Utilities Suddenly a Growth Sector?

Electric cars and clean energy give firms great growth potential, with plenty of room to run.

Editor’s Note: This article was first published in the Q1 2023 issue of Morningstar magazine.

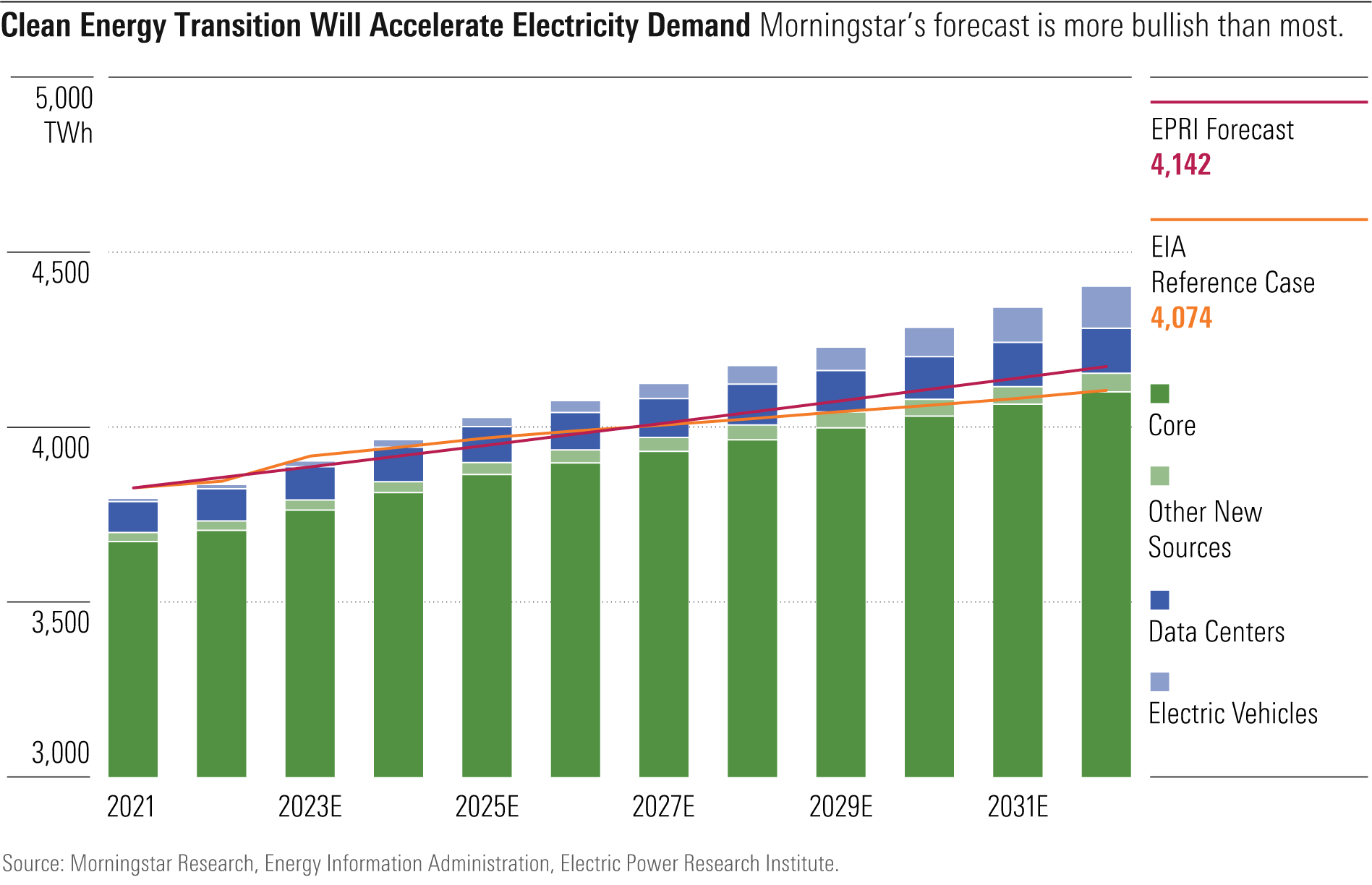

The staid utilities sector presents an exciting growth opportunity. As Morningstar Research Services’ Andrew Bischof and Travis Miller explained recently, electricity demand is set to grow faster during the next decade than it has in 20 years. “Our new forecast is more bullish than most forecasts,” they wrote in a recent report. “We think others underestimate the speed and scale of the U.S. clean energy transition.” As states and the federal government set goals to reduce carbon emissions, utilities will be key to achieving them.

