The Direct-Indexing Landscape in 3 Charts

A snapshot of the quickly evolving direct-index world.

Direct indexing is having a moment. The option that was once exclusive to high-net-worth investors is moving downstream—and quickly. In 2022, Fidelity expanded its direct-index offerings to retail investors with minimum investments as low as $5,000. Meanwhile, Schwab launched its own service starting at a $100,000 minimum, and Vanguard made its first-ever acquisition to jump-start its direct-indexing capabilities. Vanguard doesn’t currently make the offering available to retail investors with less than a $250,000 minimum, but we expect that over time it will become more democratized.

To help investors make sense of the direct-indexing options available and share some best practices for evaluating your own direct index, we’ve published our initial Direct Indexing Landscape.

The two biggest drivers of direct-index adoption are taxes and personalization, with the former attracting most of the interest. Investing directly in the underlying stocks of an index in lieu of a mutual fund or exchange-traded fund tracking the same benchmark allows for individually tailored tax management. It also allows investors to exclude certain stocks and industries or emphasize stocks with characteristics like low ESG risk or high exposure to traditional investment factors like value.

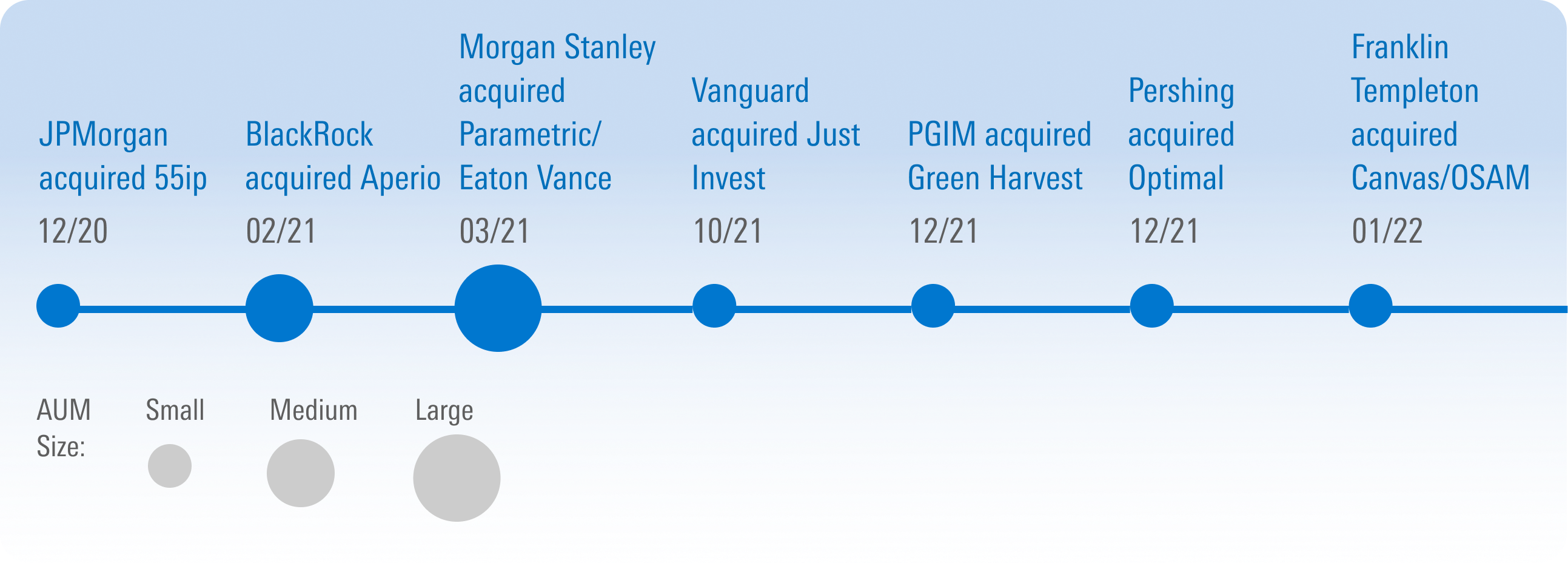

Asset Managers Go on a Shopping Spree

More than $260 billion was following direct indexes as of the end of 2022, according to a Morningstar survey of some of the largest providers. There’s no better sign of optimism for future growth than a rush of asset managers to add direct indexing to their toolkits. The exhibit below shows the timeline of asset-manager acquisitions involving direct-indexing capabilities since late 2020.

J.P. Morgan was the first, scooping up tax-focused financial technology firm 55ip at the end of 2020. J.P. Morgan used the service’s technology, which had been focused on tax-loss harvesting for model portfolios, to launch its direct-indexing offering in 2022.

Morgan Stanley’s purchase of Eaton Vance, which closed in March 2021 and included the biggest direct indexer by assets, Parametric Portfolio Associates, kicked off a spree of industry deals. BlackRock officially bought Aperio, the second-largest direct indexer, in February of that year, and then Vanguard made the first acquisition in its history. The passive investing giant obtained little-known Just Invest in October 2021 and turned it into Vanguard Personalized Indexing Management, a testament not only to direct indexing’s momentum but also Vanguard’s designs to aggressively expand its advice business.

But Telling Them Apart Can Be Difficult

As more firms rush to offer direct indexing, making tax management and customization more accessible, comparing different options is beginning to resemble comparing different chain restaurant menus. Sure, there are small differences, but the core offerings look alike. The table below gives a snapshot of the assets, minimum investments, starting fees for a U.S. large-cap index, and the number of indexes and customization options available at some of the largest direct-index providers.

