What Separated the Winners and Losers in the Bond Fund Whipsaw?

We dig deep into five categories.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it. This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud.

The six-week period from March 1-April 16 offered investors an unusual window into the risks and biases within their bond funds.

For some funds it was their heavy weights of credit-sensitive bonds; for others, it was the thinly traded securities whose prices swung widely; and in other cases, it was hedging strategies that were not sufficient enough for extreme market conditions. Other funds deftly capitalized on having come into the turmoil defensively positioned.

All this played out in a two-stage market whipsaw.

First, the spreading economic collapse caused by the coronavirus put incredible stress on portfolios with credit and emerging-markets risk, while interest-rate-sensitive bonds were frantically bid up in price along with safe-haven currencies.

Then, as the Federal Reserve and other central banks stepped into the breach with policies targeted at supporting credit markets, those trends were sharply reversed.

This article will take a close look at how--and why--funds within five major bond categories performed in these two very different environments. These five categories are: corporate, intermediate core, intermediate core-plus, multisector, and nontraditional.

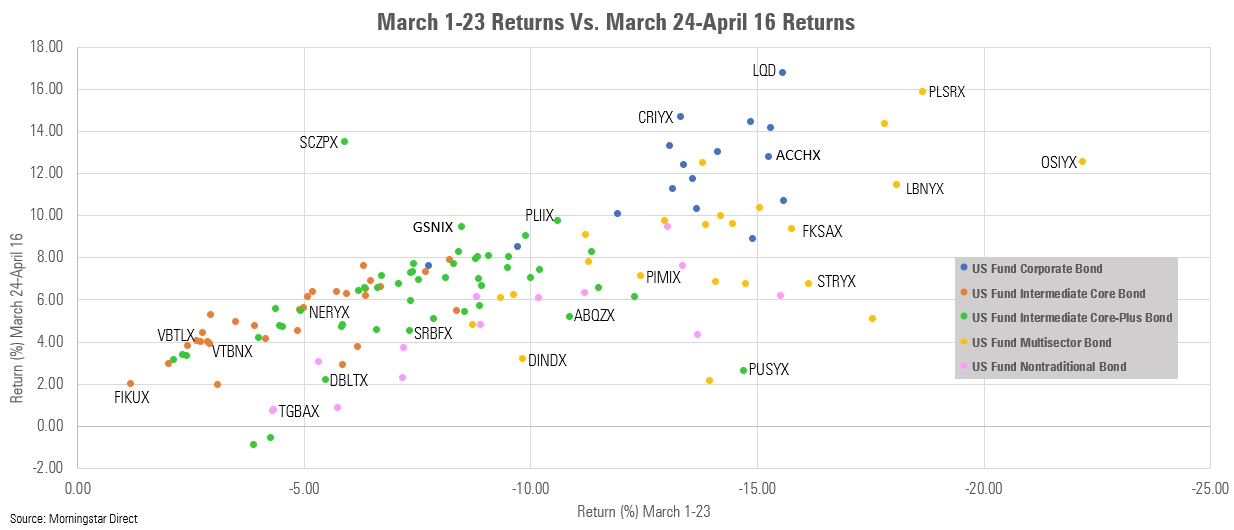

Within those five categories, the universe of funds we examined was limited to the 132 funds carrying a Morningstar Analyst Rating. For this article, the market sell-off time period was defined as March 1 to 23, and the recovery period as March 24 to April 16.

In the following chart, funds landing toward the upper left lost the least in the first stage of the market turmoil and then gained the most during the market recovery. The opposite was true for funds landing toward the lower right--those funds lost the most in the market break and then lagged in the rebound. In the bottom left of the chart are the funds that didn’t lose much but also didn’t rebound by much.

“There are two sides to the trend line, and the ones that lost the most and gained the least on the way back are the ones that I’m most watchful of,” said Eric Jacobson, senior analyst, who compiled the data for the chart. “Investors need to understand what risk parameters their funds choose within which to operate.”

