5 Stocks With the Largest Fair Value Estimate Increases After Q1 Earnings

National Instruments and Cintas saw the largest jumps among U.S.-listed stocks covered by Morningstar analysts.

Against the backdrop of a stock market that has been treading water and an uncertain outlook on the economy, the quarterly earnings season has been quieter than usual for the fair value estimates on stocks covered by Morningstar analysts.

But while these estimates have broadly seen limited changes, some stocks still impressed analysts enough to earn increases. That list includes software company National Instruments NATI and uniform retailer Cintas CTAS. (For our look at stocks with the biggest fair value estimate cuts, click here.)

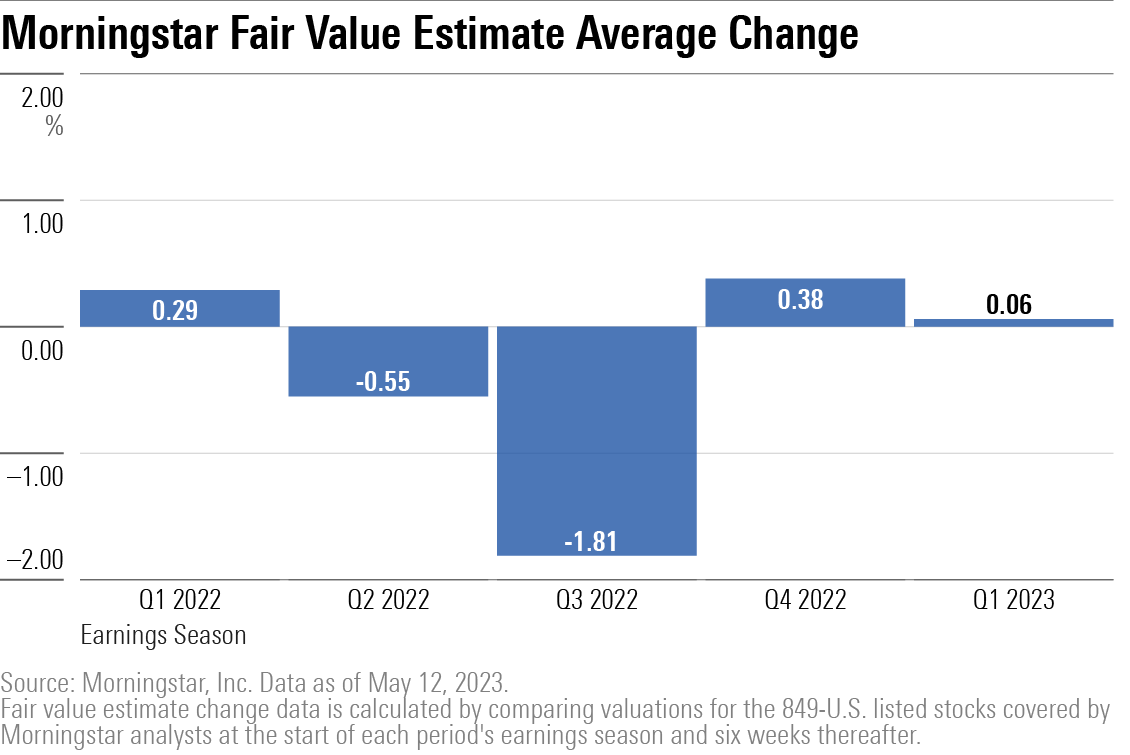

Stock valuations have held steady this earnings season. There was only a 0.06% average increase in fair value estimates across the 849 U.S.-listed stocks covered by Morningstar for 2023′s first-quarter earnings season. That’s the smallest change since the beginning of 2019, which saw an average fair value estimate change of 0.04% for 2018′s fourth-quarter earnings season.

Among the 849 stocks we scanned for changes, only 3% saw meaningful improvements of 10% or more to their fair value estimates—below the 10-year quarterly average of 8%.

On the other hand, fair value estimate cuts have continued to be more frequent than increases from a year ago. About 4.0% of companies saw cuts of 10% or more to their fair value estimates—higher than the 10-year quarterly average of 2.6%.

