The Winners Take It All in Liquid Alternatives

Liquid alternative strategies saw big inflows in 2021, yet only a small handful earned the spoils.

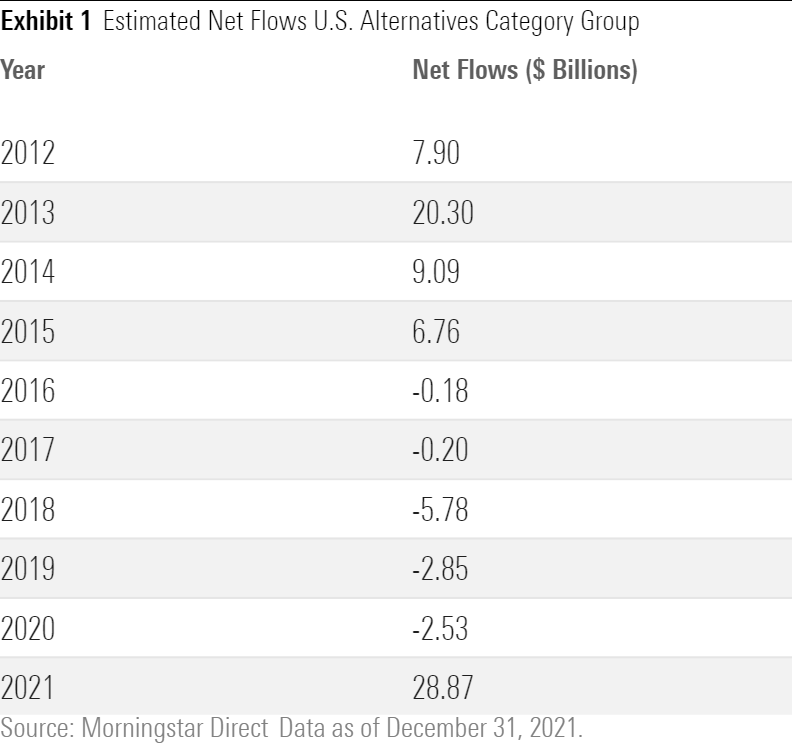

Morningstar’s 2021 Global Liquid Alternatives Landscape report noted that a new generation of liquid alternative strategies that aimed to deliver where the pioneers had failed might be primed to gain traction. The headline fund flow numbers from last year seem to back this up. Exhibit 1 shows $28.86 billion of inflows into the sector during 2021. Every liquid alternative category got inflows, at a level not seen in over a decade. In fact, 2021 alone exceeded liquid alternatives’ cumulative flows since 2013. Investors concerned about inflation, potential interest-rate increases, and market frothiness after the S&P 500’s 1990s-beating 363% cumulative rise in the decade through December 2021 may be seeking ways to limit their downside risk while remaining in the game or to damp losses if the tides turn. Another $2.96 billion went into the nontraditional equity Morningstar Category--long/short and derivative income funds--which previously had been included with liquid alternatives.