Whether funds were able to ride the wave or were wiped out during the market whipsaw often came down to the degree to which funds were exposed--to not just credit risk, but also to liquidity risk, where certain securities are difficult to trade near expected valuations. In some cases, hedges built into strategies to mitigate risks turned out to hurt returns rather than help. And for some winners, Morningstar analysts said it appears that deft tactical moves in response to the rapidly changing market conditions enabled the funds to fare better.

In the Sweet Spot Leading the group of funds best navigating the market turmoil was the $628 million Carillon Reams Core Plus Fund SCPZX, one of the better performers of the group. The intermediate core-plus bond strategy lost 5.91% during the sell-off and gained 13.48% during the reversal.

The fund’s “hallmark is waiting for market sell-offs to appear divorced from fundamentals and then buying,” said analyst Sam Kulahan.

The first quarter was no different in that respect, Kulahan said. Carillon started off the quarter positioned defensively with roughly 40% in Treasuries, 20% in investment-grade corporate credit, and 30% in agency-mortgage-backed securities.

As the turmoil hit, Carillon responded to the market volatility and significant spread-widening by shifting from a defensive stance to a more aggressive stance with respect to overall credit risk. It did so by adding investment-grade corporate credit throughout the second half of the quarter, raising to nearly half the portfolios. The team also ramped up high-yield corporate credit exposure to 19% as of March 31, 2020.

Meanwhile, the fund cut Treasuries exposure to zero by the end of the quarter and halved its stake in agency mortgages.

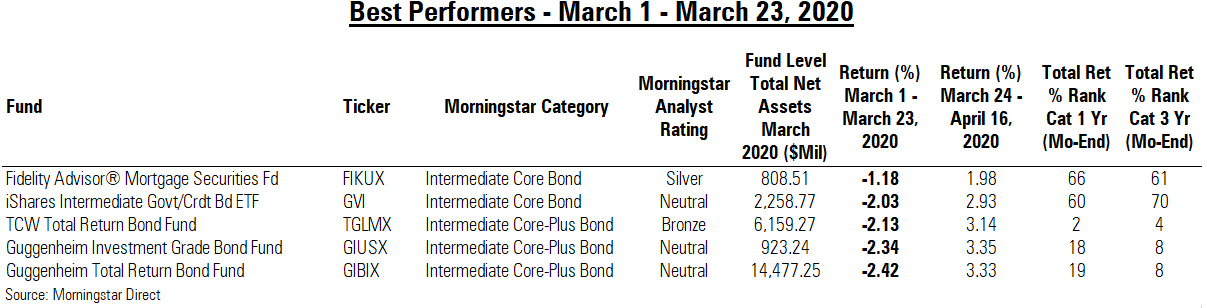

Top Performers

The top performer of the group was Fidelity Advisor Mortgage Securities FIKUX. Analyst Emory Zink said that the strategy’s agency-mortgage focus helped it outpace many of its intermediate core-bond peers, many with significant allocations to corporate credit. Zink noted that, in general, the managers of Fidelity’s bond funds have been more cautious around risk and, in recent months, took opportunities to rotate out of lower-quality tiers of credit and to hold names that the team saw as more recession-resilient. This helped the group’s bond funds perform better on balance during this tumultuous period.

Among other top performers during the first leg of the bond market whipsaw was TCW Total Return Bond Fund TGLMX, with an Analyst Rating of Bronze.

Associate director of fixed-income strategies Brian Moriarty said, “The managers at TCW have spent the last few years positioning their funds for the end of the credit cycle.”

While that led to middle-of-the-road performance during that time, it left its investors prepped for the recent market turmoil with a portfolio of longer duration than category peers, which was reduced as interest rates fell, Moriarty said.

Guggenheim Investment-Grade Bond Fund GIUSX as well as the Guggenheim Total Return Bond Fund GIBIX benefited from prudent decisions leading up to the crisis, said Jacobson. “Overall, Guggenheim had been comparatively aggressive in recent years, believing that structured product--including nonagency mortgages, CMBS, ABS, and CLOs--was cheap relative to corporate credit and government bonds in particular. They eventually became circumspect though and moved sharply in 2018 to curtail risk in their portfolios.” He noted that, “It’s exceedingly rare for funds to successfully ride a wave of strong returns with aggressive positioning and the pivot to taking so much less risk, and then have it play out successfully so quickly.”

