Vanguard Mishap Leads to an Estimated $200 Million Windfall for Investors

Execution missteps in its Nevada 529 plan resulted in an exposure to stocks that was an eye-popping 20 percentage points more than investors expected.

This article was updated on April 22, 2021, to indicate that Vanguard has taken sole responsibility for crafting the unintentionally riskier allocations in The Vanguard 529 Plan.

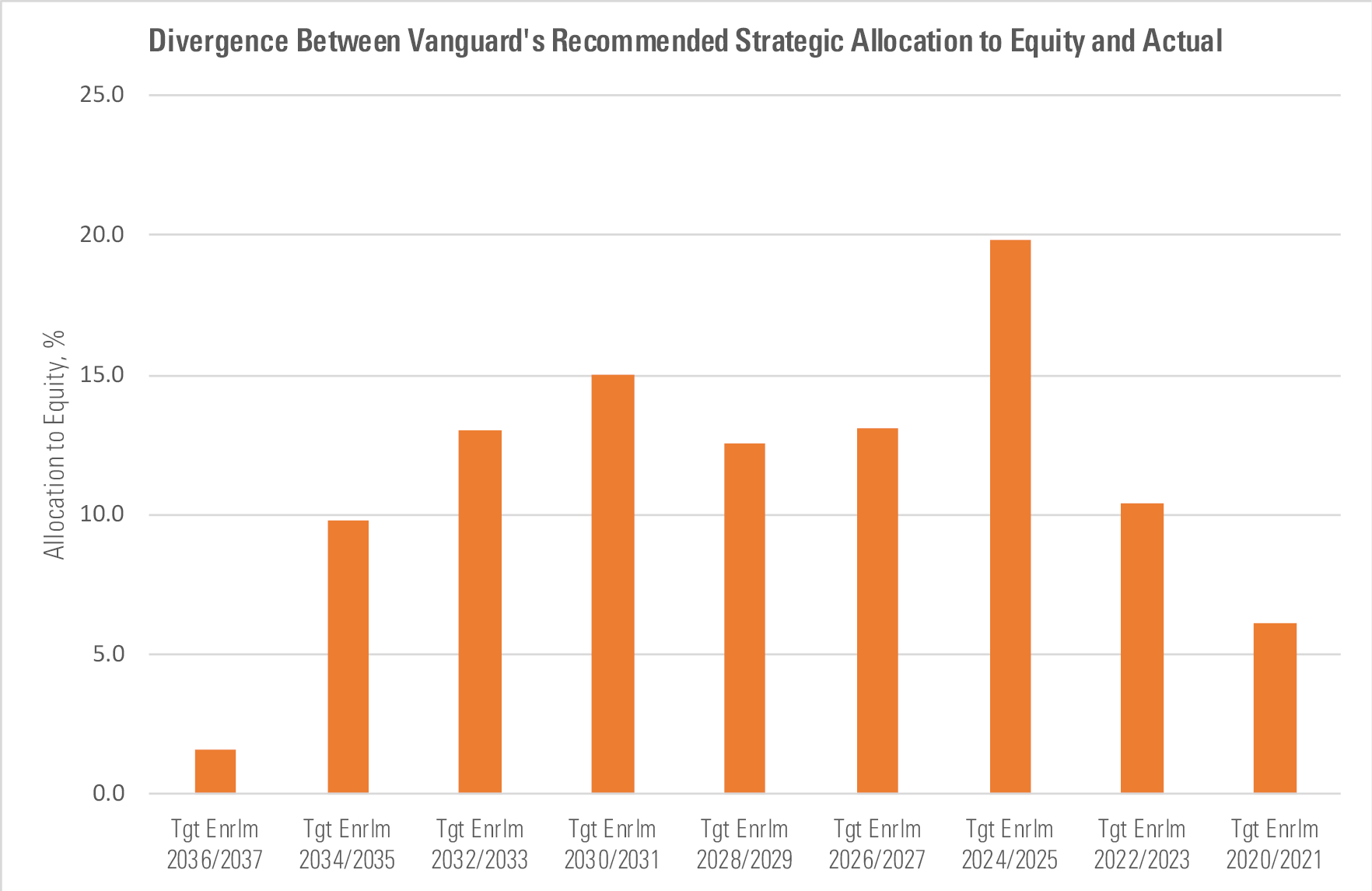

Education savers in The Vanguard 529 Plan got a lucky boost that may have amounted to over $200 million when an error led to them getting more equity exposure than they signed up for as equity markets rallied in late 2020 and early 2021. Vanguard unintentionally crafted riskier asset allocations for a suite of new portfolios developed to supplant the Nevada-sponsored plan's popular legacy suite of age-based portfolios. Last October, Vanguard applied these misguided recommendations, leaving accountholders in these new portfolios exposed to up to 20 percentage points more in stocks than they had bargained for, placing $12.5 billion of education savings in a precarious position. Since equity markets appreciated over that time, it's possible that accountholders invested in these troubled portfolios actually earned up to an additional 4%, until Vanguard corrected the error on March 24, 2021.

The issue went undetected by Nevada, its investment consultant, or Vanguard for several months. Together, Nevada and Vanguard published an announcement of the completed overhaul with the erroneous allocations on Oct. 30, 2020. Based on Morningstar's month-end portfolio data, the misallocations continued through February 2021. Vanguard identified the issue internally and brought the allocations back in line in March. The investigation of the incident is still ongoing, but given that most investors probably made money as a result of the mix-up, it's unlikely that Vanguard will retroactively correct most accountholders' returns to mimic the intended allocations.

Supplement to the Program Description, Oct. 30, 2020

Source: MSRB.

Supplement to the Program Description, March 24, 2021

Source: MSRB.

Who Was Affected?

