Markets Brief: Ahead of the Next CPI Report, More Signs Inflation is Peaking

Still, the Fed is expected to continue its aggressive push to raise interest rates.

Over the past couple of weeks, there’s been a subtle change of tone in the markets. Bonds have bounced higher after their worst first half of a year in history and stocks have, at least for the time being, stopped sliding further into bear market territory.

In the background, there’s increasing evidence that inflation appears to be peaking if it hasn’t already.

The question, only a month after the Federal Reserve made its most aggressive move to raise interest rates since 1994: Is that extreme hawkishness stance still warranted?

For now, sentiment in the markets remains squarely in the “yes, it’s still warranted camp,” even as worries about a potential recession are growing.

The latest employment report showed strong job growth in June, defying expectations that a recession is imminent. Nonetheless, it keeps the pressure on the Fed to maintain its aggressive posture when it comes to inflation.

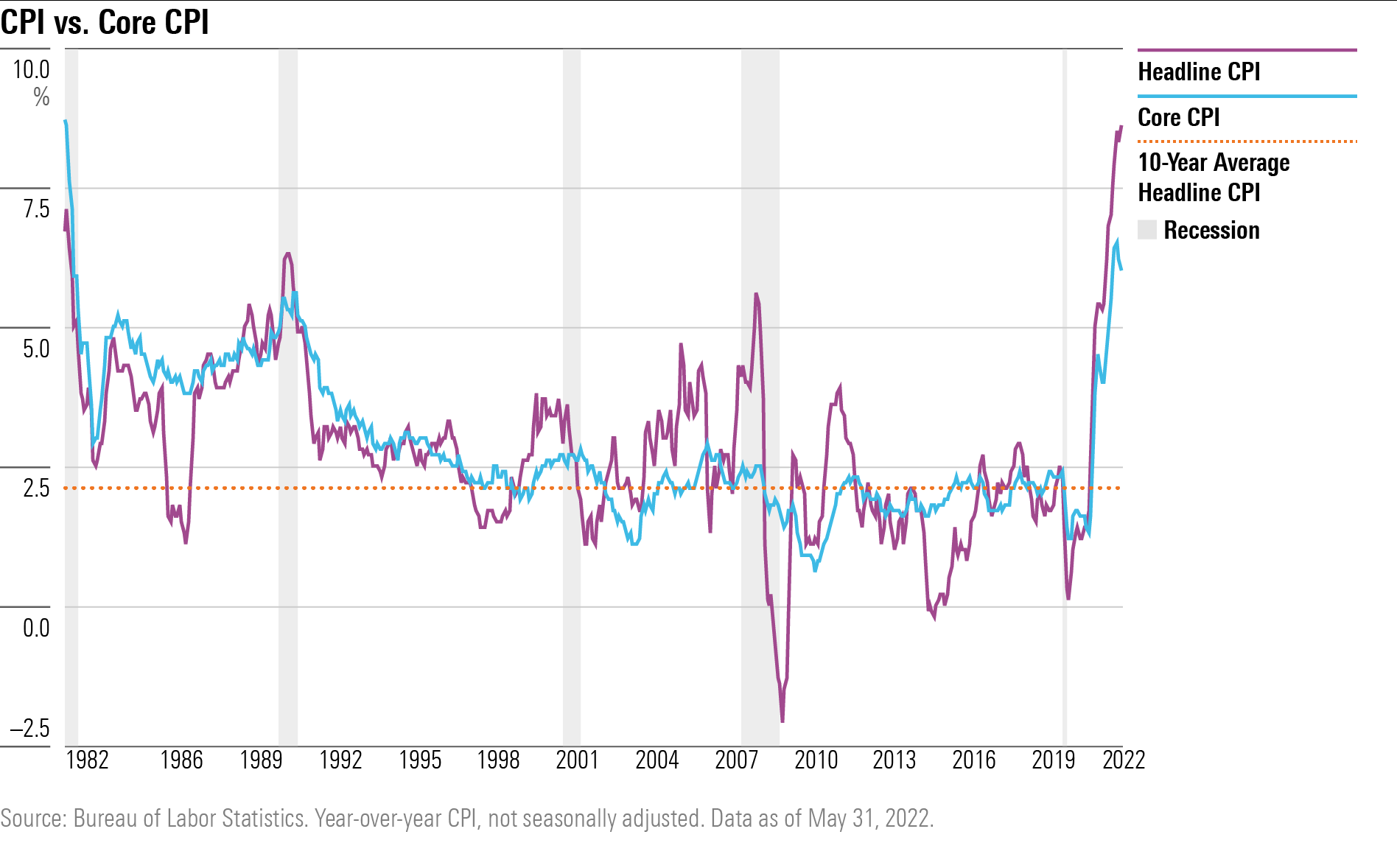

The coming week will bring more insight into inflation pressures with the July 13 release of June’s consumer price index. The consensus expects CPI to come in at elevated levels, according to FactSet: 8.8%, slightly higher than the 8.6% reading in May. A big part of that will reflect the price of oil, which started to drop in mid-June and has continued to fall into July.

Economists and strategists will be paying close attention to what is known as core CPI, which excludes food and energy, for clues as to what the Fed’s next steps will be. Core CPI for June is estimated to tot a rise 5.7% year over year and 0.50% month over month, according to FactSet. That compares with May’s 6% year over year core CPI reading and 0.6% month over month.

“I wouldn’t expect a big drop in core CPI,” says Sebastien Page, head of T. Rowe Price’s global multi-asset division and chief investment officer.

Page says T. Rowe’s economics team sees 8.8% year over year for headline CPI and another strong headline print of 1.1% month over month, driven in large part driven by strong gasoline prices.

