Which of the Largest Stocks Are Undervalued?

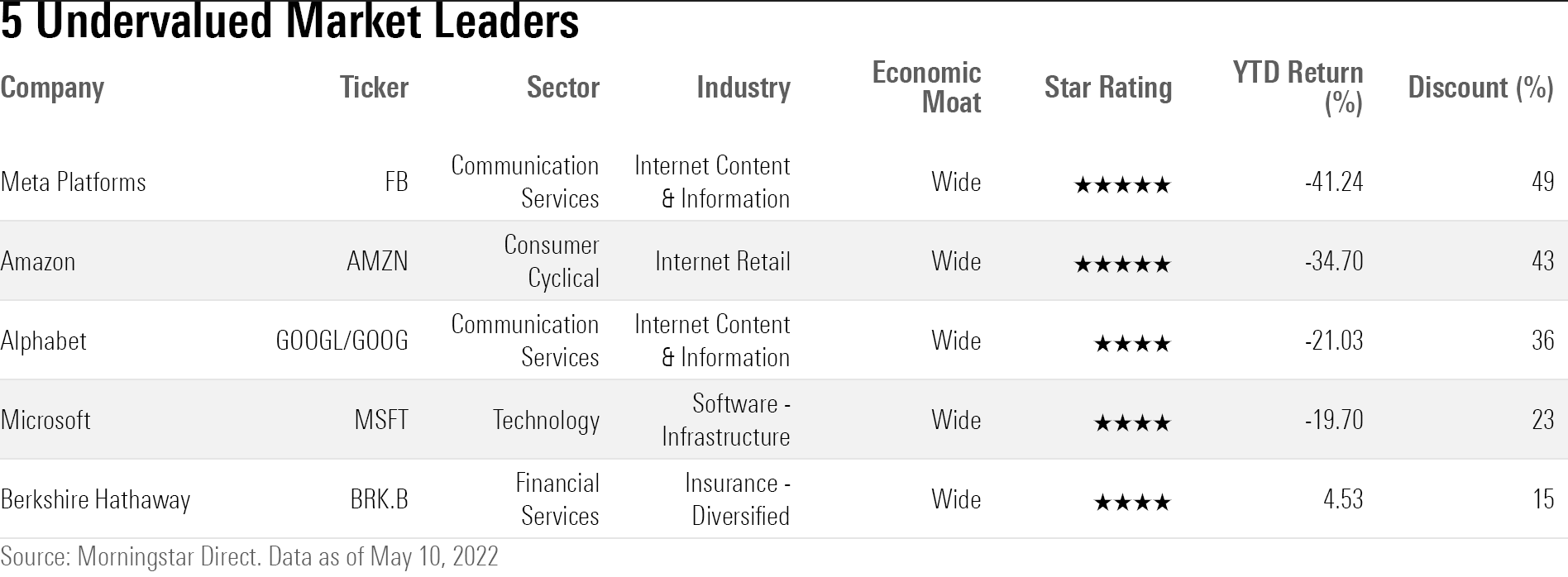

After the market’s decline, five of the biggest names are now undervalued.

The stock market selloff in 2022 has inflicted losses across much of the market, and that includes the biggest and best-known names.

Eight of the 10 biggest stocks by market capitalization are down so far this year by an average of 24.6%. Berkshire Hathaway BRK.B and Johnson & Johnson JNJ are the only names in positive territory.

The good news for investors is that means some of these industry leaders are the most undervalued they've been in years. Semiconductor giant Nvidia NVDA is trading at its largest discount to Morningstar’s fair value estimate in our history of following the stock. Tesla TSLA now trades around its fair value.

