After Earnings, Is Meta Stock a Buy, a Sell, or Fairly Valued?

With margin expansion, digital ad spending growth, and uncertainty around Threads, here’s what we think of Meta stock.

Meta Platforms META released its second-quarter earnings report on July 26, 2023, after the market close. Here’s Morningstar’s take on Meta’s earnings and stock.

Key Morningstar Metrics for Meta Platforms

- Fair Value Estimate: $ 311.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Meta’s Q2 Earnings

- Strong user growth: The network effect moat source remains strong with good user growth and higher engagement, creating more ad impressions, which has driven up revenue much more than expected.

- Digital ad spending: The surprisingly high third-quarter top-line guidance is positive, but we think Meta’s revenue recovery is just pulled forward because of faster Reels monetization, easy comps, and a favorable foreign exchange (for the time being). Digital ad spending growth is picking up, as we had assumed, but growth won’t return to its historically strong double digits, because that transition from traditional is nearly complete. We think digital/traditional ad spending is at around 70+/30 and will be around 80/20 by 2027, meaning mid-high single-digit growth, with larger publishers like META being a bit higher.

- Uncertainty around Threads: If Threads does well, we think it could add another 3%-6% to Meta’s fair value estimate.

- Margin expansion: We most welcomed the margin expansion resulting from the company’s restructuring, which we now think will be more than initially anticipated through 2027. This drove our fair value estimate to $311 from $278.

