After Dick’s Sporting Goods Stock Plunged With Earnings Miss, Is it a Buy, a Sell, or Fairly Valued?

With its disappointing margins and a big price decline, here’s what we think of Dick’s stock.

Dick’s Sporting Goods DKS released its second-quarter earnings report before the market open on Aug. 22. Here’s Morningstar’s take on Dick’s earnings and stock.

Key Morningstar Metrics for Dick’s Sporting Goods

- Fair Value Estimate: $92

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

What We Thought of Dick’s Sporting Goods Q2 Earnings

Dick’s suffered a second-quarter profit miss and cut its full-year non-GAAP earnings per share guidance to $11.50-$12.30 from $12.90-$13.80.

- Dick’s Q2 sales were close to expectations, but its earnings were well below due to disappointing margins. Reported EPS was $2.82 vs. our estimate of $3.73.

- Dick’s sales growth and profit margins have been very strong over the past three years, but we have long argued that these results were anomalous. The quarterly results and outlook support this view.

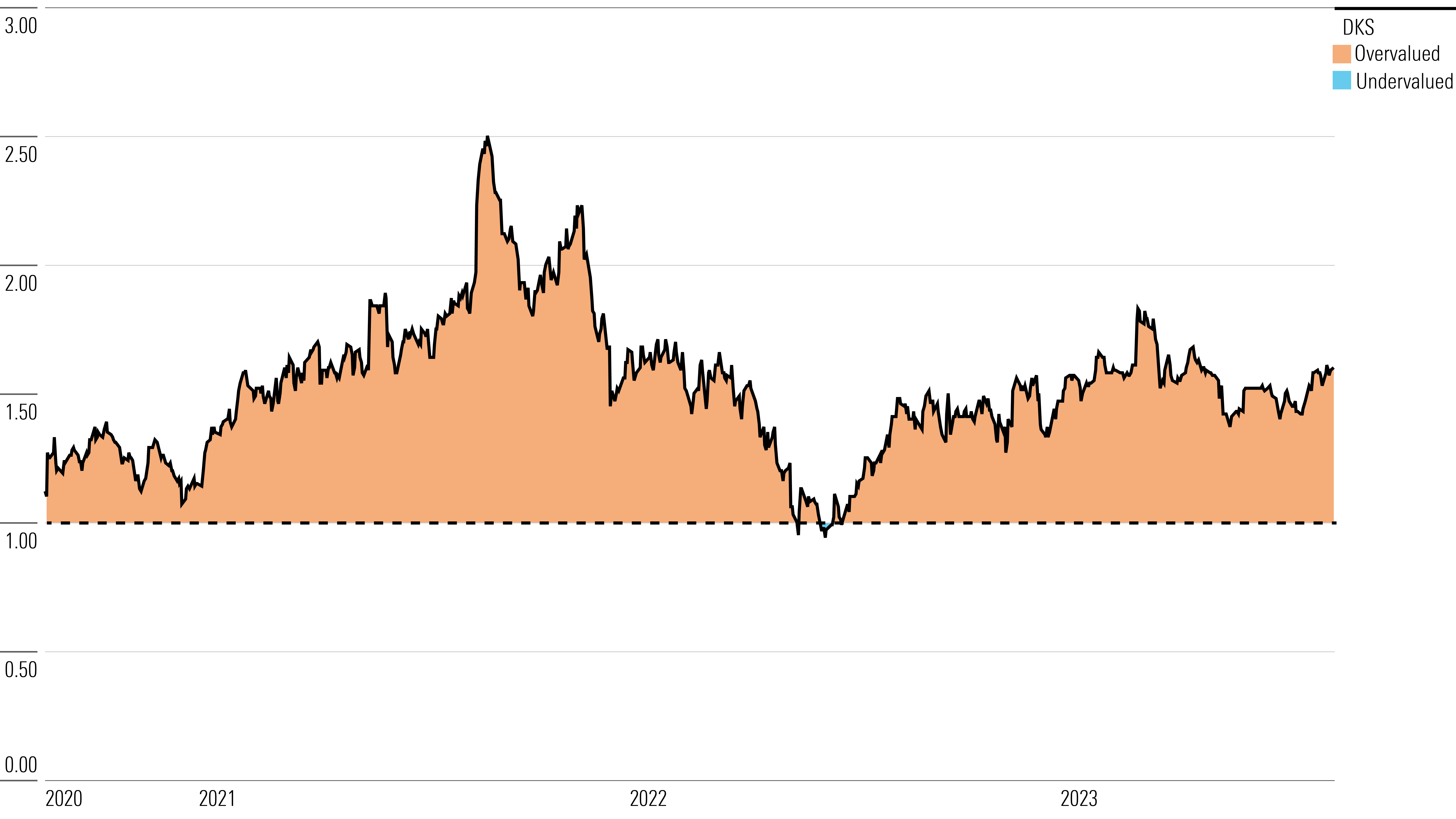

- We have rated Dick’s stock as overvalued, but the decline in its price after this earnings report means its valuation is now much more reasonable than it had been over the past few months.

