Ultimate Stock-Pickers: Top 10 Buys and Sells

Ahead of the sell-off, top managers were cautious in adding to positions and continued to sell fully valued, flawed, or more liquid securities to meet redemption requests.

By Eric Compton | Associate Stock Analyst

Our primary goal for the Ultimate Stock-Pickers concept is to uncover investment ideas that not only reflect the most recent transactions of some of the top investment managers in the business, but also are timely enough for investors to get some value from them. We regularly scour the holdings of these managers as they become publicly available. Our initial read on the buying activity of our Ultimate Stock-Pickers during the fourth quarter of 2015 was spelled out in our last article, which focused exclusively on singular high-conviction purchases and new-money buys. At that time, we noted that the conviction buying activity of our top managers remained muted, making the fourth quarter of 2015 the 10th straight calendar quarter when our Ultimate Stock-Pickers have generated incredibly low levels of buying activity. Despite collecting additional data from nearly all of our top managers and looking more closely at the aggregate buying and selling activity of those that have reported quarterly (and in some cases monthly holdings through the end of January), we continue to see fewer purchases. We are seeing increased selling activity as well, as our managers move out of positions that are either fully valued or fundamentally flawed, in their opinion, or trim more liquid positions to meet redemption requests.

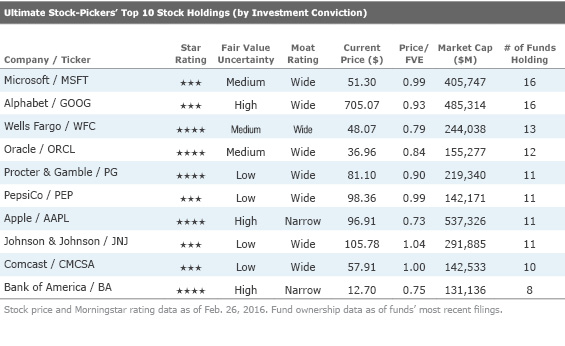

Based on the aggregate data, most of the conviction buying that took place during the fourth quarter (and early part of the first quarter) was focused on high-quality names with defensible economic moats--exemplified by a greater number of wide- and narrow-moat names in our list of top 10 (and top 25) high-conviction purchases during the period. There was also a significant amount of overlap this quarter between the top 10 high-conviction purchases from our last article and the

by investment conviction. Of note was the fact that seven different names--wide-moat rated

Much like we seen in previous periods, there was a fair number of managers selling during the fourth quarter (and early part of the first quarter), much of which we suspect was driven by sales of more liquid (and better-performing stocks) to meet the redemption requests that no doubt followed the sell-off in the global equity markets during the third quarter. That's not to say that there weren't sales of holdings that had become fully valued in the minds of our top managers, as has been the case in past periods, or where they had lost faith in a company's ability to meet their long-term expectations. We saw a fair amount of commentary that pointed in that direction for some of the outright sales. After considering this most recent bout of buying and selling activity, as well as the changes that we made to the

during the first quarter of 2015, our top managers remained underweight in energy, utilities, and communication services relative to the weightings of those sectors in the S&P 500 TR Index at the end of December. They are also now underweight the healthcare sector, which is no doubt a byproduct of the heavier selling activity in both narrow-moat-rated

While many of our top managers did alter their stakes in some of the top 10 holdings that we track, all of their buying and selling activity caused only one company--wide-moat- rated

Although there were no actual big buyers of Johnson & Johnson during the most recent period, three of our top managers--

As we noted above, seven of the top 10 stock purchases this time around were also represented on the list of top 10 high-conviction purchases from our last article, which highlighted stock purchases above a certain threshold that were derived from an early read of the data we were receiving from our top managers. Five of the top 10 stock purchases this time around--wide-moat-rated

While the insurance portfolio managers at nonrated

As for VF Corp, the apparel and footwear company was purchased by two of our top managers--

In the fourth quarter, we initiated a position in VF Corp., an apparel and footwear company better known by its top brands: North Face, Timberland, Vans and Wrangler. We have long admired this company for its growth potential, commitment to corporate responsibility and excellent management team. We finally got a chance to buy the stock in December, after a disappointing earnings announcement caused a 14% drop in the shares from the pre-report price of $73 to our average cost of $63. We hope to own VF Corp. for many years, as we expect its brands to continue to gain market share domestically and abroad.

