5 Undervalued Stocks—Even After Fair Value Estimate Cuts

While near-term pressures weigh on these stocks, analysts think they have major upside.

Thus far, third-quarter corporate earnings have broadly been a disappointment for stock investors, with many companies reporting results that either missed guidance or set a disappointing outlook for the upcoming quarters.

Morningstar equity analysts have been incorporating results from earnings to adjust their models. While analysts stick to a long-term approach to investing, quarterly results can adjust near-term assumptions, which may affect long-term growth estimates.

Against an increasingly difficult economic backdrop, for the second consecutive quarter, Morningstar analysts’ review of company performances has led to an overall decline in fair value estimates. The Morningstar Fair Value Estimate is a measure of a stock’s long-term intrinsic value. Morningstar analysts arrive at a fair value estimate by modeling a company’s future cash flows and discounting them back to what they believe it should be worth.

Fair value estimates were reduced by an average of 1.47% between Oct. 1 and Nov. 4. That followed a second-quarter decline of 0.52% for the comparable period around earnings. Prior to the current quarter, the quarterly average for fair value estimate changes over the last five years was an increase of 1.8%.

While stocks’ fair value estimates have declined, the majority of the U.S.-listed stocks covered by Morningstar analysts remain undervalued. As of Nov. 4, 61%, or 514 stocks, have a Morningstar Rating of 4 or 5 stars.

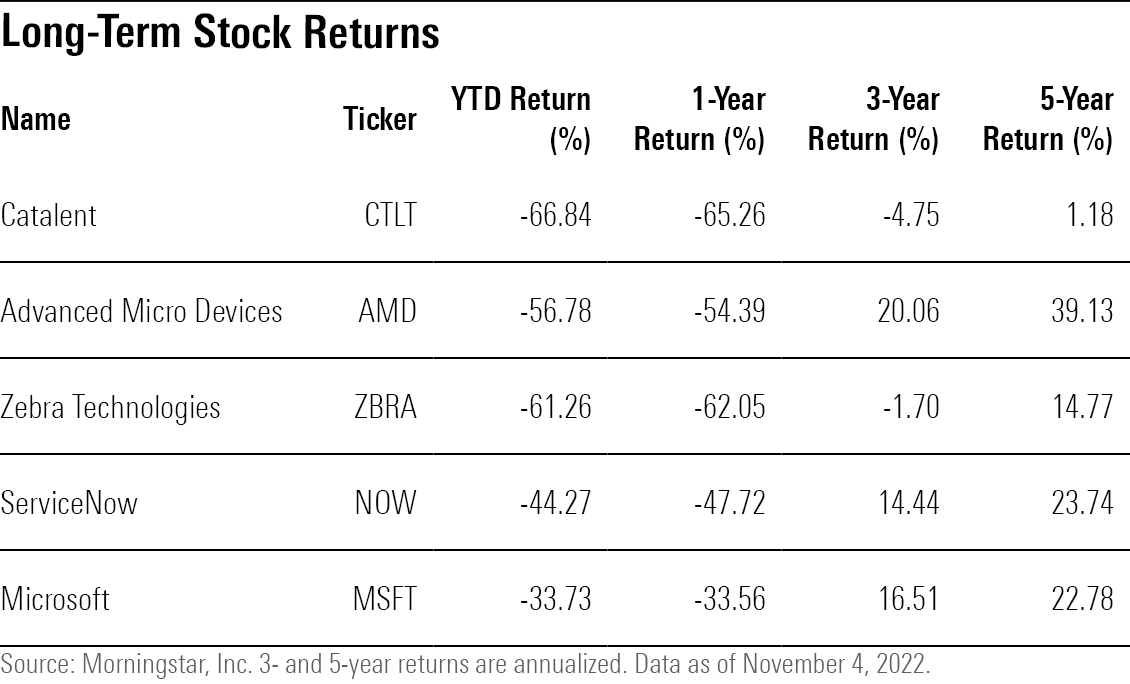

To highlight opportunities to the long-term investor, we screened for stocks that, despite a fair value estimate cut, were trading within 5-star territory. To increase the margin of safety for our picks, we also screened for stocks with an economic moat, which designates whether our analysts believe the firm has a durable competitive advantage over peers and earn high returns on capital for 10 or more years. The result was five stocks with economic moats that are undervalued, even in the face of recent fair value estimate cuts.

