In the Absence of Inflation, Some Real Assets Are Down but Certainly Not Out

Real assets are often thought of as an inflation hedge, but their diversification benefits are a plus, too.

With an uncertain inflationary picture, the role of real assets’ in a diversified portfolio warrants a further look. These varied and idiosyncratic sectors can do more than simply hedge against inflation--they may also provide an additional facet to a multidimensional long-term-oriented portfolio.

What qualifies as a real asset? There's no standard definition for what qualifies as a real asset, but in general, these investments are linked to tangible holdings with intrinsic value. Over intense inflationary periods, inelastic demand from consumers for real assets--such as real estate, commodities, and infrastructure--means that those consumers absorb the subsequent price increases. For investors in real assets, these economic exposures are attractive because they damp the influence of inflation in a total portfolio. Besides directly owning a real asset, an investor might take a position in a company or stock that derives its value from real assets for some exposure, but in those cases, the addition of beta, or equity-market sensitivity, may detract from straightforward real asset characteristics.

Precious metals, such as gold and silver, fall into the real asset bucket as well, though the return drivers for these commodities are harder to tease out. Morningstar’s Amy Arnott explored the drivers of gold’s returns in this piece, with the takeaway that it’s a mix of behavioral and economic factors.

Expanding the definition beyond physical assets and their related company stocks, some fixed-income assets fall under the banner of providing inflation-sensitive returns. For example, the principal of Treasury Inflation-Protected Securities increases with inflation. The interest payments on floating-rate notes rise alongside benchmark rates (which tends to happen in inflationary environments). Bonds backing physical assets, such as commercial mortgage-backed securities, can offer compelling inflation-adjusted returns. Each of these examples, along with a few other inflation-hedging exposures, is addressed further in this article.

While inflation immunity dominates the conversation around real assets, these investment exposures exhibit characteristics that are differentiated enough from traditional stocks and bonds to serve as a compelling strategic weight in a broadly diversified portfolio.

So, what can real assets do for a portfolio? To examine this question, we considered eight separate real asset sectors (using an appropriate index as a proxy in each case) and ran each as a complement to a broadly diversified portfolio. The benchmark portfolio is a traditional 60% equity/40% fixed-income combination, and in each test case, those weights are reallocated to 55% equity/35% fixed-income/10% single-sector real asset exposure. While there isn't an explicit reason underpinning a 10% allocation to a real asset, this number appeared substantial enough to surface effects but not so substantial as to overwhelm the goals of a diversified total portfolio. The lookback period here runs from January 2003 through August 2020 and includes a historical performance stream for each of the real-asset sector indexes employed. Notably, these years don't include an intense inflationary spike, allowing us to consider how these real assets may benefit a diversified portfolio even when inflation isn't as strongly at work.

Modern portfolio theory holds that an investor should seek to maximize return for a given level of risk, defined as volatility, or minimize risk for the same unit of return. Building on that concept, we can evaluate a given real asset’s utility by assessing whether it improved a portfolio's future risk-adjusted return. Specifically, if adding a real asset allocation to a traditional portfolio improved its risk-adjusted returns, it is considered a successful outcome here.

For the test, we created two hypothetical portfolios with the following allocations:

Diversified 60/40

60% Equity

45% U.S. Equity (S&P 500)

15% International Equity (MSCI EAFE Index)

40% Fixed Income

35% U.S. Investment-Grade (Bloomberg Barclays US Aggregate Bond Index)

5% U.S. Non-Investment-Grade (Bloomberg US High Yield 2% Issuer Cap Index)

Diversified 55/35/10 with Real Asset Allocation

55% Equity

41.25% U.S. Equity (S&P 500)

13.75% International Equity (MSCI EAFE Index)

35% Fixed Income

30.5% U.S. Investment-Grade (Bloomberg Barclays US Aggregate Bond Index)

4.5% U.S. Non-Investment-Grade (Bloomberg US High Yield 2% Issuer Cap Index)

10% Real Asset

We assumed the portfolio allocations were rebalanced back to the target monthly.

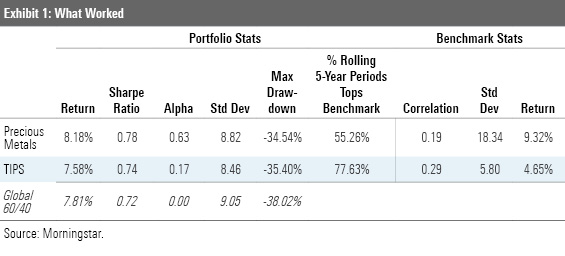

What Worked Over the test period, a 10% allocation either to precious metals or to TIPS improved the portfolio's overall Sharpe ratio. This result is less surprising, given that each of those sectors exhibited a low correlation to the benchmark portfolio. Adding uncorrelated assets to a portfolio improves its overall diversification, which can damp volatility and limit drawdowns.