Inflows Across the Board

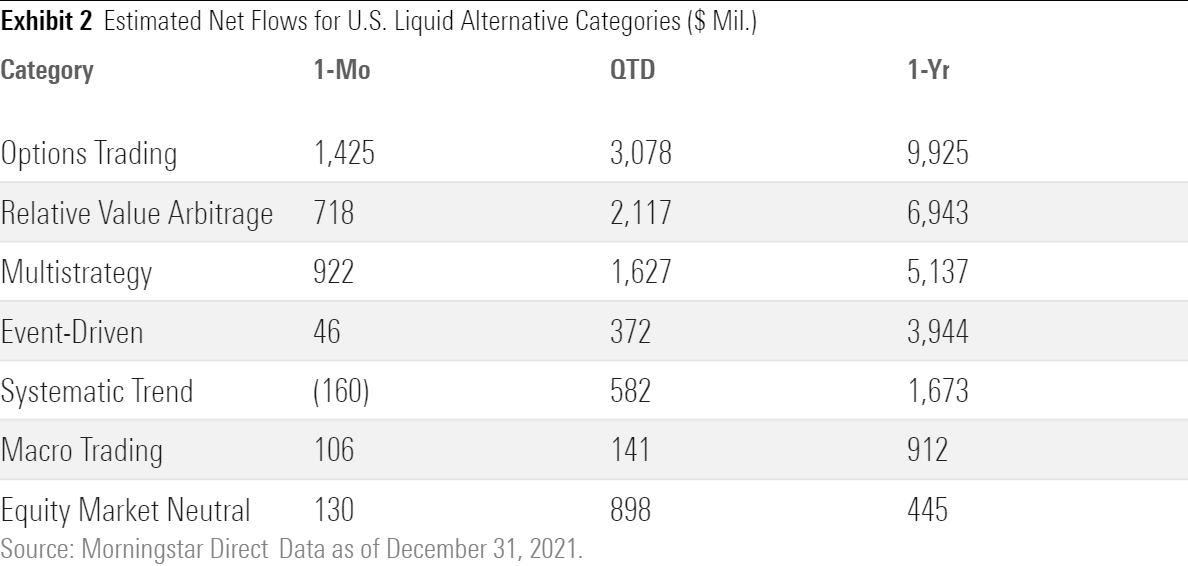

As Exhibit 2 highlights, all liquid alternative categories gathered inflows, with options trading and relative value arbitrage gaining the most. Although it’s a still a diverse group, the options trading category can be considered a generic moniker for hedged equity strategies. These funds use options to adjust their return profiles to allow investors to remain in the stock market while reducing downside risk. Relative value strategies take this a step further by trying to offer independent sources of income or alpha by seeking pricing discrepancies between related securities.

