The Santa Claus Rally Came Early. Here’s What To Do Next.

Stocks surged in November, coming off low valuations as the market priced in the end of interest-rate hikes.

Key Takeaways

- Following the November rally, the U.S. stock market is much less undervalued.

- It is time to move back to an underweighting in growth stocks, specifically the technology sector.

- Communications regains its title as the most undervalued following a rally in real estate.

Hope you were good—as the Santa Claus rally came early this year. In our November market outlook, we noted that stocks were trading at a deep discount to fair value, but even we were shocked at how fast and how far stocks surged in November. The Morningstar US Market Index rose 9.40%, one of its best November gains in history.

Historically, December is a stronger than average month for stocks, but this year, the rally started after the November Federal Reserve meeting. Traders interpreted commentary by Federal Reserve Chair Jerome Powell that the Fed had reached the end of this monetary tightening cycle. We were not surprised by that intimation as we have opined since after the July meeting that we thought the Fed was done hiking. Not only did we aver that the Fed was done hiking but also that it will begin loosening in early 2024.

According to our economic projections, we forecast that inflation will continue to moderate and the rate of economic growth will slow. This combination of lower inflation and a weakening economy not only will allow the Fed to hold off on any further rate increases, but we also expect the Fed will begin to cut rates early next year.

In the fixed-income markets, bond prices rose and long-term interest rates plummeted. The yield on the 10-year U.S. Treasury dropped 44 basis points to 4.35%, helping to propel the Morningstar US Core Bond Index up by 4.42%. This gain boosted the index into the green, and it is now up 1.59% for the year to date.

Snapback Rally From Rarely Seen Undervalued Territory

In our November 2023 Market Outlook, we noted just how undervalued stocks had become as compared with our fair values. By the end of October, the stock market had dropped to the point where it only traded at that much of a discount (or more) to our fair value only 12% of the time.

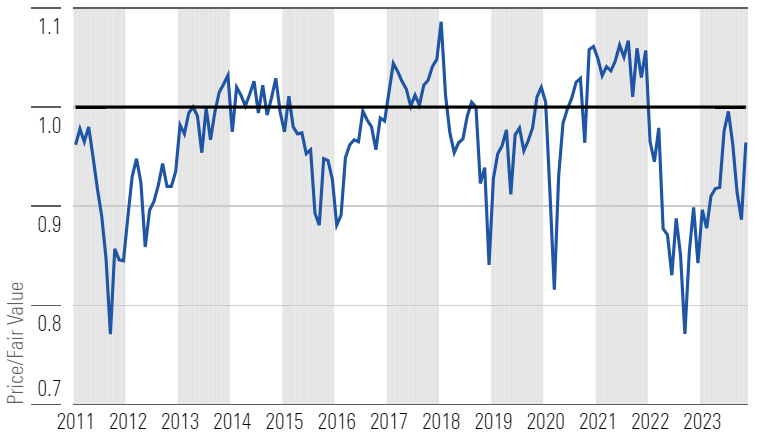

At this point, according to a composite of the more than 700 U.S. exchange-traded stocks that we cover, as of Nov. 30, the U.S. equity market was trading at a price/fair value ratio of 0.96, representing a 4% discount to our fair value estimate.

