The Funds With the Biggest Nvidia Stakes

Funds from Baron, Fidelity, and Invesco are among those with the largest positions as Nvidia stock has surged 190% this year.

Investors have just a handful of stocks to thank for this year’s rally. For some funds, much of the credit goes to semiconductor maker Nvidia NVDA.

Since the start of the year, the California-based technology company’s stock has risen 190%, with the most recent leg of its big rally coming after it unveiled its first-quarter earnings results. Funds from Fidelity, Baron, Invesco, and WisdomTree are among those with the largest weighting in Nvidia shares, helping drive outsized returns on those strategies.

Nvidia Rallies Big After a Brutal 2022

With its rally this year, Nvidia became the fifth publicly traded company in the United States to reach a market value of $1 trillion. Other companies in this exclusive club include Apple AAPL, Microsoft MSFT, Amazon.com AMZN, and Alphabet GOOGL.

Nvidia Stock Price

This marks a significant turn from the previous year, when Nvidia’s stock lost nearly 50% of its value. In August 2022, two of the company’s chips were among the technology exports the United States restricted for trade to China, which accounted for $400 million in sales for Nvidia’s third-quarter outlook. The firm’s inventory exceeded consumer demand, sales declined, expectations were slashed, and investors were spooked, leading its share to hit their lowest point for the year in October.

But Nvidia’s fortunes have taken a significant turn for the better this year. A big push higher in the stock that began in January kicked into overdrive with the release of Nvidia’s first-quarter results on May 24, thanks largely to optimism about demand for its chips due to the boom in artificial intelligence development. Stock surged 36% in May.

Nvidia is known for producing graphics processing units, which have been used to train artificially intelligent software such as Open AI’s ChatGPT. Standing to benefit from the increasing traction toward generative AI, the company says it is working to build up its supply of H100 data center GPUs to meet demand.

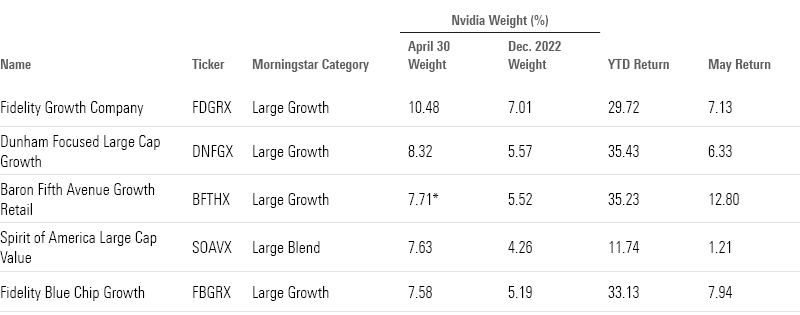

Actively Managed Stocks Funds With the Largest Nvidia Weights

To see which funds have been getting the biggest boost from Nvidia’s massive rally, we screened among large-growth, large-blend, large-value, mid-cap growth, and mid-cap blend funds. We also narrowed the strategies down to those with at least $100 million in assets.

Highlighted are five active funds with the largest portfolio weights as of April 30. Baron Fifth Avenue Growth BFTHX last updated its portfolio on March 31.

All these funds have holdings that are multiple times their weight in broad market indexes. For example, Nvidia makes up 2.3% of the Morningstar US Market Index, 2.5% of the Morningstar US Large-Mid Cap Index, and 2.9% of the S&P 500.

Highlighted Active Funds

Fidelity Growth Company

- Ticker: FDGRX

- Nvidia Portfolio Weight: 10.48%

Nvidia is Fidelity Growth Company’s second-largest holding after Apple. Morningstar strategist Robby Greengold says, “At the stock level, the strategy often bears a strong resemblance to the Russell 1000 Growth Index (the category benchmark). But with its stylistic tilts, industry biases, and unique stock-specific bets (the portfolio’s weights in Nvidia and Lululemon Athletica LULU are the category’s biggest, for example), it resists posting indexlike results. Manager Steve Wymer has a knack for spotting up-and-coming firms, which typically leads to a lower average market cap than peers and the index.”

Greengold adds, “Its largest five holdings (Apple, Amazon.com, Nvidia, Microsoft, and Alphabet) in October 2022 amounted to nearly 38% of assets, a bit more concentrated than the index’s top-five share.”

