Is It Macro Strategies' Time to Shine?

Market shocks don’t necessarily translate into superior outcomes for these investments.

Macro strategies are the quad bikes of the investment industry: They should be fit for all terrains—even though they sometimes tip over.

As global stocks enter a bear market together with rising interest rates wreaking havoc on traditional 60/40 portfolios, investors need to rethink how they’re diversifying risk. If bonds can’t play the stabilizing role they normally do in a diversified portfolio, as many believe, it’s only natural to look at alternatives such as macro strategies to fill that gap.

Like many other liquid alternative funds, macro trading strategies' performance relative to a cautious or moderate multi-asset portfolio has been broadly positive in 2022. Yet, given their largely unconstrained mandate, it’s a relatively heterogeneous group by design.

In our latest Alternative Investment Observer, we provide an overview of a sector at a crossroads.

We share how greater return dispersion across asset classes and increased market volatility provide more opportunity for macro traders’ go-anywhere wheels. Nonetheless, market shocks do not necessarily translate into superior outcomes for these strategies. Managers still need to be on the right side of the market, or they risk being caught off-guard.

What Macro Strategies Bring to the Table

Macro strategies are best used as a complement to a broader portfolio, providing an opportunistic twist to modify, diversify, or even expand the risk footprint of a traditional portfolio.

However, the relatively high return dispersion within the macro trading Morningstar Category means investors and advisors need to think carefully about how an allocation to these strategies can be beneficial to their portfolios. While all the strategies seek to reach a similar destination, the paths they take can be vastly different.

To be successful in this area, one needs good selection and a strong dose of patience. In fact, if history is any guide, the average fund will likely continue to disappoint. Most managers fail to add value relative to a broadly diversified portfolio.