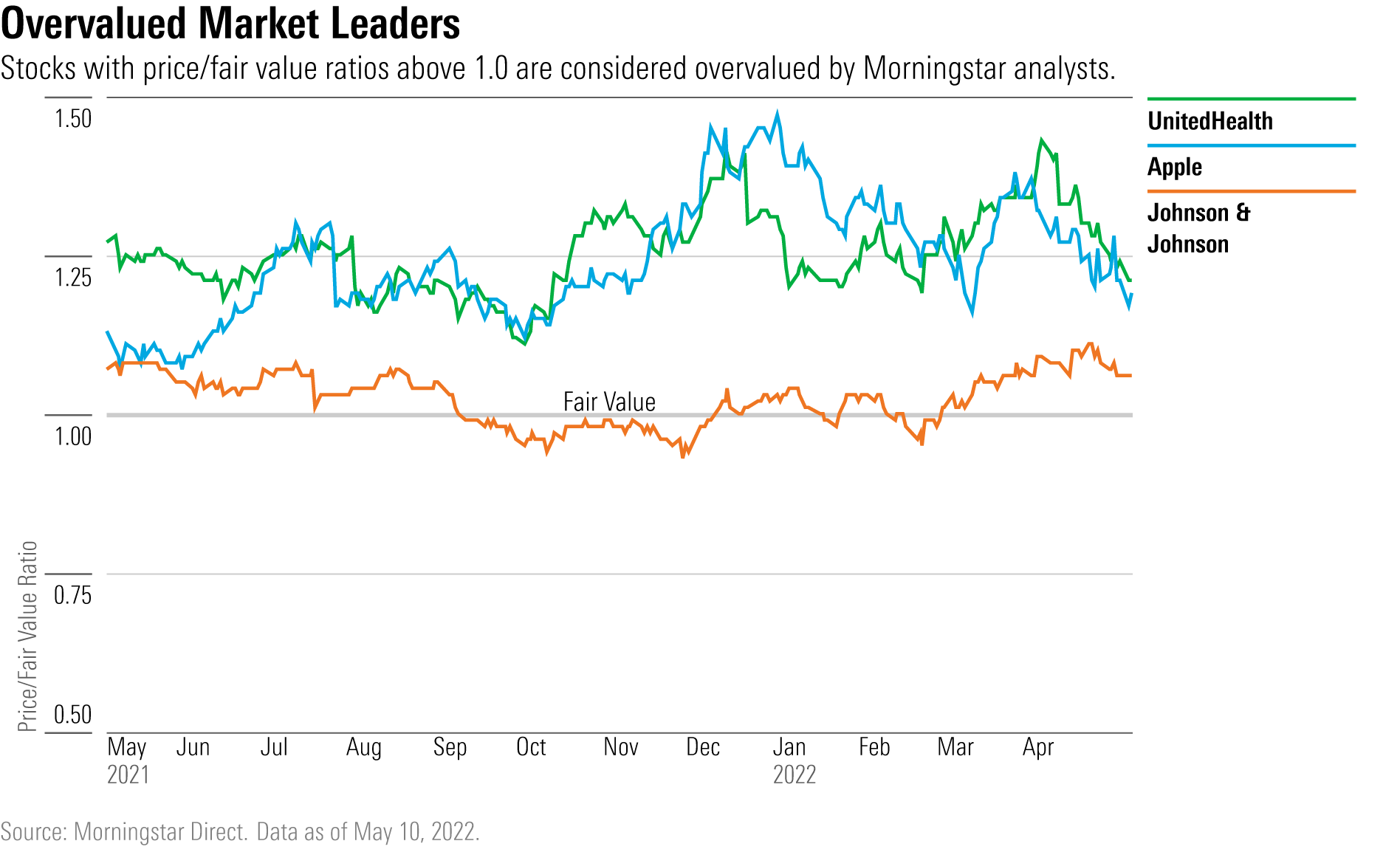

Not all of the big 10 are buying opportunities. Three remain overvalued: UnitedHealth UNH, Apple AAPL, and Johnson & Johnson. Nonetheless, these stocks have still fallen from their recent highs and moved closer to Morningstar analysts’ fair value estimates.

Here’s a closer look at the largest stocks and Morningstar’s take on their outlook:

Meta Platforms FB

Meta Platforms is one of two stocks among the largest 10 companies with a 5-star Morningstar Rating. Shares plunged in early February after a miss on fourth-quarter earnings per share and revenue estimates after the company started to heavily invest into the so-called metaverse.