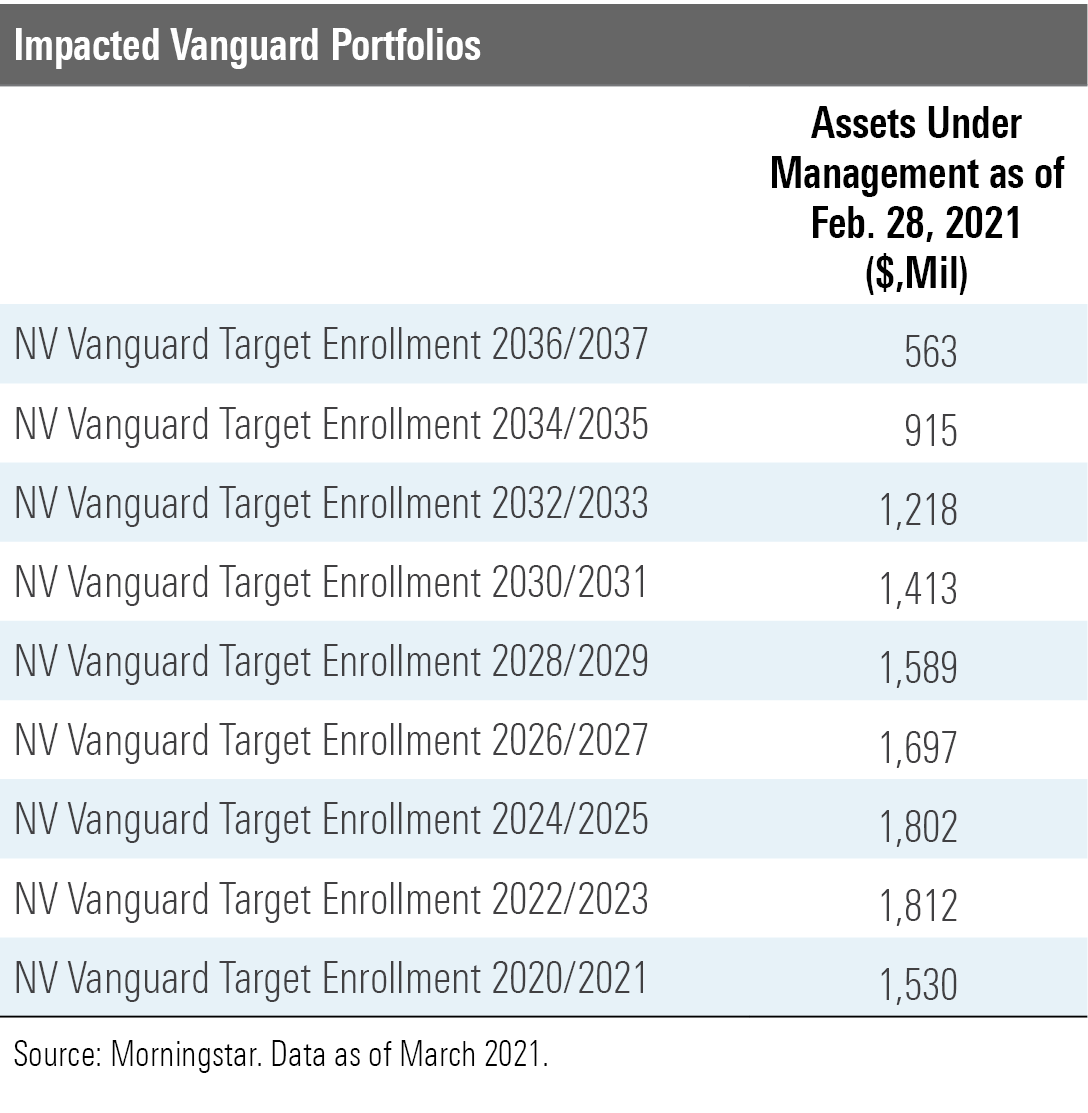

Vanguard identified nine portfolios in its suite of 11 options, called target-enrollment portfolios, that were impacted. All education savers invested in these portfolios were affected. Investor assets in these portfolios stood at $12.5 billion as of February 2021, more than 45% of the $27.3 billion assets in the plan.