Month End Price/Fair Value of Morningstar’s U.S. Equity Research Coverage

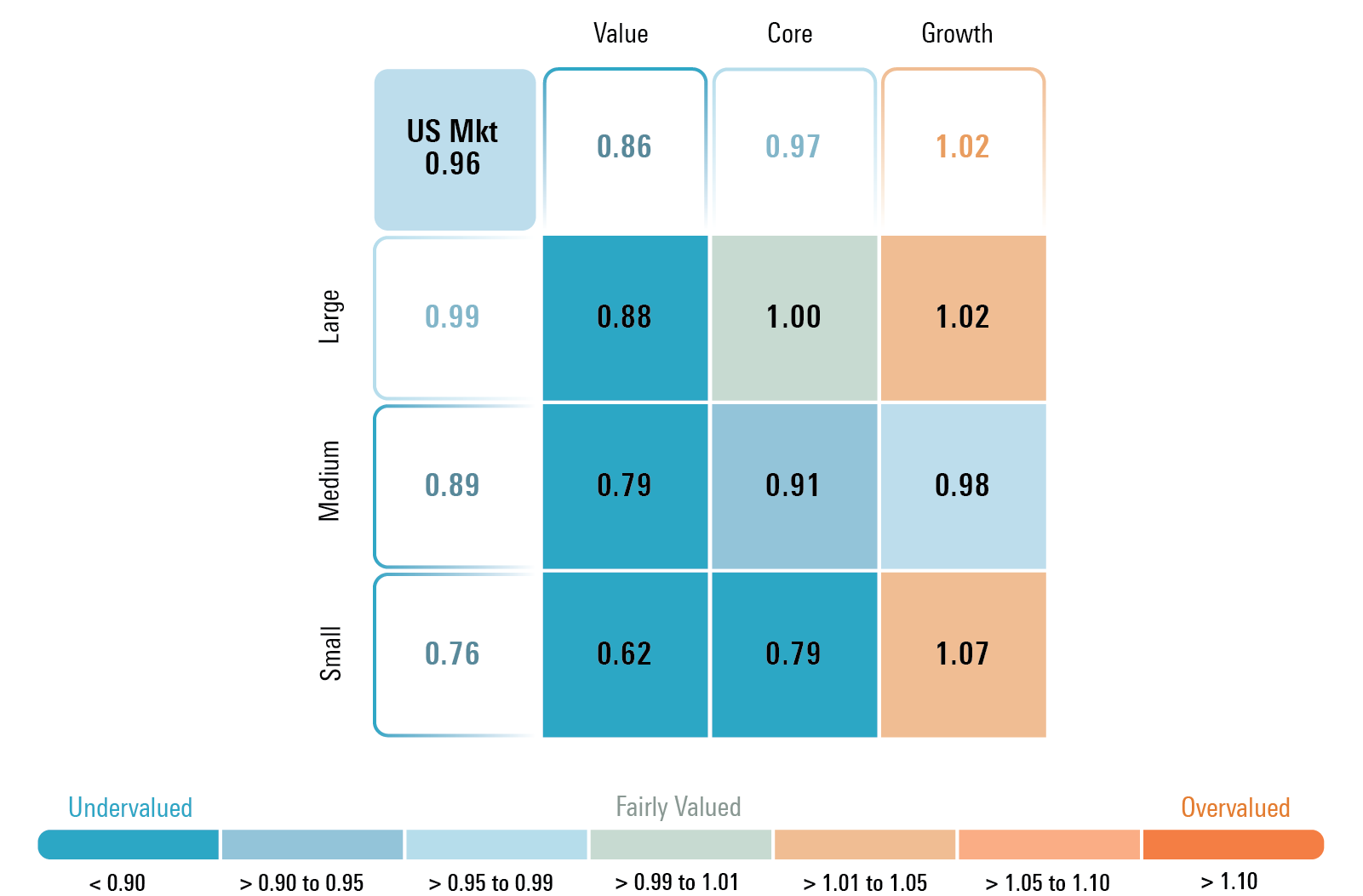

Time to Move Back to Underweight Growth and Lift Core to Market Weight

Growth stocks were the best performing category in November, rising 11.59%, whereas core and value rose 7.96% and 7.26%, respectively. Growth stocks have now started to move into overvalued territory, and as such, now is a good time to take profits and underweight the category, especially those technology stocks that have once again become overvalued and overextended. Based on the volatility in growth this year, we have moved our allocation recommendations a number of times. For growth stocks, we started the year with an overweighting, moved to a market weight in June, an underweighting in July, and then back to market weight last month.

Considering that both the broad market and core category are trading near a similar discount, investors should consider moving from an underweighting in core to a market weight.

Price/Fair Value by Morningstar Style Box Category

By capitalization, small-cap stocks remain significantly undervalued. However, the risk to small-cap stocks’ ability to appreciate over the near term is that we project the rate of economic growth to slow sequentially until the third quarter of 2024. We suspect small-cap stocks will have a difficult time performing until the market begins to price in an economic rebound. In fact, market sentiment is such that we will need a much more “normalized” economic environment before investors become comfortable going back into smaller-cap stocks. In a slowing (or recessionary) economic environment, institutional investors will have the predilection to hide out in large-cap stocks as opposed to taking the risk of the greater earnings volatility inherent in small caps.

Where Do We See Some of the Best Opportunities in Today’s Market?

