Investors Shun Portfolio Diversifiers as They Hedge Their Bets

AQR dominates third-quarter returns, but J.P. Morgan takes the spoils.

Our quarterly Liquid Alternatives Observer highlights a positive third quarter for net fund flows, but it was a bifurcated marketplace. With equities and bonds both negative for the quarter, there was a clear split between uncorrelated liquid alternatives and those nontraditional categories that contain traditional market betas in modified form.

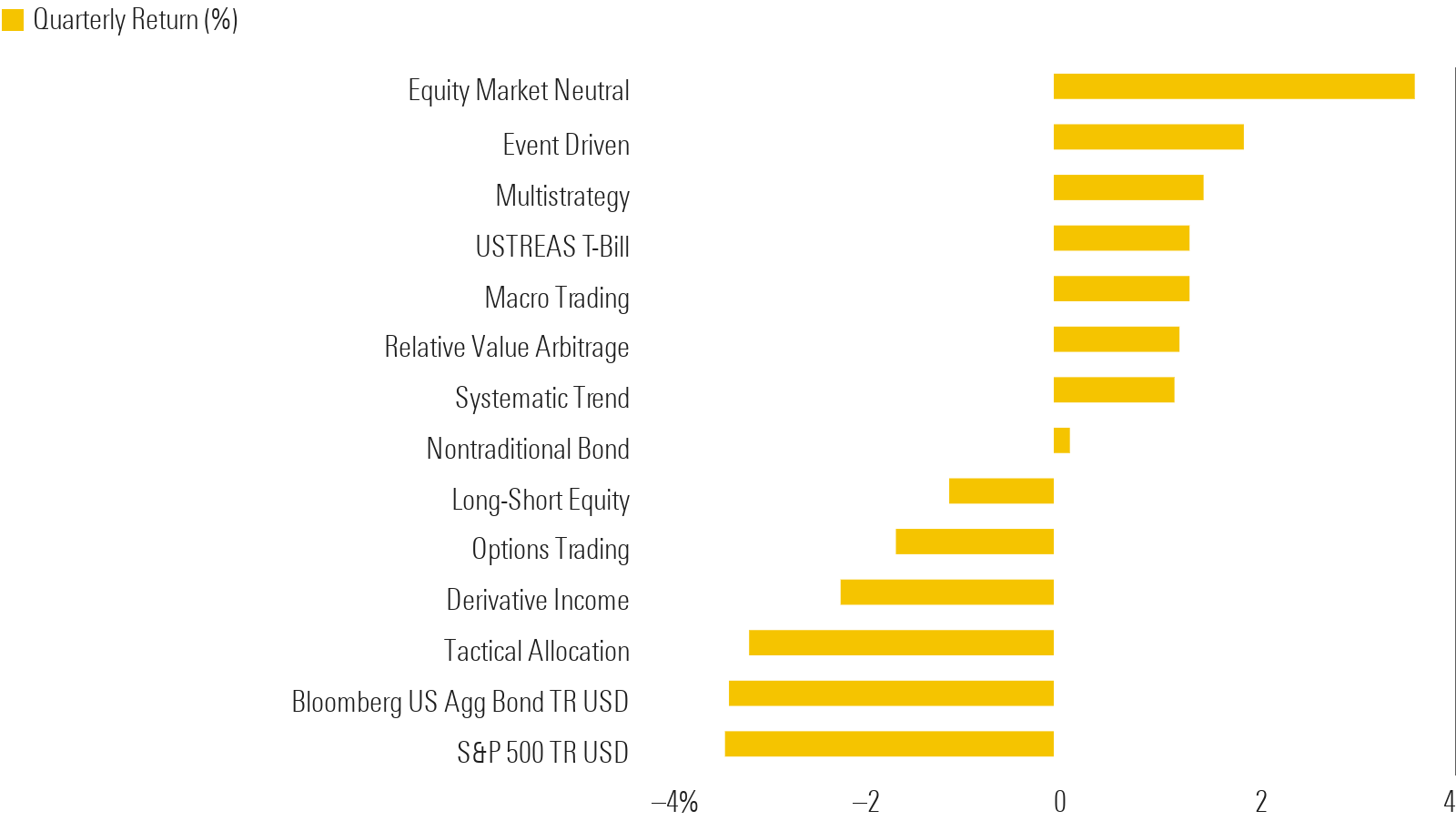

Though every liquid alternatives category turned positive, along with some individual strategies that posted double-digit gains for the quarter, every nontraditional equity category posted negative returns. That may not be a huge surprise, as the much higher equity and bond sensitivity of the nontraditional cohort would naturally deliver weaker returns when markets retreat.