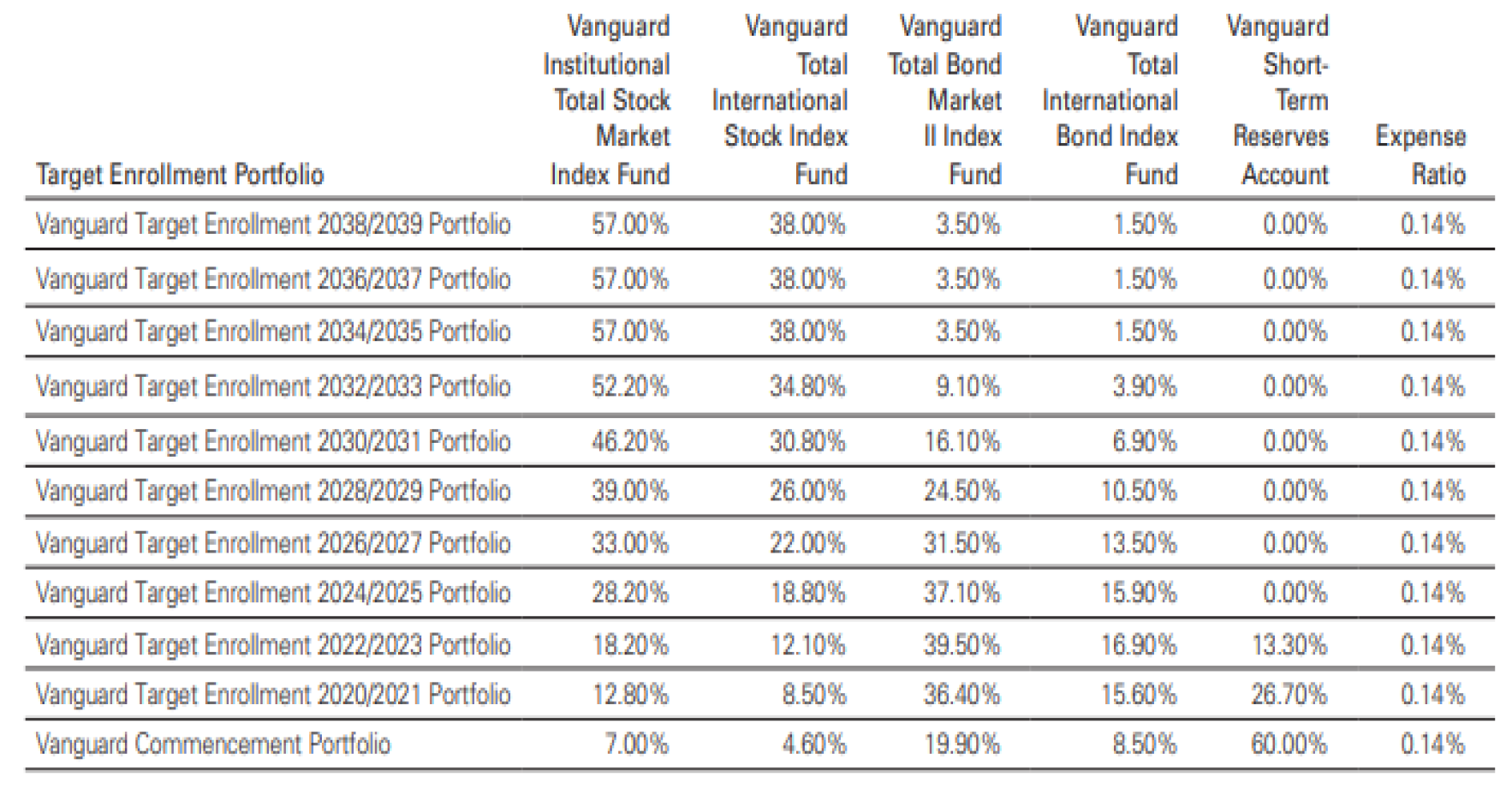