Meanwhile, as 2022 drew to a close, utilities’ stock valuations were as attractive as they’d been in years, their dividend yields were back up to long-term averages, and balance sheets were stronger than ever. I spoke with Miller and Bischof about why they are optimistic about the sector, and which picks are today’s standouts. Our discussion reflects conditions and valuations as of Dec. 6, 2022. It has been edited for length and clarity.

Laura Lallos: To set the scene, utilities had a dramatic performance pattern in 2022—sharply up until September, then a selloff. What happened?

Travis Miller: The interest-rates dynamic has been driving the utilities sector performance for a lot of the year. Utilities have been one of the best yield investments for more than a decade, and that’s changed abruptly as interest rates started moving up. September was a revaluation of the sector and a realization that utilities are no longer necessarily an income investment. Now, they’re increasingly a growth investment.

Lallos: They had also been seen as a safe haven.

Miller: In addition to the attractive yields they’ve offered over the last decade, they’ve also been a hedge against recession fears, especially more recently. The debate in the market around whether we’re going into a recession has also given utilities a relative boost this year. Utilities are outperforming by 17 percentage points this year [as of Dec. 6]. They are up about 1%, including dividends, while the market is down about 16%. If that holds, that will be the largest outperformance since 2000, so more than 20 years.

Lallos: At the same time, because they gave up some of that performance, it sounds like there are some great values here, also for the first time in a long time.

Miller: We think that combination of growth and a still fairly attractive yield offer a good total return for investors in utilities. The utilities that we see with good growth prospects and dividend yields near 4% are the ones that we think are really attractive for long-run investors. Growth is becoming the big variable there. Since interest rates have moved up, the yield properties are less attractive. But the growth potential has become more attractive given the macro trends toward electrification and toward clean energy.

Andrew Bischof: I think some of the volatility you’ve seen year-to-date reflects a little bit of a question around renewable growth. We started out the year with some uncertainty around tariff policy. Then you had the Inflation Reduction Act [or IRA, which allocated money for reducing carbon emissions]. I think that was a surprise for many in the industry. It provided legs for long-term growth, at least on the clean energy side, for utilities.

If you take a broader look, utilities will play a key role in helping reduce as much as 75% of total energy carbon emissions. The IRA provided benefits that helped reduce the inflationary impacts of some of these capital programs. And then we see a lot of growth for utilities as we get more EVs [electric vehicles] onto the grid—not only growth from the electricity demand, but from the underlying transmission and distribution investment that you’ll need to support those vehicles.

Lallos: Investors don’t necessarily think of utilities and growth in the same sentence. Is this an unprecedented environment for utilities?

Miller: Utilities are never going to rival tech companies or biotech companies in terms of growth. But this is the best utilities growth environment that we’ve seen in decades. When you combine those big macro themes of electrification and clean energy, we’re seeing utilities with growth prospects that we haven’t seen in many, many, many years. And these aren’t just growth prospects for the next year or two. This is growth that we think can last for a decade or more. A lot of the clean energy goals and the electrification goals out there right now are 2040, 2050 goals. When you look at all of the infrastructure investment that’s needed to get to those goals, this is a long runway of growth for utilities, perhaps more so than any other sector.

Bischof: Perspective is key, too. We’re talking median earnings growth of 5.8%, which is good for utilities.

Lallos: How do you find the companies that are going to be best able to take advantage of this opportunity?

