10 Undervalued Wide-Moat Stocks

These are the cheapest names in the Morningstar Wide Moat Focus Index--plus stocks the index has recently added and dropped.

The Morningstar Wide Moat Focus Index tracks companies that earn Morningstar Economic Moat Ratings of wide and that are trading at the lowest current market price to fair value. How has this cluster of high-quality names performed over time? Pretty well: The index has beaten the broad-based Morningstar US Market Index during the trailing three-, five-, and 10-year periods as of this writing.

With those performance numbers on the wide-moat index's side, its constituents are a fertile hunting ground for investors looking for high-quality stocks trading at reasonable prices.

In an effort to keep the index focused on the least-expensive high-quality stocks, Morningstar reconstitutes it regularly. The index consists of two subportfolios containing 40 stocks each, many of which are overlapping positions. The subportfolios are reconstituted semiannually in alternating quarters on a "staggered" schedule. We re-evaluate the index's holdings and add and remove stocks based on a preset methodology. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves rightsizing positions.

After the most recent reconstitution on Sept. 17, 2021, half of the portfolio added eight positions and eliminated eight. The Morningstar Wide Moat Focus Index now holds 40 positions.

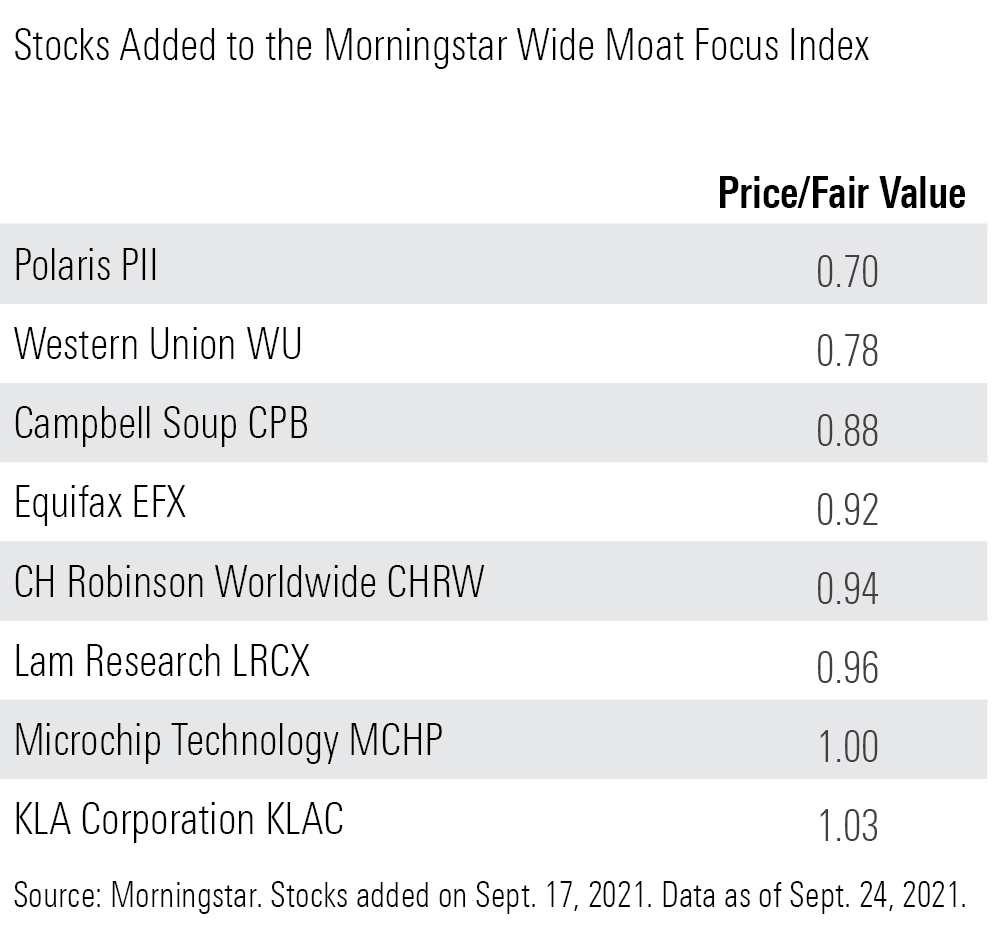

Additions

Three technology companies--KLA Corporation KLAC, Lam Research LRCX, and Microchip Technology MCHP--were added to the index.

Given its dominance in the process diagnostic and control segment of the semiconductor equipment industry, KLA is well positioned for the long-term, says strategist Abhinav Davuluri. Plus, the firm continues to charge a premium for its higher-quality, specialized products, he adds.

