3 Dividend ETFs That Play Good Defense

Here's a look at how these Morningstar Medalists are holding up in the face of a crisis.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

The coronavirus crisis has wrought havoc on the global economy. Deteriorating fundamentals have forced many firms to pull out all the stops to conserve cash. Many companies have suspended or cut their dividends. Among them are S&P 500 stocks such as Carnival CCL, Estee Lauder EL, Hilton Worldwide HLT, and Kohl's KSS.

With interest rates pitifully low, income-seeking investors may be leaning on dividend income more than ever. Investors must consider the different ways they might mitigate this risk.

In this article, I look at a trio of Morningstar Medalist dividend-focused exchange-traded funds that manage this risk in several ways.

Damage Control While headlines about dividend suspensions and cuts have spooked investors, the damage to these three dividend ETFs has been limited. In each case, diversification has been their first line of defense. Not putting all their eggs in one basket diminishes the impact of dividend suspensions or cuts by a few stocks. Additionally, two of these funds screen for dividend durability and act quickly to remove companies that have announced dividend cuts.

SPDR S&P Dividend ETF SDY tracks the S&P High Yield Dividend Aristocrats Index and carries a Morningstar Analyst Rating of Silver. The fund's benchmark applies a rigorous screen for dividend durability. Eligible stocks must have raised dividend payments for at least 20 consecutive years. Although this is a high bar for inclusion, it is a backward-looking screen and there is no guarantee that firms won't succumb to dividend cuts. Those that do quickly get the boot. The index reviews constituents' dividends monthly. Any stock that has suspended, omitted, reduced, or eliminated its regular dividend will be removed from the index at month-end.

Silver-rated Schwab U.S. Dividend Equity ETF SCHD tracks the Dow Jones U.S. Dividend 100 Index. The index targets the higher-yielding half of stocks from the Dow Jones U.S. Broad Market Index. It then applies a quality screen that mitigates exposure to firms at risk of cutting their dividends. This screening approach aims to balance dividend yield with dividend durability. As is the case with SDY, this fund's bogy reviews constituents' dividends monthly and kicks out those that have failed to maintain their payouts. Both funds' indexes set a high bar for inclusion and act quickly to remove companies that have announced dividend cuts or suspensions.

Silver-rated Vanguard High Dividend Yield ETF VYM takes a different approach compared with the above-mentioned funds. It tracks the FTSE High Dividend Yield Index. This benchmark sorts stocks by their dividend yield and adds names to the portfolio until it folds in the higher-yielding half of the total market capitalization of its selection universe. This fund is more broadly diversified than its peers. It holds about 400 stocks, while SDY and SCHD hold roughly 100 stocks each. It weights its holdings by market cap, which skews the portfolio toward the larger and more stable companies that have the potential to maintain dividend payments. Unlike SDY and SCHD, the fund's benchmark does not conduct a monthly dividend review. As a result, companies that announce dividend cuts or suspensions may not be removed in a timely manner. That said, its broad diversification should protect against a few bad apples.