Q3 Returns by Morningstar Category

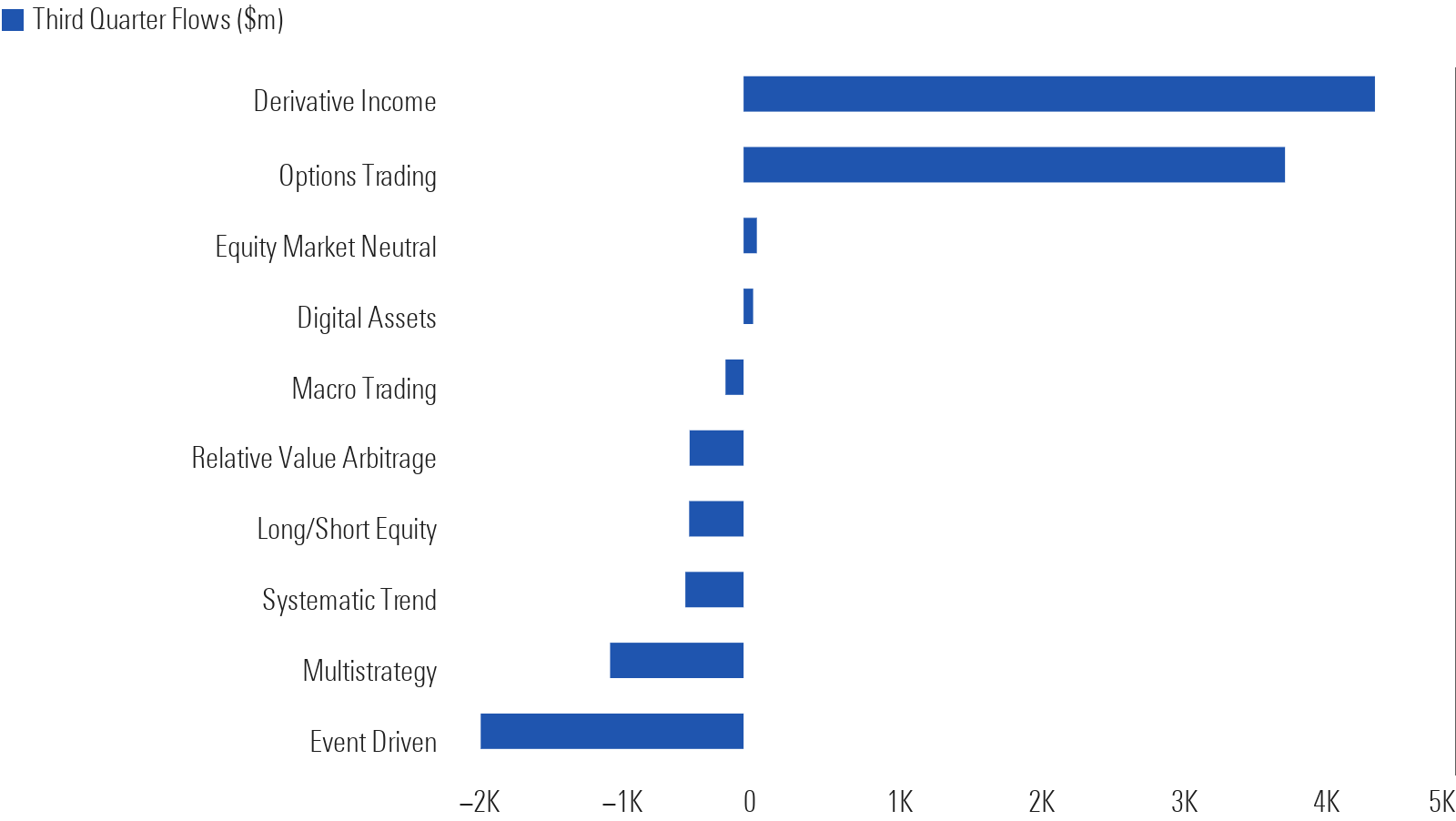

Against that backdrop, though, every one of the Morningstar Categories representing these uncorrelated strategies saw outflows. Nontraditional equity strategies, however, experienced the opposite. These strategies, which were among the weakest performers during the quarter, were by far the winners in receiving new investor capital. Were investors being contrarian or are they psychologically preparing themselves for a dark winter?

Q3 Liquid Alternatives Flows by Morningstar Category

Negative Sentiment Weighing on Investors

The backdrop of the third quarter was generally negative. Central banks’ signaling of “higher-for-longer” interest rates led to the U.S. 10-year note rising to its highest level since 2007. The hawkish tone of the Federal Reserve drove the U.S. dollar higher, rallying against the other major currencies, particularly the Japanese yen. Woes in the Chinese property sector led to an interest-rate cut, and weather forecasts talked up the impact of the El Nino weather pattern.

Updates from managers didn’t signal any new opportunity sets arising. Event-driven funds did at least see some green shoots appear after a muted year for deal flow after global regulators cast a shadow of uncertainty over the category. Special-purpose acquisition companies, or SPACs, have become prominent in recent years as they balance out the ebbs and flows of corporate activity. But with that part of the sector in runoff, and with little new issuance since 2021, investor optimism has faded, and event-driven managers saw the greatest outflows over the quarter. Convertible bond issuance has been ticking up during 2023, and the relative attractiveness for those raising capital is starting to look more favorable. While coupons on these new issues are higher for those trading convertible arbitrage strategies, the rise in the VIX over the quarter weighed on options pricing while suppressed equities caused the bonds to trade, well, like bonds.

