Why Are There Oil Companies in My ESG Portfolio?

A look at the compromises made by ESG dividend funds when their dual mandates collide.

High dividend yield and stellar environmental, social, and governance practices tend to mix like oil and water. Many of the higher-yielding blue-chip companies favored by dividend funds don’t have the best ESG records, while broad-market ESG funds tilt toward younger technology firms that either don’t pay dividends yet or have lower yields. Combining the two strategies into one fund is like fitting a square peg in a round hole.

However, where there’s a will, there’s a way. Index providers and asset managers have made several attempts to fuse an ESG mandate with a dividend focus within a passive strategy, three of which we will be looking at in this article.

The first quarter of 2022 presented an interesting case study into how these funds balance their dividend and ESG mandates, especially with regards to energy stocks, whose revival drove a wedge in the performance of different ESG dividend strategies. Traditional energy companies, those deriving much of their revenue from fossil fuels, don’t tend to make it far into ESG portfolios. However, their generous dividend payouts over the last few years have made them dividend darlings. This article explores the compromises made by ESG dividend funds when their dual mandates collide.

A Brave New World

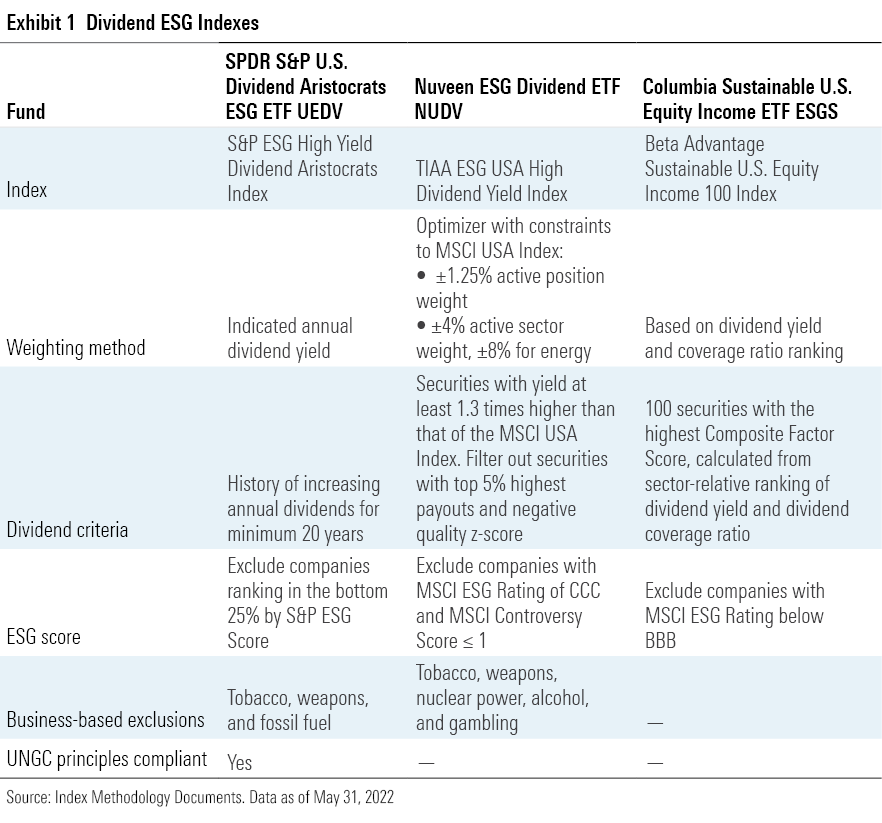

ESG dividend strategies recently carved out a new niche of passive ETFs with few funds currently targeting the combination. Exhibit 1 lays out the three funds (and their indexes) that fit the bill: SPDR S&P U.S. Dividend Aristocrats ESG ETF UEDV, Nuveen ESG Dividend ETF NUDV, and Columbia Sustainable U.S. Equity Income ETF ESGS. Each fund’s index has its own method for how much it dials up the portfolio’s ESG credentials and yield focus. Taken together, they produce a gradient of options:

Weighting Methods

One of the common ways portfolios enhance their dividend focus is by weighting securities according to yield instead of market cap. This overweights the portfolio in the highest-yielding stocks compared with the broad market. Both UEDV and ESGS’ indexes base their constituent weights on a measure of dividend yield, while NUDV’s index use an optimizer that constrains its weights to those of the MSCI USA Index, a market-cap-weighted portfolio. While there is some wiggle room, both the sector and security weight constraints keep NUDV’s portfolio tethered to the broader market.

Dividend Screens

Out of the three funds, UEDV’s index has the strictest dividend screening; it requires increasing annual payouts for at least 20 years straight. In other words, companies must have increased their dividends since 2001 to be eligible for the portfolio in 2022. The longer lookback period is a difficult hurdle to clear, requiring companies to be stable and profitable franchises. This keeps many of the highest-yielding stocks out of the portfolio.