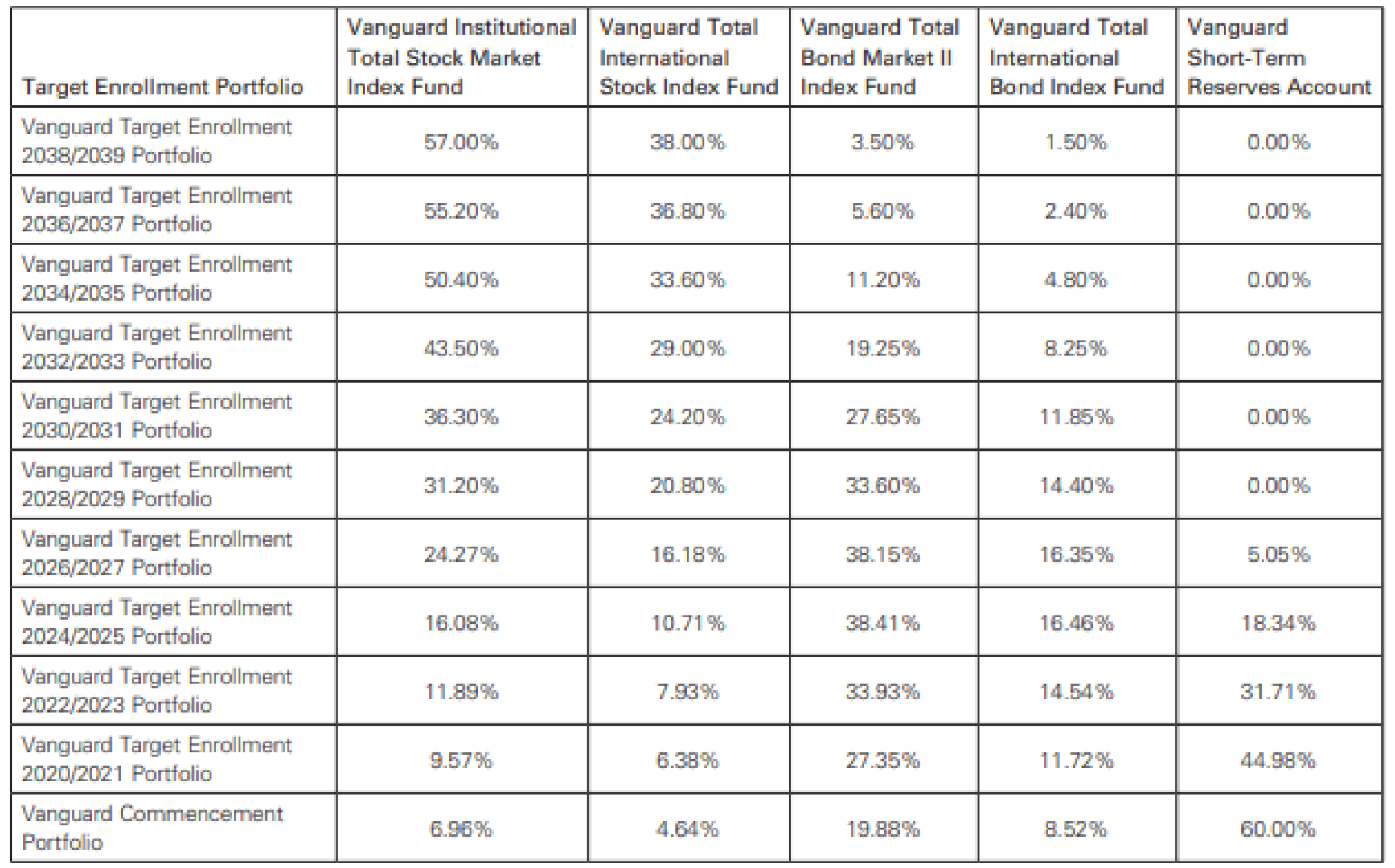

What Happened?