Directional equity strategies have had a hard time of it. The stock market rally in the first half of the year challenged the resilience of those with material short positions, many of which were unwound at a fast pace early in the quarter. Managers have chosen to either maintain high net long positions or reduce overall market exposure. With the subsequent pullback in equity markets, relative sensitivity was a key determinant of quarterly performance.

Systematic-trend and macro-trading managers, the two categories with the deepest toolkits, clawed back first-half losses from net short exposures to fixed income. In more-niche markets, the larger trend-followers benefited from being short carbon emissions and European power contracts. Strategies with the ability to utilize commodities saw results from soft commodities, such as sugar and cocoa, as dryer conditions were forecast. In currencies, most caught the relative U.S. dollar strength against the majors, but those who veered into emerging-markets currencies gave back some of those gains. Investors, as highlighted in our article “Market Wizards Wave Their Wands but Investors Miss the Magic,” had already started redeeming these strategies earlier in the year.

Options Strategies Meet Changing Needs

With bonds being challenged and investors getting whipsawed by their own behavior in diversifying strategies, many have sought out options strategies to bring greater certainty to portfolio outcomes. Hedged equity strategies from the options-trading and derivative-income categories soared in popularity, with over $8 billion flowing into these categories during the quarter.

On the one side, yield hunters, seeing the fluctuating capital return on fixed income, sought to receive income from the use of derivatives rather than the bond market. We wrote about the merits of this approach in “Should You Own a Covered-Call ETF Like JEPI?” On the other side are those who see some headwinds for growth assets and are positioning accordingly. The options-trading category sees managers use a variety of techniques to enhance return by swapping the equity risk premium for the volatility premium. Equity sensitivity reduces to around 45% of the market, mitigating drawdowns while keeping one toe in the water.

