2 Sectors With the Largest Fair Value Increases

Solar stocks get a boost from the Inflation Reduction Act. Increased demand benefits oil and gas drilling equipment suppliers.

Fair value estimates, Morningstar’s measure of a stock’s intrinsic value, declined on average this earnings season. The last time that happened was during 2020’s first-quarter earnings.

While fair value estimates as a whole dropped, Morningstar analysts still saw some bright spots in earnings results that prompted them to increase their fair value estimates for a number of stocks. The bulk of those increases were concentrated in the energy and technology sectors.

From June 30 through Aug. 11, fair value estimates were cut by an average rate of 0.52%, compared with an average increase of 1.79% per earnings season in the past 10 years. Fair value estimates decreased for 178 stocks, more than double the previous year’s average of 80 per earnings season. Only 164 stocks impressed analysts enough to raise their fair value estimates, which is the fewest since 2020’s first-quarter earnings season, during which only 85 stocks saw an increase. A list of the stocks with the largest fair value increases can be found at the end of this article.

Stocks that earned the largest increases were those that stood to benefit from the Inflation Reduction Act, which President Joe Biden signed into law on Aug. 16. At the top of the list were hydrogen fuel cell manufacturers Bloom Energy BE and Plug Power PLUG.

Morningstar analysts conduct a fundamental review and create models to determine a fair value estimate of a company's shares. While Morningstar analysts take a long-term approach to investing, they monitor quarterly earnings results to update their assumptions and, potentially, their estimates.