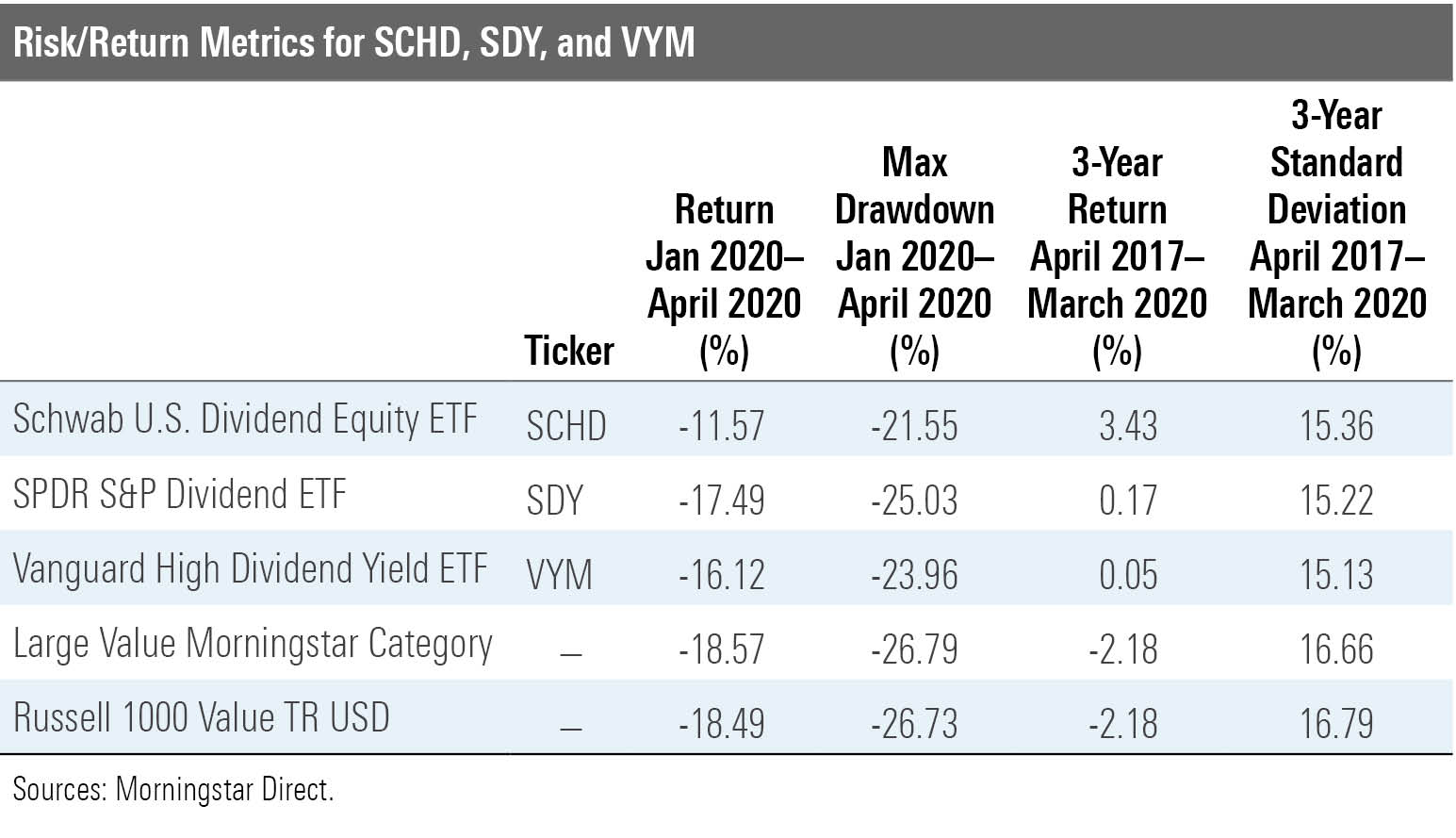

As shown in the table, all three Morningstar Medalists suffered less-severe drawdowns compared with the Russell 1000 Value Index and the large-value Morningstar Category average through April 2020. All three funds have a quality bent, which helps them weather downturns. SCHD's quality orientation springs from its scoring system, which considers stocks' cash flow/debt, return on equity, and dividend-growth rates. SDY's 20-year dividend growth requirement sweeps up higher-quality names. VYM weights its holdings by market cap, which pulls its portfolio toward larger and more stable companies with strong balance sheets and spreads its bets over 400 stocks. Over the long-term, these funds' quality tilt should allow them to outperform their category index on a risk-adjusted basis by limiting the severity of drawdowns.

Good Defense Doesn't Guarantee a Shutout While these funds generally play good defense, each held companies that have cut or suspended dividends.

In the first quarter of 2020, TJX Companies TJX suspended its dividend. Helmerich & Payne HP cut its dividend payment, in the face of the COVID-19 crisis. Both companies were removed from SDY's portfolio toward the end of April 2020. As of early March 2020, Helmerich & Payne was the second-largest holding in the fund with a weight of 2.2%, while TJX Companies had a weight of 0.61%. SDY's monthly maintenance screen expediently eliminated these stocks. Similarly, Nordstrom JWN, Gap GPS, Macy's M, and Darden Restaurants DRI recently announced dividend cuts or suspensions and were subsequently removed from SCHD's portfolio as a result of its dividend maintenance requirement.

VYM relies exclusively on broad diversification and market-cap-weighting to mitigate the risk of dividend cuts or suspensions compared with its peers. Dividend casualties of COVID-19 including General Motors GM, Kohl's, Las Vegas Sands LVS, and Nordstrom were in VYM's portfolio on Dec. 31, 2019 and remained there as of Feb. 29, 2020. That said, the impact has been limited: The largest holding among those in VYM's portfolio that have cut or suspended dividends, General Motors, had a weight of 0.40% as of Feb. 29.

Not Out of the Woods Yet Depending on the duration of and severity of the coronavirus-induced downturn, there may be more dividend cuts in the future. Looking at these funds' portfolios through a sector lens can help uncover potential vulnerabilities as not all sectors have been equally impacted. The consumer discretionary, energy, industrials, and basic-materials sectors have borne the brunt and will likely see continued volatility as the world emerges from the lockdown. As of May 19, 2020, SCHD had a 34% allocation to the consumer discretionary, energy, and industrials sectors, while SDY had 36% of its portfolio allocated to them. VYM appeared to be the least vulnerable with a 20% allocation to these sectors as of Feb. 29. However, there are no guarantees that companies in other sectors will be immune from dividend cuts. No one knows for certain how this pandemic will play out and how the macroeconomic environment may be impacted. Investors can not expect to be protected from every dividend cut, but the approach taken by the these three Morningstar Medalists should give investors confidence that they will likely weather the storm and serve investors well over the long term.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)