Dunham Focused Large Cap Growth

- Ticker: DNFGX

- Nvidia Portfolio Weight: 8.32%

Dunham Focused Large Cap Growth lists Nvidia as its largest holding. The strategy’s portfolio is overweight with technology stocks by 14.2 percentage points. Under long-term manager Scott O’Gorman, the fund “has provided better returns compared with peers, but subpar returns compared with the category benchmark,” according to Morningstar Manager Research.

Morningstar Manager Research continues: “This strategy skews toward smaller, higher-growth companies than its average peer in the large growth Morningstar Category. Analyzing additional factors, the fund has held stocks with higher trading volumes compared with category peers in the past few years. Such stocks may have less potential upside than illiquid holdings, but they are easier to trade during market downturns. This strategy also has had an overweight bias to the volatility factor over these years, meaning it has owned companies that have a higher historical standard deviation of returns. Such exposure tends to pay off when markets are hot and to be costly when they are not.”

Baron Fifth Avenue Growth Retail

- Ticker: BFTHX

- Nvidia Portfolio Weight: 7.71%

Behind Apple and Microsoft, Nvidia makes up the top holding for Baron Fifth Avenue Growth Retail, whose fund’s portfolio is overweight in technology stocks by 22.3 percentage points. Manager Alex Umansky brings more than 25 years of experience to the strategy, but “has delivered inferior performance, lagging both the category benchmark and the average peer over the past 10-year period,” according to Morningstar Manager Research.

Says Morningstar Manager Research: “This strategy has also exhibited a tilt toward high-volatility stocks over these years, meaning it has invested in companies that have a higher historical standard deviation of returns. This orientation tends to pay off most prominently when markets are hot. Over the past 10-year period, this share class lagged its average peer by an annualized 1.6 percentage points. It also trailed the category benchmark, the Russell 1000 Growth Index, by an annualized 4.5 percentage points over the same period.”

Spirit of America Large Cap Value

- Ticker: SOAVX

- Nvidia Portfolio Weight: 7.63%

Spirit of America Large Cap Value’s largest holding weight is Nvidia, while its portfolio is overweight with technology stocks by 5.9 percentage points. Manager Douglas Revello “has delivered a mixed track record, leading the average category peer but lagging the category benchmark for the past five-year period,” says Morningstar Manager Research.

Morningstar Manager Research adds, “This strategy prefers smaller market-cap firms compared with the average fund in its peer group. But in terms of style (value/growth) exposure, it is similar. Looking at additional factor exposure, this fund has constantly tilted toward stocks with higher trading volumes than its category peers over the past few years. It has provided varied returns compared with peers, but subpar returns compared with the category benchmark. Over an eight-year period, this share class’ 9% return matched the category average. But when expanded with a 10-year period, it underperformed the average by 21 basis points.”

Fidelity Blue Chip Growth

- Ticker: FBGRX

- Nvidia Portfolio Weight: 7.58%

Nvidia is Fidelity Blue Chip Growth’s third-largest holding. Manager Sonu Kalra maintains “a sprawling portfolio emphasizing companies with higher-than-average expected growth rates, paltry earnings relative to their share prices, and high stock-price volatility,” says Robby Greengold.

Greengold explains: “These features position the strategy to thrive when investors’ risk appetites grow, but they also set the stage for its underperformance when markets stumble or when value stocks—those with low price multiples, low growth rates, or high dividend yields—are in favor. Kalra has demonstrated the long-term merit of the strategy. Its success on his watch owes mostly to his knack for spotting high-potential up-and-comers, such as Tesla and Nvidia, which the mutual fund has ridden over the past decade to spectacular gains. The fund’s total return since his start in 2009 is among the large-growth category’s highest.”

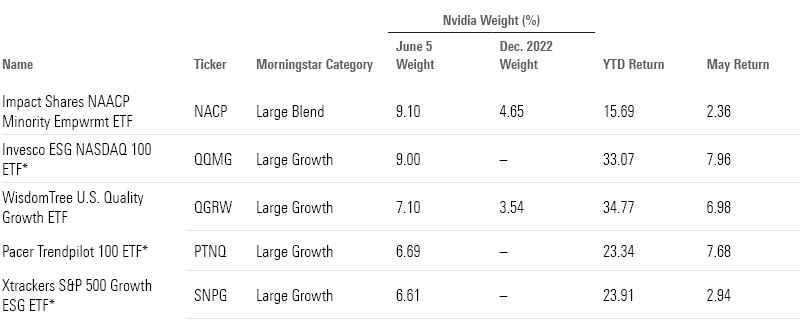

Index Funds With the Largest Nvidia Weights

Highlighted Index Funds

Impact Shares NAACP Minority Empwrmt ETF

- Ticker: NACP

- Nvidia Portfolio Weight: 9.10%

Impact Shares NAACP Minority Empwrmt ETF’s largest holding is Nvidia, and its portfolio is overweight with technology stocks by close to 3.7 percentage points. Morningstar Manager Research says this fund “seeks investment results that, before fees and expenses, track the performance of the Morningstar Minority Empowerment Index,” and that it will invest at least 80% of its total assets under normal circumstances.