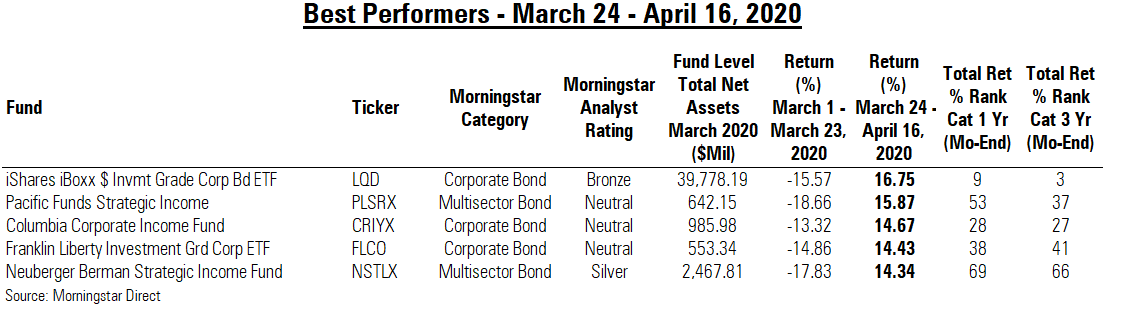

The period between March 24 and April 16 was a different environment, as the Fed stepped into the bond markets with aggressive debt purchases to help inject liquidity into the financial system. That meant that many funds punished for being overweight corporate credit rebounded strongly, whipsawing investors.

Among the biggest turns in fortune was in iShares iBoxx Investment Grade Corporate Bond ETF LQD, which, the Fed said on March 23, was among the securities that it would be directly buying as part of its liquidity program. “This fund went from trading at historic discounts to its NAV, to historic premiums as investors sought to front-run the Fed and piled into the fund,” said analyst Neal Kosciulek.

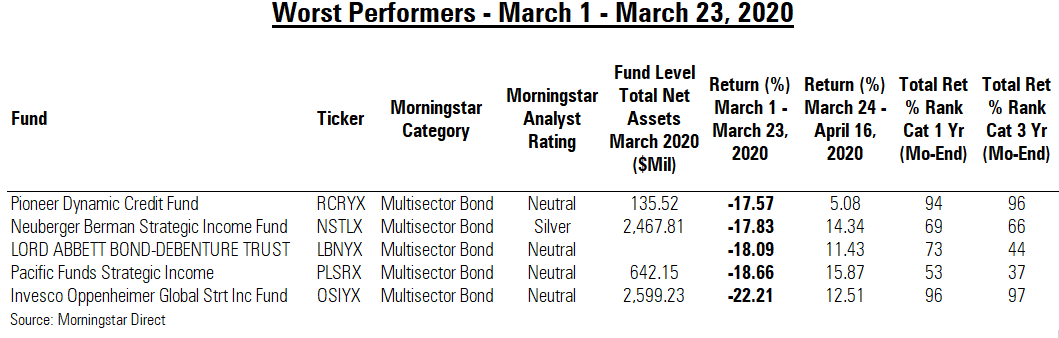

Swamped by the Wave It was a particularly difficult time for investors in a pair of Putnam Investment bond funds: Putnam Income PNCYX and Putnam Mortgage Securities PUSYX.

Analyst Benjamin Joseph, who covers both funds, said the strategies carried multiple layers of risks, which played out during the first leg of the bond market sell-off: interest-rate risk, credit risk, and liquidity risk (many of the securities they own are very lightly traded), along with a dose of leverage that is inherently involved in their ownership of some of the mortgage securities in the funds’ portfolios.