Miller: There are two big considerations. One is clean energy growth potential, and the second is regulatory support. Utilities have to have a core underlying need for infrastructure growth, and they also have to have regulatory approval to be able to recover those costs from customers. Without a comprehensive stakeholder buy-in, utilities can’t grow earnings at the rate they’re projecting. We think the utilities with the most support, the most buy-in from stakeholders, will be the ones that can meet their growth objectives and produce the best total returns for shareholders.

Bischof: The clean energy utilities investing in renewables like solar or wind are kind of the obvious ones. But we also look to those supporting that transition, particularly on the transmission side, those with the underlying infrastructure. You’ll see a lot of exposure there in our top picks, particularly Edison International EIX.

Lallos: How certain is the regulatory support? Is that the weak link here?

Miller: There’s a wide range of regulatory support across the country. Some states, like California and New York, are very aggressive about clean energy mandates and are shifting their utility ratemaking process to support that transition. There are other states where utilities benefit from low energy costs and get regulatory support to build infrastructure to offset energy costs. And then there are some states where it is just very difficult to pass through any kind of customer rate increases; that’s where we think there will be less growth.

Lallos: What about federal regulation?

Miller: There’s a big distinction here between clean energy or overall energy regulation and what we see at the state level in terms of customer rate regulation. Most recently, we’ve gotten a lot of federal movement in clean energy, but the states have been playing in that arena for a long time. Clean energy mandates have been a part of legislation for almost a decade in some states. Utilities have done a good job adapting to state regulations, and now the federal regulations are another layer of support for clean energy growth. Andy referenced that with the IRA.

Bischof: I think that the biggest thing that the federal regulation did is it lowered costs for renewables. That helps utilities get buy-in from regulators at the state levels, particularly from states that might not have been as open to clean energy, because now you have more favorable economics for wind and solar.

Miller: That’s a key point: Federal regulation has helped lower the costs for renewable energy and clean energy overall, if you include electric vehicles in that.

Lallos: What are your top picks today and what makes them the most attractive in the sector?

Miller: In our top picks, we’re looking for two components: a long-term, transparent growth trajectory and a dividend yield that still offers a good relative income.