Morningstar Manager Research explains: “The strategy owns 203 securities, and its assets are more dispersed than the typical peer in the category. In the most recent disclosure, 32% of the strategy’s assets were concentrated in the top 10 fund holdings, compared with the category’s 48.2% average. Narrowing in on the past two-year period, it trailed the category index, the Russell 1000 Index, by an annualized 58 basis points, and underperformed its average peer by 57 basis points. Although more importantly, when widening the time horizon, the strategy came out ahead.”

Invesco ESG NASDAQ 100 ETF

- Ticker: QQMG

- Nvidia Portfolio Weight: 9.00%

Nvidia is Invesco ESG NASDAQ 100 ETF′s third-largest holding, just behind Microsoft and Apple. Possessing a portfolio overweight with technology stocks by 24.9 percentage points and tracking the investment results of the Nasdaq-100 ESG Index, the fund’s “initial performance has been encouraging,” says Morningstar senior analyst Gregg Wolper, though “it is too early to have a strong opinion on its prospects,” since it was launched less than two years ago.

“Since then, this share class has returned 5.4%, compared with the category benchmark Russell 1000 Growth Index’s 2.3% return for the same period,” Wolper adds. “During that time, it also outperformed the category average’s 0.2% loss for the period.”

Adds Morningstar Manager Research: “52.8% of the fund’s assets are housed within the top 10 holdings, compared with the category’s 48.1%.”

WisdomTree U.S. Quality Growth ETF

- Ticker: QGRW

- Nvidia Portfolio Weight: 7.10%

Nvidia is WisdomTree U.S. Quality Growth ETF’s fourth-largest holding, trailing Apple, Microsoft, and Alphabet. The strategy’s portfolio is overweight with this category of stocks by 11 percentage points, and “in particular, 61.4% of the fund’s assets are housed within the top 10 holdings, compared with the typical peer’s 48.1%,” Morningstar Manager Research says.

Morningstar Manager Research adds: “This strategy has tended to hold more stocks than others in the large growth category, but in terms of market capitalization, it is on par with peers.” The fund launched only on Dec. 13, 2022, but since then, “this share class has returned 22.7%, compared with the category benchmark Russell 1000 Growth Index’s 15.5% return for the same period. During that time, it also outperformed the category average’s 12.4% return for the period,” according to Morningstar Manager Research.

Pacer Trendpilot 100 ETF

- Ticker: PTNQ

- Nvidia Portfolio Weight: 6.69%

Nvidia is Pacer Trendpilot 100 ETF′s fifth-largest holding, just behind Amazon, Apple, Microsoft, and U.S. Treasury bills, which account for almost half the fund’s portfolio weight. While it is overweight with technology stocks by 16.1 percentage points, the portfolio is considered top-heavy, with 56.2% of its assets concentrated within the top 10 holdings.

Says Morningstar Manager Research: “On a seven-year basis, this share class underperformed the category index by an annualized 48 basis points. However, it has come out ahead of its peers, leading the average by an annualized 2.7 percentage points over the same seven-year period. One-year performance does not largely affect this share class’ rating. However, its impressive 6.5% return is worth mentioning: a 6.7-percentage-point lead over its average peer, placing it within the top 10% of its category.”

Xtrackers S&P 500 Growth ESG ETF

- Ticker: SNPG

- Nvidia Portfolio Weight: 6.61%

Behind Microsoft and Apple, Nvidia is the third-largest holding of Xtrackers S&P 500 Growth ESG ETF.

Despite being incepted just on Nov. 8, 2022, the fund has performed well, with 7.9% in returns against the Russell 1000 Growth Index’s 6.7% and the category average of 4.5%. Compared with other large-growth strategies, it targets deeper value plays but has an average size exposure, according to Morningstar Manager Research.

“Looking at additional factor exposure, this strategy consistently held some companies with relatively lower trading volume compared with category peers in the last few years. Less-liquid stocks might offer strong returns to compensate for their risks, but they can be harder and more expensive to trade in bear markets,” says Morningstar Manager Research.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)