Most fees for U.S. large-cap indexes start in the ballpark of 0.20% to 0.40% and fall as account balances increase. At Schwab, for example, fees fall from 0.40% to 0.35% once an account has more than $2 million. Fees can also be higher for international or more niche indexes.

For the index and customization options, we considered fewer than five index or customization options to be limited and more than that to be extensive to distinguish between those that have a wide range of options and those that don’t. Despite the similarities, direct-indexing investors have myriad options that let them choose their own unique adventure, even at the same provider.

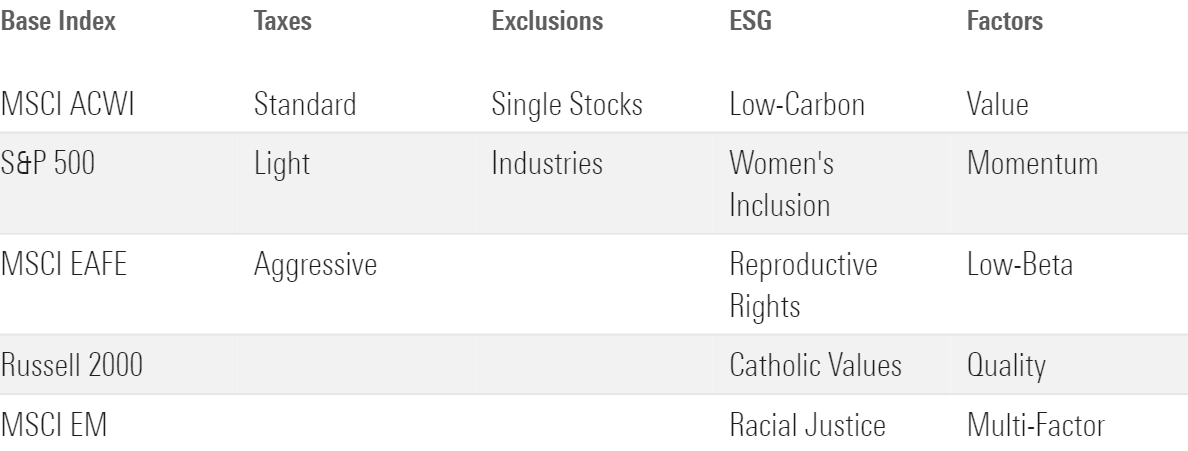

A Sample Menu

The table below shows a small sample of what investors can pick from at most direct-indexing providers.

Base Index: The first choice is probably the easiest: picking the index. Several firms reported their most popular direct index was the MSCI ACWI, or equivalent, which is a market-cap-weighted global equity index. For investors concerned with tax-loss harvesting, that’s a sound choice. The MSCI ACWI, which includes developed- and emerging-markets stocks, has the broadest investment universe and the more individual securities, the more opportunities to harvest losses. Most firms also offer a standard index range of other common benchmarks, like the Russell 2000 for small-cap exposure or the MSCI Emerging Markets.

Taxes: Direct-indexing clients usually expect tax-loss harvesting, but there are limitless ways to decide what kind of loss is worth harvesting. Is it a drop of 1%, 5%, 10%, or more? Direct indexers tend to run their tax-management algorithm daily but can set any threshold for locking losses. None of the direct indexers surveyed shared their tax-loss-harvesting secret sauce. Some, like BlackRock’s Aperio, though, leave the choice to investors. While it may be tempting to collect every penny of losses, that would entail higher turnover that would likely lead to more tracking error and increased overall trading costs.

Exclusions: These can be done at the individual stock level or at the industry level. At the individual security level, an investor may already have a lot of exposure to a stock in another account, like a Microsoft executive who has a lot of stock options. At the industry level, investors can carve out large chunks of the index, which may have a big impact on returns. For example, someone working in the tech sector may want to exclude technology hardware from the S&P 500 because so much of their net worth is highly correlated to that industry already. But that would remove Apple AAPL, the largest weight in the S&P 500 as of mid-March 2023. Some industry exclusions, like oil, gas, and consumable fuels, will most likely appeal to investors most interested in the next set of options related to environmental, social, and governance investing.

ESG: It’s a common critique of ESG investing that it can mean pretty much anything. But with direct indexing, investors can hone specifically on the aspects of ESG investing that mean the most to them. For example, someone purely concerned with climate change could only choose to emphasize stocks with low-carbon footprints. Or an investor that cares more about the social aspect of ESG could choose to focus on women’s rights and target companies that have better metrics on equal pay.

Factors: Targeting stocks with specific characteristics, like those with cheaper-than-average price/earnings multiples or lower earnings volatility, has been a common investment tactic since academics Eugene Fama and Kenneth French published their three-factor pricing model in 1992. The most common factors, like value, momentum, quality, and size, are on most direct indexers’ menus. Investors can also combine factors into customized multifactor overlays that blend, say, value and quality. It can even get more granular than that. Some providers, for instance, will let investors pick among valuation methods, such as price/book, price/earnings, or price/sales.

Direct Indexing for All?

Direct indexing delivers when it comes to offering a more personalized investment than an off-the-shelf mutual fund or ETF. But there are other factors to consider before following the crowd. Here are eight factors to consider when deciding if direct indexing is right for you. Stay tuned to Morningstar for more coverage of direct indexing throughout 2023.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)