Does Your State's 529 Plan Pay for Itself?

For some college savers, state tax incentives might outweigh their investment fees.

One of the first choices an investor makes when choosing a 529 college savings plan is whether to stay in-state or shop around for a better option among the more than 50 plans available nationally. Most states with an income tax offer an incentive to stay, but those benefits vary. We sharpened our pencils to calculate the value of those benefits for Morningstar's Annual 529 Landscape.

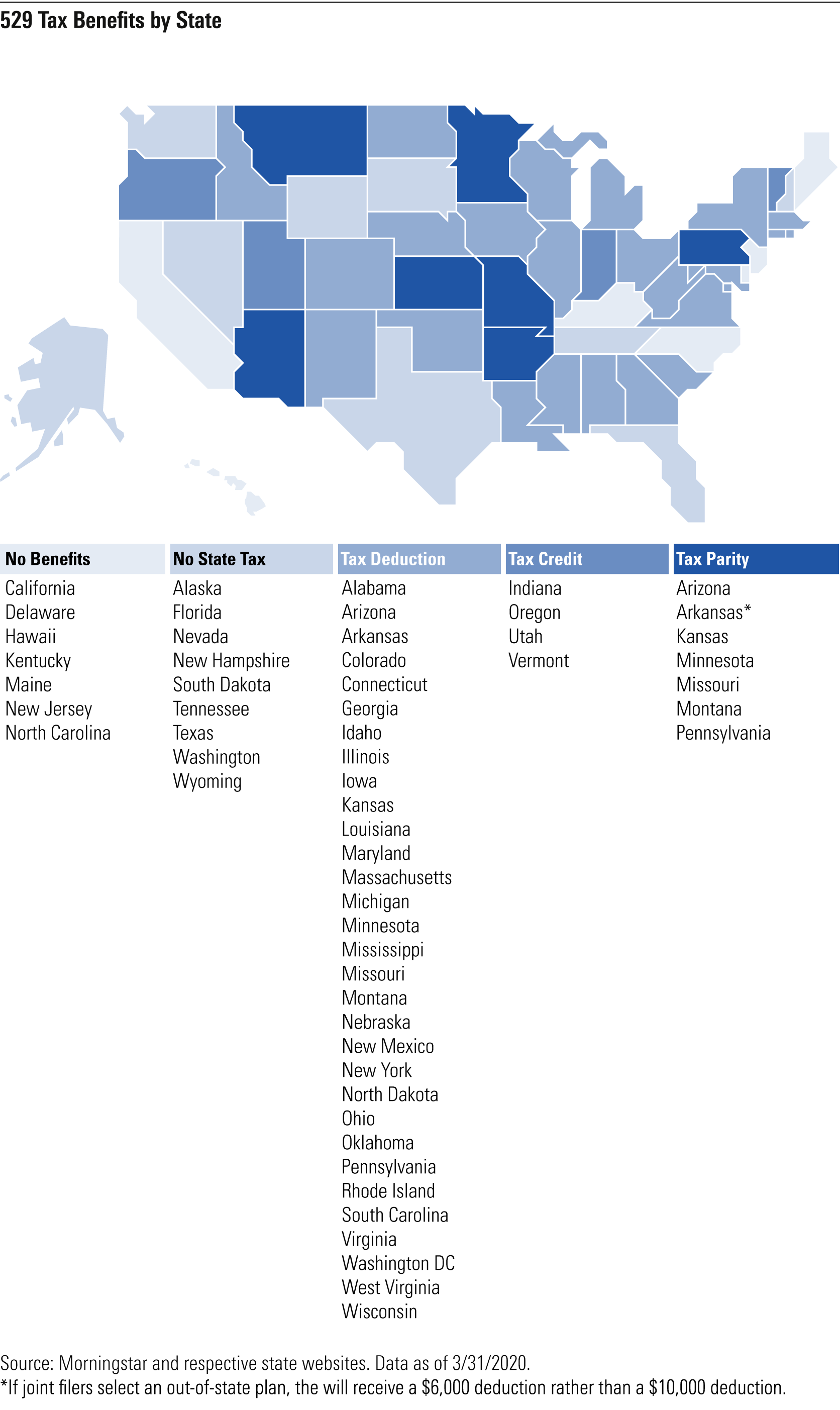

How Much Does It Pay to Stay in State? When states offer a tax benefit, they either restrict investors to in-state plans or they offer tax parity, which allows investors to pick any state's plan and still receive a tax benefit from their state of residence. For 529 plan investors across 34 states and Washington D.C., these benefits can come in the form of a deduction or credit. Generous in-state benefits might entice investors to select a local plan rather than going elsewhere. Exhibit 1 illustrates which states offer tax benefits. Tax parity is a less restrictive version of a tax deduction, so the dark blue tax parity designation trumps the light blue tax deduction in our map.

