Is Your Fund Affected by Asset Manager Layoffs?

See what these cuts mean for our Parent Pillar ratings.

Outflows, performance woes, technological changes, mergers, and other competitive pressures have driven several global asset-management firms to restructure and lay people off in the past year. Though the absolute number of recent asset-manager job cuts seems tiny compared with the thousands of positions slashed recently by companies like Alphabet GOOGL, Meta META, Amazon.com AMZN, and Cisco CSCO, they have often represented a similar percentage of asset-manager workforces. No matter the raw numbers, it’s natural to wonder how the reductions affect the firms’ investment capabilities. This article offers a qualitative survey of the impact of some of the largest and most notable investment management industry layoff announcements since the start of 2023.

Exodus of Assets

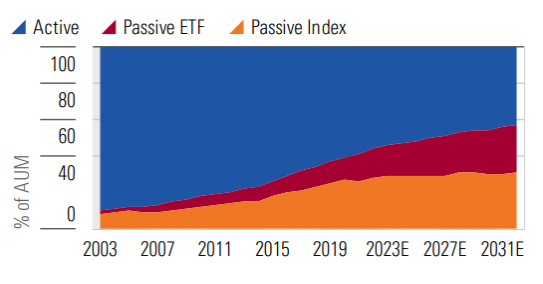

Many challenges beset asset managers. The most persistent and, from traditional active investors’ standpoint, pernicious one is the accelerating asset exodus from higher-fee active strategies to passive approaches, particularly those sold as exchange-traded funds.

In his recent US Asset Manager Landscape, Morningstar strategist Greggory Warren wrote, “On the traditional side of the (money management) business, low-cost, passively managed products have taken share from actively managed funds over much of the past two decades. An ongoing shift to fee-based accounts over commission-based structures in the retail-advised channel and institutional investors turning more and more to index-based funds (including ETFs) to gain market exposure while pursuing alpha with other products (like private equity and private debt) have increased the demand for index funds and ETFs in the marketplace.”

Passive Funds Continue to Take Share

Catch the Drift

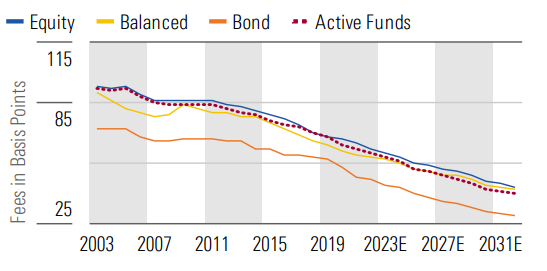

Industrywide fees have drifted down over the years because of this drift, as managers have cut expense ratios and launched lower-cost options to stay competitive. While good for investors, this has made the money management business more fraught.

Warren expects fees to continue to drop by 2.5% annualized over the next decade. He wrote, “Asset-weighted average fund fees have been falling for more than two decades, with the average fee rate for actively managed funds dropping below 60 basis points in 2023, while passive funds have slid 11 basis points. Management fees have been pressured by the growth of the passive market as well as pressure from distributors looking for low-cost higher-performing funds for their platforms.”

These trends have been especially hard on fund families whose fund lineups skew toward active equity funds, which have lost the most assets to passive alternatives. “Going forward, the continued growth of passive products at the expense of active funds will leave more of the traditional managers in our coverage behind,” Warren wrote.

The ability to offer a wide array of strategies across asset classes and disciplines and in many geographic markets mitigates some of these trends, but few asset managers, save giants like BlackRock, have such diversification. Even the titans have not been immune from the imperative to streamline operations.

Fund Fees Still Under Pressure

Touching the Third Rail

Typically, investment firms will nibble away at almost any other business line before trimming investment personnel. Competition to attract and retain investment talent is fierce, and no fund family wants to be known as the outfit that doesn’t stand by its portfolio managers and analysts when times get tough. A survey of publicly announced or reported money manager staff reductions over the past 13 months, however, shows that not all the firms spared their investment teams. Fund houses that did reduce investing staff, though, did so without exacerbating their existing trials.

Morningstar analysts recently reviewed some of the biggest asset-manager layoff announcements of 2023 and early 2024. Some situations are worth watching, but none resulted in Morningstar downgrading (or upgrading) any Parent Pillar ratings.

Cuts of All Kinds

First, here’s a look at firms whose layoffs have included investment personnel.