“Yes, the economy is slowing, but rents have been rising, and Fed policy works with a lag. On headline (CPI including energy and food), the drop in commodities probably hasn’t been fully baked in the numbers,” Page says. “The overall level of inflation remains too high for the Fed to pause, even in the face of slowing activity.”

Morningstar chief economist Preston Caldwell says he’ll be looking closely at the core components of the CPI and expects “core inflation will probably tick upwards a bit along with headline CPI owing to pass through of energy costs for core categories.” “But,” he adds, “I'm expecting core inflation to decelerate gradually through the end of the year.”

In the background, prices on a range of commodities—oil and natural gas, wheat and corn, lumber and copper, among others—have fallen sharply in the past month. The housing market has cooled in response to rising mortgage rates.

Then, there's the 5-year TIPS breakeven indicator, which tracks the yields on Treasury Inflation-Protected Securities to measure expected inflation. The 5-year TIPS breakeven rate has fallen one full percentage point since March, reflecting diminished concerns about inflation over the next five years.

Out in the real economy, consumer expectations for inflation, a measure tracked by the University of Michigan and given considerable weight by the Fed in setting rate policy, also eased slightly in June.

You can also add to the list of inflation indicators moving in the right direction the Fed’s preferred gauge of inflation, the core Personal Consumption Expenditures price index, Excluding Food and Energy. Core PCE came in at 4.7%, for May, down from 4.9% the prior month, and below expectations of a 4.8% increase.

But the Fed, caught off guard last month by a broad-based acceleration in consumer prices to their highest levels in more than 40 years, raised the federal-funds rate by 0.75 percentage points in June.

Just-released minutes of the Fed's rate-setting policy committee showed that officials determined another boost of between 0.50% and 0.75% would "likely be appropriate" at its next meeting in late July. Committee members noted price stability is paramount even at the risk that their efforts to achieve a 2% inflation rate could result in an economic slowdown "for a time."