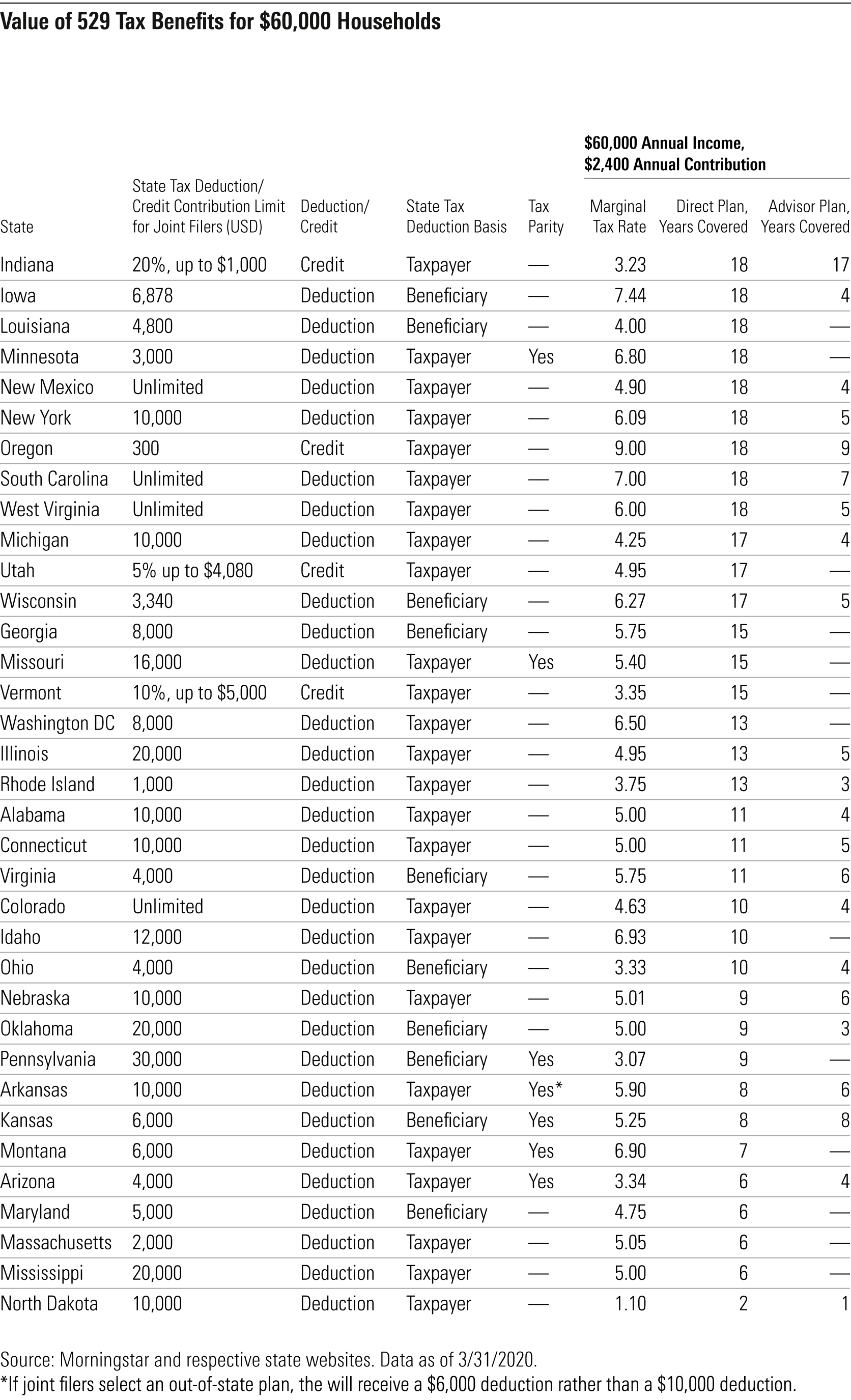

Given the differences in state income tax benefits, we evaluated whether it was possible to cover the average fee of a plan's age-based portfolios with the available state-specific tax benefits on a state-by-state basis (assuming both stay constant), and if so, how long that advantage lasts. We completed a similar analysis in November 2019 but updated our methodology since then based on further research into how investors use 529 plans. Previously, we assumed investors would stay invested in their plan over an 18-year investment horizon allowing for tax savings and costs to accumulate. However, our research shows, most individuals don’t start investing in a 529 plan until the beneficiary is more than 7 years old. With this in mind, rather than calculate the fees versus expense savings at the end of an 18-year period, we looked at each year’s fees versus its corresponding year’s tax benefit.

We evaluated tax savings versus the expense ratios charged by each state’s plan(s). The annual cost in dollars charged by the plan increases as the account balance grows, whereas tax savings stay constant. Eventually, the balance may grow to the point where fees charged are greater than the tax benefit. We assumed a family of four with a $60,000 income per year--about the median U.S. household income in 2019--contributed $100 each month per child, or $2,400 a year. We also assumed each state's highest marginal state tax rate for the family’s income level and an annual 6% return on investment. Across all plans, we assumed investors chose the age-based portfolios and took an average expense ratio across the plans’ tracks to find the average price of each plan. When states offer more than one direct or advisor plan, we considered the one with the higher Morningstar Analyst Rating. Exhibit 2 outlines how long a plan's tax benefits cover its fees.

