BlackRock Active Equity Funds: Better but Not Complete

After several years and several restarts, BlackRock's active equity funds have shown signs of life.

It took nearly a decade and several restructurings, but BlackRock's active equity lineup may have finally found an edge.

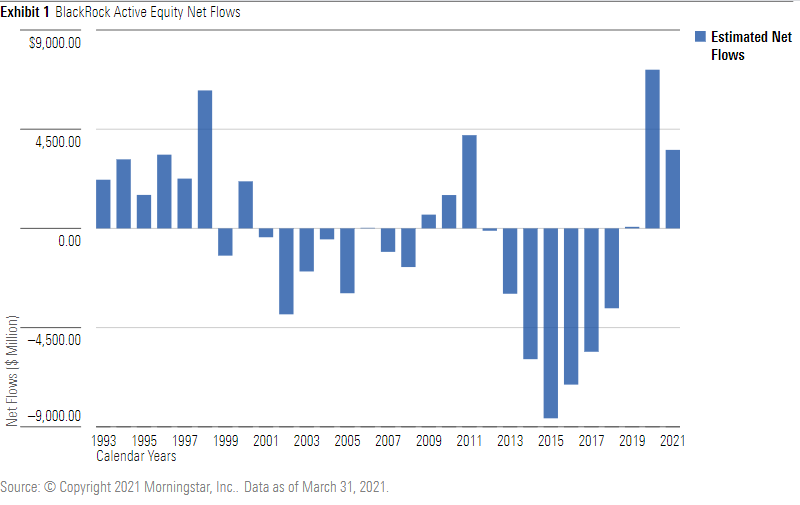

Performance and flows have improved since the firm last reorganized its active stock funds in March 2017. Although the $10.8 billion of new money that BlackRock's active equity funds collected in the past 2.25 years through March 2021 is an average month for iShares, it's still a big turnaround for the funds that, like most of their rivals, had been watching investor cash leave for passive options. More of the funds have beaten their peers and benchmarks since the last restructuring, too.

Ten years ago, BlackRock's active equity funds were a motley collection of mediocre-to-poor strategies accumulated through acquisitions. Besides the usual fiduciary and business incentives to coax better results out of the funds, BlackRock's competitive streak also played a role. As a proud enterprise that never saw an investment strategy it didn't think it could master, it irked BlackRock and its CEO Larry Fink that they had not cracked active equity's code, especially after they had rejuvenated the firm's fixed-income funds following the global financial crisis.

Indeed, BlackRock's active stock fund revival plans borrowed from its fixed-income playbook: lure talent with the promise of higher pay, hard-to-rival resources, and more fee-generating and bonus-swelling assets, and let them build the teams and systems they want. It took two big reboots in 2012-13 and 2017, dozens of smaller course corrections, and some leadership changes, but the effort has borne some fruit.

That 2017 reformation emphasized technology. It shifted about 11% of active equity assets from the firm's managers who relied on old-fashioned human research to quantitative managers who used computer models and artificial intelligence. Fink and the executive he recruited to spearhead the project, Mark Wiseman, all but issued the firm's fundamental managers an ultimatum: make more use of data science or wither.

So far, the plan has not panned out as envisioned. Wiseman left BlackRock under a cloud of scandal in 2019, and the vaunted quant strategies run by BlackRock's Scientific Active Equity group haven’t done as well as the firm hoped. Many bottom-up teams tap more technology and data in their processes, but BlackRock has had to alter its tack there, too. The data expert BlackRock hired in 2017 as a bridge between fundamental and quant managers departed in 2020, leaving each team to find its own data lead.