Precious metals provide the clearest example of the benefits of diversification. Over the time period measured, the index suffered a nearly 50% drawdown that bottomed in 2015, but because it occurred during a strong period for stocks and bonds it didn’t significantly hurt a diversified portfolio. In contrast, during the 2007-09 global financial crisis, many precious metals served as safe-haven assets, and these subsequently buoyed a portfolio’s performance relative to the traditional 60%/40% proxy, and as monthly rebalancing took place, provided a funding source for investors to reallocate into equities when those securities were cheap. Investing in precious metals isn’t for the faint of heart; its volatility is high and price moves can be unpredictable, but its diversification benefits are appealing over long time periods.

Treasury Inflation-Protected Securities are a unique asset, with both safe-haven status and a built-in inflation hedge. These are U.S. government securities, though, and while their potential yields are expected to trail those of corporate credit, these benefit from an expectation of risk-free status, ultimately damping volatility. Notably, given the low inflationary environment over the lookback period here, TIPS’ success derives from low volatility and a falling-rate environment that served as a boon to performance.

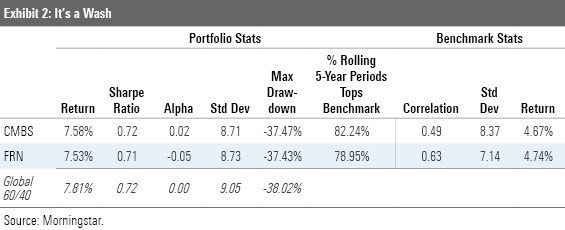

It's a Wash Neither CMBS nor floating-rate notes frequently receive standalone allocations in a traditional portfolio, and it's understandable given results over this lookback period. While these sectors are more peripheral to discussions of real assets--CMBS rely on real estate valuations while floating-rate notes structurally benefit during periods of inflation--they are also much more influenced by broad market moves than other considered real-asset sectors. In this test scenario, a standalone allocation to either didn't provide much additional boost to the risk-adjusted returns of the portfolio, and leave us to conclude that they are compelling considerations for other more customized situations.

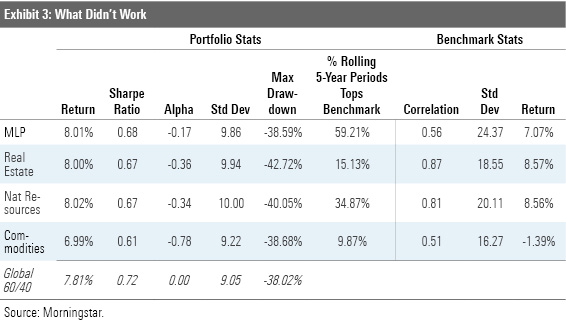

What Did Not Work None of the equity sectors--master limited partnerships, infrastructure, natural resources, or real estate--improved the portfolio's Sharpe ratio. Mostly, this is because the same factors that drive stock and bond performance drive these, so diversification benefits are limited. None of the assets had particularly bad performance, but rather than add a differentiated return stream they just added more equity risk.

Commodities are a different beast. Because the raw assets do not pay interest or dividends, the only way to profit from long-only commodities investing is through price appreciation. Energy prices--the largest component of the Bloomberg Commodities Index and an indirect driver of metals/agricultural prices--stalled as the boon in U.S. shale production drove down prices starting in the late 2000s, which hurt returns into the 2010s and included a significant portion of this lookback period.

What Does It Mean for Investors? These results highlight that investors looking at real assets face a bevy of choices and must consider their individual risk tolerance before allocating to the space. Far from a homogeneous group, the different real assets explored here all derive performance from different factors that lead to unique risk/return characteristics. Even in a period of benign inflation, the performance of TIPS and precious metals led to better outcomes for a broadly diversified portfolio. Should inflation return, it's likely that additional real assets would join them.

Indexes Used:

- Precious Metals -- S&P GSCI Precious Metal TR

- Commodities -- Bloomberg Commodity TR USD

- MLPs -- Alerian MLP Infrastructure TR USD

- CMBS -- BBgBarc CMBS IG TR USD

- Floating-Rate Notes -- S&P/LSTA Leveraged Loan TR

- TIPS -- BBgBarc US Treasury US TIPS TR USD

- Real Estate -- DJ Global World Real Estate TR USD

- Infrastructure -- MSCI World Infrastructure GR USD

- Natural Resources -- VanEck Natural Resources TR USD

/s3.amazonaws.com/arc-authors/morningstar/fadee740-dfeb-494d-95b1-c462d0ac1f59.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fadee740-dfeb-494d-95b1-c462d0ac1f59.jpg)