Our research finds that more than half of states’ tax benefits cover a direct-sold plan’s expenses for more than a decade, during which time families essentially receive free investment management. Impressively, nine states offer tax benefits generous enough to cover the cost of their direct-sold plan for all 18 years.

Tax benefits come in the form of a tax deduction or credit. Indiana, Oregon, Utah, and Vermont offer a tax credit, which directly decreases the tax dollars owed, while a tax deduction reduces taxable income. Indiana’s tax incentive far exceeds other states in its generosity. The tax savings covers all 18 years of expenses for its direct plan and 17 years for its advisor plan.

Notably, high fees on advisor-sold plans dim the appeal of state tax incentives. The average fee for an age-based portfolio in advisor-sold plans was 0.87% at the end of 2019 as compared with 0.35% in direct-sold plans. Indiana’s tax benefits cover costs for eight years more than the next most-generous state with an advisor plan, Oregon. Over 18 years, the median advisor-sold plan’s tax benefits cover five years of costs, as compared with 13 years for direct-sold plans. For advisor-sold plans, we typically used the A share class, but we employed the cheaper resident share class when available.

One of the primary reasons for the higher fees levied, on average, by plans sold through an advisor is that they cater specifically to financial advisors who receive commissions from the funds their clients invest in. In advisor-sold plans, funds tend to include compensation for the advisor in the cost of the fund; plans sold directly to individuals exclude these additional fees. Investors in advisor-sold A shares may also pay an upfront fee, making them even less attractive versus direct-sold plans. These commissions tend to drive fees higher in advisor-sold plans’ age-based portfolios, regardless of the type of underlying funds the portfolios use.