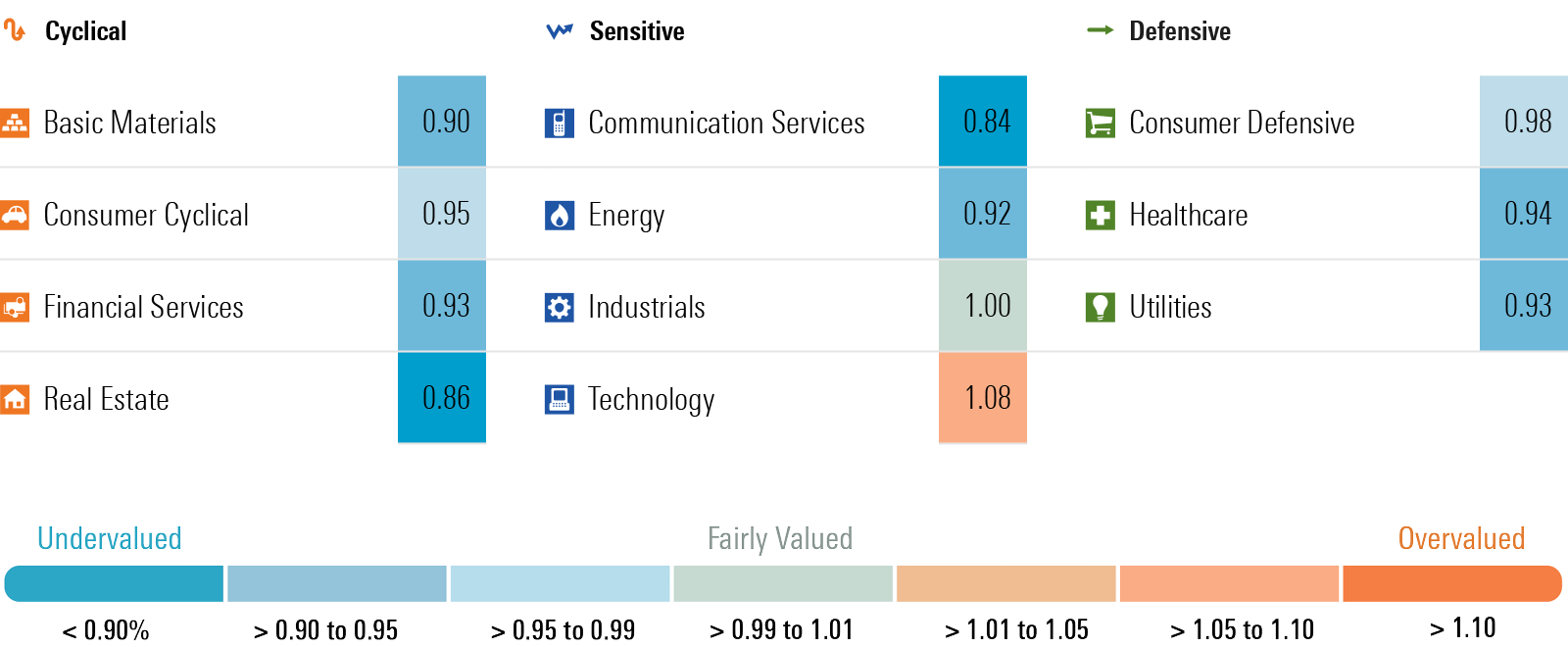

The greatest change among our sector valuations since the end of last month was in the technology sector. The price/fair value for technology moved up into overvalued territory to 1.08 from 0.95 in October. The next greatest change occurred in the real estate sector, which rose to a price/fair value of 0.86 from 0.76. That was just enough to mean that real estate is no longer the most undervalued sector—communications has regained that title.

To the downside, energy was the only sector that became further undervalued, dropping to a price/fair value of 0.92 from 0.95 last month.

Morningstar Price/Fair Value by Sector

Notable Changes This Past Month

Time to underweight technology (again).

The technology sector has been one of the most volatile sectors in 2023. In our 2023 Stock Market Outlook, we recommended an overweight position at the beginning of the year as the sector traded at a 19% discount to our fair value. By midyear, we lowered our recommendation to an underweighting as the sector valuations rose to as high as an 11% premium at the end of July.

Yet, as the market sank thereafter and technology dropped to a 2% discount at the end of September, we moved back to a market-weight recommendation. Following the 13.29% surge in the Morningstar US Technology Index in November, the valuation has risen back to an 8% premium. At this point, we think it’s a good time to move back to an underweighting and take profits in those stocks that have become overvalued and overextended.