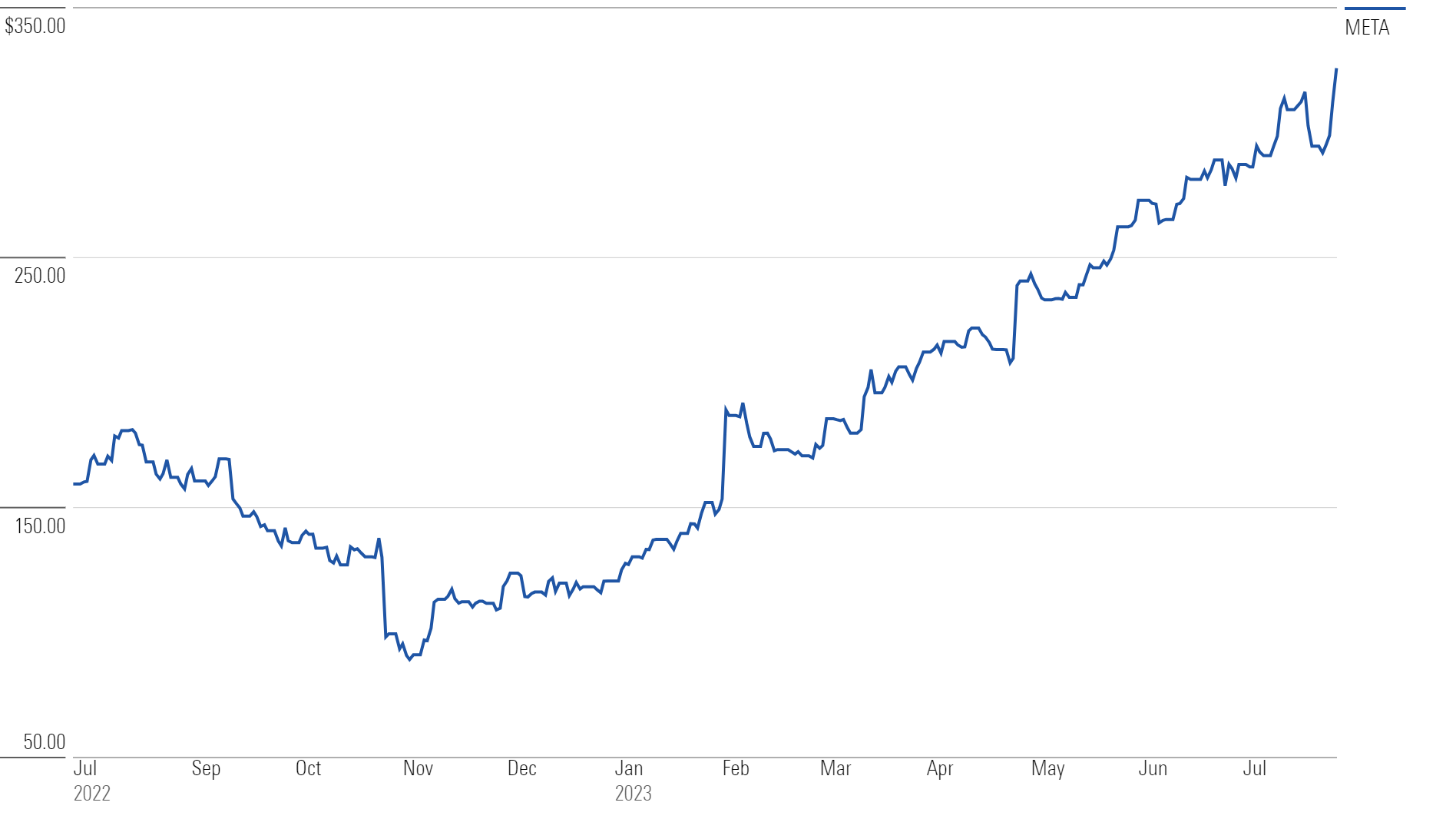

META Stock Price

Fair Value Estimate for Meta

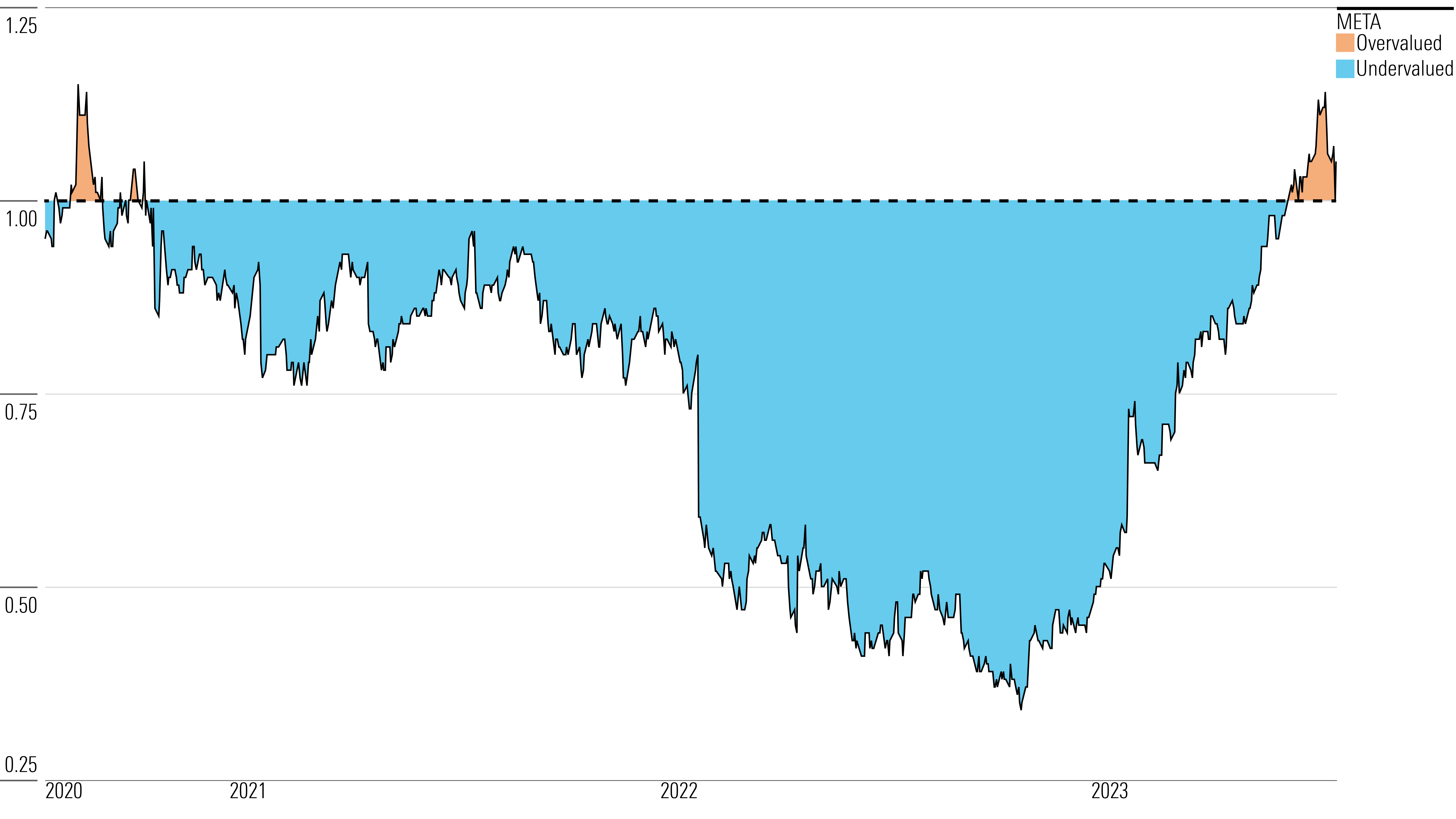

With its 3-star rating, we believe Meta’s stock is fairly valued compared with our long-term fair value estimate. With the stock more than tripling its 52-week lows, we now believe it is fairly valued, with much faster revenue growth than initially anticipated this year and higher long-term margins now priced into the shares.

Our fair value estimate is $311 per share, representing an enterprise value of 12.5 times our 2024 adjusted EBITDA projection. We have modeled 10% average annual growth over the next five years. Since the firm’s increasing efficiency in the wake of its restructuring will more than offset its plans to further invest in research and development, content creation, data security, and virtual/augmented reality offerings (or the metaverse), we see average operating margin improving in 2023 through 2027. We expect an average operating margin of 35% during the next five years, above the previous three years’ 34%.

Meta’s revenue growth will be driven primarily by the increasing allocation of dollars toward mobile, video, and social network ads. We expect solid 14% growth in 2023 ad revenue, followed by 9.4% growth in 2024, assuming an economic rebound and improvement in Reels monetization. We expect Meta’s monthly active users to grow about 2% annually, due to growth outside the United States. We also assume a deceleration in overall advertising revenue per user growth to 6% per year over the next five years, down from the average of 14% over the past five years.

Read more about Meta’s fair value estimate.

Meta Historical Price/Fair Value Ratios

Economic Moat Rating

We assign Meta a wide moat rating based on network effects from its massive user base, as well as its intangible assets, which consist of a vast collection of data that users have shared on its various sites and apps. Given its ability to profitably monetize its network via advertising, we think Meta will more likely than not generate excess returns on capital over the next 20 years.

Now that Meta has emerged as the clear-cut social media leader, we believe its offerings—consisting of Facebook, Instagram, Messenger, and WhatsApp—have strengthened the firm’s network effects. All these platforms become more valuable to Meta’s users as more people join and use these services. These network effects serve to both create barriers to success for new social network upstarts, as well as barriers to exit for existing users, who might leave behind friends, contacts, pictures, memories, and more by departing for alternative platforms.