- Catalent (CTLT)

- Advanced Micro Devices (AMD)

- Zebra Technologies (ZBRA)

- ServiceNow (NOW)

- Microsoft (MSFT)

Here’s a closer look at these five undervalued stocks:

Catalent

Shares of Catalent plunged after the firm, which provides development and manufacturing solutions to pharmaceutical companies, posted fiscal first-quarter results that missed expectations by a large margin. The company reported earnings per share of $0.34 versus consensus estimates of $0.56, according to FactSet. Management also decreased its revenue guidance for fiscal 2023 to $4.63 billion-$4.88 billion from $4.98 billion-$5.23 billion.

“The declines are attributed to changes in market conditions, negative outlook received from some of their customers (cash-sensitive decisions from customers related to inventory levels), inflation, foreign-exchange headwinds, and supply chain pressures,” says Rachel Elfman, a Morningstar equity analyst.

However, while Elfman reduced her fair value estimate to $82 from $98 after incorporating the results, she believes the market was overly punitive. “While Catalent faces near-term challenges, we think the selloff was too extreme and shares are trading at an attractive entry point,” she says.

“We expect low- to mid-single-digit sales growth over the next few years and longer-term growth in the high single digits toward the back half of our 10-year explicit forecast period.” Catalent stock is trading at a 48% discount to its fair value estimate.

Advanced Micro Devices

Advanced Micro Devices’ most recent fair value estimate downgrade came after the company provided on Oct. 6 updated expectations for weaker personal computer demand. The company also reported preliminary third-quarter revenue results of $5.6 billion, below the original guidance of $6.7 billion. In response to the news, Morningstar technology strategist Abhinav Davuluri reduced AMD stock’s fair value estimate to $115 from $130.

Official third-quarter results from Nov. 1 did show PC softness leading to disappointing revenue, but results beyond that were still promising, according to Davuluri.

“The firm’s data center business continues to execute well with on-time product launches (including the upcoming 5-nm Genoa server CPU lineup) and we expect continued market share gains as Intel struggles with delays to its Sapphire Rapids server CPU family,” he wrote in a recent analyst note. Third-quarter results led him to maintain his fair value estimate of $115 for AMD stock, which is now 46% undervalued.

Zebra Technologies

Zebra Technologies, a leading provider of automatic identification and data capture technologies such as barcode printers and scanners, had its fair value estimate cut to $417 from $449 after the company missed both management’s and the market’s estimates for revenue and earnings per share.

Revenue also declined between the second and third quarters to $1.38 billion from $1.47 billion as supply chain issues prevented the firm from servicing its full demand. But Morningstar equity analyst William Kerwin sees the stock as an opportunity for long-term investors as “its current share price implies unjustifiably low long-term growth and margin assumptions,” he says.

Zebra Technologies stock is 45% undervalued.

ServiceNow

ServiceNow showed relatively good third-quarter results as the firm reported earnings per share of $1.96 versus a consensus estimate of $1.85. However, currency headwinds pressured results to the point that it pushed results below Morningstar senior equity analyst Dan Romanoff’s expectations.

The company set guidance for subscription revenue in the fourth quarter at $1.83 billion-$1.84 billion, which was also lower than Romanoff’s expectation as “currency was the culprit once again,” he says. While the lower guidance led to Romanoff cutting his fair value estimate for ServiceNow stock to $640 from $675, he still views the stock as one of his top picks.

“We continue to favor ServiceNow as one of our top picks for its long-term organic-driven growth as it leverages its strength in workflow automation to bring its existing customers more deeply into IT and more broadly with human resources and customer service-specific products, as well as its continued push into industry segment-specialized versions,” he says.

ServiceNow stock trades at a 43% discount to its fair value estimate.

Microsoft

Despite solid third-quarter results ahead of guidance midpoints, Morningstar’s Romanoff cut his fair value estimate for Microsoft stock to $320 per share from $352.

The move was sparked by fourth-quarter revenue guidance of $52.35 billion-$53.35 billion, which was softer than the consensus estimates of $56.22 billion prior to results, and lower than Romanoff’s expectations. The lower guidance led to Romanoff cutting his revenue growth and operating margin forecasts for fiscal 2023 and fiscal 2024, and contributed to its fair value estimate reduction.

However, even with the fair value estimate cut, Romanoff sees Microsoft shares as oversold. “We continue to find encouragement in Azure, Office E5 migration, and traction with the Power platform for long-term value creation, but we think near-term pressures will not be exhausted within the next quarter. It is premature to say the Azure growth story is over despite the slowdown. We see results as reinforcing our thesis centering on the proliferation of hybrid cloud environments and Azure, as the firm continues to use its on-premises dominance to allow clients to move to the cloud at their own pace,” he says.

Microsoft stock currently trades at a 31% discount to its fair value estimate.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)