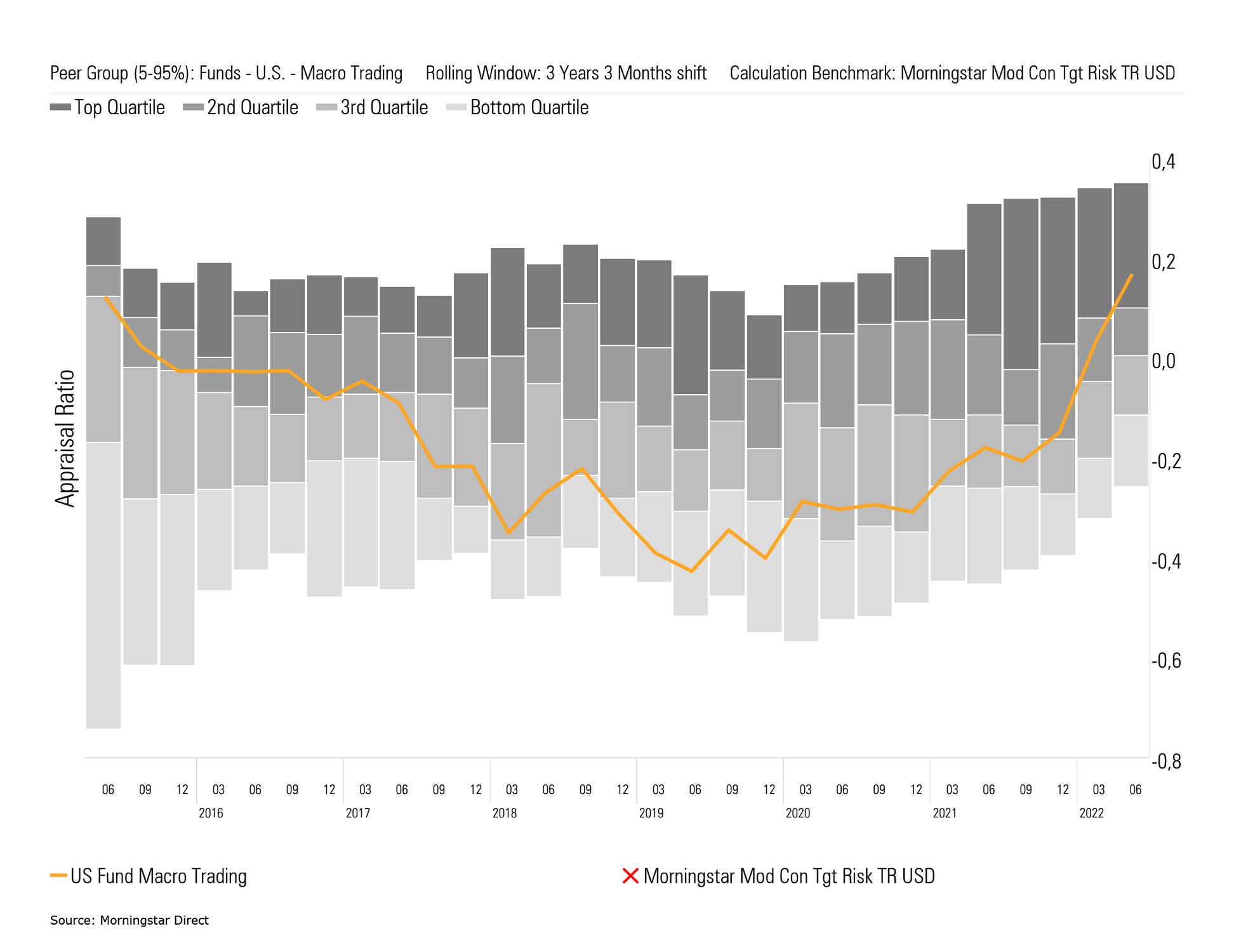

In Exhibit 1, we show the appraisal ratio (alpha divided by unsystematic risk) for the U.S. macro trading category average relative to the Morningstar Moderately Conservative Target Risk Index over rolling three-year periods, as well as the breakdown by quartiles. In other words, the exhibit measures whether the addition of the average macro trading fund would add value to a traditional portfolio.

Exhibit 1: Portfolio Additivity of Average Macro Trading Fund

The data is not entirely surprising: Like most other categories, few active managers can outperform.

But here’s the catch: Alternative funds tend to have higher mortality rates, they are complex to analyze, and it’s sometimes tricky to set the right expectations, which is a critical step that can help investors stay the course. As a result, alternatives more than any other asset class require deeper manager analysis to find beneficial holdings.

In short, macro strategies are probably not worth the pain for some investors—either because they don't provide the specific solution required, or because they belong on the "too hard" pile. But that doesn't mean there can't be good opportunities.

Wide Dispersion in Macro Strategies’ Performance in 2022

An often-used Michael Jordan quote applies more than ever in liquid alternatives: “All I knew is that I never wanted to be average.”