Read more about Meta’s moat rating.

Risk and Uncertainty

We believe that while barriers to exit may be increasing for Meta’s nearly three billion users, the risk remains of another disruptive and innovative technology (more recently TikTok) coming onto the scene and luring users away. We do not expect competition in the form of a substitute for Meta, as most consumers use more than one social network. However, given the fixed number of hours per day, an increase in usage and engagement on one social network could come at a cost to others, reducing user engagement and the potential return on investment for advertisers. Furthermore, even with Meta’s dominant position, its dependence on the continuing growth of online advertising could heighten the negative impact of a lengthy downturn in online ad spending, resulting in a much lower fair value estimate.

The firm’s high dependence on user behavior data also represents an environmental, social, and governance risk. Limitations could be imposed by regulatory agencies around the world on what user and usage data Meta can compile and how the data can be utilized. Lack of data privacy and security plus data misusage could affect users on the social platform negatively.

Read more about Meta’s risk and uncertainty.

META Bulls Say

- With more users and usage time than any other social network, Meta provides the largest audience and the most valuable data for social network online advertising.

- Meta’s ad revenue per user is growing, demonstrating the value that advertisers see in collaborating with the firm.

- The application of AI technology to Meta’s various offerings, along with the launch of VR products, will increase user engagement, driving further growth in advertising revenue.

META Bears Say

- Meta is currently a one-trick pony, and it will be severely affected if online advertising stops growing, or if more advertising dollars shift to competitors like Google or Snapchat.

- Despite rapid user growth, many of Meta’s customers may also belong to other social networks, such as Snapchat or TikTok, so the firm will continually have to fight to capture a user’s time and engagement.

- Regulations could emerge that limit the application and collection of user and usage data, or restrict acquisitions, affecting data utilization and growth.

This article was compiled by Monit Khandwala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U746MWXQHFFZPLSMTEJSUD7HLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)