Even after reducing his fair value estimate to $384 in response to lower-than-expected first-quarter revenue, Morningstar senior equity analyst Ali Mogharabi still sees the stock as undervalued.

“While Meta continues to focus on metaverse opportunities in the long run, it is also increasing its efforts and investments in its very profitable advertising business to overcome obstacles created by Apple and position itself to benefit from the growing short-form video trend,” he says. The company also showed an uptick in daily active users, which briefly sent shares up, but it remains 49% undervalued.

Amazon.com AMZN

Amazon shares slid 34.7%, due in part to the e-commerce giant posting a loss for the first quarter, its first quarterly loss in seven years. That was fueled by a $7.6 billion pretax loss from its stake in electric automaker Rivian RIVN. Inflation, overstaffing, and underutilized capacity also ate into profitability. Additionally, management set guidance for the second quarter below the expectations of Morningstar senior equity analyst Dan Romanoff.

In response to lower growth and profitability estimates, Romanoff cut his fair value estimate to $3,850 from $4,100. Despite this, the company remains 43% undervalued. Romanoff sees improvements in the second half and opportunities for long-term growth, especially with Amazon Web Services and the company’s advertising business.

Alphabet GOOGL GOOG

Alphabet, the parent company of Google, is down 21% this year, with shares now trading at a 36% discount to the company’s $3,600 fair value estimate. Results for the first quarter were mixed, with revenue coming in lower and margins higher than Wall Street estimates.

Alphabet saw 23% year-over-year growth in revenue, driven by a 20% rise in advertising revenue and a 44% increase in cloud services. However, those results were offset by a deceleration of YouTube’s advertising revenue growth, Morningstar's Mogharabi says.

Despite this, the senior analyst says Alphabet is trading at an attractive price for investors. While management sees the slowdown in YouTube’s revenue trend continuing in the second quarter, Mogharabi says growth may accelerate in the fourth quarter.

“Viewership has not been affected by competitors, as according to the firm, YouTube has maintained its more than 2 billion monthly active users, which we believe will continue to attract content creators," Mogharabi says. "Also, YouTube Shorts, the effort to battle TikTok, is progressing, attracting more than 30 billion views per day, which is four times greater than last year.”

Microsoft MSFT

Microsoft shares have shed 19.7% this year as the market sold off on riskier assets. However, the fundamentals behind the company are still strong despite recent headwinds, Morningstar's Romanoff says.

“Microsoft remains impressive in its ability to drive both growth and margins at scale, and we think there is more to come on both fronts,” Romanoff says. Even with rising inflation, a growing currency headwind, licensing practice changes, and supply chain issues, Microsoft’s first-quarter revenue and EPS results came in slightly higher than Romanoff’s expectations.

“Key pillars of our growth narrative from the quarter included year-over-year growth as reported in Azure of 46%, Dynamics 365 of 35%, and LinkedIn of 34%,” he says. Operating margin also increased to 41.4% from 40.9%.

Romanoff values Microsoft at $352 per share, leaving it 23% undervalued.

Berkshire Hathaway BRK.B

Berkshire Hathaway reported weaker pretax income than expected during the first quarter, says Morningstar financial-services sector strategist Greggory Warren. Unlike most of the other market leaders, Berkshire rose 4.5% this year. Despite that gain, the company is still slightly undervalued.

Warren sees Berkshire’s biggest problem in the past few years as being its inability to reinvest retained earnings in anything other than cash or cash-equivalent securities. The first quarter showed a major reversal of the firm’s cash-hoarding behavior of the last few years. It invested about $51.1 billion in equities during that period.

“Looking back historically, Berkshire has not been this significant of a net buyer of common stocks during any quarter that we could find over the past 15 years,” Warren says. Recent acquisitions include a stake in HP HPQ, Occidental Petroleum OXY, and Alleghany Y. These purchases were the driving force for Berkshire’s fair value increase in April, when Warren raised his valuation of the company to $367 from $350 for its Class B shares. Berkshire is now 15% undervalued.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D653LVS4SJBYREMM6W6TGIX2DQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)