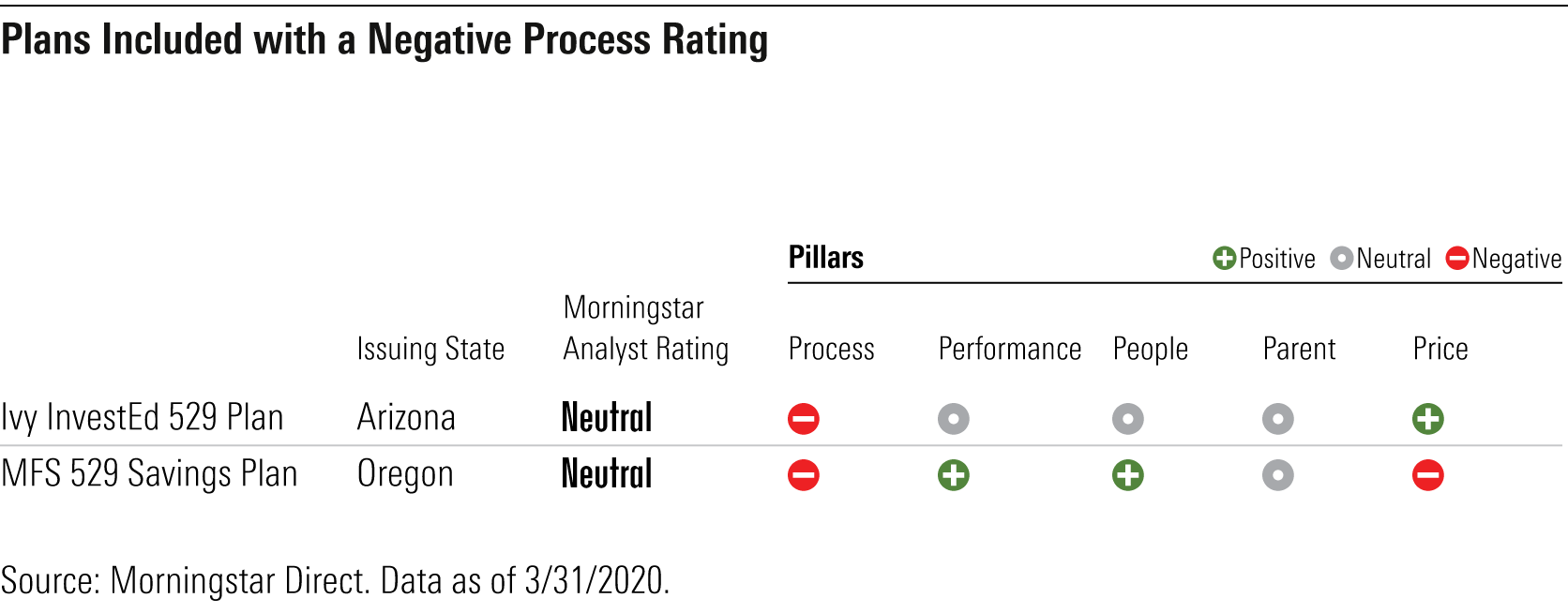

Cost Savings Aren't the Only Factor Although the cost of a plan and your state tax benefit should be considered when selecting the right 529 plan, they shouldn't be the only factors. Three critical pillars of 529 plans' Morningstar Analyst ratings include: People (measuring the strength of the investment lineup), Process (determining whether there is a repeatable and thoughtful asset-allocation process), and Parent (signifying robust oversight). A Negative rating for People, Process, or Parent signals that even at zero cost, investors should consider other options. Two advisor-sold plans considered in our tax-saving analysis earn a Negative Process rating. Exhibit 3 outlines plans included in the tax-incentive analysis with a Negative People, Process, or Parent Pillar rating.

