Aligning Interests

Boutique buys businesses run by managers who have skin in the game.

In every issue, Undiscovered Manager profiles a noteworthy strategy that hasn’t yet been rated by Morningstar Research Services’ manager research group.

Tucked within Principal Global Investors, which runs more than $450 billion of assets as part of Fortune 500 company Principal, is equity boutique Aligned Investors. There, chief investment officer Bill Nolin and director of research Tom Rozycki oversee a $22 billion portion.

Most of that is in a successful mid-cap strategy Nolin has run since 1999, which is closed to new investors. The mutual fund version,

To signal that distinction, the team adopted the Aligned Investors name when it was officially carved out as an autonomous boutique within Principal in 2015. The name alludes to Nolin and Rozycki’s preference for investing in companies run by owner-operators or demonstrating an owner-operator culture— where management’s personal interests are aligned with those of company shareholders, a deep knowledge of the business fosters innovation, and a long-term perspective predominates. “We contrast managers who have real skin in the game with ‘cash-paid’ CEOs,” Nolin says. “Someone with their family’s net worth in the company, who thinks about risk and acquisitions differently. They aren’t going to buy back stock like Citigroup C did in 2007 and then issue tons more in 2009, or make acquisitions at the top of the cycle.”

Building From the Bottom Up The owner-operator angle is one of four cornerstones underpinning the process. In addition, the team seeks high-quality businesses with sustainable competitive advantages; it evaluates buyers, suppliers, and competitors to determine whether a company enjoys barriers to entry such as economies of scale, switching costs, and distribution advantages. The team then employs a valuation discipline to build in a margin of safety before buying, forecasting financials and running discounted cash flow models.

These three cornerstones help keep risk in check by fostering careful buy decisions. The fourth cornerstone is risk reduction. After purchase, the team monitors holdings for adverse developments that might signify fundamental change. Early warning signals include disruptive technologies, regulatory changes, and eroding barriers to entry.

As the funds’ relatively low turnover suggests, the process has identified picks worth holding for the long term. Both funds have turnover ratios well below the median for active funds in their respective Morningstar Category, mid-cap growth for the MidCap fund and large growth for Blue Chip.

“Of the 40 companies in the Blue Chip portfolio,” Nolin says, “18 were in there on Day One.” Similarly, nearly half of the names in MidCap’s portfolio at the end of May were first purchased more than five years ago, according to Morningstar’s data.

A Concentrated Take The Blue Chip fund applies the process to the largest 200 stocks in the Russell 1000, while MidCap starts off by screening the smallest 800 for companies with high returns on investment capital and healthy profit margins. But the buy-and-hold philosophy leaves room for overlap between the two, as companies may remain in the MidCap portfolio after they grow into large-cap territory. (As of May 31, MidCap held nearly 60% of assets in large-cap stocks, compared with less than 35% for its average peer.)

The two funds had 23 holdings in common at the end of May, representing about 55% of the MidCap fund and 33% of Blue Chip. MidCap’s largest holding at nearly 5% was

According to Nolin, the Blue Chip portfolio breaks down roughly as one third names that are among the large-cap holdings in MidCap; one third “graduates” of the MidCap fund, such as

The Blue Chip fund is more concentrated, with about half the number of holdings; at last count, that fund held 42 stocks to its sibling’s 78. “These companies tend to be dominant in their field,” Nolin says, “with good capital allocation, very strong moats, and high recurring revenues and free cash flow coming from several parts of the world.”

Blue Chip’s top holding,

“They will try and fail, but they wrap it up fast,” Rozycki says.

Meanwhile, the team sold

Teamwork and Legwork Building and monitoring the portfolios involves legwork as well as analysis and is a team effort: Under Rozycki's direction, the analysts visit management, call on customers and suppliers, and interview former employees to develop an understanding of company culture and assess competitive advantages.

“The team has grown in numbers and talent. We’ve got a very good group here, in terms of ability, drive, and initiative,” Nolin says. One analyst recently retired, but they added to the team in anticipation of this transition, and it now numbers five analysts and a research associate.

Rozycki is tasked with bringing in new analysts and immersing them in the investment culture. He seeks not just professionals but enthusiasts who are eager and able to travel and interact effectively with company management. “There is a high level of dialogue and engagement across the team,” he says. “It’s a strong group analytically and from a social and networking perspective. We want people who love the job.”

While individual analysts have areas of expertise, “we like everyone to think of themselves as a generalist,” Rozycki says. “As a general rule, ideas go in all directions.” Sometimes Nolin might bring an idea to an analyst for research, for example, but an analyst might also initiate the process. The first step is to review 10-Ks and other filings and work with Rozycki to determine whether a prospect is worth further investigation. If so, research intensifies to understand corporate culture, assess competitive advantage, and estimate intrinsic value.

“It’s an iterative process,” Rozycki says. After the initial analyst assessment and then a deeper dive in consultation with him, “we are ready to go with a conclusion when we get to Bill.”