Baillie Gifford

Edinburgh, Scotland-based Baillie Gifford laid off dozens of people in January 2024, including some investment professionals. The layoffs primarily affected the historically equity-centric firm’s fixed-income teams and were the result of a strategic review that has led Baillie Gifford to rationalize its bond strategies. It is not abandoning the asset class altogether, but rather refocusing its efforts on the UK market. The firm closed four fixed-income funds—one each targeting global, European, emerging markets, and sustainable emerging markets—that had few clients. The actions did not trigger a review or change of Morningstar’s High Parent Pillar rating for the firm.

Columbia Threadneedle

In November 2023, Boston-based Columbia Threadneedle said that it had laid off 14 investment personnel as part of a broader effort to cut costs and refocus its people on existing strategies. The actions did nothing to alter Morningstar’s impression of the firm as an organization in transition. Its Parent Pillar rating remains Average.

Lazard

Lazard began reducing its global workforce by about 10% in early 2023. Most of the layoffs hit its investment banking unit. The job cuts that did come out of its New York-based Lazard Asset Management unit were so-called back-office positions in areas like distribution, sales, and marketing. Some manager changes coincided with the layoffs, though. Kevin Matthews, comanager of Lazard International Equity LZIEX, and Stephen Russell, comanager of Lazard Emerging Markets Core Equity ECEIX, left, and the firm shut its small technology long-short and Korean equity teams. Lazard Asset Management’s overall Parent Pillar rating remains Above Average.

Charles Schwab

Charles Schwab, of Westlake, Texas, laid off about 2,000 workers across the corporation in October 2023, including three notable Schwab Asset Management Solutions personnel—former COO Jonathan de St. Paer, fixed-income CIO Brett Wander, and active bond portfolio manager Ken Salinger. Schwab Asset Management Solutions’ core competence is in passive index funds, though, which the layoffs did not affect. The firm still gets an Above Average Parent Pillar rating.

T. Rowe Price

T. Rowe Price of Baltimore reduced staffing by 2%, or about 160 employees, in July 2023 because of large outflows. The firm did not break out the reductions by business unit, but some investment team departures coincided with and followed the layoff announcement. T. Rowe Price confirmed that 22 investment personnel left the firm in 2023′s third quarter when it announced the layoffs. The departures don’t change Morningstar’s opinion of T. Rowe Price’s 812-person investment corps, which is still large, deep, experienced, and global. The firm’s Parent Pillar rating remains High.

Targeted Reductions

Most firms said they avoided laying off investment personnel.

Fred Alger

In March 2023, New York’s Fred Alger Management, advisor to the Alger funds, laid off nine noninvestment employees, or about 5% of the growth investing boutique’s staff, after its assets under management fell because of weak performance and substantial outflows. The layoffs did not change Morningstar’s Average Parent Pillar rating for the firm.

American Century

American Century Investments of Kansas City, Missouri, eliminated 30 sales, marketing, and client-relations positions in June 2023 as part of a strategic realignment. The reductions, less than 2% of the total employee count, didn’t touch the firm’s investment teams and did not change its Average Parent Pillar rating.

Capital Group

Capital Group, the Los Angeles-based advisor of the American Funds family, let go 3% of its workforce, or about 300 people, in March 2023. The cuts did not include investment personnel and did not change its High Parent Pillar rating.

Franklin Templeton

Franklin Templeton, which recently completed its acquisition of Boston-based Putnam Investments, reduced its global payroll by about 3% over the course of 2023. The San Mateo, California-based fund family, which achieved the reductions through a combination of buyouts, attrition, and layoffs, said it did not cut any investment-related positions and that “limited” reductions at Putnam did not affect any investment professionals. Franklin’s Parent Pillar rating remains Average.

Goldman Sachs

New York-based Goldman Sachs slashed a combined 3,500 jobs in two rounds of layoffs in 2023, a large number made larger by the fact that the firm did not make any staff adjustments in 2021 and 2022 as it had done annually for most of its history. The firm’s trading and investment banking units bore the brunt of the cuts, not the asset-management group. The firm’s Parent Pillar rating remains Average.