Examples of technology stocks that we think are overvalued include:

Oracle ORCL

- Morningstar Price/Fair Value: 1.53

- Morningstar Rating: 1 Star

- Dividend Yield: 1.4%

- Morningstar Economic Moat Rating: Narrow

International Business Machines IBM

- Morningstar Price/Fair Value: 1.26

- Morningstar Rating: 2 Stars

- Dividend Yield: 4.2%

- Morningstar Economic Moat Rating: Narrow

Apple AAPL

- Morningstar Price/Fair Value: 1.19

- Morningstar Rating: 2 Stars

- Dividend Yield: 0.5%

- Morningstar Economic Moat Rating: Wide

Yet, not everything in the technology sector is overvalued. While the obvious plays in artificial intelligence have already run up, we see opportunities in those stocks we consider as second derivative plays on AI. Examples include:

Cognizant Technology CTSH

- Morningstar Price/Fair Value: 0.75

- Morningstar Rating: 4 Stars

- Dividend Yield: 1.7%

- Morningstar Economic Moat Rating: Narrow

Snowflake SNOW

- Morningstar Price/Fair Value: 0.81

- Morningstar Rating: 4 Stars

- Dividend Yield: None

- Morningstar Economic Moat Rating: None

Lastly, there remains only a handful of large-cap technology stocks that are undervalued. For example, although it has risen 128% thus far this year, we continue to view Uber as undervalued.

Uber UBER

- Morningstar Price/Fair Value: 0.83

- Morningstar Rating: 4 Stars

- Dividend Yield: None

- Morningstar Economic Moat Rating: Narrow

Utilities Not as Cheap, but Remain Near Historically Undervalued Level

In early October, we first noted that valuations in the utilities sector had fallen to extremely undervalued levels, and in mid-October, we highlighted that they were trading at the greatest discount to our valuations since market bottoms in March 2020 and March 2009. From its low on Oct. 10, the Morningstar US Utilities Index has risen 11.32%, of which almost half that gain came in November.

While the utilities sector is no longer trading at as much of a discount, it remains significantly undervalued on a historical basis. Since December 2010, the utilities sector has traded at a 7% discount (or more) less than 3% of the time.

Looking forward, we expect valuations in the utilities space will be bolstered by our expectation that long-term interest rates will continue to decline in 2024 and into 2025.

Basic Materials Lag Market Rally as Lithium Hit Hard

Stocks of lithium miners were hit hard in November as prices for lithium continued to crash in 2023 after skyrocketing in 2022. We see this as an opportunity as we continue to forecast that lithium will be undersupplied over the next decade. Each of the lithium mining companies under our equity research coverage trades at a deep discount to our long-term fair value estimates. For example, Albemarle ALB, which we consider to be one of the more stable and established lithium miners, trades at a 60% discount to our fair value.

Gold miners are also an interesting prospect. Gold has risen to $2,037 per ounce, yet in our financial models we assume a gold price of $1,865 through 2025 and a midcycle price of roughly $1,740 per ounce from 2027. Even at those assumptions, gold miner stocks are trading at a significant margin of safety, and if gold remains high or moves higher, we could see valuations leap higher.

Newmont Mining NEM

- Morningstar Price/Fair Value: 0.76

- Morningstar Rating: 4 Stars

- Dividend Yield: 4.0%

- Morningstar Economic Moat Rating: Narrow

Energy Started 2023 in Overvalued Territory, Now Looking Attractive

While the broad market has risen 20.29% this year, the Morningstar US Energy Index is essentially unchanged, having lost 0.40%. At this point, the energy sector is looking attractive, trading at an 8% discount to fair value.

Here are a few energy stocks that have fallen enough to slip into 4-star range:

Exxon Mobil XOM

- Morningstar Price/Fair Value: 0.84

- Morningstar Rating: 4 Stars

- Dividend Yield: 3.7%

- Morningstar Economic Moat Rating: Narrow

APA APA

- Morningstar Price/Fair Value: 0.65

- Morningstar Rating: 4 Stars

- Dividend Yield: 2.8%

- Morningstar Economic Moat Rating: None

Devon Energy DVN

- Morningstar Price/Fair Value: 0.75

- Morningstar Rating: 4 Stars

- Dividend Yield: 7.7%

- Morningstar Economic Moat Rating: Narrow

Real Estate Now the Second-Most Undervalued Sector

Morningstar US Real Estate Index was the second-best-performing sector in November, rising 12.15%, yet remains the most undervalued according to our valuations. While valuations among urban office space remain muddy, we see a significant amount of undervaluation in other areas of the real estate market. Looking forward, based on our forecast that interest rates will continue to decline in 2024, we think real estate should continue to perform well. In our November Market Outlook, we provided several different stock investment ideas.