Even at that point, Nolin says, “we might hash it out some more. The analyst might do more work, set up another call with someone in the industry who knows the nuances.”

A team book club fosters camaraderie and hones investment knowledge. Nolin cites William Thorndike's The Outsiders as one of his favorite picks. The team recently read Intelligent Fanatics Project, by Sean Iddings and Ian Cassel, which provided examples of owner-operators who built sustainable businesses. On the flip side, Billion Dollar Lessons, by Paul B. Carroll and Chunka Mui, offered cautionary tales.

The Right Place The team atmosphere is one factor that has helped draw and retain analysts. The Des Moines location and lifestyle are another. As Nolin puts it, some of the team previously experienced the "90-hour-week, New York City investment-banking lifestyle." He did his own stint in New York after receiving a Yale MBA and was glad to return to Iowa, where he grew up and attended university.

“Des Moines is a great place to raise a family,” Rozycki says. “The whole lifestyle is nice.”

It’s not just Principal’s location, he emphasizes. It’s Aligned Investors’ position within Principal. “It’s a special setup where we can focus on investing and not have to jump through hoops to get approval. We have the latitude to make investments that we think are going to be great investments over time.”

Inspired by his finance-professor father, Rozycki went from collecting baseball cards and stamps to investing in companies at a fairly young age. From there, he beelined to his current position. He had an internship at Principal while at Drake University, landed a job in the equity area upon graduation in 2001, and joined Nolin six months later.

Nolin’s path wasn’t quite as direct as Rozycki’s. He started in credit at Principal, analyzing private placements. That taught the importance of downside protection, but he prefers the upside possibility of equity investing. “It is fun to understand a business, the people, the competition. Is it a good deal, a high-probability/ low-risk opportunity?”

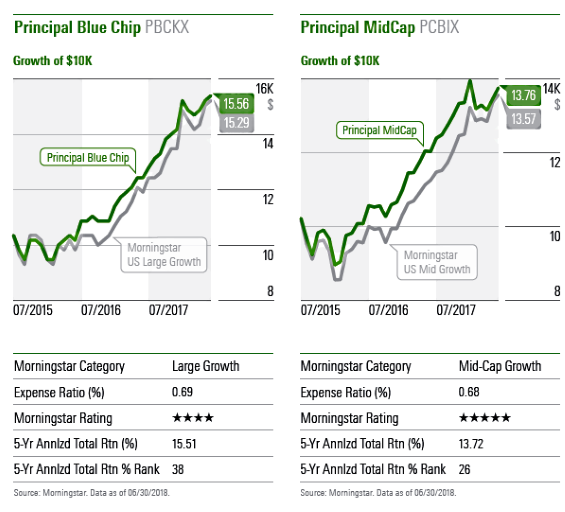

Ups and Downs The funds' performance records demonstrate that Nolin and team have found an attractive balance between risk and reward. Morningstar analyst Tony Thomas, who covers Principal MidCap, cites the fund's risk/reward profile as a component of its Positive Performance score and the fund's overall analyst rating of Silver.

“The fund’s focus on high-quality, viably growing firms has helped it hold its own in rallies, and hold up better than peers in downturns,” Thomas says. The fund doesn’t fly as high as more aggressive growth peers or its benchmark in rallies, but its 10-year trailing return through June is top-decile in its category, and its 10-year Morningstar Risk score is Below Average.

The fund’s strong downside performance owes to stock-picking, not cash. “We stay fully invested. We are not market-timers,” Nolin says.

The same goes for Principal Blue Chip. That fund has not had the chance to prove its mettle in an extended downturn yet, but its Morningstar Risk scores are Below Average. It has also held its own in the up market that’s prevailed since its 2012 inception, earning a 16.9% annualized return through June, beating the 15.2% large-growth category average and in line with its benchmark, the Russell 1000 Growth.

Blue Chip is not under Morningstar analyst coverage, so it does not have an analyst rating, but it recently made the Morningstar Prospects list, a collection of lesser-known or newer strategies that Morningstar's manager research analysts deem promising.

“Nolin and Rozycki’s favorite type of business— the owner-operator firm with a disciplined capital allocator at the helm—tends to prove itself in the downturns that expose poorly run firms. That is as true of large caps as it is of mid-caps,” Thomas says. “That is a key part of what makes Blue Chip an intriguing prospect despite its relatively short track record.”

In addition to sharing the strong process and management team that contribute to MidCap’s Silver rating, Blue Chip also benefits from moderate expenses—though its cost advantage relative to large-cap peers is not as great as MidCap’s within the mid-cap cohort. And according to SEC filings, Nolin has invested more than $1 million in both funds, indicating his own alignment with shareholders.

While Blue Chip is not a replica of its Silver-rated sibling, it is a reasonable alternative for those who like the strategy and have room for larger-cap stocks in their portfolio.

This article originally appeared in the August/September 2018 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)