5 Stocks To Buy as Q2 Earnings Season Wraps Up

The virtual world demonstrates strength, while the real world exhibits mixed results.

Key Takeaways for Second-Quarter 2023 Earnings Season:

- Companies steeped in the virtual world demonstrated strength, while those in the real world are showing mixed results.

- After hitting our fair value on July 31, the U.S. stock market has retreated.

- Short-cycle industrials continue to provide evidence that the rate of economic growth is slowing.

- Guidance supports our economic outlook (slowing rate of growth), but no recession is on the horizon.

- Several stock screens after earnings reveal new investment opportunities.

Earnings season is winding down as most S&P 500 companies have reported their results. As we expected, on the whole, second-quarter earnings are solid compared with expectations, and a high number of companies have easily beat consensus. The better-than-expected results were driven by a combination of management teams providing conservative guidance at the beginning of the quarter and the U.S. economy proving to be more resilient to tight monetary policy than anyone expected. Yet, as noted by Lauren Solberg in 10 Undervalued Stocks That Crushed Earnings in Q2 2023, compared with a year ago, earnings are on track to decline 4.3% from the second quarter of 2022.

We expect that returns for the rest of the year will be muted. The U.S. stock market is trading at only a 6% discount to our fair value compared with the beginning of the year when it was at a significant discount. We also forecast that the rate of economic growth will slow over the next three quarters through the beginning of 2024 before rebounding. This slow economic growth will in turn pressure earnings growth. With the market trading at a lower discount, it will have a tough time making a meaningful advance until economic indicators turn upward.

This provides investors with an opportune time to take a fresh look at their portfolios with an eye to sell and lock in profits on those stocks that have run up to the point that they are now overvalued and overextended. Investors should then look to redeploy those proceeds into those undervalued stocks that have lagged.

5 Undervalued Stocks to Buy After Earnings Season:

Based on our valuations, we continue to advocate for an overweighting in value stocks with an underweighting in both core and growth stocks on a relative value basis. Both mid-cap and small-cap stocks remain more undervalued than large-caps.

Virtual Versus IRL

This earnings season has shown a clear bifurcation between those companies that are tied to the virtual (online) world versus the real (in-person) world.

Earnings season started off strong in July as those companies tied to the virtual/online world—as well as many associated technology companies—generally posted results much higher than consensus expectations and provided good to strong guidance. Examples include Alphabet GOOGL, Meta Platforms META, and Amazon.com AMZN. As these stocks traded up in July, our market valuation reached 1.00 on July 31, indicating the broad market was trading at fair value.

However, in August, as earnings season turned toward the real/in-person world, the story became much more mixed. Between a greater number of companies missing expectations and/or providing softer-than-hoped-for guidance, the U.S. stock market has pulled back since the end of July.

In the industrials sector, for example, companies tied to short-cycle products (those with a short time between production and sale) continued to show weakness. We first noted that trend last quarter and suspect that this is indicative of the beginning of a general economic slowdown, albeit not weak enough to be a harbinger of a near-term recession. Many of these stocks, such as Johnson Controls JCI and Honeywell HON, sold off after their earnings reports. Also, among those industrials that have more exposure to the consumer, there have been some disappointments. Generally, the top line was weaker than expected and they are still struggling to raise prices to cover inflationary input costs.

Companies tied to long-cycle products (those that have a long manufacturing time frame and sales cycle) continued to show strength. In fact, Morningstar senior equity analyst Josh Aguilar joked, “Recession? What recession?” as he noted that many of these companies provided strong guidance and/or noted increasing backlogs. Stocks such as Eaton ETN traded well after earnings. He also noted that stocks tied to infrastructure buildout such as General Electric GE are seemingly doing extremely well and have a good runway for continued growth. Much of this is tied to spending from both the Inflation Reduction Act and the Infrastructure Investment and Jobs Act, and many of these projects are multiyear projects. Another beneficiary of the heightened infrastructure spending will be engineering and construction companies that are needed to manage infrastructure projects.

