8 New High-Quality Stocks in the Morningstar Dividend Yield Focus Index

We take a closer look at the dividend payers we added to the index (and those we removed) in June.

In June, we made some changes to the Morningstar Dividend Yield Focus Index.

Our Dividend Yield Focus strategy considers both backward-looking and qualitative forward-looking measures to find high-yielding stocks that are financially healthy enough to sustain their dividend.

We first screen the Morningstar US Market Index for dividend-payers. (The dividend must come from qualified income, so real estate investment trusts are not included.) We then apply the quality screens: We search the high-yielders for companies that have Morningstar Economic Moat Ratings of wide or narrow, meaning that we think they have competitive advantages that will allow them to continue to earn above-average profits and sustain their dividends for 20 or 10 years, respectively. We also consider a company's Morningstar distance to default ratio, a metric that uses market information and accounting data to determine how likely a firm is to default on its liabilities.

The 75 highest-yielding stocks that make it through the quality screen are then included in the index. The index is dividend dollar-weighted (constituents are weighted according to the total dividends paid by the company to investors). Click here to see the current holdings.

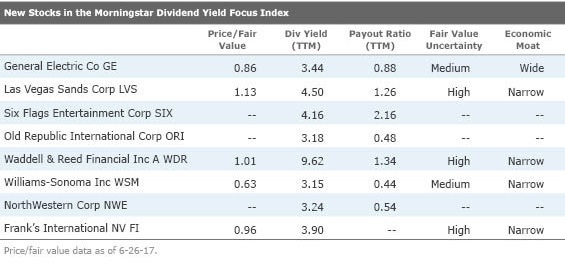

New Dividend-Payers in the Index The table below lists the newest entrants to the Dividend Yield Focus Index, which pass our strict requirements for high yields, sustainable competitive advantages, and financial health. (Note that the dividend yields listed below are backward-looking and could change.)

We added eight stocks to the index during the latest reconstitution.

The following stocks look cheap relative to our analysts' estimate of intrinsic value.

After two years of aggressive restructuring, GE's portfolio of industrial businesses looks better than ever, says equity analyst Barb Noverini. Harking back to the company's 100-year-old roots as a pioneer in energy distribution, GE's seven core industrial segments still share the common theme of infrastructure development, powering the "industrial Internet" that has come to symbolize the company's future growth platform, she said. We believe GE's wide moat owes to its intangible assets in the form of patents, long-lived customer relationships, and a strong brand all support. With R&D at the heart of GE's industrial core, Noverini said, it would take vast amounts of capital and, more important, time to match the value of GE's R&D organization.

The sustainability of GE's dividend has been a controversial issue with investors lately, as payout ratios have climbed. As Noverini discusses in this video, however, we believe the dividend is on solid ground, and GE's portfolio looks well positioned.

Williams-Sonoma has carved out a solid niche in the fragmented $109 billion domestic home furnishing market: Its brand-intangible asset (the company owns Pottery Barn, PBkids, PBteen, and West Elm as well as its namesake brand) has historically supported the firm's top- and bottom-line growth, said equity analyst Jaime Katz. Its ability to drive repeat business is reliant on customer loyalty and smart marketing and merchandising, Katz points out. She also believes Williams-Sonoma distinguishes itself through its access to some of the best analytics in retail, which in turn allows the company to operate more efficiently, market more effectively, and turn inventory faster than its peers. Katz believes Williams-Sonoma's narrow economic moat is evident when considering the solid ROIC performance that the business has delivered over the past decade--at around 13%, it exceeds our 9% cost of capital, even with the inclusion of the recession years that yielded low-single-digit ROICs for the business.

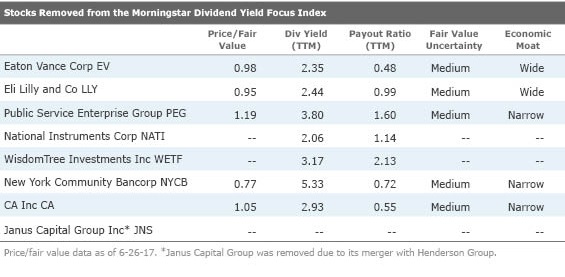

Stocks Removed from the Index On the flip side, eight companies were removed from the index.

We removed narrow moat-rated Janus Capital Group after its merger with Henderson Group, which closed at the end of May.

Three companies--

Distance to default is another other safety-oriented metric that we use to build the index. True to its name, it's focused on financial health. Distance to default uses option-pricing theory to measure whether a firm is falling into financial distress. It's gauging whether the value of a company's assets will fall below the sum of its liabilities. If a company is in distress, the dividend is at risk and there's trouble ahead. So, like moat, distance to default is another important screen for this index. (To read more about distance to default, click here.)

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)