Percentage of Fair Value Increases Versus Cuts

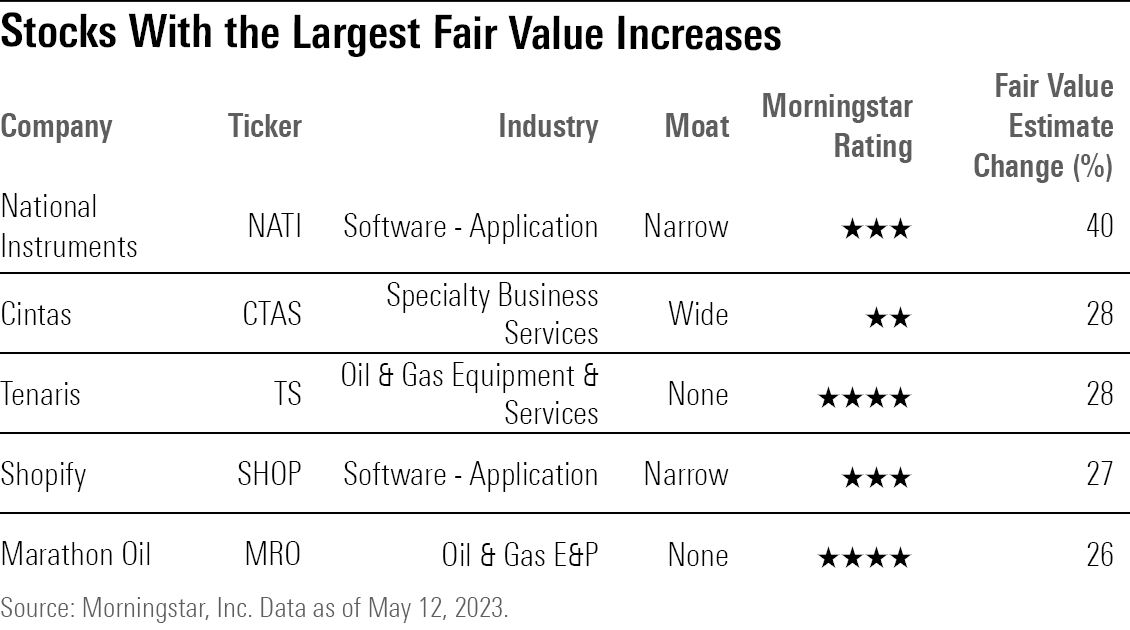

In this article, we’ll highlight the stocks with the greatest valuation increases and largest improvements to what Morningstar analysts believe they should be valued.

While some of these changes are substantial, not all have resulted in notable changes in their Morningstar Ratings, which help investors assess whether stocks are trading at attractive prices. In the list below, only Marathon Oil’s MRO fair value estimate increase led to a change in the stock’s star rating. Marathon now trades in undervalued 4-star territory, versus its prior 3 stars.

Stocks With the Largest Valuation Increases

- National Instruments—$60 from $43

- Cintas—$384 from $299

- Tenaris TS—$37 from $29

- Shopify SHOP—$57 from $45

- Marathon Oil—$29 from $23

Here’s more of what Morningstar analysts had to say about their fair value estimate cuts:

National Instruments

National Instruments had the largest fair value estimate increase, as it went to $60 from $43 because of its deal to be acquired by Emerson Electric EMR for $60 per share. “We see no regulatory hurdles to the deal and reiterate that it should be viewed positively by NI shareholders, representing a 40% premium to our stand-alone NI fair valuation of $43 per share,” says William Kerwin, Morningstar equity analyst. National Instruments stock is trading close to its new fair value and has a Morningstar rating of 3 stars.

Cintas

Cintas, a provider of uniform sales and rentals to businesses, had two increases to its fair value estimate after the start of the second quarter. Morningstar senior equity analyst Joshua Aguilar first raised his fair value estimate on Cintas stock to $381 from $299 in early April, and then again to $384 in mid-May.

The initial substantial increase was a result of “our bullish outlook on long-term sales growth in uniform rentals and operating margins,” Aguilar says. Cintas’ growth has been tied to the growth of nonfarm payrolls in the United States. The growth rate of the core uniform business has a track record of exceeding the nonfarm payroll growth rate by 300 basis points.

As the labor market ebbs and flows, Cintas’ business typically follows. As such, a potential rise in unemployment and a recession could challenge the firm, says Aguilar. He views Cintas stock as overvalued, and it has a Morningstar Rating of 2 stars.

Tenaris

Tenaris, one of the largest producers of tubes used in the construction of oil and gas wells, saw its fair value estimate increase twice in the past few weeks, first to $32 from $29 and then again to $37.

Driving the change was an improved outlook for the firm’s profitability. Morningstar equity analyst Katherine Olexa now models that the company’s EBITDA margins will average 29% over the next five years versus prior estimates of 24%, despite declining demand and lower prices for the firm’s products.

“We expect a more favorable product mix will offset normalizing tubes demand over the next five years,” she says. “We still expect the currently advantageous pricing dynamics will abate over the next few quarters. However, we’re now more confident the firm will secure more margin-accretive revenue streams, further supported by internal cost management initiatives.”

Tenaris stock trades in undervalued territory with a Morningstar Rating of 4 stars.

Shopify

Shopify also saw one of the largest fair value estimates increases in recent weeks. The firm announced it was going to sell its logistics business Shopify Fulfillment Network to Flexport, a supply chain management firm. After modeling the impact of the sale, Morningstar senior equity analyst Dan Romanoff now values the company at $57 per share versus $45 before. Shopify stock trades close to its new fair value, with a Morningstar Rating of 3 stars.

Marathon Oil

The fair value estimate on Marathon Oil stock was raised to $29 per share from $23 as a result of the oil and gas exploration and production firm putting out slightly more barrels of oil than expected during the first quarter amid lower operation costs. Also driving the valuation increase was a more bullish outlook toward the company’s integrated gas business in Equatorial Guinea. The gas produced is currently sold at prices linked to the Henry Hub Natural Gas benchmark.

However, this contract is set to expire in 2024. The business will then instead utilize the Title Transfer Facility benchmark, which captures higher prices in Europe. David Meats, Morningstar director of energy and utilities research, says this will lead to a meaningful increase in equity income and cash flow from its gas operations in Equatorial Guinea.

“This was previously announced, but while we were already incorporating a surge in equity income, we were not fully capturing the upside with our previous estimate,” Meats says. The valuation boost also leaves Marathon Oil trading in 4-star territory, making it one of only two undervalued U.S.-based oil and gas exploration and production stocks covered by Morningstar analysts (the other is APA Corp APA).

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)