Focus Turns to Strength of the Consumer

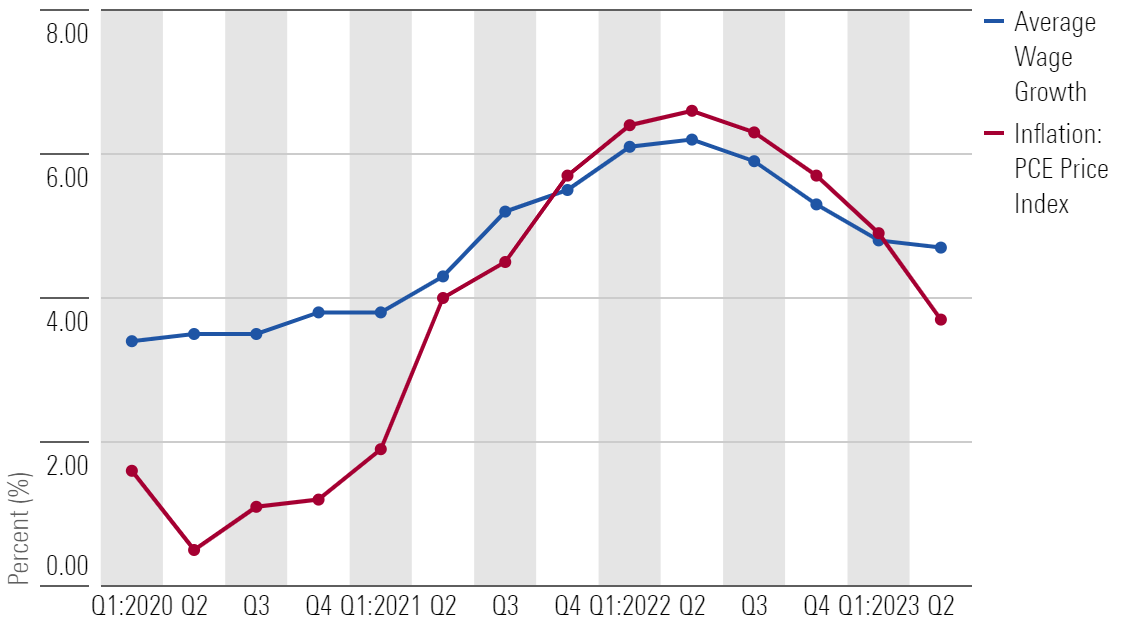

As earnings season wound down, the focus turned to the health of the U.S. consumer. Consumers have been under pressure since the end of 2021, when real wages declined as inflation outpaced nominal wage growth. Real wage growth turned positive in March 2023, and we may just be starting to see indications that real wage growth is leading to an increase in consumer spending. This indication was further bolstered by the surge in retail sales, which blew away consensus expectations.

Wage Growth Versus Inflation

The combination of earnings reports from Walmart WMT and Target TGT provides the broadest view into consumer spending. Based on their earnings reports, at this point it’s still too early to see the improvement in real wages flow through to retailers; nevertheless, the consumer has remained resilient.

While overall spending is holding up, the way money is spent continues to evolve. For example, spending continues to shift into services categories (especially into travel and entertainment) and away from goods. What we’ve seen within the goods categories is that the trend remains away from discretionary items (Target) and into staples (Walmart) with an especially keen focus on value. It appears that consumers are looking to save money in their goods spending to support the shift in spending toward services.

In the short term, we expect spending will be pressured by the resumption of student loan repayments later this year. However, the outlook for the U.S. consumer looks set to improve over the course of 2024. The combination of rising real wage growth, moderating inflation, and reacceleration of economic growth in 2024 are all expected to improve the health of U.S. consumers.

Target’s top line missed consensus, but the firm was able to bolster operating margins enough to substantially beat earnings forecasts. After its stock had been sliding owing to merchandising mistakes, this EPS beat was enough to lift the stock off its lows. However, we once again reduced our fair value estimate to account for an even greater pullback in near-term expectations.

While we project Target’s margins will gradually recover from their depressed 2022 base as inventory normalizes, we do not expect margins will be able to recover to peak levels.

Walmart delivered solid second-quarter results and even raised its earnings guidance. However, the stock remained moribund after earnings as the company noted that over the near term, consumer budgets will be under pressure from rising energy prices, resumption of student loan payments, and higher borrowing costs rates. We maintained our fair value estimate and the stock continues to be rated 2 stars.

Stocks We Like After Earnings Fall Into Several Different Themes

Following earnings season, we screened for several different types of opportunities. First, we looked for undervalued stocks that were already rated 4 or 5 stars that beat their earnings estimates and raised guidance. We filtered the list for companies whose stocks have traded up and still have further to go by our measures. One such example is:

Cognizant

- Global provider of IT services, consulting, and outsourcing.

- Beat earnings consensus and raised guidance.

- Stock traded up 7% after earnings.

- We think Cognizant will benefit from not just current long-term digital transformation trends, but also from its burgeoning artificial intelligence business.

- Morningstar Economic Moat Rating: Narrow

- Morningstar Rating: 4 stars

We also took a look at undervalued stocks that met earnings expectations and are tied to themes that have further room to run. One such example is:

Jacobs Solutions

- Earnings in line with our expectations, and management reiterated its fiscal 2023 EPS outlook.

- We think positive momentum will carry into 2024.

- Infrastructure spending from Inflation Reduction Act consists of multiyear projects.

- Market liked what it heard as the stock traded up after earnings, and we think it’s still undervalued.

- Morningstar Economic Moat Rating: None

- Morningstar Rating: 4 stars

We also scoured our coverage to find previously overvalued stocks that have fallen too far to the downside and have improving fundamentals. An example includes:

American Tower

- REIT that owns cellphone towers.

- Cellphone tower REITs were significantly overvalued several years ago but started to come down in 2022, and that downward momentum has carried into 2023.

- Second-quarter earnings beat consensus on both revenue and earnings, and management raised guidance on both the top and bottom lines.

- Morningstar Economic Moat Rating: Narrow

- Morningstar Rating: 4 stars

On the riskier side, we looked for stocks where we think the market has it wrong. For example:

RTX (formerly known as Raytheon)

- Stock dropped in mid-July after reports surfaced that its Pratt & Whitney engines must be inspected for microscopic cracks.

- We adjusted our model to reduce 2023 free cash flow to account for the added cost.

- In our opinion, the market is overestimating the issue and decided to sell first and ask questions later.

- Following earnings, we increased our fair value estimate to $112 from $106 on strong bookings and resupply contracts.

- Morningstar Economic Moat Rating: Wide

- Morningstar Rating: 4 stars

Another example includes:

U.S. Bancorp

- One of our top picks among U.S. regional banks.

- U.S. regional banks sold off too much following bank failures earlier this year.

- The regional bank model is under stress as depositors move money to higher-yielding investments.

- But the business model is not permanently broken.

- We project earnings will decline for the next three quarters before bottoming out and rebounding.

- Morningstar Economic Moat Rating: Wide (Few regional banks earn our wide moat rating.)

- Morningstar Rating: 4 stars

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U746MWXQHFFZPLSMTEJSUD7HLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OBA7UVI75RGFDOHGJTZ2FK542Q.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)