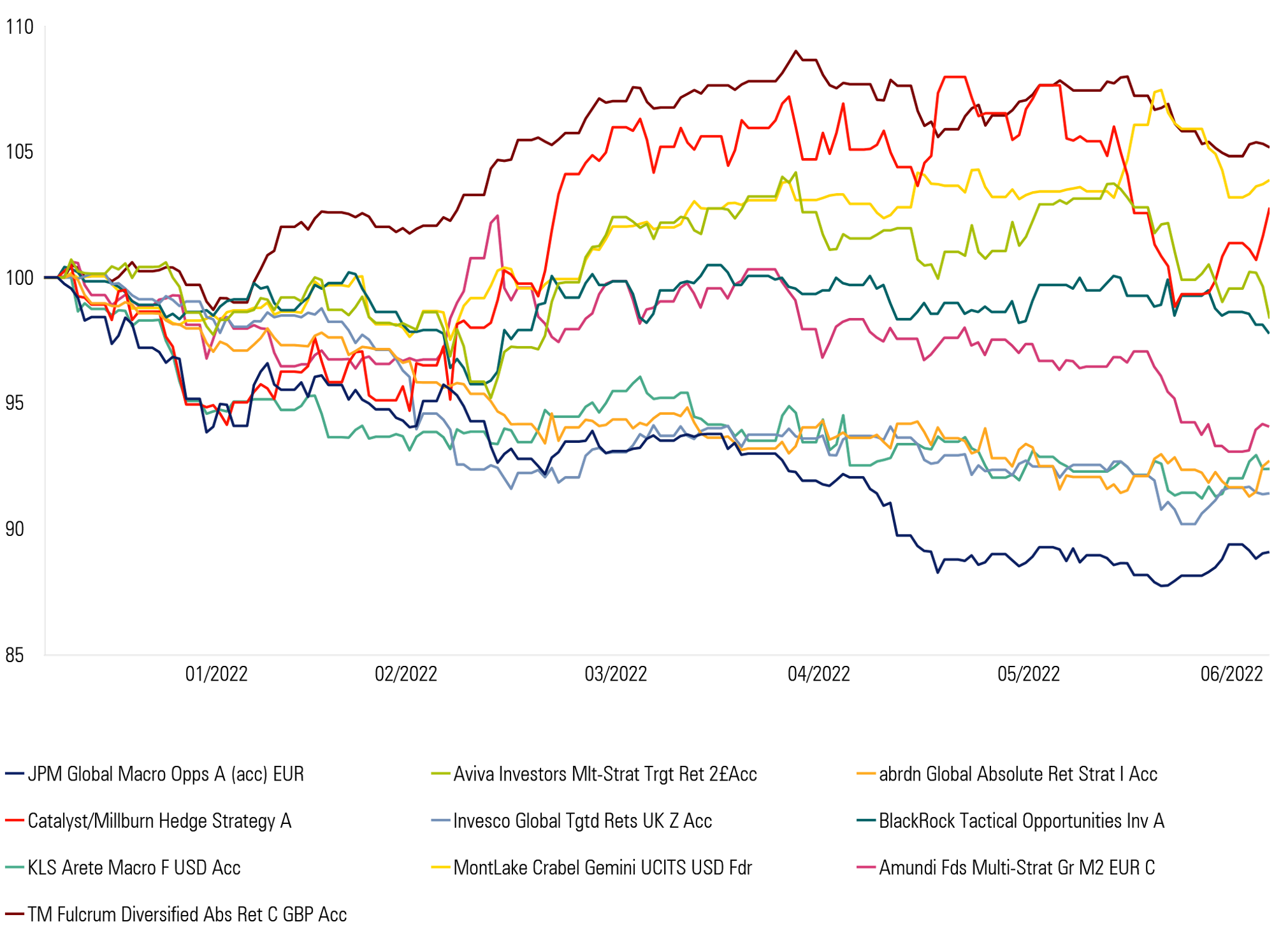

The huge dispersion in category constituents results in a category average that often is not realistic or representative of the investment choices. Indeed, macro strategies’ performance in the first half of 2022 has been far from uniform.

As shown in Exhibit 2, some have thrived and some have been caught in the cross-currents of financial markets, posting high-single-digit losses. This year provides a snapshot of what investors are in for when they approach this market.

The same dynamic is at play across the liquid alternative complex: Another example is market-neutral, where the huge factor tilts exhibited by some of the constituents can lead to vastly diverging performance patterns.

Exhibit 2: Dispersion of Individual Macro Trading Strategies

Source: Morningstar Direct. Data as of July 1, 2022. Data in base currency.

Where Macro Strategies Fit in a Portfolio

"Do or do not. There is no try." —Yoda, a long time ago

Yoda’s teachings have significance for alternative funds, too. Too often, investors approach the sector with the goal to get their timing right, even though a hands-on, tactical approach to diversification often proves to be a fool’s errand.

A more robust approach entails focusing on one’s own goals, preferences, and risk tolerances.

Generally, alternative funds are there to provide a portfolio solution, such as insurance or risk diversification. Those seeking to maximize total wealth may be better off focusing on traditional asset classes with a buy-and-hold approach—if they can stick with it.

In short, for some investors the wealth trade-off associated with an alternative allocation will be too much, while for others it is worthwhile for some extra sleep at night. And as for dispersion, investors seeking to reduce single-manager risk can always take the additional step of diversifying their diversifiers.

/s3.amazonaws.com/arc-authors/morningstar/6696c1b7-7e6b-4f2b-b505-4ca0aaef8cd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6696c1b7-7e6b-4f2b-b505-4ca0aaef8cd3.jpg)