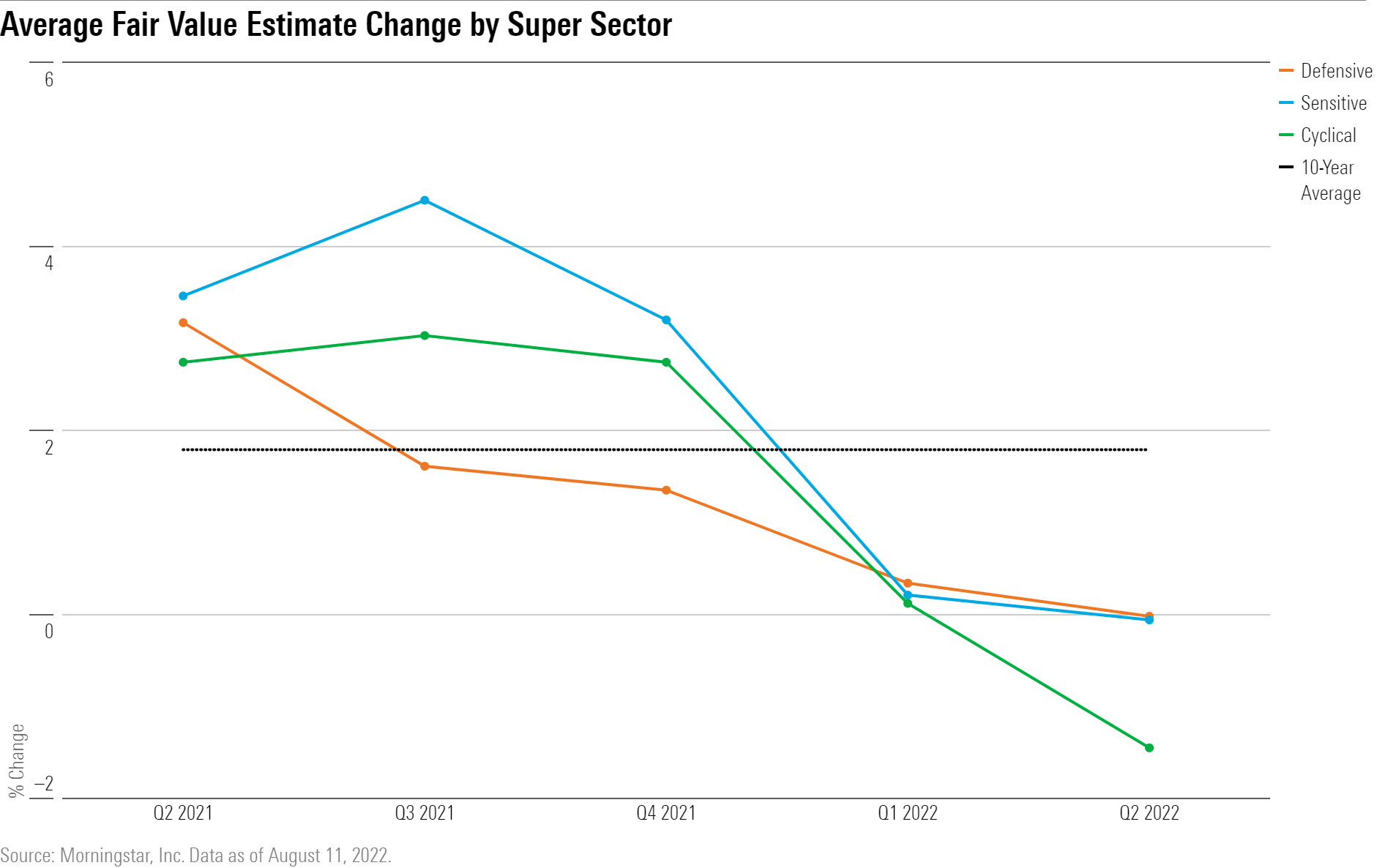

The chart below shows the average percentage change in fair value estimates following and during earnings for the past five quarters. The estimates were pulled from Morningstar Direct for the end dates of each quarter and compared against the estimates six weeks after each quarter ended.

We’ve sorted data by what Morningstar calls Super Sectors: companies that fall into the categories of cyclical, defensive, and sensitive.

Cyclical sectors are those that are heavily correlated with the business cycle. As the economy expands or contracts, cyclical sectors follow.

The defensive sector includes industries that are relatively immune to economic cycles.

Sensitive sector industries ebb and flow with the overall economy, albeit with less volatility, and fall between defensive and cyclicals.

Changes in fair value estimates were flat in the defensive and sensitive sectors of the market.

However, economy-sensitive or cyclical sectors had an average fair value decline of 1.44%, the worst single-quarter drop since the first-quarter earnings season of 2020. Those stocks saw their fair value estimates fall by 3.64% on average.