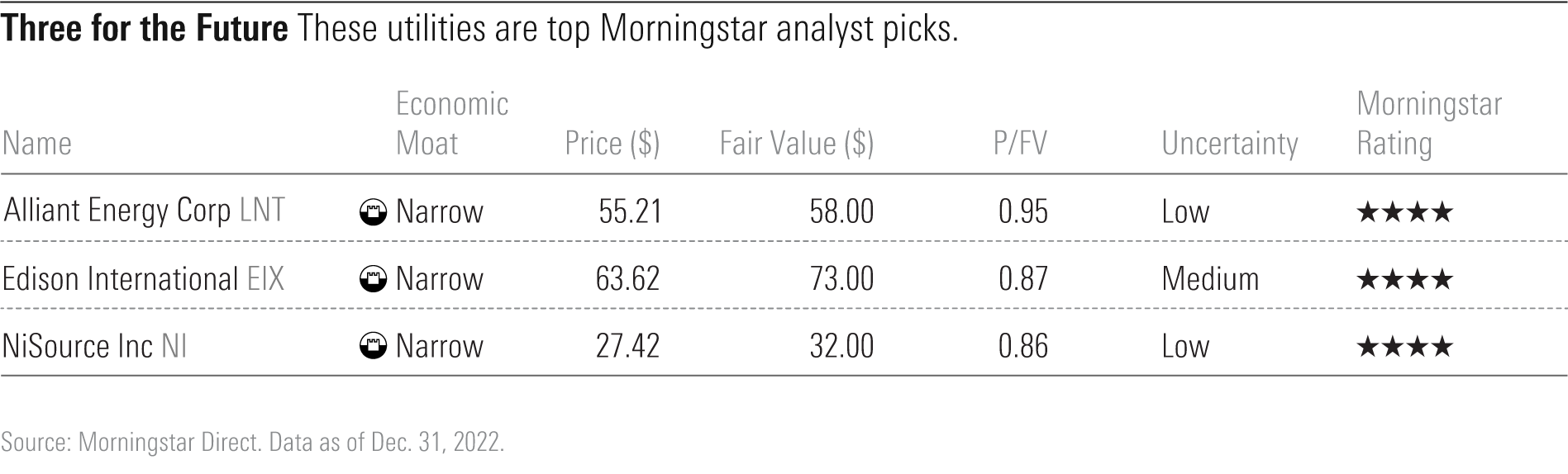

Edison International operates in Southern California and is one of the few pure-play electric utilities with no direct fossil fuel exposure. For ESG investors, Edison is about the best you can get in terms of environmental exposure. In addition to that, they’re a pure-play electric utility, so they benefit from all of the electrification trends. That includes electric vehicles, and it also includes electrifying space and water heating in homes. On top of that, California has the most aggressive clean energy policies.

When you put all of that together, we think Edison has a long runway of growth. They have a lot of support for electrification, and they don’t have any of the fossil fuel exposure that you see from a lot of other utilities. On top of that, it has a yield above 4%, which is one of the top yields in the industry and rivals some of the fixed-income alternatives.

The other top pick I’ve got is NiSource NI, a combination electric and gas utility in the Midwest, which has a 3.4% yield. The big growth opportunity for NiSource is the Midwest shifting from coal-powered generation to renewable energy, and particularly solar and wind. We expect NiSource will be the biggest investor in renewable energy relative to its investment plan. That is, if you look across every utility’s capital investment plan for the next five years, the clean energy portion is the largest for NiSource. It’s not the most dollars spent, but it’s the largest percentage share, in the 70%-plus range.

Also, gas continues to be a primary energy source in their market, and safety is a big concern in the gas distribution business. NiSource has stakeholder buy-in to make some large safety investments.

Lallos: What are the investments they’re making in safety?

Miller: Upgrading pipes that could be a century old. We’ve seen terrible disasters with various utilities across the country where a gas pipeline ruptures simply because it’s old and has not been maintained.

Bischof: Alliant Energy LNT is on my list. You give a little bit up on yield, which is right about 3.1%, but it’s a high-quality utility with a very long history of constructive regulatory support in Wisconsin and Iowa. In the inflationary environment that we’re in, I would point to that.

Alliant Energy is one of the biggest beneficiaries of the Inflation Reduction Act and gets a lot of customer benefits from the renewables. They just recently increased their capital plan 40%, so we think that’s going to allow them to grow right around 7%, in the highest quartile of utility growth. There’s been talk about a corporate minimum tax, but they’re below that threshold. So, they get to provide all these benefits to customers while earning a return on those investments, and it really helps mitigate the overall customer impact, which regulators like.

Alliant is going to be a big proponent of renewable energy, and they still have some coal, so they’re going to continue to benefit from that transition.

Lallos: You expect all the utilities you cover to raise their dividends in 2023. Why is that?

Miller: Utilities are in the best financial shape that I’ve seen in at least two decades. They have taken advantage of low interest costs to strengthen the balance sheet. They’ve also strengthened regulatory relationships. And their earnings growth trajectory supports a consistent dividend payment for a long time. This is the first time in many decades that we haven’t had a given utility here or there that might be looking at a dividend cut or even a flat dividend. We’re seeing quality dividend growth across the sector.

Bischof: I would toss in their portfolio mix. Where you have seen a reduction in dividend in the past couple years, it’s usually because the utility is moving assets out of unregulated assets and focusing more on the regulated assets. That’s been a theme throughout the industry. Without getting too in the weeds, sometimes regulated utilities would have unregulated assets, and that would present cash flow volatility, thus potential volatility in the dividend.

Miller: Yes, the sector’s really de-risked itself.

Lallos: What is an example of an unregulated asset that a utility might have exposure to?

Bischof: It would usually be merchant generation. In some states, regulation is just for transmission and distribution, and the generation part of it is unregulated—so then you have commodity risk on those assets. But in general, there’s been a significant move away from that. Exelon EXC is the last one to fully divest their unregulated assets. There are only two stand-alone independent power producers that we cover, NRG Energy NRG and Vistra VST.

Lallos: How important is the growing EV market to utilities’ growth prospects?

