How to Diversify Assets Like a Pro When You Own a Lot of Equities

Long duration is the "Sharpe" choice for aggressively positioned portfolios.

The yield on the 30-year U.S. Treasury fell below 2% for the first time ever on Aug. 15 and has changed little since. That marked an incredible rally in those long-term bonds, which were yielding nearly 3.50% on Nov. 2, 2018. Vanguard Long-Term Treasury ETF VGLT, which mainly holds U.S. government bonds with maturities between 20 and 30 years, rallied 31.9% over that time period, nearly triple the return of Vanguard Total Bond Market ETF BND, which gained 11.9%. Clearly, long duration has been as hot as the new Taylor Swift album this year, which may seem like a poor time to consider it for a portfolio. For investors with big equity allocations, however, long duration is one of the best diversifiers for a portfolio.

A Quick Refresher on Duration Duration is a measure of a fund's sensitivity to interest rates. In simple terms, the higher a fund's duration, the more sensitive it will be to moves in interest rates. For example, a bond fund with a duration of five years would be expected to gain (lose) 5% of principal for a 1% parallel fall (rise) in interest rates across the yield curve. Things can get a bit more complicated depending on exactly where on the yield curve the fund is most concentrated, as Morningstar fixed-income super sleuth Miriam Sjoblom points out in this article, but the general idea holds that higher duration equals more interest-rate sensitivity.

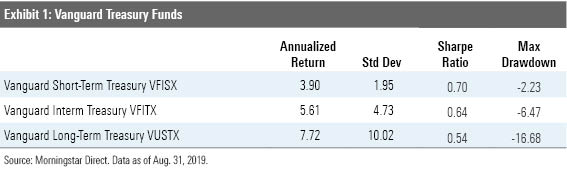

Long-duration bond funds are subject to a lot of interest-rate risk. The average effective duration for the long-term government Morningstar Category was 18.1 years as of the end of August 2019. For comparison, the average effective duration of the intermediate-term government category was 4.3 years. That increased sensitivity makes long-duration bonds a particularly volatile asset class, and, on a stand-alone basis, it certainly doesn’t look like a very attractive asset class when looking at its Sharpe ratio, which is a measure of its risk-adjusted return. Exhibit 1 shows the annualized return, standard deviation, and Sharpe ratio for long-term, intermediate-term, and short-term U.S. Treasury bonds, using Vanguard’s suite of Treasury funds as proxies, from their common inception in November 1991 through Aug. 31, 2019. The Treasury funds are free from credit risk, unless there’s the unlikely event the U.S. government defaults, so using Treasury funds isolates the duration risk.

Even though the long-term Treasury fund had the highest annualized return over the period, its higher returns didn’t compensate for its higher volatility, which results in the worst Sharpe ratio of the three. The long-term fund also had by far the worst max drawdown of the three over the period, so again, on a stand-alone basis, it's not necessarily what one would think is a great diversifier.

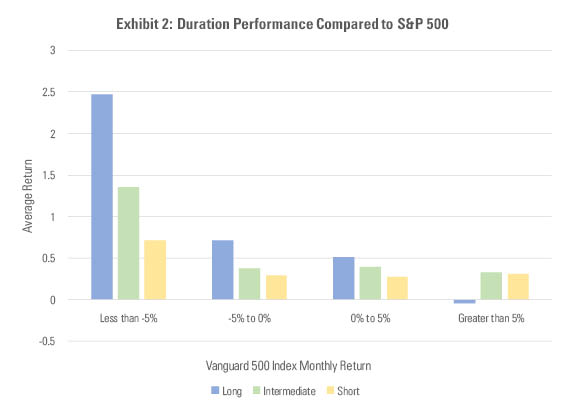

When Duration Helps Interest rates and equity prices have historically had an inverse relationship. As economic risks make stocks in aggregate less attractive, investors look to the safety of fixed-income--particularly U.S. Treasuries, which carry virtually zero risk of default, as noted previously. Over the past nearly 30 years, the greater the worry about stocks, the better duration has done. Exhibit 2 shows the average return for each of the three Vanguard Treasury funds depending on the monthly return of Vanguard 500 Index VFINX from November 1991 through August 2019.

- Source: Morningstar Direct. Data as of Aug. 31, 2019.

Although all three funds have positive returns on average when the S&P 500 has a down month, it’s clear that long duration gives the biggest boost when equities struggle the most. In December 2018, for example, the S&P 500 lost 9%, its biggest monthly loss since February 2009. That month, the long Treasury fund returned 5.5%, while the intermediate- and short-term bond funds gained 1.9% and 0.88%, respectively. Conversely, when the S&P 500 has its best months, the long Treasury fund tends to have its worst months.

