-quarter earnings will also continue to roll out. Tech and consumer sector companies expected to report earnings in the coming week include: Monday: HP HPQ , Viatris VTRS Wednesday: Salesforce CRM , SoFi Technologies SOFI Thursday: The Kroger Company KR Friday: Broadcom AVGO , Gap GPS

For the trading week ending Feb. 25:

Markets recovered from Thursday's plunge sparked by Russia's invasion of Ukraine to end the week higher. Despite falling as much as 5% in the past week, the Morningstar US Market Index started to trim its losses in a reversal Thursday afternoon. That rally lasted through trading on Friday and the index closed the week up 0.96%.

- The U.S. 10-year note rose to 1.98%.

- Healthcare gained 2.7%, and utilities 2.2% to top the week's best performers. Consumer cyclical stocks fell 1.8%.

- The WTI crude oil ended the week up 1.7% to close at $92.81. Prices briefly topped $100 in trading Thursday.

- Of the 861 U.S.-listed companies covered by Morningstar, 61% rose and 39% fell in the past week.

Advancers:

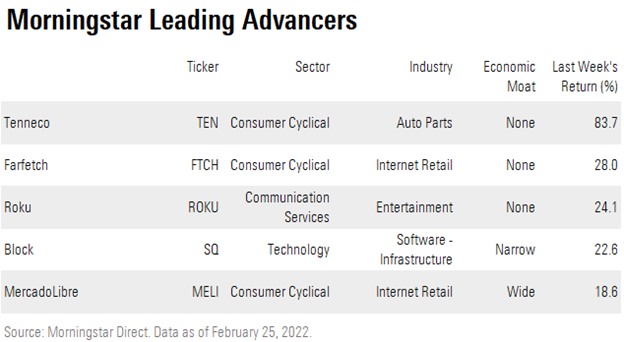

Top performing stocks on Morningstar’s U.S. coverage list: Tenneco TEN, Farfetch FTCH, Roku ROKU, Block SQ, and MecardoLibre MELI.

Tenneco outshined the stocks in the Morningstar U.S. coverage list, rising 83.7% after news broke that the company would be taken private by Apollo Funds for $7.1 billion, a price of $20-per share.