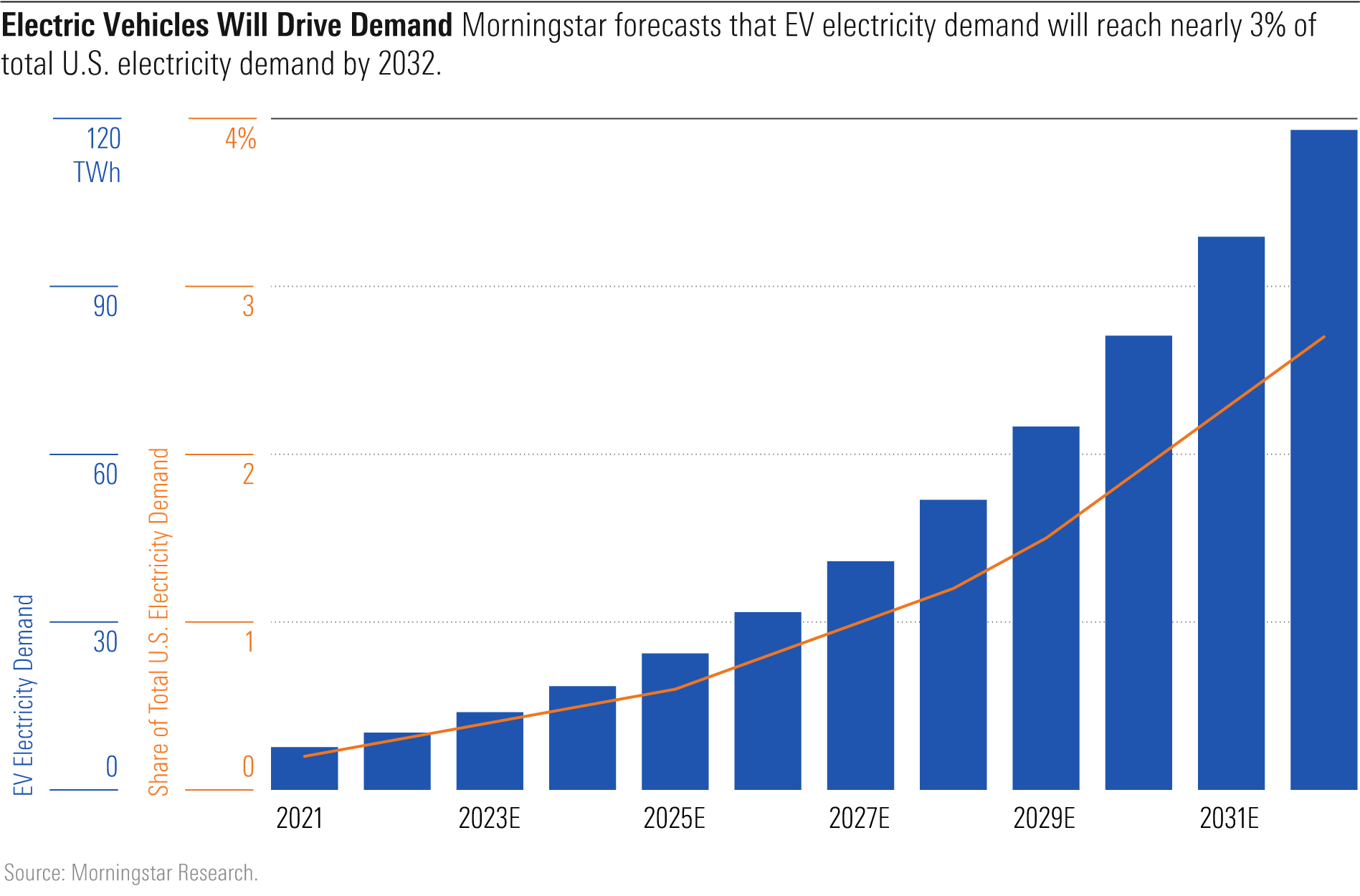

Miller: Small or light-duty vehicle transportation produces almost a third of carbon emissions in the U.S. So, if the U.S. or any state is going to reduce their carbon emissions, one of the first places they have to start is by reducing emissions from vehicles. The only economic technology right now is to electrify transportation. That’s a huge area of electricity demand growth.