As the Fed battles inflation, the risks rise of a sharp slowdown in growth or the potential for a full-blown recession, both of which put corporate earnings at risk, T. Rowe Price’s Page says. Investors, he says, “need to consider that global markets may have reached a structural inflection point and the end to the era of ample liquidity, low inflation, and low interest rates that followed the 2008-09 global financial crisis.”

He notes that portfolio diversification matters more than usual in this type of market and says his team is overweight value stocks, but generally cautious and underweight stocks overall.

Events scheduled for the coming week include:

- Wednesday: Consumer Price Index June update.

- Thursday: Produce Price Index June update.

- Friday: JPMorgan Chase JPM, BlackRock BLK, Wells Fargo WFC, Citigroup C, and UnitedHealth UNH report earnings. U.S. retail sales June report.

For the trading week ending July 8:

- The Morningstar US Market Index rose 2.0%.

- Best-performing sectors were technology, up 4.7%, and consumer cyclical, up 4.4%.

- The worst-performing sectors were utilities, down 2.9%, and energy, down 2.4%.

- Yields on the U.S. 10-year Treasury rose to 3.1% from 2.89%.

- WTI Crude Oil prices fell $3.67 to $104.67 per barrel.

- Of the 864 U.S.-listed companies covered by Morningstar, 481, or 56%, were up, and 383, or 44%, declined.

What Stocks Are Up?