On the other hand, NUDV and ESGS’ indexes select securities based on their trailing 12-month dividends. ESGS’ index also incorporates dividend growth and dividend coverage ratio in its criteria, as measured over a similarly short time frame. These features fall on the other end of the spectrum from UEDV by choosing to relax some quality controls in favor of stocks with the highest current yields.

ESG Criteria

The funds’ indexes all incorporate a minimum ESG score or rating threshold from either MSCI or S&P, which are industry-relative rankings. While UEDV and NUDV’s indexes also explicitly filter out companies involved in certain controversial businesses, such as tobacco or weapons, ESGS applies a stricter ESG score requirement but stops short of any further exclusionary criteria. Thus, ESGS’ lineup includes military contractors such as Huntington Ingalls Industries HII or L3Harris LHX.

Yet, even as UEDV’s index explicitly screens out companies involved in extraction of thermal coal and oil sands, as well as thermal coal generation, Exxon Mobil XOM and Chevron CVX still passed its revenue-based threshold of 5%. In fact, because of its yield-driven weighting, these companies took the top and third spot in its portfolio as of May 2022, respectively. Similarly, ESGS’ second- and third-largest holdings were UGI Corp UGI, a natural gas distribution company, and Edison International EIX, a utility provider.

While definitions of ESG can vary, it’s difficult to imagine that many environmentally conscious investors would be comfortable with these firms as the top holdings in their ESG portfolio. For dividend investors, on the other hand, their 3%-4% trailing 12-month dividend yield can surely justify their inclusions, given the S&P 500’s dividend yield currently stands at 1.5%. And in a strategy that tries to have its cake and eat it too, something has to give.

A Curious Case Study

Each fund has a different way of dealing with the trade-off of yield and ESG. One of the more interesting differences across these portfolios lies in their energy positions. NUDV’s weight to energy stocks has remained close to that of a broad-market portfolio. On the other hand, both UEDV and ESGS tend to be overweight in energy stocks by around 5%-6% compared with the MSCI USA Index. While this gap has narrowed to about 3% recently, their energy allocation more closely resembles the FTSE High Yield Index, a market-cap-weighted portfolio of the highest-yielding U.S. stocks.

All told, these funds have less than 10% of their assets invested in energy stocks, which isn’t typically enough to move the needle—until it is. Geopolitical tensions in early 2022 have fueled energy stocks’ strongest rally in the past decade just as the broader market flounders. This amplified the funds’ differing treatment of energy stocks, resulting in divergent performance.