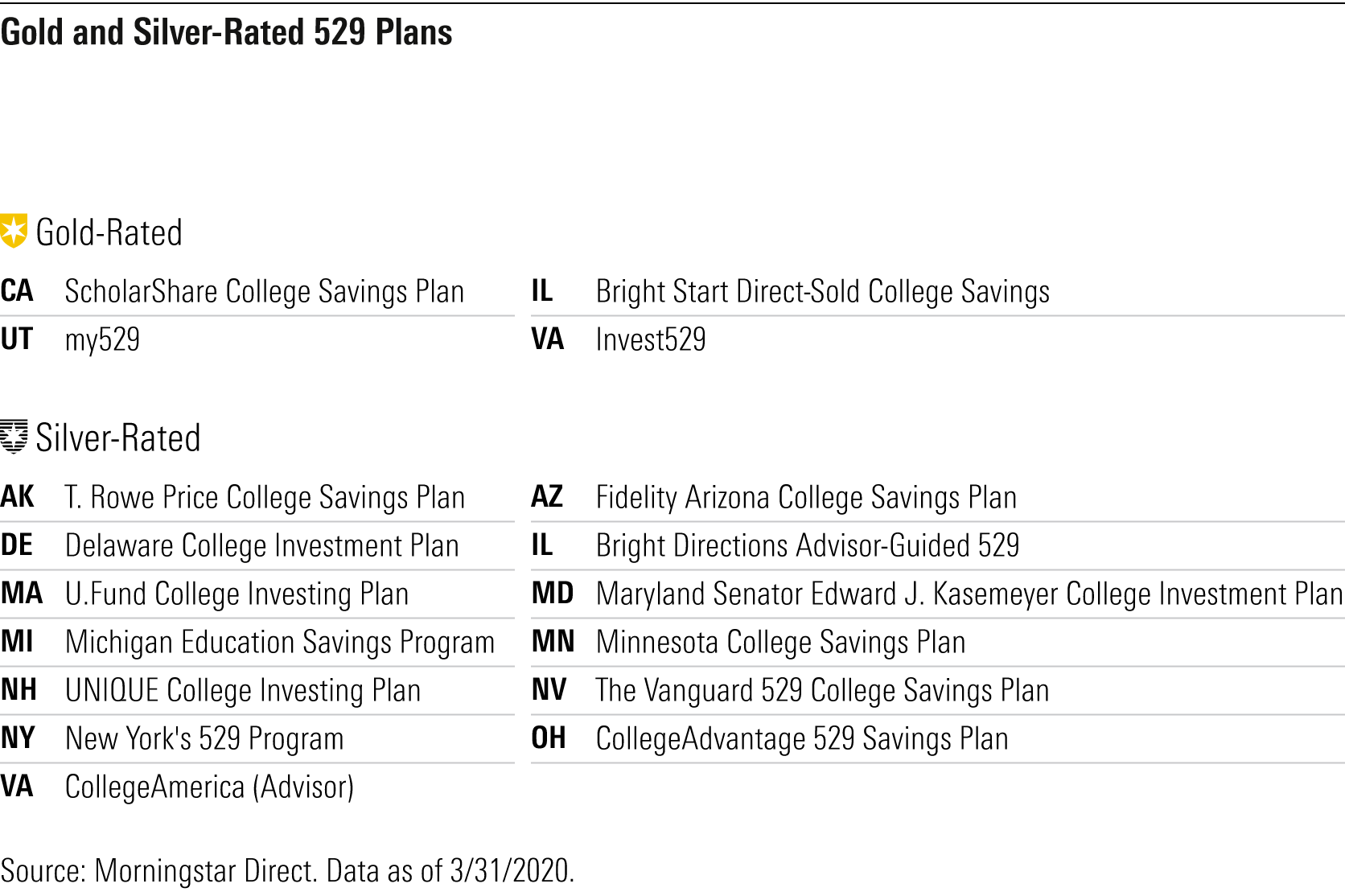

Plans That Make the Grade If You Are Looking Out of State Investors living in states that have tax parity or don't offer an incentive to stay in state (either because the state has no state income tax or it doesn't offer a deduction or credit for staying in state) shouldn't feel obligated to stay. Morningstar Analyst Ratings for college savings plans consider the plan's relative strength across the national industry, not taking into account state-specific incentives when evaluating them. Morningstar currently assigns four 529 plans a rating of Gold and 13 a rating of Silver. Exhibit 4 shows Morningstar's highest-rated 529 plans for investors shopping nationwide.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)