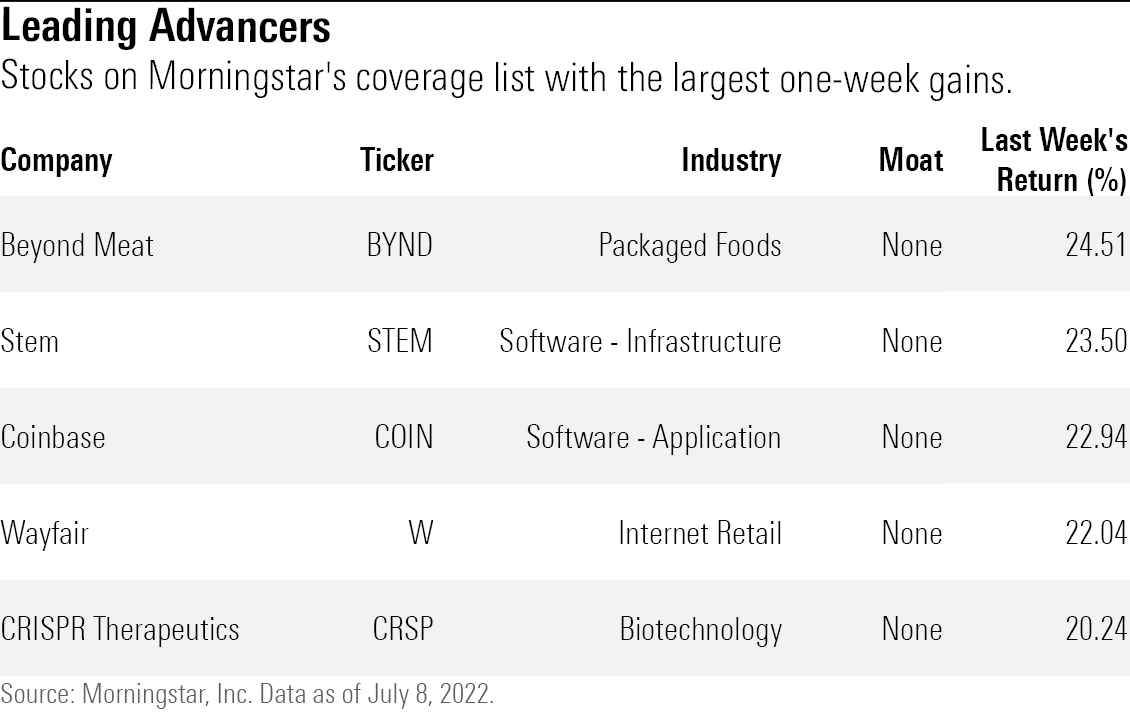

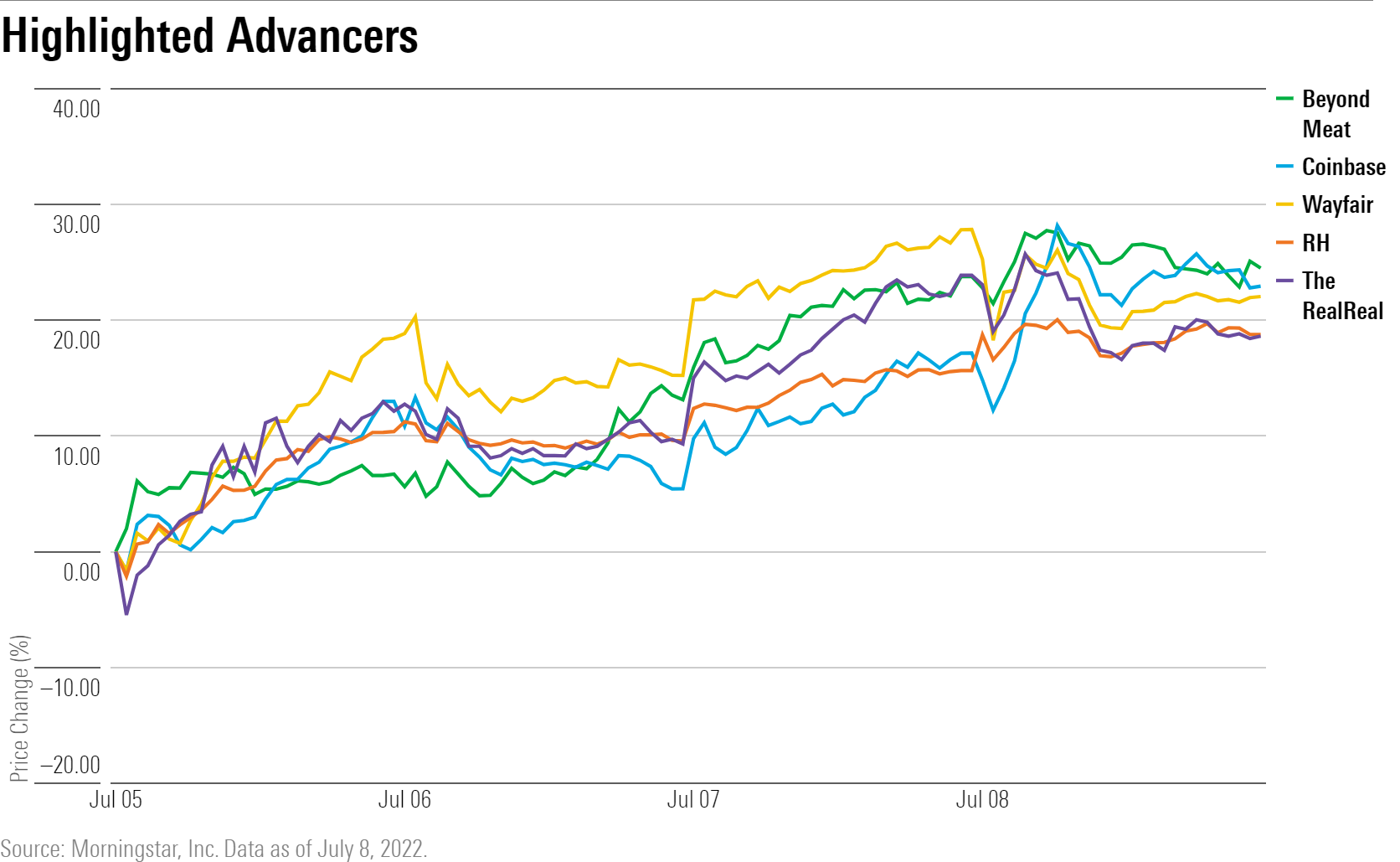

The best-performing companies in the past week were Beyond Meat BYND, Stem STEM, Coinbase COIN, Wayfair W, and CRISPR Therapeutics CRSP.