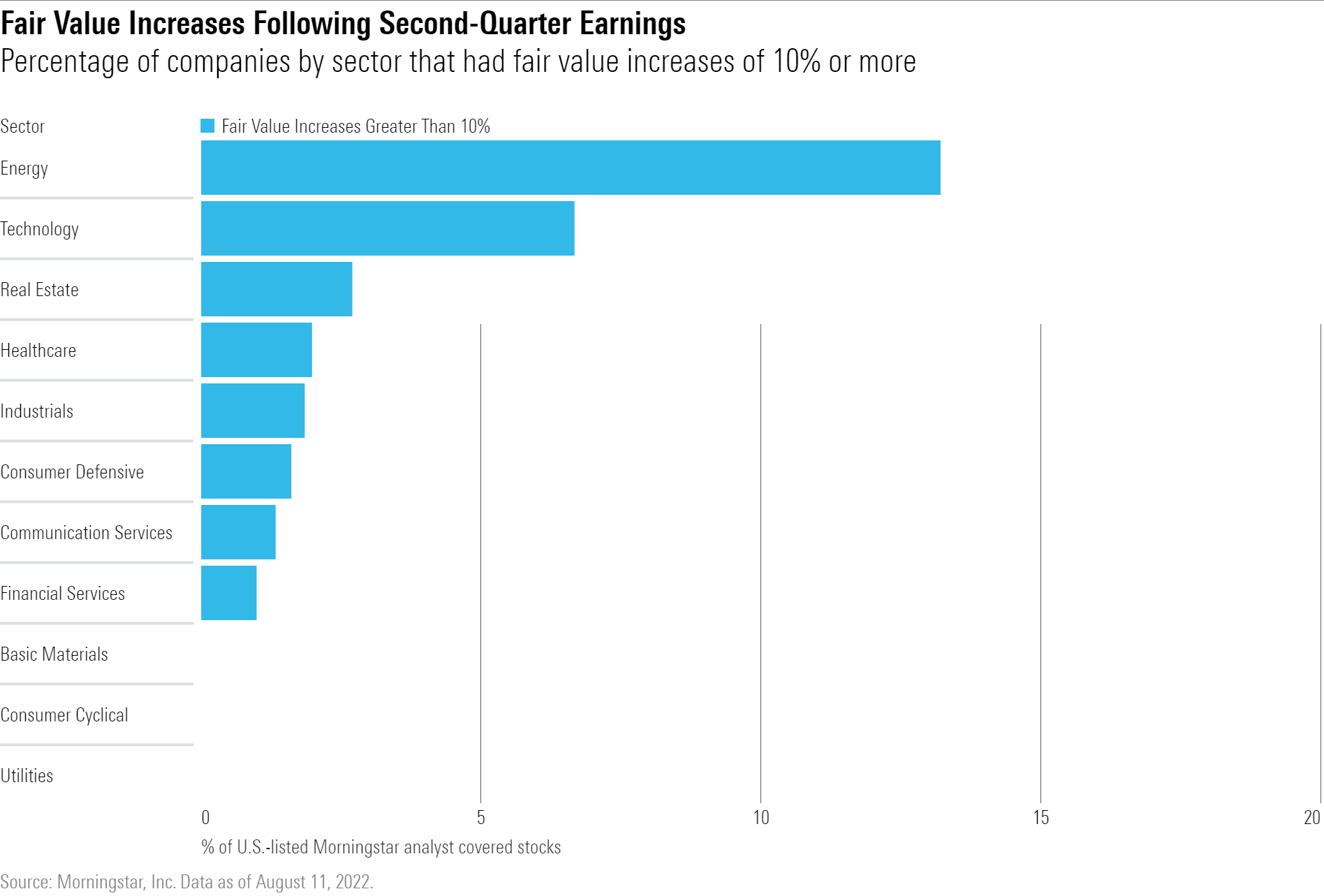

To highlight the most important fair value increases, we screened for those companies whose estimates rose 10% or more. Of those, increases were found to be concentrated in the energy and tech sectors. A total of seven (13%) of the 53 energy stocks covered by Morningstar analysts had fair value increases of 10% or more. Meanwhile, 10 (or 7%) of the 135 tech companies under coverage also saw their values increase by that same amount.

Energy Stocks

Oil and gas drilling equipment providers were among those with the largest fair value increases, with Patterson-UTI Energy PTEN leading stocks in the sector in upgrades. As oil demand and prices remain high, the need for drilling rig equipment and pressure services has remained strong. That has also benefited one of their competitors, Helmerich & Payne HP.

“Increased rig demand along with supply chain constraints and service provider capital discipline throughout North America continue to drive high rig utilization that’s improved pricing power for service providers, including H&P,” says Katherine Olexa, a Morningstar equity analyst.

While the current environment should prove favorable for both Patterson-UTI and Helmerich & Payne, Olexa thinks the market is overly optimistic about their long-term pricing power.

“As the tight supply/demand balance levels out, we expect tough price competition will return to the drilling market,” she says.

Although Patterson-UTI’s fair value estimate was increased to $12 per share from $9, and Helmerich & Payne’s to $35 from $31, both currently trade in Morningstar’s fairly valued 3-star rating territory.

Higher drilling demand also helped boost prospects for oil tubular transportation product supplier Tenaris TS; Olexa raised her fair value estimate to $26 per share from $23 as she now expects the market to remain tight until at least 2023.

“Activity increases in North and South America drove most of the growth this quarter, as high oil and gas demand has spurred a significant increase in drilling and completion activity,” Olexa says. “This, coupled with low tubes inventory, have created a favorable pricing environment that’s allowed Tenaris to expand its margins even amid supply chain constraints and high raw materials costs.”

Tenaris trades as a 3-star-rated stock at recent prices.

Oil refining firms also had substantial fair value increases. HF Sinclair DINO had its fair value raise to $54 from $40, and Valero Energy VLO to $109 per share from $101. Morningstar energy sector strategist Allen Good raised his fair value estimates for the companies after reviewing their latest results.

“Second-quarter refining results produced a round of record profits after margins soared during the quarter. Although that will probably prove a peak as margins have since softened on concerns about weakening demand, they remain at relatively high levels, implying that strong, above-midcycle profits will continue,” he says.

“Although margins have narrowed since our report, the factors we identified behind the strong margin environment—capacity reductions, strong demand, and Russian disruptions—remain in place, while U.S. refiners’ cost advantage has gotten stronger with increasing European natural gas prices. The pressure on natural gas prices looks unlikely to abate anytime soon, which should underpin higher Atlantic Basin margins,” Good says.

Despite the fair value increases, HF Sinclair and Valero shares trade in a range he considers fairly valued, with a Morningstar Rating of 3-stars.