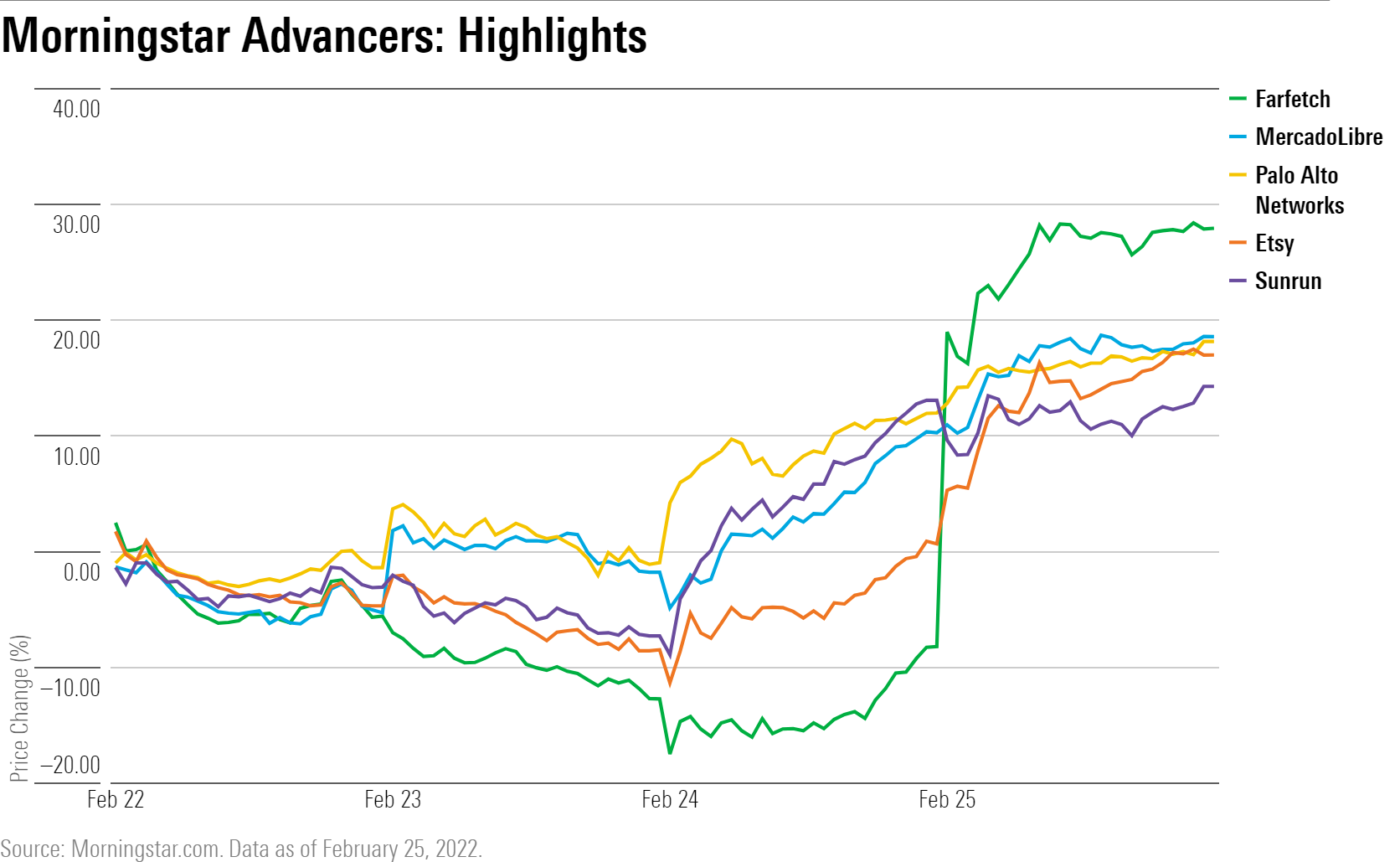

It was a strong week for retail firms, many of which posted earnings in the past week. Luxury fashion retailer Farfetch led the group, rising 28%, followed by Argentinian e-commerce marketplace Mercadolibre 18.6%. Etsy ETSY shares gained 17% after posting strong earnings results.

Cybersecurity firms rallied following Russian cyberattacks on Ukrainian public and private sites, emphasizing the need for updated security. Palo Alto PANW rose 18.2% with CrowdStrike CRWD and Check Point Software CHKP also getting a boost.

Alternative energy stocks also gained with oil prices briefly rising over $100 per barrel. Solar panel and battery company Sunrun RUN rallied 14.3%. Shoals Technologies SHLS, a company providing equipment to safely transmit solar energy, and home energy solutions company Enphase Energy ENPH also closed the week higher. Decliners:

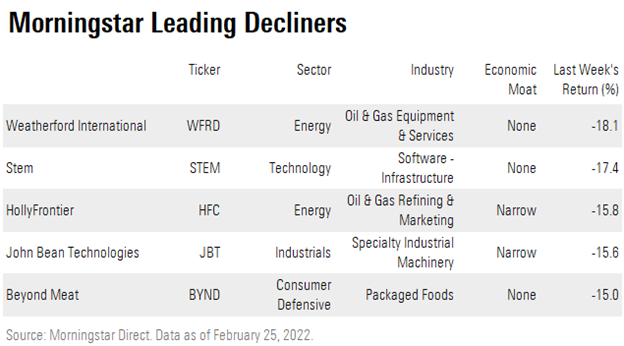

The worst performers in Morningstar’s U.S. coverage were Weatherfield International WFRD, Stem STEM, HollyFrontier HFC, John Bean Technologies JBT, and Beyond Meat BYND.