Dick's Sporting Goods Stock Price

Fair Value Estimate for Dick’s Sporting Goods

With its 2-star rating, we believe Dick’s stock is overvalued compared with our long-term fair value estimate.

We anticipate Dick’s profit margins and EPS growth will decline over the next few years, with its operating margins dropping below 10% by 2026.

Prior to the COVID-19 pandemic, we think Dick’s underperformed the growth of the broader U.S. athletic apparel market due to competition from e-commerce and other retail, as well as weakness in hunting and other categories (negative same-store sales in 2015, 2017, and 2018). Although we believe it has since made substantial progress, we still think competitive pressures in a relatively low-growth industry are a concern. We forecast compound average annual sales and store base growth rates of 3% and 1%, respectively, for Dick’s over the next 10 years. Further, we estimate same-store sales growth will stabilize at 2% in the long term.

As competition has intensified, we think Dick’s has had to invest heavily in e-commerce, marketing, and merchandising, and will continue to do so. The firm’s adjusted operating margins peaked at 9.0% in 2012 and then gradually declined to 4.3% in 2019 before spiking during the pandemic.

Read more about Dick’s Sporting Goods’ fair value estimate.

Dick's Sporting Goods Historical Price/Fair Value Ratios

Economic Moat Rating

We assign Dick’s no economic moat, as we do not believe the company has established a durable advantage over its competitors.

While Dick’s is the largest independent sporting goods chain in the United States, intense competition from e-commerce, mass-market retail, outlet stores, and specialty stores has reduced customer traffic and eroded its operating margins. The firm’s sales soared during the pandemic, but it had been struggling despite an aggressive store expansion. In 2014, the company reported $559 million in operating profit on $6.8 billion in sales (8.1% margin). Five years later, it reported $8.8 billion in sales but adjusted operating profit of only $442 million (5.1% margin). Dick’s recorded sequential declines in its operating margins every year from 2012 to 2019. Due to the surge in sales during the pandemic, Dick’s operating margin jumped to an astounding 16.5% in 2021, but it dropped to 11.8% in 2022, and we anticipate it to trend downward over the next decade.

Dick’s has no production cost advantage, as it sources its private-label merchandise from the same third-party manufacturers as other sporting goods retailers. Dick’s does not have an efficient scale either, as its distribution system is like those of its competitors. There is no network effect in the sporting goods retailing business, and switching costs are nonexistent.

Read more about Dick’s Sporting Goods’ moat rating.

Risk and Uncertainty

We assign Dick’s a High Morningstar Uncertainty Rating. The firm, like all apparel and sporting goods retailers in the U.S., faced disruption from the COVID-19 pandemic, and it has had to manage an inflationary environment and industry turmoil. However, demand for activewear has generally been resilient.

Dick’s is dependent on a few key vendors. Under Armour UAA, for example, was once Dick’s second-largest brand, but it ceased to be a 10% customer in 2017 when it introduced its product at Kohl’s. Further, we think Dick’s is vulnerable to suppliers making direct-to-consumer sales. Vendors are increasingly cutting out wholesale middlemen to better control marketing and improve margins. Nike NKE, for example, is by far Dick’s largest individual brand at 23% of 2022 sales, but it is actively limiting the distribution of some popular products to its own e-commerce and branded stores. In its fiscal 2023, Nike’s direct-to-consumer and digital sales were 44% and 26%, respectively, of its brand sales.

We think Dick’s store base of about 870 is too large and insufficiently productive. We estimate Dick’s annual sales per square foot are comparable to those of smaller rivals. The rise of e-commerce puts the future productivity of Dick’s stores into question.

Read more about Dick’s Sporting Goods’ risk and uncertainty.

DKS Bulls Say

- Dick’s is the largest pure sporting goods chain in the U.S. It has a large loyalty program that is integrated with Nike’s own program. Dick’s has a strong business in high school and youth sports.

- Dick’s benefits from innovation in athletic apparel and footwear, as well as the growth of activewear in everyday fashion.

- Dick’s has adapted well to a market that has changed during the pandemic. While the firm no longer discloses its digital sales, we believe they may be roughly double the pre-crisis level.

DKS Bears Say

- Key vendors of Dick’s, like Nike and Adidas ADDYY, are reducing their dependence on wholesale sales by investing heavily in their own e-commerce and branded stores. A pullback from wholesale sales could have a negative impact.

- Apparel retailers are increasingly devoting selling space to activewear and introducing private-label items. There has also been an increase in active brands that bypass the wholesale channel entirely.

- Like others in the industry, Dick’s has recently been impacted by inflation and slowing demand for apparel and footwear.

This article was compiled by Lauren Solberg.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)