Shares of Continental Resources CLR now trade in 3-star territory after Morningstar director of equity research of energy and utilities David Meats raised his fair value estimate to $61 per share from $52. The new fair value is a result of a probability-weighted average that the company would be taken private with a $70 per share buyout offer from founder and current board chair Harold Hamm. Meats thinks the offer has a 50% chance of success.

Technology Stocks

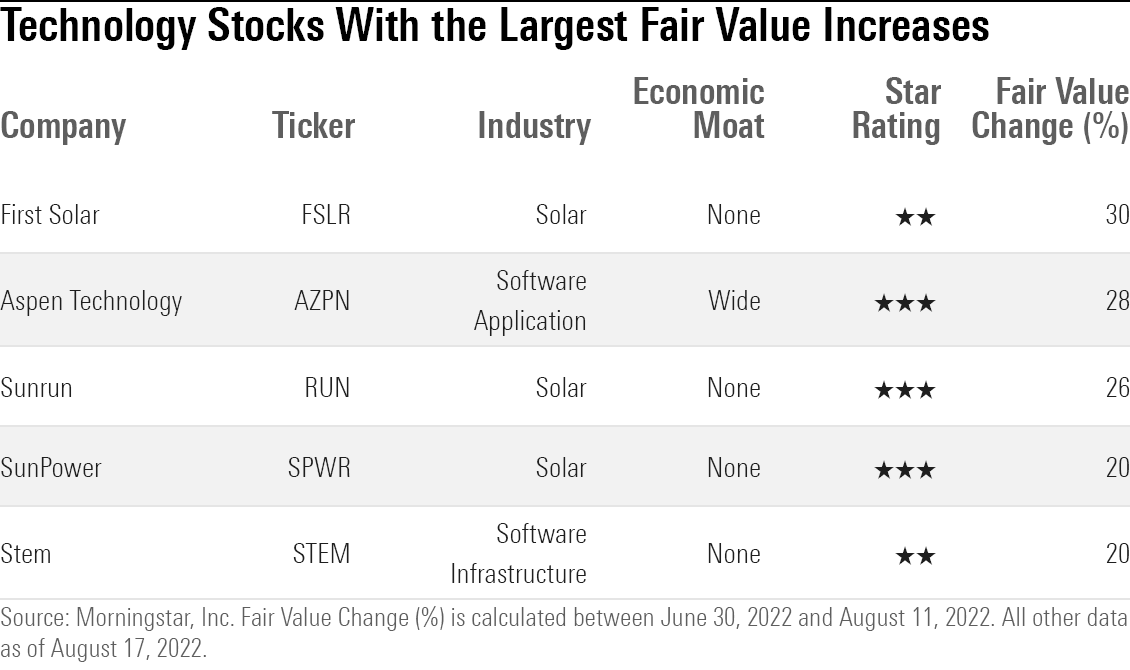

The largest fair value increases among tech stocks were spurred by the Inflation Reduction Act.

Stocks in the solar industry faced the largest fair value increases, with First Solar FSLR having the biggest jump among the group. The company’s fair value estimate was increased to $100 per share from $77 after Morningstar equity analyst Brett Castelli incorporated the potential effect of the act.

Castelli says the bill’s incentives “are likely to dramatically alter the competitive landscape of solar modules in the U.S.—First Solar's key end market.” He views First Solar as a primary beneficiary of the bill, which would provide refundable tax credits for solar modules. Buoyed by the incentives, he expects the company to announce capacity additions in the next few months and projects its current U.S. solar capacity will increase to more than 10 gigawatts by the end of 2025 from 2.6 gigawatts at the end of last year. First Solar’s stock is considered overvalued and trades in 2-star territory.

Residential solar solution providers Sunrun RUN and SunPower SPWR saw their fair value estimates also increase. Sunrun’s is now at $34 per share, up from $27, while SunPower’s is up to $24 from $20. Driving the increases is another proposal within the legislation that would provide a 10-year extension of solar investment tax credits, which Castelli sees as boosting residential solar installations. Both Sunrun and SunPower are trading at levels Castelli views as fairly valued, and they are rated at 3 stars.

Energy storage system provider Stem’s STEM fair value increased to $12 from $10. The company is also poised to benefit from a proposal in the act that would provide tax credits for stand-alone energy storage projects.

Historically, these projects “had to be paired with solar to qualify for federal tax credits,” says Castelli. “We view this as expanding the addressable market for stand-alone storage and retrofit opportunities for operating solar and wind projects.”

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)