The Lions Grab Their Share

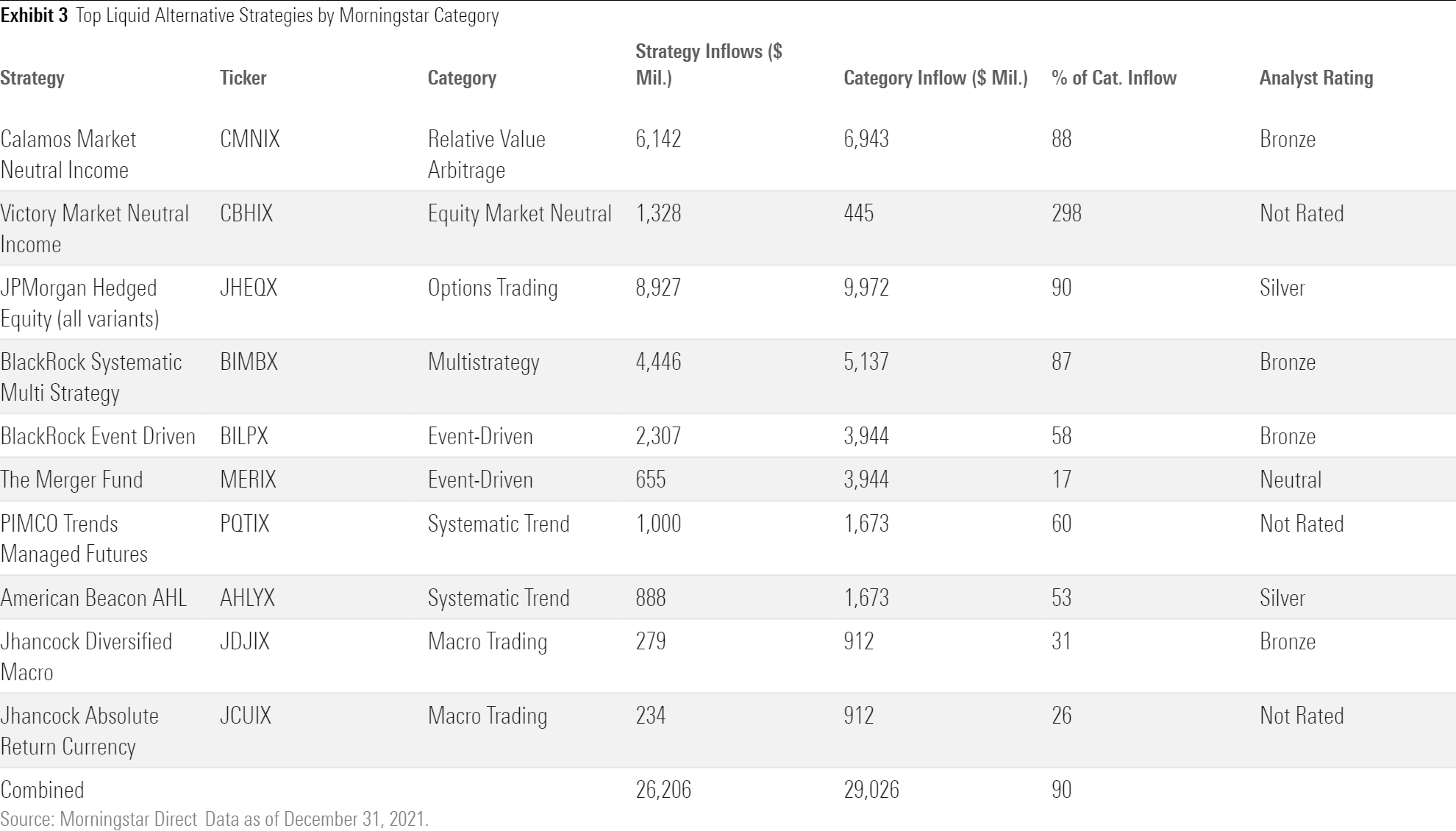

While this appears rosy for alternatives in general, a deeper look at each category shows some clear winners. Exhibit 3 shows the strategies with the most flows within each category. These 10 strategies accounted for 90% of the alternative funds’ 2021 inflows.

Each of the funds in Exhibit 3 is also the largest or second-largest fund within its respective category--in some cases, several billion dollars larger than the next-largest peer. The trend of the largest funds in a category dominating net flows has been a consistent trend year after year. In an area where lots of small alternative funds come and go, investors often opt for options whose scale suggests they may have more staying power.

Performance Chasing or Repositioning?

Morningstar’s 2021 Global Liquid Alternatives Landscape listed the top 10 challenges investors faced with the first generation of liquid alternatives. One of which was that chasing performance had been rampant, causing wild swings in asset flows among funds and in and out of the asset class. At times, flows have pursued the next fancy strategy, only to dramatically exit once performance stalled. The so-called “investor gap,” or difference between investor returns (also known as dollar-weighted returns or internal rates of return) and reported total returns, had been estimated at 100 basis points annualized for the nearly 800 U.S. and European liquid alternatives funds for which data was available.