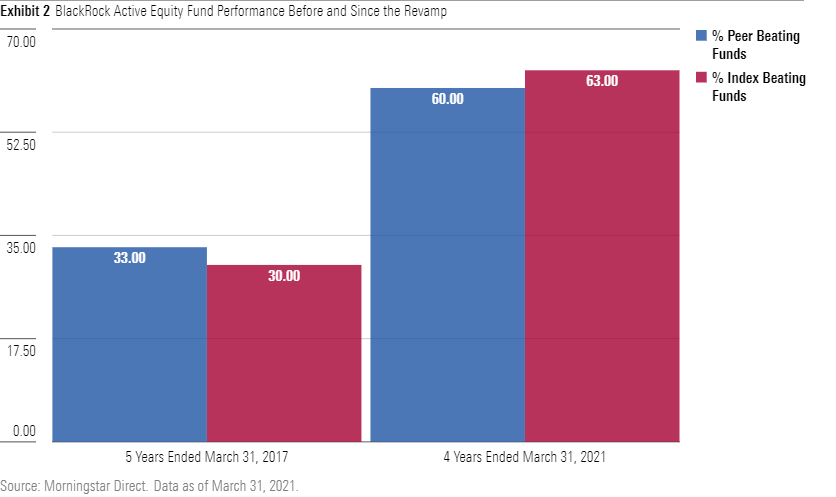

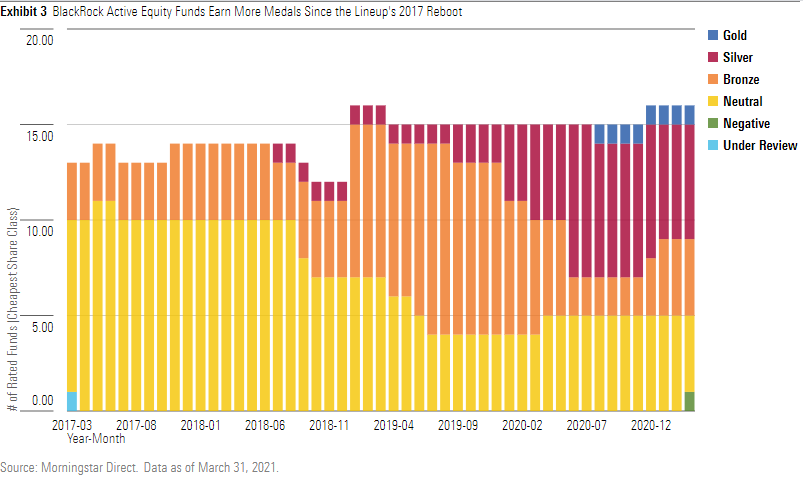

The project has had success, though. In the five years ended March 2017, less than 40% of BlackRock's active equity funds beat their respective Morningstar Category peers' average annualized returns; even fewer, about a third, beat benchmarks. In the four years ended in March 2021, more than 60% of BlackRock's equity funds beat their typical rivals and about two thirds beat relevant indexes. More of them also earn Morningstar Medalist ratings now.

BlackRock Technology Opportunities BGSAX and BlackRock Mid-Cap Growth Equity BMGAX have been standouts. BlackRock Technology Opportunities' nearly 37% annualized gain from April 1, 2017, through March 2021 beat 97% of its technology category peers and topped relevant benchmarks by wide margins.

BlackRock has granted Technology Opportunities manager Tony Kim a lot of freedom since luring him from Artisan Partners in 2013. Taking advantage of knowledge and contacts built from his base in the San Francisco Bay area, he uses a diversified yet distinct and aggressive approach that has downplayed tech sector incumbents, such Apple AAPL and Microsoft MSFT, in favor of smaller challengers.

BlackRock Mid-Cap Growth Equity's nearly 25% annualized gain beat 87% of its rivals in the mid-cap growth category and the Russell Midcap Growth Index by 5 percentage points. Lead manager Phil Ruvinsky works on the same BlackRock U.S. growth team that supports BlackRock Capital Appreciation MDFGX manager Lawrence Kemp, who also has done well since 2017. They shift their portfolios among dominant, steady, and cyclical growth stocks. Ruvinsky has tended to stress the steadies but has made his share of aggressive picks, too, such as Netflix NFLX.

Other winners include BlackRock Emerging Markets MDDCX. Lead manager Gordon Fraser has beaten 93% of its category peers and the MSCI Emerging Markets Index by more than 5 percentage points with a mix of deft country calls and stock-picking since taking over in 2017. The firm's largest active equity fund, BlackRock Equity Dividend MDDVX, has been solid since the Income and Value team that runs it bolstered its ranks in 2017. So have two of the new strategies that team inherited then, BlackRock Mid Cap Dividend MDRFX and BlackRock High Equity Income BMEAX.

BlackRock can't simply declare victory, though. First, it's still a short time period. Market winds could shift and foul some top-performers' sails. BlackRock Technology Opportunities and BlackRock Mid-Cap Growth Equity, for instance, turned in more subdued results in 2021's first quarter as value stocks rallied. Success also could spoil those strategies if BlackRock lets the funds, which are much larger than they were in 2017, get too big.

The quant revolution also hasn't lived up to its hype thus far. BlackRock's Advantage series quant funds have had mixed results since their 2017 christening. Out of the about a dozen Advantage funds, only BlackRock Advantage Large Cap Value MDLVX, BlackRock Advantage Small Cap Core BDSAX, and BlackRock Advantage ESG U.S. Equity BIRAX have beaten their peer norms and benchmarks in absolute and risk adjusted terms from April 2017 through March 2021. BlackRock Advantage Global MDGCX and BlackRock Advantage Large Cap Core MDLRX beat most peers but not their benchmarks. That said, BlackRock's Scientific Active Equity team has an impressive combination of experience, programming/modeling talent, and data and computing resources. Most of the funds still get Morningstar Analyst Ratings of Bronze.

Performance woes, manager turnover, and other issues have plagued several funds, including BlackRock Basic Value MDBAX, BlackRock Global Dividend BABDX, and BlackRock International Dividend BREAX. BlackRock Asian Dragon MDPCX and BlackRock Natural Resources MDGRX have Negative ratings partly because of key manager changes and process changes.

It remains to be seen if BlackRock can keep whatever edge it has honed over the last four years.

/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)