Lam Research is a major vendor of semiconductor fabrication tools that boasts cost advantages and intangible assets related to equipment design, explains Davuluri. We expect growth to continue based on our strong outlook for wafer fab equipment spending in the coming years.

We think Microchip Technology is one of the best-run firms in the chip space, says director Brian Colello. A leading supplier of microcontrollers, Microchip has shown an ability to generate profitability and free cash flow no matter the economic climate.

The remaining five additions hail from a hodgepodge of sectors.

Polaris PII is one of the longest-operating brands in powersports. Its well-known brands, innovative products, and lean manufacturing underpin a wide economic moat, notes senior analyst Jaime Katz. We think the company will benefit this year as it continues to backfill dealer inventory, though supply chain constraints could lead to some volatility in market share gains.

We assign Western Union WU a wide moat based on its scale advantage in the money transfer market, and we expect solid growth in the near term as the industry bounces back from pandemic-driven declines, notes senior analyst Brett Horn. However, given the firm's stagnant top line, we think longer-term prospects are limited.

Campbell Soup CPB faces cost headwinds, but we think this well-known brand is following a prudent strategic playbook focused on driving profitable growth in its meals and snacking areas, says sector director Erin Lash.

CH Robinson Worldwide CHRW dominates the asset-light truck brokerage market, notes analyst Matthew Young. Despite growing competition, we think the firm is well-positioned to capitalize on truck brokerage industry consolidation.

One of the big three credit bureaus, Equifax EFX enjoys strong operating leverage from incremental revenue, thanks to the fixed costs inherent in its business, says analyst Rajiv Bhatia. Its workforce solutions segment has been a standout in recent years, he adds.

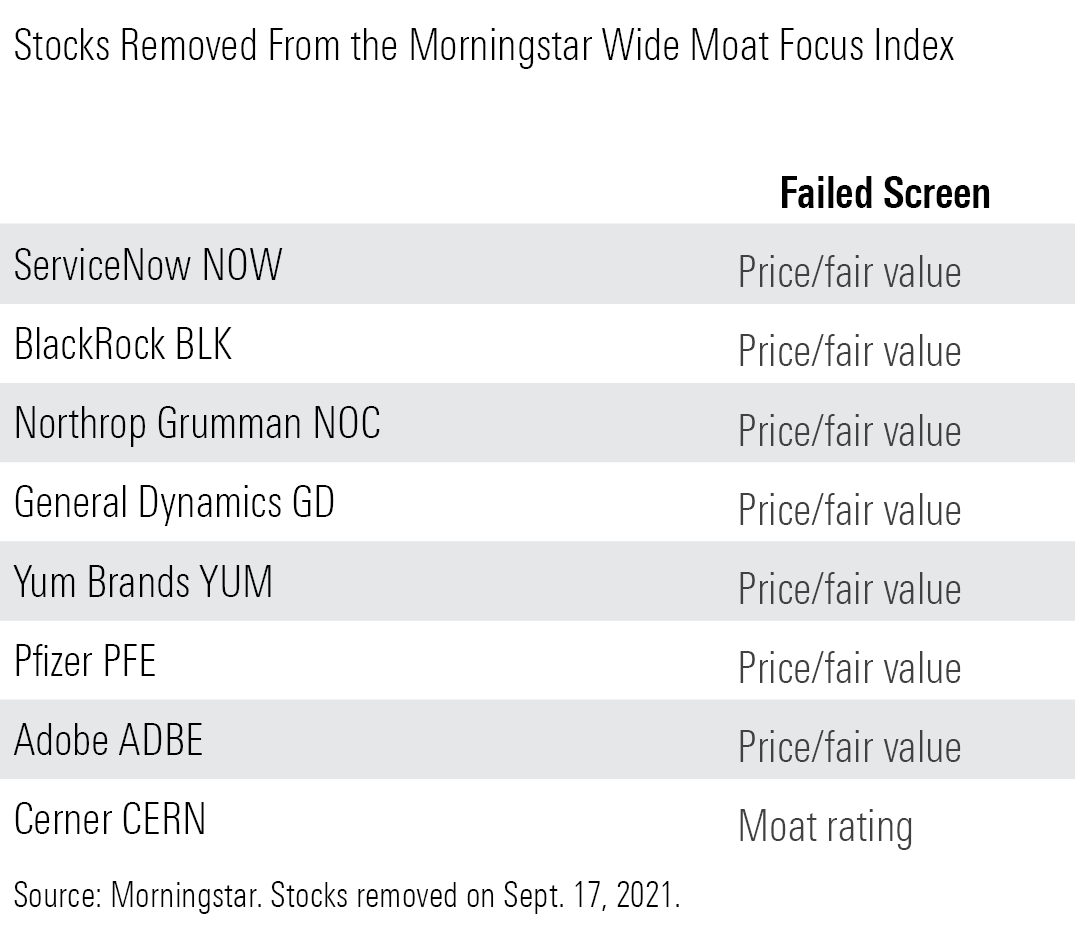

Removals

Stocks can be removed from the index for a few reasons: If we downgrade their economic moats or if their price/fair value ratios rise significantly. Most of the removals in the latest reconstitution were pushed out by stocks that were trading at more attractive price/fair value ratios at the time of reconstitution.