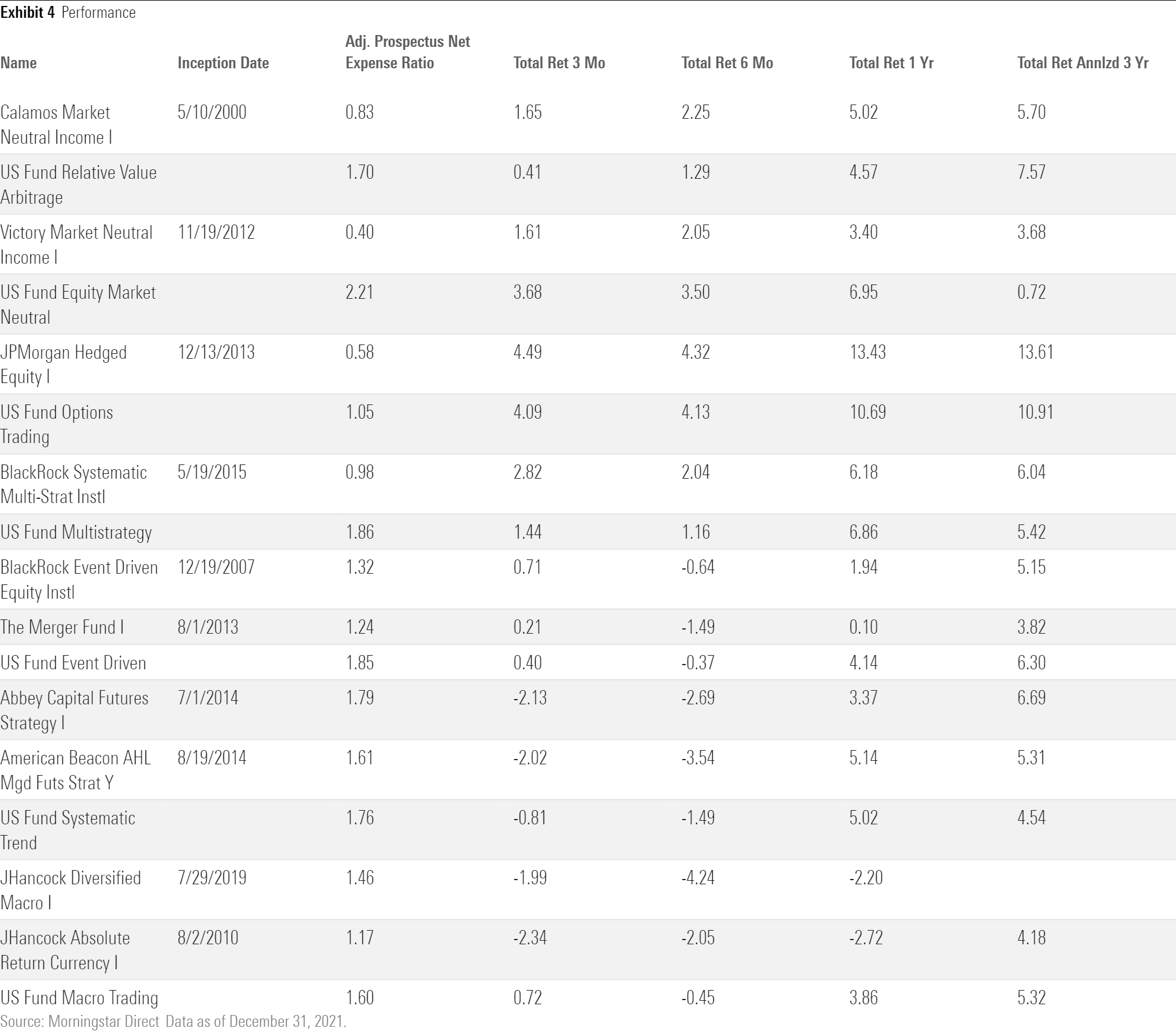

It is hard to draw solid conclusions from the point in time data shown in Exhibit 4, but a pattern emerges: Strongly performing categories--including relative value arbitrage, options trading, and multistrategy--dominated 2021 inflows. These categories provide greater clarity on the expected investment profile than the more alpha-seeking ones.

Weaker-performing categories, such as systematic trend, macro trading, and equity market neutral, had the least inflows. That these groups still received inflows still supports the theory that investors are positioning themselves for a potential downturn. The landscape report classified both the systematic trend and macro trading as “opportunistic,” or strategies that can follow the markets up, but quickly reverse direction to follow, and benefit, from markets when things head south. Both kinds of strategies utilize the full breadth of equities, bonds, currencies, and commodities offering a valuable source of diversity when equities fail.

Consistent with the industrywide trend toward lower fees, the 10 strategies receiving the largest inflows are all cheaper than their respective category averages. All things being equal, investors will opt for the cheaper fund.

Liquid alternatives offer a variety of solutions for investors seeking to adjust their portfolios in more-challenging markets. In an area where the median age of a liquidated fund is little more than four years, and with 59% of strategies in our database coming to market since 2015, its understandable that in uncertain times investors and their advisers would seek comfort in the tried and tested. Many of the strategies garnering strong inflows now have a track record of between seven and 11 years. There is life in the old generation yet.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)