Morningstar analyst Bridget Weishaar believes that VF Corp has established a broad and growing array of leading lifestyle brands, carefully selected to enhance its presence in high-growth categories and for synergies within existing operating units. She thinks that management will continue to make acquisitions with an eye toward strengthening its brand leadership and will continue to invest heavily in existing brands through branding campaigns, marketing, product development, and in-store experiences--the basis for her wide moat and positive trend ratings. With the shares trading at 83% of her fair value estimate right now, they continue to offer a compelling long-term investment opportunity for investors.

Aetna was actually the recipient of two new-money purchases--by the managers at Diamond Hill Large Cap and Columbia Dividend Income--with the purchase made by the former manager passing the threshold for a high-conviction purchase. Both American Funds American Mutual and

While we don't currently cover Ally Financial, the two Ultimate Stock-Pickers that were buying the stock during the fourth quarter--Oakmark and

During the quarter, we added a new position in Ally Financial…and we eliminated positions in Accenture, Amazon and Omnicom Group. Amazon has been a great holding for the Fund, and with the share price more than doubling in 2015, we believe the business is now fairly valued. With minimal reported earnings and a very high P/E ratio, Amazon may have looked like an unusual purchase for a value-based fund when we initiated a position in April 2014. We looked past reported earnings, which were tempered by large investments for future growth, and found that the scale and core earnings power of Amazon's business were quite impressive and under-appreciated. Omnicom Group has also been a strong performer for the Fund. We have held Omnicom since late 2008, and we eliminated the position in the fourth quarter as the share price approached our estimate of fair value.

Ally was founded nearly a century ago as General Motors Acceptance Corporation. Its purpose then was to provide financing to GM dealers and retail customers. Today, Ally's business is largely the same except that it is no longer owned by GM and now serves dealers and customers of many other automobile manufacturers, such as Ford, Chrysler and Toyota. Since Ally's initial public offering in spring 2014, its shares have fallen over 20% while the S&P 500 has returned over 15%. Over this period, some investors have grown concerned that the business is at a cyclical peak, as U.S. auto sales are near record levels and credit losses are below long-term averages; as a result, some believe Ally's earnings have nowhere to go but down. We believe cyclical pressures will be offset by continued internal improvements, such as funding cost reductions (as "legacy" liabilities are replaced with lower cost borrowings) and improving their capital structure. With Ally's stock trading at just 80% of tangible book value, we believe Ally is a compelling addition to the Oakmark Fund.

Clyde McGregor of the Oakmark Equity & Income fund basically reiterated this commentary when talking about his fund's new money purchase of the name during the fourth quarter.

While not a new-money purchase,

holding stakes in the name.

That said, there is some debate about whether Apple's best days are behind it as innovation has seemed to slow and competition has increased as the first-mover advantage that the firm had in smartphones wears off. Morningstar analyst Brian Colello believes that Apple is currently undervalued, trading at 73% of his $133 per share fair value estimate. While the firm's most recent results, as well as its near-term outlook (which emphasized reduced growth due to sluggish macroeconomic conditions and currency headwinds), may seem to support the bear case, Colello argues that the long-term story isn't as gloomy as some may believe. He does not see a premium "iPhone killer" emerging anytime soon, and notes that current iPhone customers remain satisfied and loyal to the brand. While the replacement cycle for current users has lengthened, putting some pressure on near-term sales, Colello believes that the lengthening of replacement cycles could portend pent up demand in the future, especially once global economic conditions improve, which means that the current demand lag is likely more cyclical in nature than secular. On top of that, Apple's ability to maintain premium pricing on the iPhone within a smartphone market where virtually no other OEM can earn excess returns on capital remains in place. While the future of Apple may be up for debate, it remains a cash flow machine today and trades well below our current fair value estimate, making this an attractive entry point for long-term investors.