For example, Putnam Mortgage Securities is focused on investing in mortgage-backed securities--both agency and nonagency debt had roughly 10% of the portfolio in interest-only securities that are very sensitive to changes in interest rates, Joseph said. During a rapid drop in interest rates, such as seen in the first part of March, the value of the bonds can fall substantially.

The issue, said Joseph, is that the hedging strategies that the Putnam strategies employed weren't effective. That was in part, he said, because the extreme decline in interest rates likely overwhelmed their protective bets against falling rates. At the same time, the funds’ big exposure to nonagency debt carried a hefty amount of credit risk.

Joseph noted that both funds' overall rating of Neutral has been maintained despite the blowup, in large part because the funds make the risks of their strategies known. “If the fund tells you this is what they do, it’s a question of whether investors like that strategy,” he said. “Some people like really spicy food. Maybe it’s not good for you, but you know it’s spicy.”

The worst-performing fund among the group in the downdraft was Neutral-rated Pioneer Dynamic Credit RCRYX. Moriarty noted that, as a whole, “The firm saw multiple strategies struggle during the coronavirus crisis, but in each case the struggles came from the same bet on nonagency residential mortgages.” He then went on to note, “Pioneer’s exposure was predominantly through credit-risk transfer securities, which have seen some of the worst losses in the mortgage market and have been relatively slow to recover.”

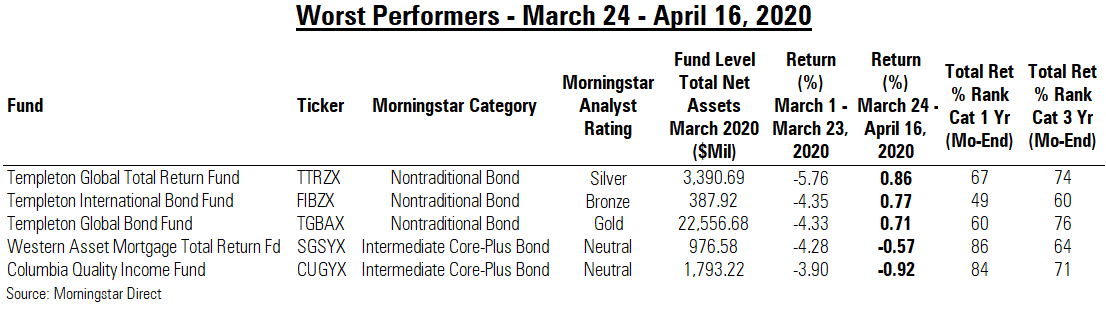

When it came to the bond market rebound, three Franklin Templeton funds also made the list of laggards. But analyst Karin Anderson, who covers the funds, which are managed by Michael Hasenstab, said their underperformance reflected currency hedges that the fund had in place. During the sell-off, the hedges worked in favor of the fund, cushioning the decline, but on the rebound those hedges acted to limit the gains.

The Templeton strategies have large weightings in local currency emerging-markets debt including Brazil, Mexico, and Indonesia. As a hedge against owning debt denominated those currencies, the fund also had a substantial long yen position and a short position in the Australian dollar. Anderson noted that currency hedge is one that is aimed at paying off in times of market turmoil, such as the first part of March. Those hedges “helped when the market was in a risk-off period, and when the market goes back to risk on, they aren’t going to perform as well,” Anderson added.

The Heavyweights Both the Vanguard Total Bond Market Index VBTLX and the Vanguard Total Bond Market II Index VTBNX are among the bigger bond funds for investors. To get further insight as to what happened with these funds, we asked director of passive funds research Alex Bryan to give his insights. Bryan said that, "... both track a float-adjusted version of the Bloomberg Barclays Aggregate Bond Index, which has lower credit risk than most active funds in the intermediate-core Bond category. Mirroring the composition the U.S. investment-grade market, these funds tilt heavily toward U.S. Treasuries and agency-mortgage-backed securities." He then went on to add, "As a result, nearly 70% of these funds' assets are invested in AAA rated securities. This low credit risk helped these funds weather the COVID-19 sell-off better than most of their peers."

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)