In the process of rolling out a new approach that turns on a child's targeted year of enrollment rather than her age, Vanguard incorrectly mapped its own recommendations to the new portfolios. Prior to the launch of the portfolios, the issue was not detected by either Vanguard or Nevada. Vanguard subsequently implemented the incorrect allocations in this plan.

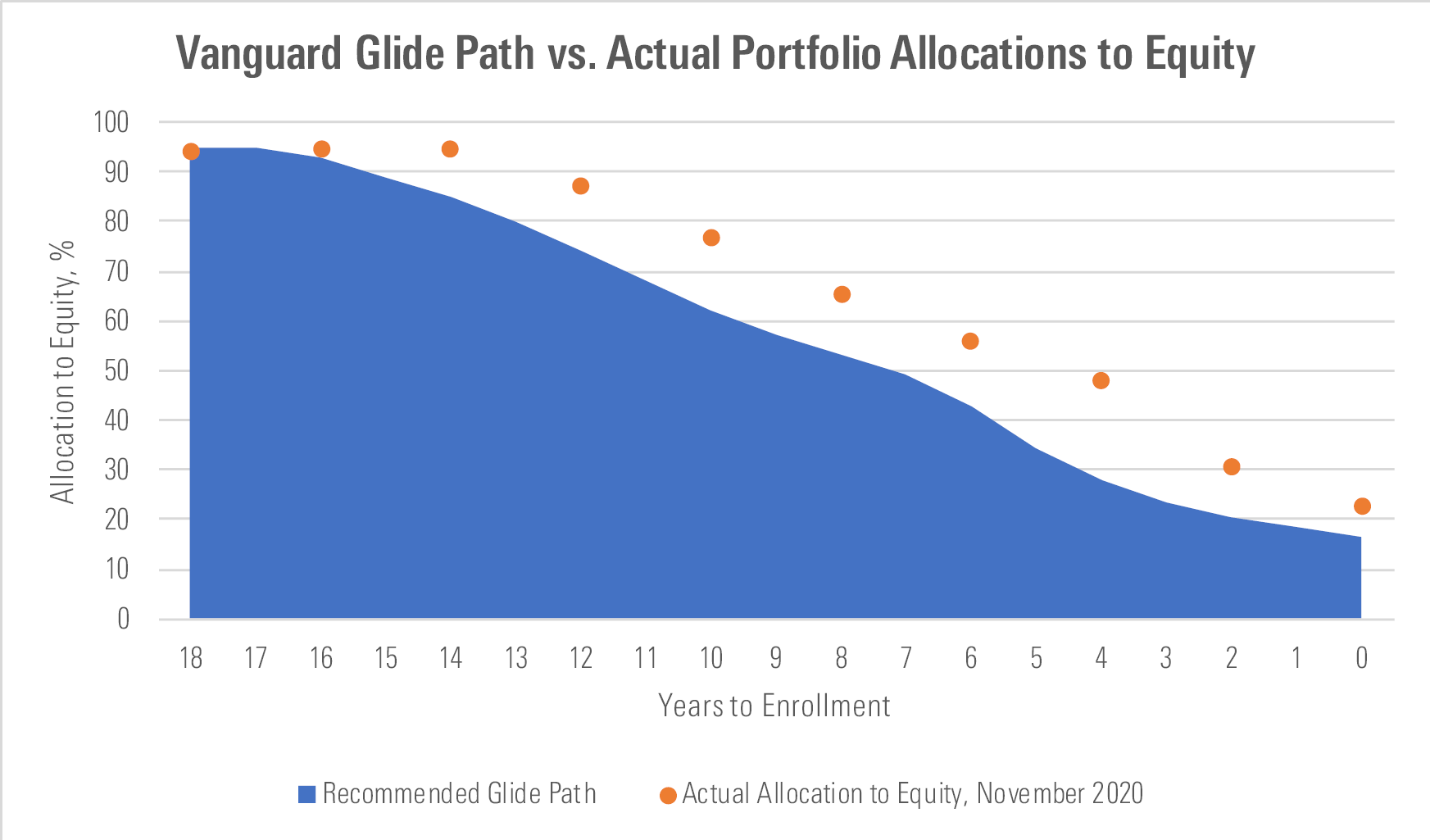

The plan transitioned from an age-based fixed structure to a target-enrollment model in October 2020. Unlike fixed portfolios that maintain stable allocations over time, target-enrollment options manage risk dynamically by shifting from stocks to bonds over time along a predetermined trail prepared by Vanguard called a glide path.

Like track athletes on a staggered starting line, target-enrollment portfolios will start their gradual risk reduction at different points along the glide path, depending on how far they still have to go until a child's enrollment date. But Vanguard got its measurements wrong, unintentionally extending a 95% equity allocation starting line to the Target Enrollment 2034/2035 portfolio when it should have started at a lower 85% stake in stocks.

Source: Morningstar. Data as of March 2021.

Because 529 plans often cut equity faster than other investments like target-date funds, the additional stock exposure swelled as the portfolios approached enrollment. Vanguard's glide path has a kink when a child is six years away from enrollment, at which point its slope accelerates downward. Like Wile E. Coyote, this feature of the glide path left the Target Enrollment 2024/2025 portfolio stranded in midair. The portfolio started with a whopping 20-percentage-point overweight in equity compared with what Vanguard intended, according to Morningstar's November 2020 portfolio data.

Source: Morningstar. Data as of March 2021.

It's important to note that Morningstar portfolio data includes the impact of cash, which commonly causes our figures to differ from a firm's ideal allocations even in the best of circumstances. (These ideal allocations, called strategic weights, often don't account for the inconveniences of reality.) The target-enrollment portfolios carried about 0.5% of excess cash over this time, which placed the Target Enrollment 2036/2037 portfolio's overweight in equity within a margin of error.

Lady Luck Saved College Savers

With these massive unintended swings, The Vanguard 529 Plan left investors in a vulnerable position, but education savers got lucky this time. It's likely that most accountholders actually made money as a result of this blunder.