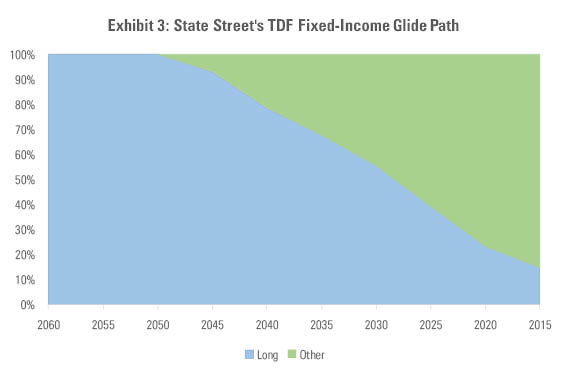

How Top Target-Date Fund Teams Use Long-Duration Funds The trade-off of having the best returns when equities do their worst and vice versa is why asset-allocation teams we rate highly from State Street, Fidelity, and T. Rowe Price use long-duration fixed income in their target-date funds when investors are furthest from retirement and the allocation to equities is at its highest. Let's look first at State Street's target-date series, which earns a Morningstar Analyst Rating of Silver. Its fixed-income glide path, shown in Exhibit 3, takes the boldest approach to using long duration. It holds long duration as its sole fixed-income holding until 30 years from retirement, when the portfolio's allocation to equities starts to lower from its 90% starting point. It continues to hold a 10% weight in long duration until five years before retirement, when equities fall to about 60% of the portfolio.

- Source: Morningstar Direct. Data as of Aug. 31, 2019.

The managers of the Fidelity Freedom target-date series and the T. Rowe Price Retirement series, both rated Silver, blend long-duration with other fixed-income asset classes, like intermediate-duration and high yield, which play a larger role as the series moves away from equities closer to retirement. Fidelity Freedom 2055 FNSDX, for example, has a 3.3% allocation to long-term government bonds, which is half of the total fixed-income exposure, and it remains the largest fixed-income position until investors are roughly 10 years away from the target retirement date and the portfolio’s allocation to equities is roughly 66%. T. Rowe Price Retirement 2055 PAROX has a 2% allocation to long duration, which equals 20% of the fixed-income allocation, and it remains the second-largest fixed-income allocation until approximately 10 years from retirement, when the equity allocation falls to 70% from a high of 90% in the longer-dated funds.

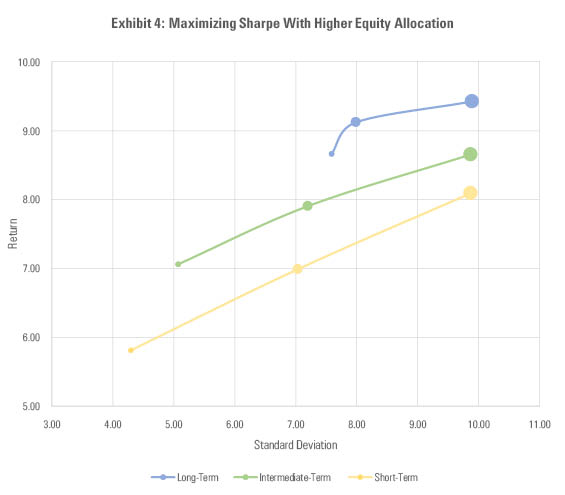

Putting Long Duration to the Test Investors should seek to maximize their level of return for a given level of risk. To see where long duration gives investors the biggest portfolio boost, we built model portfolios using each of the three funds with 30%, 50%, and 70% allocations to the S&P 500 to represent conservative, moderate, and aggressive investor portfolios. Exhibit 4 shows the portfolios plotted by their annualized return and standard deviation over the period from November 1991 to August 2019.

- Source: Morningstar Direct. Data as of Aug. 31, 2019.

The smallest dot to the far left of each line represents the conservative 30% equity portfolio, and the largest dot furthest to the right represents the aggressive 70% equity portfolio. In the 30% equity portfolio, the long duration makes the overall portfolio far more volatile than even the 50% equity portfolios of the other bond funds. It’s because with a small allocation to equities, the long-duration fund drives the overall performance. With the 50% equity portfolios, the long-duration fund did marginally improve risk-adjusted returns, but it also made the portfolio significantly more volatile, which may be more volatility than a moderate investor is seeking.

The "Goldilocks" portfolio was the 70% equity portfolio. In this one, the long-duration bonds didn’t increase the overall risk of the portfolio, and because of its strong diversification characteristics, it led to a significant boost in returns over the nearly 30-year period.

Endgame When investors need their equity-heavy portfolios to calm down in a sell-off, long-duration bond funds have been the best ballast. Top allocation teams use this approach in their target-date funds when equities are near their peak allocations, and investors with similarly high equity allocations would do well to follow suit. Of course, there's always the risk that historical correlations and relationships between asset classes will change in the future, especially over short time periods, but diversification remains investors' best protection against the uncertainty of future returns.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)