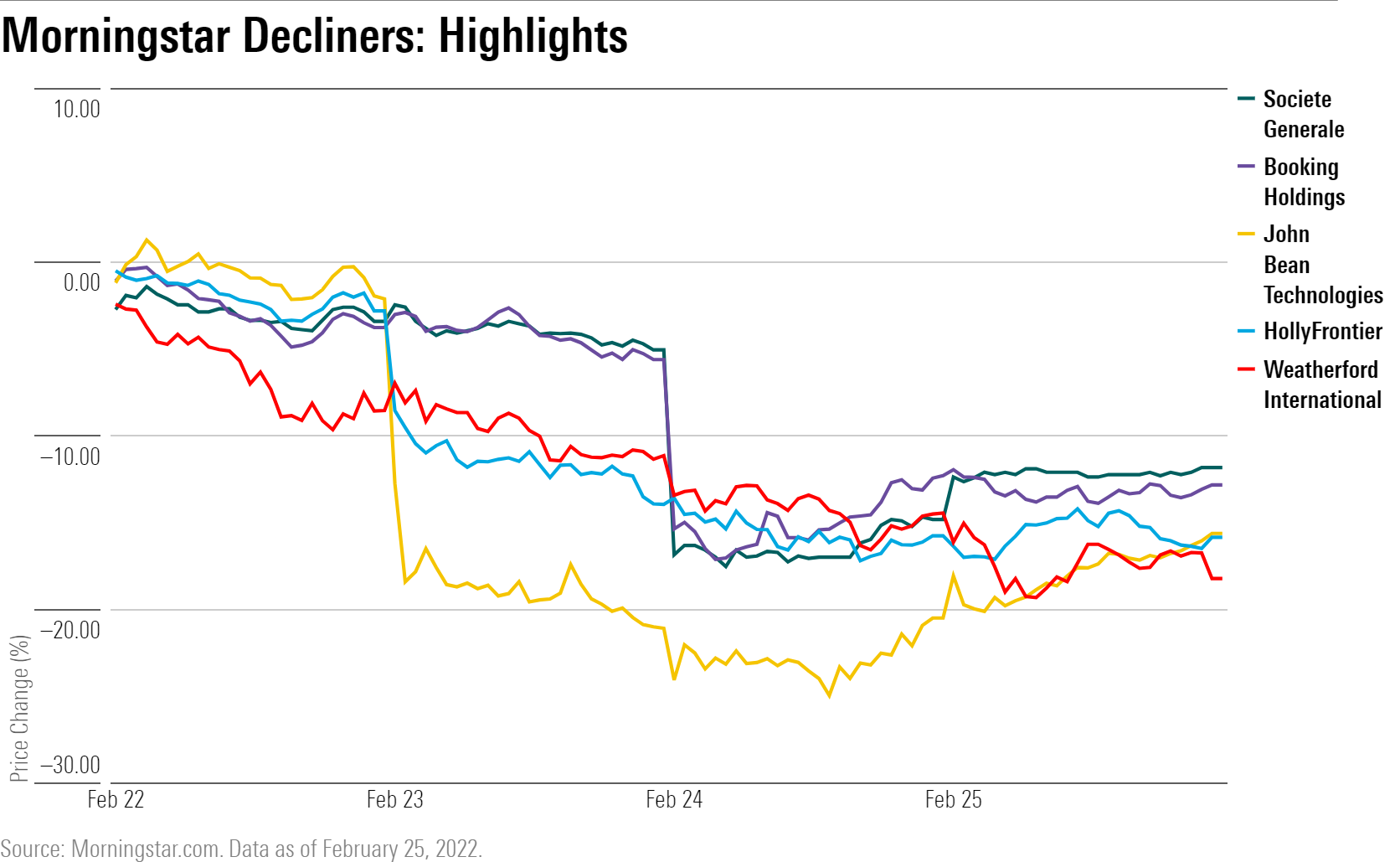

Disappointing quarterly earnings sent shares of both Weatherford International and HollyFrontier sliding at least 15%. Airline equipment provider John Bean Technologies also closed lower following results.

The travel services and leisure industries fell with Booking Holdings BKNG down 12.8% despite earnings topping Wall Street estimates. Airbnb ABNB fell 11.3%, Melco Resorts & Entertainment MLCO 7.4%, and Norwegian Cruise Line Holdings NCLH 7.3%. Wynn Resorts WYNN, Carnival CCL, and Las Vegas Sands LVS also closed lower.

European financial services stocks declined on global economic fears following the attack on Ukraine. Societe Generale SCGLY fell 11.6%, ING Groep ING slid 9.4%. Intesa Sanpaolo ISNPY and BNP Paribas BNPQY were also down.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)