Few Opportunities in Consumer Cyclical Sector

We see pockets of opportunity in powersports companies that have benefited from people's desire for outdoor activities while social distancing.

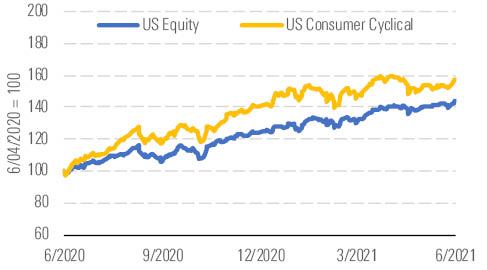

While the consumer cyclical sector had consistently outpaced the market over the past year, with trailing-12 month returns of 58% compared with 44% for U.S. equities overall, growth slowed this quarter. The sector’s more modest 5.5% return underperformed the 8.1% marks of the broader market.

Consumer cyclical continues to outpace the broader market. - source: Morningstar

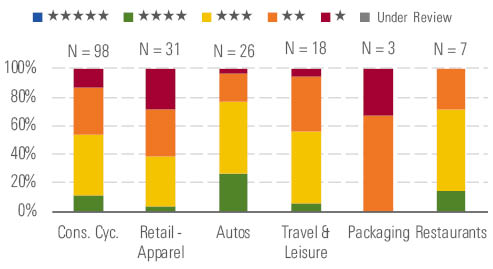

Even so, the sector remains overvalued, trading at a median 12% premium to our fair value estimates. The one exception may be vehicles and parts.

The sector offers pockets of value in clusters of the auto space. - source: Morningstar

Though we believe the subsector is fully valued, trading at a 2% premium to our assessment of intrinsic valuation, there are some pockets of opportunity, especially among powersports companies we cover, which have benefited from people’s desire for outdoor activities while social distancing.

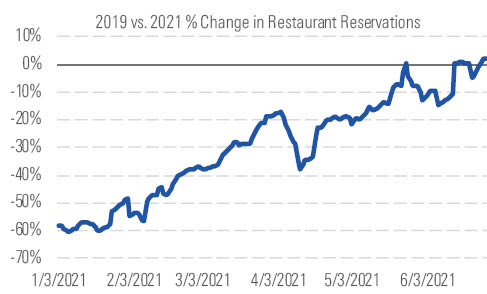

However, as more states have fully reopened, we think consumers, many of whom have excess savings after a year at home, will jump at the opportunity to return to in-person dining this summer. Data from OpenTable shows that average weekly restaurant reservations have been steadily increasing since the beginning of the year compared with 2019, with a slight dip in late March when some restrictions were reimposed.

Restaurant reservations set to surpass 2019 levels in short order. - source: Morningstar

In recent weeks, reservations have matched 2019 levels, indicating that increasing vaccinations and nice weather have eliminated much of the hesitation around eating out, and we anticipate this upward trend will continue.

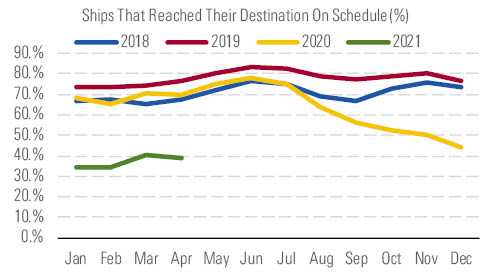

After months of missing regular activities, spenders may decide they want the more immediate satisfaction of experiences like bars, casinos, and travel, as opposed to the delayed gratification of packages they won’t see for weeks or months. Massive delays in the global shipping business have exacerbated wait times for other discretionary goods for the home or leisure. According to Sea-Intelligence, the percentage of ships reaching their destinations on time has dropped below 40%, nearly half what it was in 2019.

Shipping reliability has dropped to nearly half of 2019 levels. - source: Morningstar

As a result, we expect the next few months to be strong for the travel and leisure businesses and restaurants we cover, while retail may drop off in response.

Top Picks

Hanesbrands HBI Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $25 Fair Value Uncertainty: Medium

We believe narrow-moat Hanesbrands, currently trading at a roughly 25% discount to our $25 per share fair value estimate, offers a good opportunity for investors. The firm’s strong first-quarter results exceeded both our revenue and operating margin expectations, and its recent investor day gave us more insight into its new strategic plan, Full Potential. We view the plan favorably, particularly its emphasis on growing athleisure brand Champion, and think the firm is in capable hands under former Walmart executive Michael Dastugue, who took over as Hanes’ CEO in August 2020.

Malibu Boats MBUU Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $97 Fair Value Uncertainty: High

Trading at a 24% discount to our fair value estimate, narrow-moat Malibu Boats is an excellent opportunity for investors looking to capitalize on the ongoing powersports craze. Though it boasts a smaller market capitalization than some competitors in the powersports category, Malibu has made a name for itself as a top-notch innovator and serial acquirer (most recently adding Maverick Boats in 2020). While Malibu experienced some supply chain issues in the third quarter, which could persist, we surmise that these concerns will be transitory and that the firm’s substantial backlog positions it for robust shipment growth through calendar 2022.

Polaris PII Star Rating: ★★★★ Economic Moat Rating: Wide Fair Value Estimate: $173 Fair Value Uncertainty: High

Wide-moat Polaris also offers good value, trading at around a 23% discount to our $173 fair value estimate. The company's favorable brands, innovative products, and lean manufacturing support the firm's wide economic moat. We think Polaris will continue to capitalize on its research and development, solid quality, operational excellence, and acquisition strategy to grow demand. Polaris has historically generated topnotch returns on invested capital, including goodwill, and should be able to deliver around 45% metrics by 2030, well above our 9% weighted average cost of capital assumption.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)