The exception: Cerner CERN, a long-standing leader in the electronic health record industry. We lowered our economic moat rating to narrow in June after re-evaluating the company's growth areas and recent market share losses, explains analyst Dylan Finley.

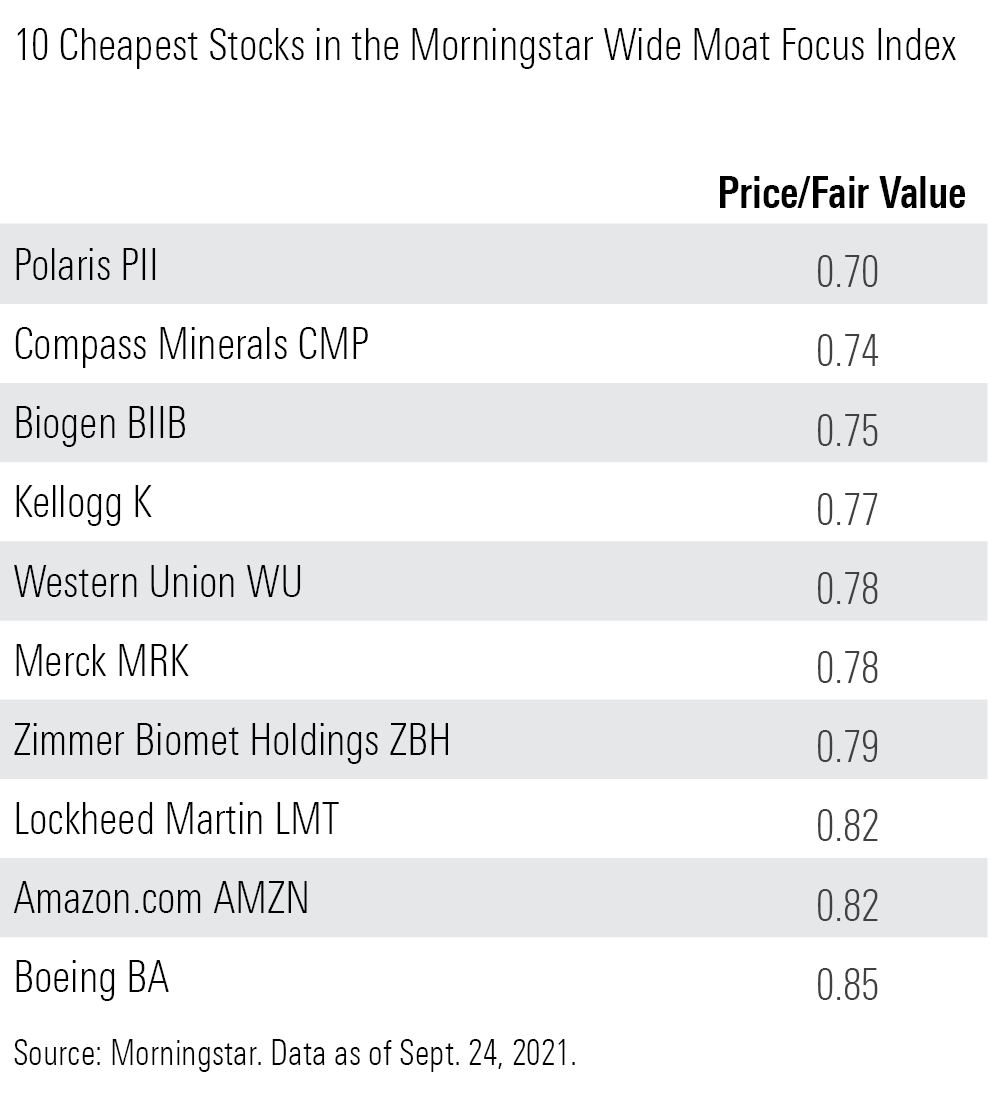

High-Quality Stocks in the Bargain Bin

Here are the 10 cheapest stocks in the Morningstar Wide Moat Focus Index as of Sept. 24.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)