Abrdn

The layoffs that Edinburgh-based Abrdn revealed in January 2024 were part of its plan to realize GBP 150 million in annual cost savings, but the firm did not announce any investment team cuts. Noninvestment roles, such as technology, operations, and finance, were on the block. Over the past few years, Abrdn has been refocusing on its core competencies because of industry pressures and struggles across its business lines, including its global absolute return, smaller-companies, and emerging-markets strategies. The firm has sold off niche strategies such as private markets and could merge or close other strategies, but its recalibration hasn’t yet precipitated any investment team changes. Abrdn is still in turnaround mode and has an Average Parent Pillar rating.

J.P. Morgan

The layoff of 500 employees that J.P. Morgan announced in May 2023 mostly claimed technology and operations positions from across multiple divisions within the bank, including wealth management and asset management. But this represented less than 0.2% of J.P. Morgan’s almost 300,000 employees, which mitigates concerns about the cuts’ effects on the New York firm’s investment capabilities or its asset-management business’ Above Average Parent Pillar rating.

Morgan Stanley

Morgan Stanley of New York will cut about 3,000 jobs from its global workforce by the end of 2024′s first quarter, according to news reports. That would amount to 5% of its staff, excluding financial advisors and their support personnel. It’s not clear how the cuts will affect the firm’s investment capabilities. Its Parent Pillar rating remains Average.

State Street

Boston-based State Street’s downsizing of 1,500 employees, or about 3.5% of its workforce, that was announced in December 2023 included cuts at its bank and asset-management arm State Street Global Advisors. Most of SSGA’s assets are in index-tracking funds whose management is increasingly automated, and the cuts did not hit any of those management teams. The layoffs didn’t affect SSGA’s Above Average Parent Pillar rating.

Northern Trust

In 2023, Northern Trust laid off 900 employees, or 2.5% of its overall personnel, in two rounds in January and July. The downsizing was consistent with the firm’s “focus on cutting expenses and driving productivity,” according to the firm’s CFO. The layoffs did not change Morningstar’s view of Northern Trust’s investment organization or its Parent Pillar rating of Average. Most of the layoffs affected the firm’s asset-servicing arm, which is separate from its investment teams.

Net Additions

These funds cut some posts while creating others.

AXA

AXA Investment Managers, of Puteaux, France, said in August 2023 that it could cut about 90 positions, or about 3% of its staff, as part of a restructuring of its core unit, which includes its public markets investment capabilities. AXA is still discussing the reductions with employee unions in Germany and France, so it could not yet confirm if it would realize its targeted job cuts, but they should affect the supporting staff of its Europe-based teams rather than investment personnel. The firm, which said it hired 438 people in 2023, has slashed costs before. In 2018, it laid off about 100 support personnel. AXA IM has an Average Parent Pillar rating.

BlackRock

New York-based BlackRock in January 2024 announced about 600 staff reductions as business units decided how to best allocate their people. This wasn’t the first time that the world’s largest money manager started the year with a layoff announcement. Indeed, regular restructurings to ensure that its staffing aligns with its strategic priorities are part of the firm’s culture. BlackRock contends that even with periodic layoffs, its overall headcount has grown since 2019, though its employee count of 19,801 as of December 2023 was about the same as its December 2022 tally of 19,800. BlackRock expects to continue to add people in areas where it is investing, such as technology development. Its recent acquisition of Global Infrastructure Partners also should swell its ranks after that deal closes in 2024′s third quarter. BlackRock’s occasional layoffs and periodic culling of low performers are features, not bugs, of its culture and do not alter its Above Average Parent Pillar rating.

Invesco

Atlanta’s Invesco also laid people off in the past year as part of an ongoing effort to improve fund performance, and some executives also left as a new CEO took over and made some changes. Overall, the firm added employees between the end of 2022 and December 2023. Its investment operations, for example, had 24 more portfolio managers and analysts on Dec. 31, 2023, than it did a year earlier, according to numbers provided by Invesco. The firm’s Parent Pillar rating is still Average owing to the mixed quality of its investment lineup.

Morningstar Manager Research directors Mathieu Caquineau, Jason Kephart, Danielle LeClair, Jonathan Miller, Matias Möttölä, and Janet Yang; associate director Elizabeth Foos; senior analysts Mike Mulach, Paul Olmsted, Adam Sabban, Daniel Sotiroff, Chris Tate, Stephen Welch, and Gregg Wolper; and analysts Michael Born, David Carey, Zachary Evens, Daniel Haydon, Ryan Jackson, Hyunmin Kim, Thomas Murphy, Megan Pacholok, and Andrew Redden contributed to this report.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)