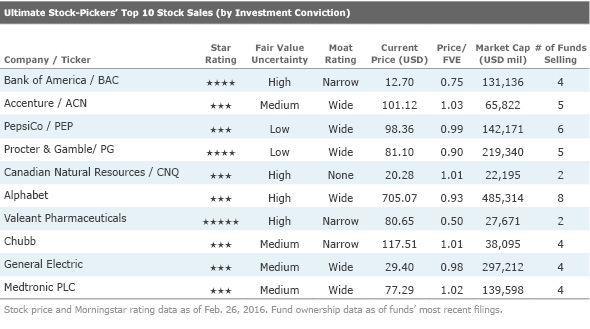

As for the top 10 sales by investment conviction this time around, there continued to be a fair amount of outright selling, driven by holdings either becoming fully valued in the minds of our top managers or where the fundamentals of the company had changed meaningfully from the selling manager's original investment thesis. With six of the top 10 sales--wide-moat-rated

While the managers at Oakmark noted that they had eliminated their stake in Accenture, they had very little else to say about the sale:

During the quarter, we added a new position in Ally Financial…and we eliminated positions in Accenture, Amazon and Omnicom Group. Amazon has been a great holding for the Fund, and with the share price more than doubling in 2015, we believe the business is now fairly valued. With minimal reported earnings and a very high P/E ratio, Amazon may have looked like an unusual purchase for a value-based fund when we initiated a position in April 2014. We looked past reported earnings, which were tempered by large investments for future growth, and found that the scale and core earnings power of Amazon's business were quite impressive and under-appreciated. Omnicom Group has also been a strong performer for the Fund. We have held Omnicom since late 2008, and we eliminated the position in the fourth quarter as the share price approached our estimate of fair value.

Todd Ahlsten and Benjamin Allen at Parnassus Core Equity Investor, which also blew out its stake in Accenture, had nothing to say about the sale. With the managers at ASTON/Montag & Caldwell Growth,

A strong return from Accenture, Henkel, and SMC Corp. also helped to boost relative performance. Overall, we are generally pleased with the results, especially when considering that growth has outperformed value over this time horizon.

The shares were up more than 10% through the end of September 2015, and increased close to 18% overall last year, so it's not too surprising to see some managers cashing in, especially if they had other opportunities to put the money to work in (which was at least the case with Oakmark). This also looked to be the case with

Our second best contributor in the quarter was Alphabet (the parent company of Google), whose Class C shares rose by 25%. The shares benefited from the Company's October announcement of strong quarterly results and the initiation of a $5.1 billion share repurchase program. Alphabet's robust top-line growth continued to be driven by mobile search, YouTube and programmatic advertising, as well as a continued narrowing of the ‘cost per click' gap between desktop and mobile-initiated queries. Better expense discipline throughout 2015 coupled with benefits from weaker foreign currency translation have led to slower-than-expected growth in operating expenses and slightly improved operating margins. While the share repurchase announcement marked a significant shift in Alphabet's financial strategy, we believe Management continues to view capital expenditures and acquisitions as the top priorities for capital allocation, and the Company's significant holdings of cash and securities ($72.8 billion at the end of the third quarter) as a strategic asset. However, given the substantial free cash flow generation of the core business and current liquidity that likely exceeds the medium term investment needs of the business, we welcome the decision to return part of this excess cash to shareholders. Following sizable gains in 2015 that pushed Alphabet's shares closer to our estimate of intrinsic value per share, we elected to reduce our position for Core Select during the fourth quarter.

While both

As valuations became more attractive, we added selectively to existing holdings, including Baker Hughes, Bank of America, Cigna, EMC Corp., HP Inc., and MetLife. We also identified 8 new investment opportunities (including American Express, Anthem, Concho Resources, and VMware) and exited 13 holdings (including Chevron, General Electric, and PayPal).

What's interesting is that while Dodge & Cox was adding to its stake in narrow-moat rated

As for Medtronic, which was sold outright by Jensen Quality Growth, the managers of the fund noted the following about the liquidation:

Medtronic PLC (MDT) manufactures and markets a broad range of medical devices. We sold the position as its fiscal 2015 financial performance resulted in Return on Equity of less than 15%, a breach of our requirement for Fund inclusion. Medtronic issued equity during the year to fund a portion of a large acquisition, resulting in the decline in Return on Equity. In our view, the acquisition was strategically sound, but our analysis indicates that the company may be burdened with low returns on capital for some time to come.