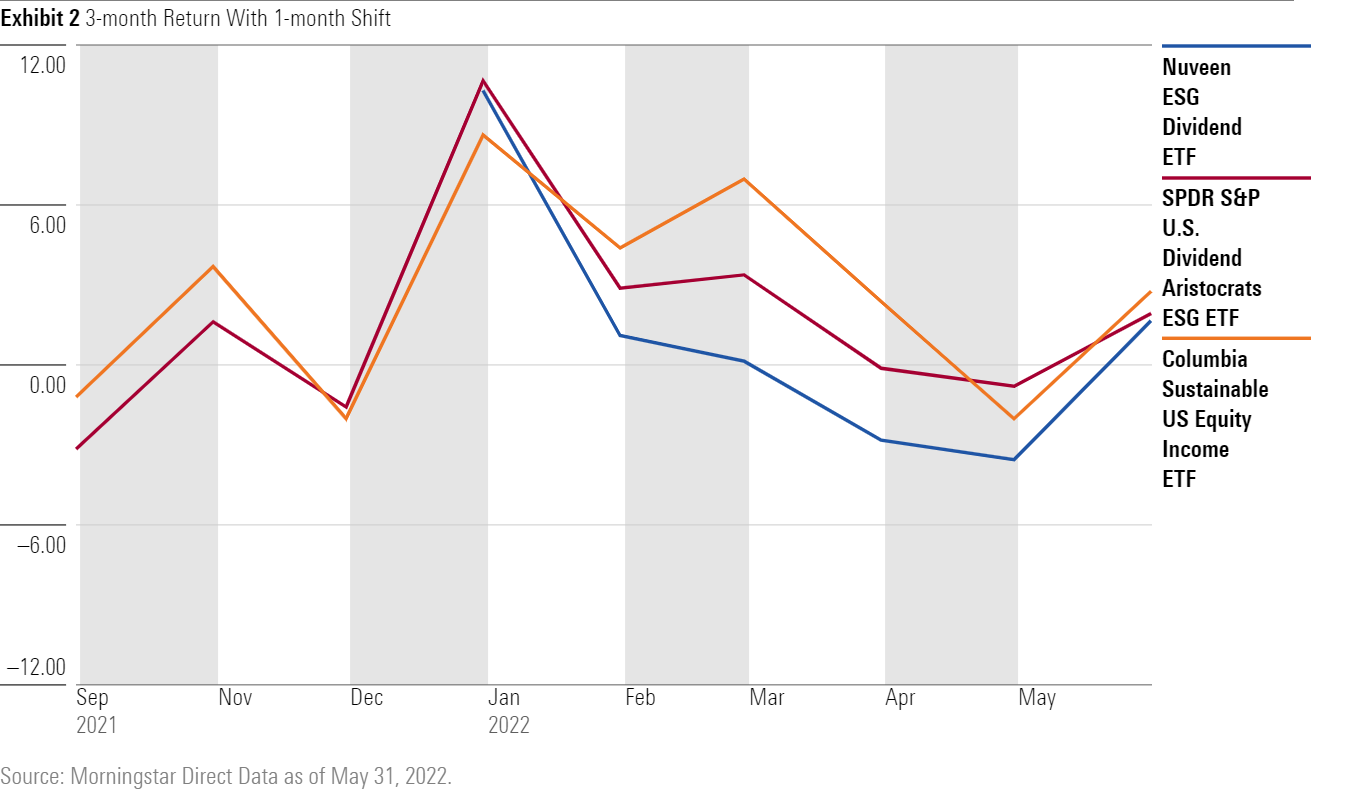

Exhibit 2 plots the rolling three-month return for each of the funds.

The funds performed similarly prior to 2022. However, starting in January 2022, the funds diverged based on their varying dedication to their high-yield mandate. As energy stocks began to rise, NUDV lagged the pack by virtue of tethering its portfolio weights to the broad market. UEDV performed better, but still fell behind ESGS, which had the most aggressive high-yield mandate.

What Fuels Their Performances

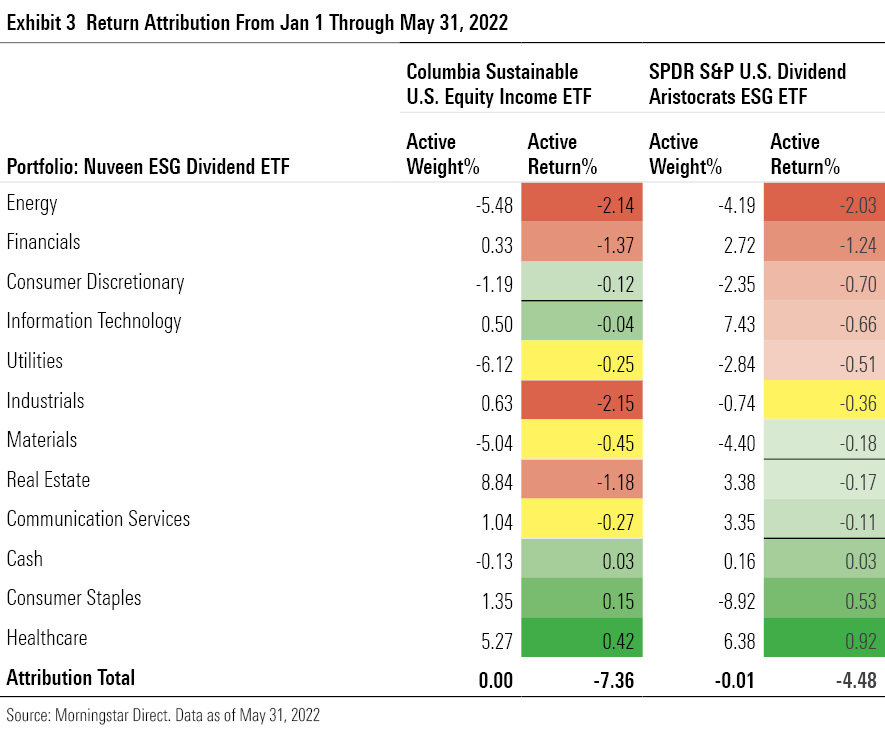

Exhibit 3 presents a more granular breakdown of these performance gaps. I ran the return attribution for NUDV against ESGS and UEDV from Jan. 1 through May 31, 2022.

The energy sector was indeed a major headwind for NUDV in comparison with the other two funds. Its selection of industrials stocks was also a source of underperformance against ESGS. As NUDV excludes companies involved in weapons and firearms, its performance also suffered by excluding many of the defense contractors that benefited from geopolitical tension in February 2022, such as Northrop Grumman NOC or Huntington Ingalls.

Buyers Beware

While dividend and ESG investing are not mutually exclusive, they are not complementary. The stocks with the ESG credentials that investors want often don’t pay the dividend they want, and vice versa. Balancing the two requires compromise, which we have examined here.

In broader terms, balancing ESG with any traditional investment factors will require investors to make a similar trade-off. With so many different interpretations of ESG standards and no cohesive disclosure requirements, ESG investors need to perform thorough due diligence before taking the plunge on any fund marketed as “ESG.”

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)