Bischof: [Morningstar analyst] Seth Goldstein, who does Morningstar’s EV forecast, expects that two out of three new cars will be either fully electric or hybrid by 2030. We expect EV electricity demand to increase 15 times from now until 2032, which would be 2.7% of all U.S. electricity demand. It’s currently at just 0.2%.

Miller: Even 3% of electricity consumption is a small overall percentage, but electric vehicles are definitely the largest source of growth for electric utilities. I think that’s fair to say. Right, Andy? Data centers were the other big area of growth in terms of electricity demand growth.

Bischof: Data centers are a little bit more mature, so they have much slower growth. But if we’re looking at our overall electricity demand, EVs are by far the largest adder to core growth, which is more tied to GDP.

Lallos: What advice would you give to an investor looking to get into utilities?

Miller: It’s really important to look company by company, to look at regulation and clean energy growth potential for every utility, because it can vary widely. We think the best investments right now are those utilities with long runways of clean-energy-focused growth and support from regulators and customers to be able to invest in those growth programs.

In addition, there are still some utilities out there that yield over 4%, which is very attractive relative to the rest of the equity market, even though it’s not quite as attractive relative to the fixed-income market.

Bischof: I would point to the need for strong management. We’ve seen some head-scratching decisions recently. Poor management introduces uncertainty and doesn’t give you as much confidence in a utility to weather these factors that we’ve been talking about. That’s why our three top picks have high-quality management teams as well as strong regulation that gives us confidence in their growth.

Lallos: Is there a cautionary tale here?

Bischof: While Dominion Energy D stock might seem cheap, management has made some questionable decisions in recent months. We like Dominion from a long-term perspective, but management’s recent strategic review created what we think is unnecessary investor uncertainty. I think it’s going to underperform relative to the market under our methodology, with a five-year outlook. While Dominion might be cheaper than, say, Alliant Energy, I have a lot more confidence in Alliant. I think longer term, Dominion will be fine, but I don’t really see near-term catalysts that would reduce that discount relative to its peer group in the short term.

Lallos: You give WEC Energy Group WEC an Exemplary capital allocation rating. What makes their management team stand out?

Bischof: I like WEC Energy a lot. It’s trading right in line with my fair value estimate. It’s a premium utility, and I value it as such. When you look at management actions, they were one of the first to begin to transition their coal fleet with their “Power the Future” plan. That was over a decade ago, so before the recent focus on that transition.

The management team has continued to develop very strong relationships with policymakers, leading to constructive outcomes not only for shareholders, but for customers. And they execute extremely well. They put financial targets out there and you can have confidence that they will manage within those financial expectations.

And they’ve been very cost-disciplined. Historically, we’ve found that when utilities acquire, it’s usually slightly value-destructive. But management has significantly driven costs out of their recent acquisition. They’ve been a very solid, conservative operator. You won’t expect any surprises from that management team.

Lallos: So, WEC Energy isn’t often undervalued, but worth watching.

Bischof: Yes, typically it’s been 1 to 2 stars. Right now, it’s 3 stars, so that’s a solid long-term hold. WEC Energy is often compared with Alliant Energy. It’s a bit more expensive than Alliant Energy, but you can’t say enough good things about the management team and the regulatory construct that they operate in is very supportive. It’s more of a sleepy utility. Nothing too exciting is going to come out of them. But that’s what investors usually like from their utility holdings.

Lallos: Overall, how would you sum up the opportunity in utilities today?

Miller: The overall theme is that there’s still good income available. It’s as solid as we’ve seen in decades. The balance sheets are as solid as we’ve seen in decades. And the long-term growth potential is as good as we’ve seen in decades. The clean energy transition is a great opportunity for utilities to invest in infrastructure and help achieve some of the carbon emission reduction goals that many governments have.

To subscribe to Morningstar magazine, click here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6bbc8215-6473-41db-85a9-2342b3761e74.jpg)