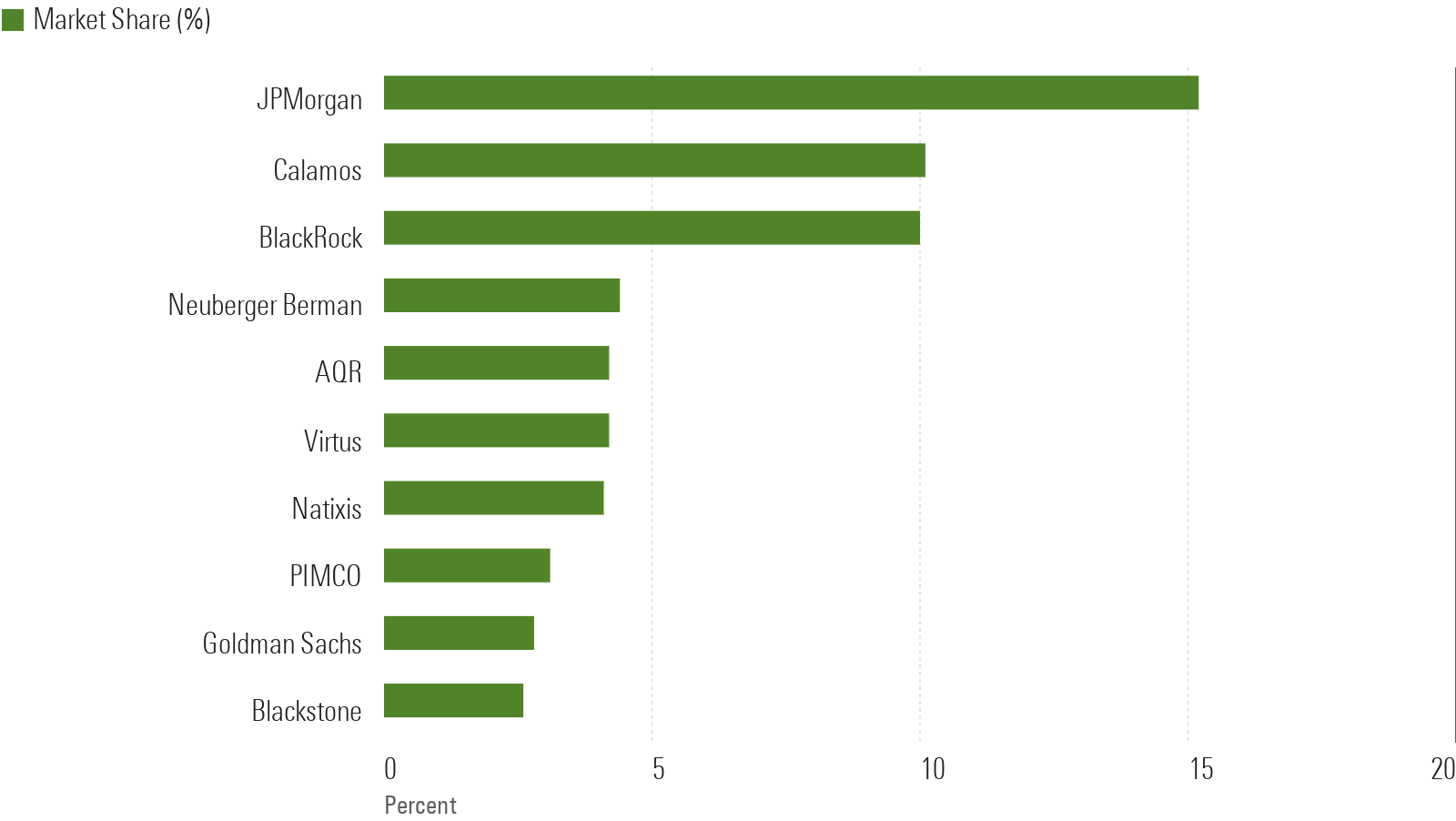

Top 10 Firms by Market Share in Alternatives Mutual Funds

AQR Delivers, but the House of Morgan Benefits

The primary beneficiary of this change in risk appetite is J.P. Morgan. The firm dominates both options-based categories with a well-established franchise, deep distribution footprint, and reliable product outcomes. The hedged-equity product has delivered consistently on investor expectations for close to a decade now. Seven years ago, J.P. Morgan was not even in the top 10 firms by market share in alternatives mutual funds. Now, however, it is the dominant player with a market share of over 15%.