The managers at Jensen Quality Growth have a simple and rigorous stock selection criterion. The fund only invests in companies that have earned a 15% return on equity every year for the past 10 years, with the point of this exercise being to limit the fund's holdings to companies that are consistent value creators. As a result, it is not unusual to see periods like we just saw where the managers liquidated positions wide-moat-rated

While we had very little information about the conviction sales of no-moat Canadian Natural Resources and narrow-moat-rated Chubb, we can guess that the latter was tied more to the runup in the stock price as we moved closer to the closing of the merger with Ace, which is expected in the first half of 2016, with Ace assuming the Chubb name and stock ticker. As for Valeant Pharmaceuticals, which was sold outright by the managers at Morgan Stanley Inst Growth and Alleghany, we have very little to go on from the selling managers. That said, we did some insight from Robert Goldfarb and David Poppe at

Sequoia turned in its second straight year of poor results in 2015.Teasing out the source of our underperformance doesn't take much work. We began the year with a 20% weighting in Valeant Pharmaceuticals. Valeant rose by more than 80% through the summer, driving very strong gains for the Fund. But the price collapsed in the fall amid revelations and allegations about the company's business practices. Ultimately, Valeant declined 29% for the year and by more than 70% from its 52-week high to its low. We bought more shares in October, and we calculate that Valeant contributed -6.3% to Sequoia's return of -7.3% for the year.

At its peak price, Valeant constituted more than 30% of the Fund's assets. We've been criticized for allowing the holding to grow so large, but our feeling before the crisis erupted was that Valeant was executing well on its business model. Earnings were growing rapidly and we believed the company was making intelligent acquisitions that were creating shareholder value. Valeant was taking outsized price increases on a portion of its drug portfolio, but the entire branded pharmaceutical industry routinely has taken substantial annual price increases on drugs for more than a decade.

As you are no doubt aware, Valeant was rocked in the fall by the closure of an affiliated specialty pharmacy, Philidor, after health care payers said they would not reimburse Philidor for claims it submitted. It has been further buffeted by subpoenas from Congress over its pricing strategies and by regulatory and law enforcement scrutiny over practices at Philidor. A committee of Valeant's board of directors is investigating the relationship with Philidor. Valeant recently said it would restate prior earnings as it improperly accounted for sales to Philidor in late 2014.

As these inquiries continue and Valeant remains a subject of intense scrutiny, the share price is very unstable. For the stock to regain credibility with long-term investors, Valeant will need to generate strong earnings and cash flow this year, make progress in paying down some of its debt, demonstrate that it can launch new drugs from its own development pipeline and avoid provoking health care payers and the government. The company has committed to doing all of these things and we are confident interim CEO Howard Schiller and interim board chairman Robert Ingram are focused on the right metrics. Before CEO J. Michael Pearson went out on an extended medical leave, he also seemed committed to this path.

In the end, Valeant's ability to grow earnings over a period of years will determine the stock price. A few months ago, the consensus cash earnings estimate from Wall Street analysts for Valeant in 2016 was about $16 per share. Today, estimates are closer to $13.50. This represents material deterioration, but still good growth over 2015 results. And with strong performance from its gastrointestinal drug Xifaxan and a slate of new product releases in 2016, Valeant has the potential to grow earnings for several years driven more by organic volume increases than price hikes.

As the largest shareholder of Valeant, our own credibility as investors has been damaged by this saga. We've seen higher-than-normal redemptions in the Fund, had two of our five independent directors resign in October and been sued by two Sequoia shareholders over our concentration in Valeant. We do not believe the lawsuit has merit and intend to defend ourselves vigorously in court.

Needless to say, it has been a rough ride for Valeant recently. Morningstar analyst Michael Waterhouse has the difficult job of trying to make sense of the situation, and states that the bottom-line effect of the current restatements looks relatively minor, and doesn't expect this issue to have any material effect on his free cash flow forecasts. That said, as Valeant continues to work through the fallout of its discontinued relationship with Philidor, it is likely, in Waterhouse's view, that near-term performance will remain depressed, including the possibility of impairments and restructuring charges. Regardless, he still thinks that Valeant's narrow economic moat and long-term opportunities remain intact--that is, as long as he doesn't begin to see material weaknesses in other parts of the company's operations, especially the more attractive ophthalmology and gastrointestinal segments, as well as its international operations. It would be an understatement to call this a difficult situation, which is why Waterhouse reiterates the high uncertainty rating he has on Valeant's shares.

If you're interested in receiving email alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Eric Compton has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)