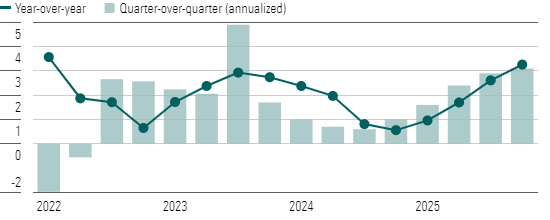

Economic Growth Rate Poised to Slow

Economic metrics continue to support our forecast that the rate of economic growth is slowing in the fourth quarter. We further project that economic growth will slow each quarter sequentially until bottoming out in the third quarter of 2024 and then beginning to reaccelerate in the fourth quarter.

In our most recent economic outlook, we bumped up our forecast for economic growth in 2024 to 1.6% from 1.4%, but this is a pull forward from 2025, where we now project gross domestic product to expand by 1.7% as opposed to our prior forecast of 2.1%. On the inflationary front, we continue to forecast that inflation will moderate, falling to 2.0% in 2024.

Over the next year, we project that the rate of economic growth has begun to slow. We are forecasting real GDP will slow to a 1.7% annualized rate in fourth-quarter 2023 and continue to slow sequentially each quarter until bottoming out in third-quarter 2024. We then forecast the rate of economic growth will climb throughout 2025.

GDP Growth, Quarterly Forecast

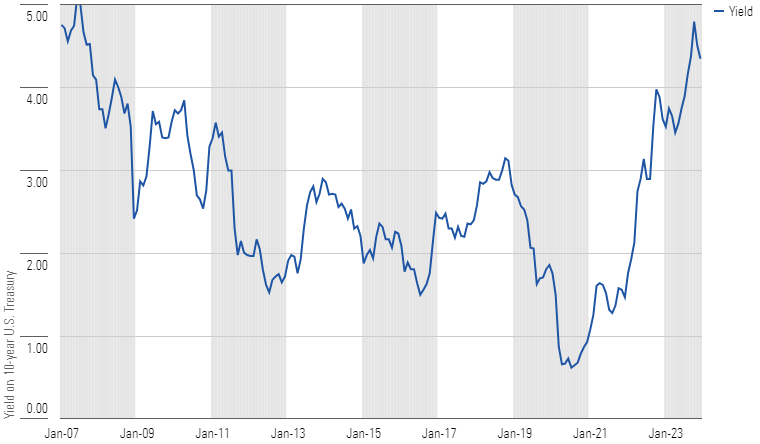

Interest-Rate Outlook

Long-term interest rates continued to decline, and we project they have further to fall. Starting in mid-2023, we noted that we thought it was a good time to start lengthening the duration of the fixed-income allocations. Most recently, in our November Market Outlook, as the 10-year U.S. Treasury bond was testing 5%, we highlighted that it was a good time to lock in those high rates as we forecast yields would decline in 2024.

While short-term rates remain high for now, we project that the Fed will begin to ease monetary policy in the first half of 2024, possibly as soon as the March meeting. With the economy poised to begin slowing and inflation expected to moderate, we also forecast that long-term rates will fall further and the added duration will boost returns over the yield carry. We forecast the yield on the 10-year U.S. Treasury bond will average 3.60% in 2024, a 75-basis-point decrease from where it ended November.

As we highlighted last month, we expected that Fed officials would start shifting the focus of their messaging to the markets to a more balanced perspective between inflation and employment. That shift has begun, as several Fed officials, including Chair Powell, made subtle changes, but the market quickly picked up this shift. Several other Fed officials stayed the course with their overemphasis on the need to fight inflation, but we suspect they will soon come around as well in early 2024 as the Fed prepares the market for its first interest-rate cut.

Yield on 10-Year U.S. Treasury

Correction: A previous version of this article was published with incorrect exhibits. Exhibits 2, 3, and 4 have been updated.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)