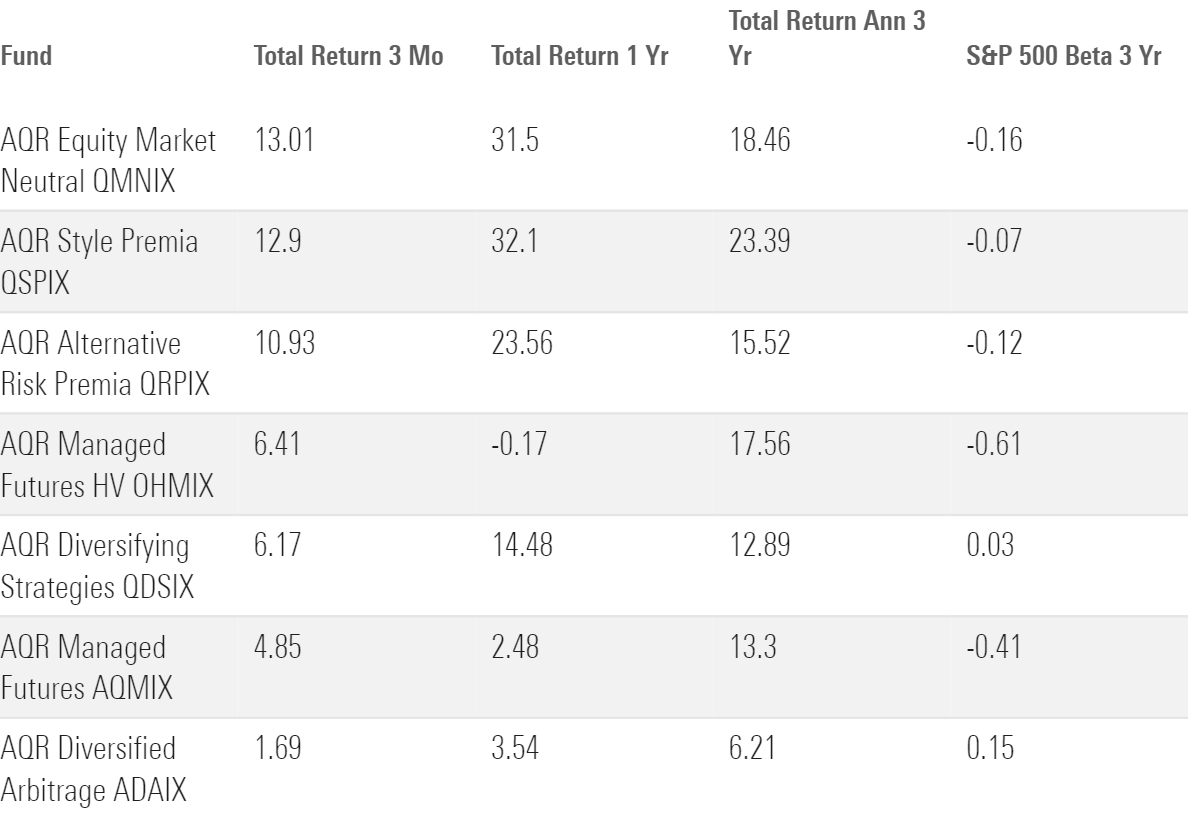

The firm that intends to reduce that dominance is the incumbent from seven years ago, AQR Capital. In June 2016, it had a market share north of 24%. AQR has flown under the radar in the past couple of years after its much-publicized struggles. A revamped lineup of both personnel and products has created a leaner and meaner machine, which resulted in its strategies being six of the seven top performers over the third quarter. Almost all strategies have a three-year annualized return in the double digits.

Returns (%) for AQR Strategies

It is an uncertain world in 2023, and protecting capital has returned as a priority for investors who don’t want to derisk with fixed income or duration. With a lack of enthusiasm on the outlook for many diversifying strategies, options-based funds have come to the fore as a means to remain invested in equities but with lower volatility and beta. Options come with a more complex valuation process, and the return profile may not be as smooth as anticipated. As with trend-following in 2022, greener pastures appear in these categories more readily than most, and investors are their own worst enemy often at the point when the anticipated payoff is finally required.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)