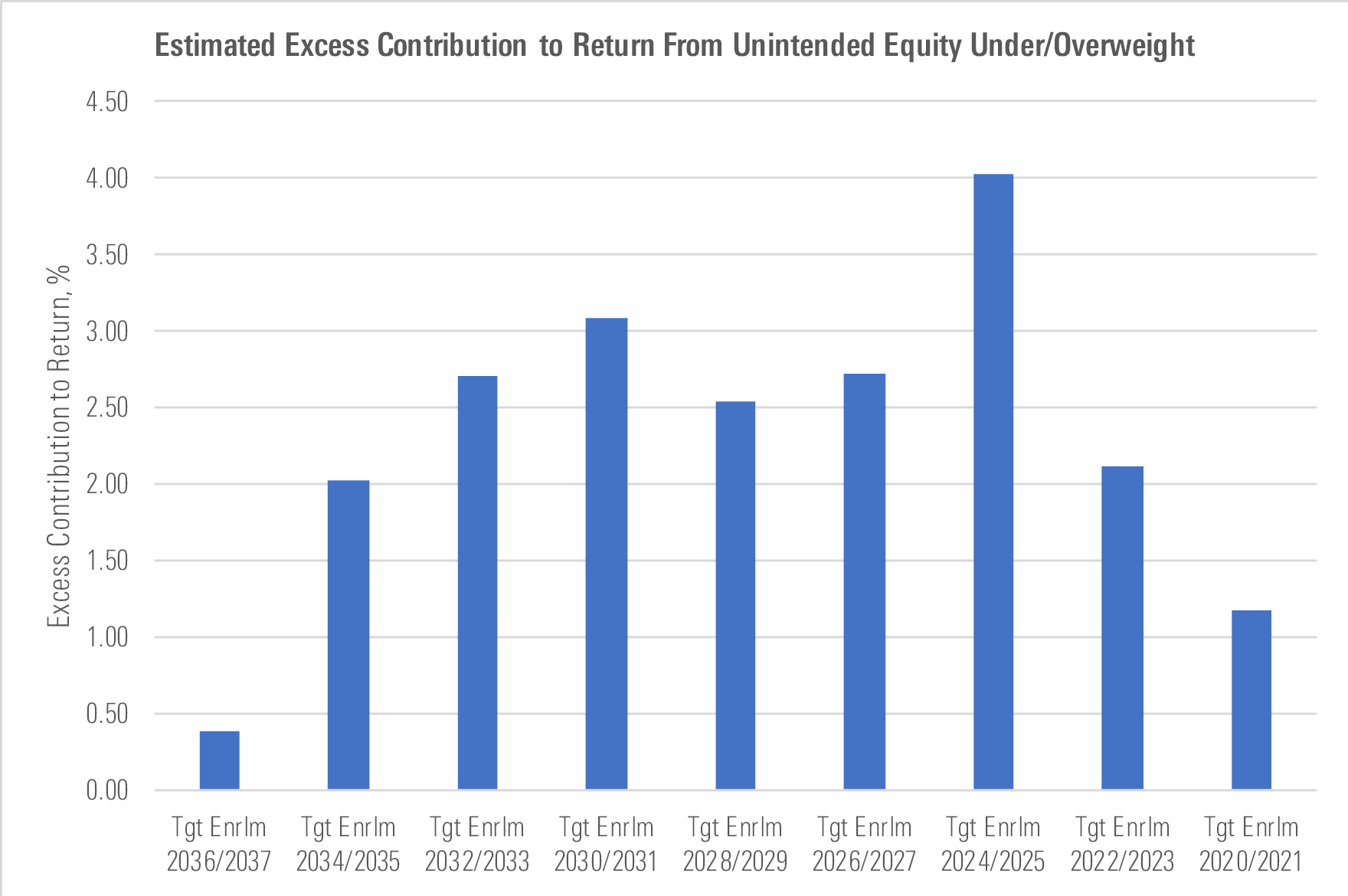

Vanguard's target-enrollment portfolios only hold four mutual funds and maintain a consistent split between U.S. and non-U.S. exposure, which makes it straightforward to approximate the impact of the mistake. From Oct. 30, 2020, through March 24, 2021, a hypothetical 60%/40% portfolio of Vanguard Institutional Total Stock Market Index VITPX and Vanguard Total International Stock Index VTISX returned 20.7% net of fees. Over that same time period, a basket of 70%/30% Vanguard Total Bond Market II Index VTBNX and Vanguard Total International Bond Index VTIFX would have returned negative 1.9%. Luck can sometimes pay off more than skill.

Adjusting this return differential to the size of each portfolio's unintended overweight, we find that this relationship may have actually boosted investors' returns by up to 4% before Vanguard readjusted the allocations.

Source: Morningstar. Data as of March 2021.

On Jan. 4, 2021, the portfolios derisked by 0% to 2% as designed, which we've included in our estimated excess contributions. Because some investors made contributions or withdrawals over the period, we can't know exactly how much investors gained or lost from the mistake. As a result, these figures are only estimates, but based on the assets in the portfolios reported in November 2020, investors collectively could have netted more than $200 million.

What's Next?

We will continue to evaluate the developments that unfold from this error, but for now, The Vanguard 529 Plan continues to earn Above Average People and Process ratings. In the event that any investors lost money as a result of this error we are confident that Vanguard will make investors whole. Plus, Vanguard's robust research organization and long history of broad diversification, both of which drive these pillars, are still intact. Under Morningstar's new 529 plan methodology released in 2020, the State Treasurer of Nevada received a Parent rating downgrade to Below Average in recognition of the limited administrative oversight the trustee can afford each of its five plans, including this one. Given its low fees, on balance, these pillar ratings drive a Morningstar Rating of Silver.

Vanguard still intends to expand its target-enrollment methodology to other plans that it advises, with Pennsylvania slated to execute the next transition in April. Investors in Pennsylvania's plan received a brochure distributed in March that borrowed from Nevada's incorrect recommendations. Pennsylvania has promised to notify investors of this error in advance of the transition, and Vanguard intends to apply corrected recommendations to the new portfolios. We will be monitoring the developments of these planned transitions for evidence that Vanguard has taken steps to make its recommendations clearer to the states it advises, and that the trustees are able to properly implement Vanguard's recommendations.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)