Consumer cyclical and tech companies recovered from punishing losses in the second quarter as they led the market's gains in the last week. Among them were the retailers The RealReal REAL and RH RH.

Shares of software companies such as Coinbase, Snap SNAP, and MongoDB MDB, who were all among the worst-performers in the second quarter, also jumped.

What Stocks Are Down?

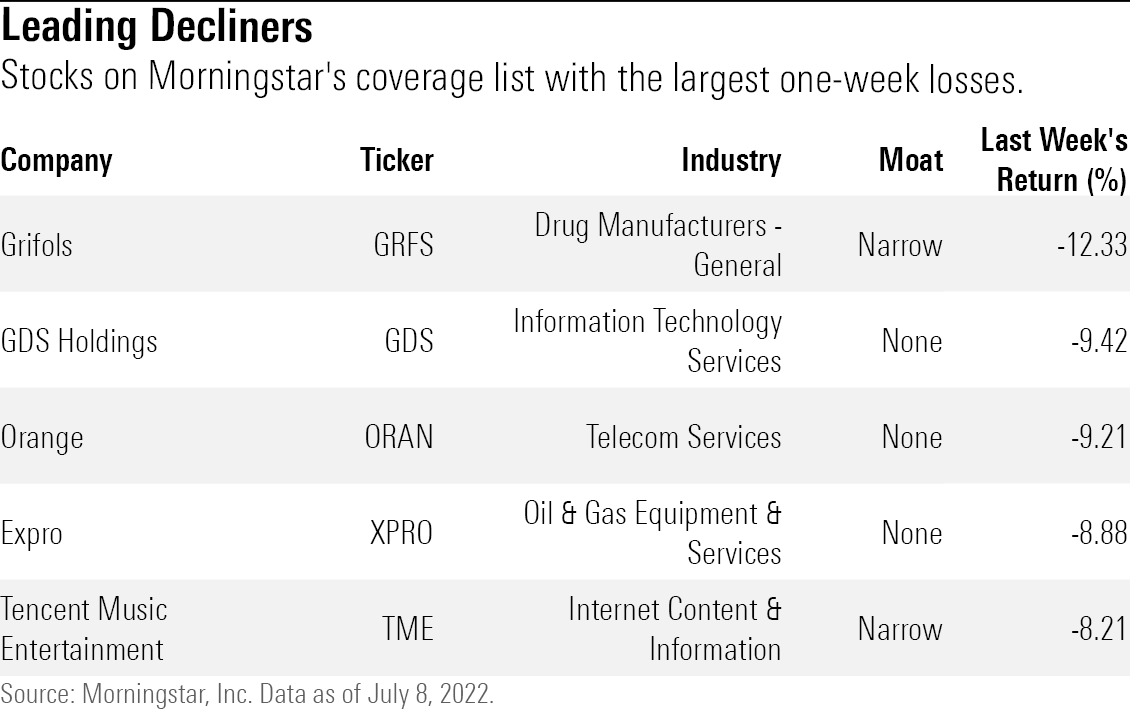

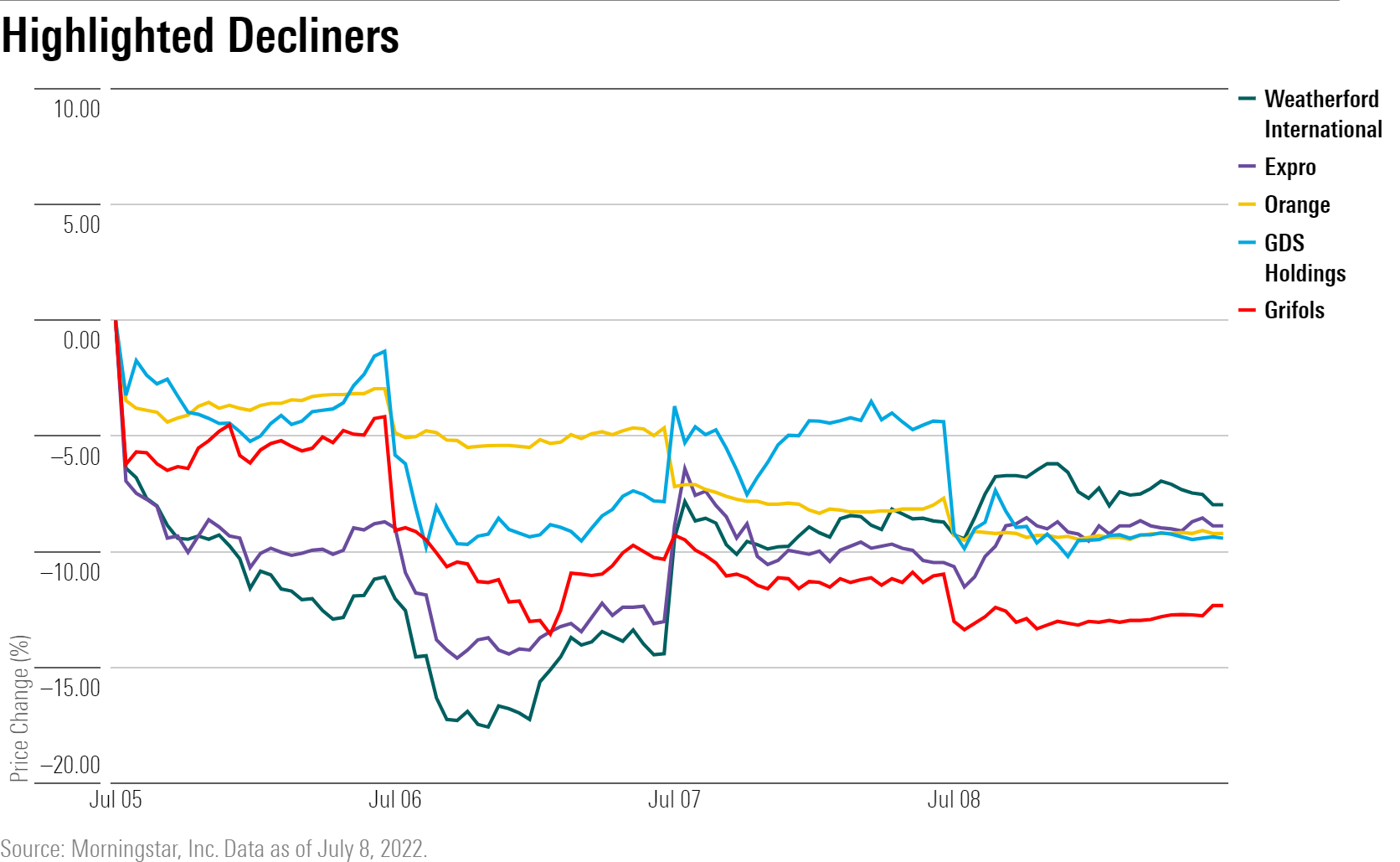

The worst-performing companies in the past week were Grifols GRFS, GDS Holdings GDS, Orange ORAN, Expro XPRO, and Tencent Music Entertainment TME.

International stocks listed on U.S. exchanges were lower in the past week, with Spain-based healthcare firm Grifols, French telecom operator Orange, and Chinese data center operator GDS among the worst performers last week.

Oil and gas companies also fell, with shares of Expro, Weatherford International WFRD, Patterson-UTI PTEN, and Shell SHELL leading losses in that group. Oil prices briefly dipped below $100 on July 6 for the first time since May 10, but closed the week at $104.67, down 3.5%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)