The Promise and Peril of Multi-Asset Income

Don’t let the solution for more income be worse than the problem.

A tough decade for income-seeking investors has only gotten more challenging in 2020. At the end of October, the yield on the Bloomberg Barclays U.S. Aggregate Bond Index was 1.25%, nearly a full percentage point lower than it was a year ago. Yields have fallen as the Fed slashed rates to near zero and investors piled into safe havens amidst heightened uncertainty stemming from the coronavirus pandemic.

Given the scarcity of income from high-quality bonds, investors may understandably cast a wandering eye toward the seeming oasis offered by multi-asset income funds. These allocation funds combine multiple income-producing asset classes, like dividend-paying stocks, REITs, high-yield bonds, and emerging-markets debt, to generate above-average income.

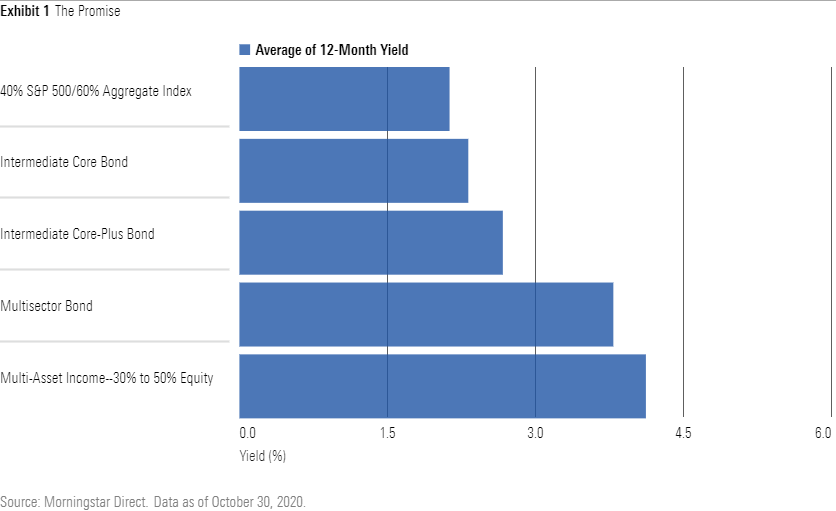

Most multi-asset income funds reside in the allocation -- 30% to 50% equity Morningstar Category. There, they have easily met their higher income targets. Exhibit 1 shows the average 12-month yield for multi-asset income funds in the allocation -- 30% to 50% equity category compared with other popular fixed-income categories and a 40% S&P 500/60% Aggregate Index benchmark.

The average multi-asset income fund in the category has yields just over 4%, almost 2 full percentage points more than a straightforward 40/60 portfolio of U.S. stocks and bonds and almost 1.5 percentage point more than the average core and core-plus bond fund. Multisector bond funds, which have similar allocations as multi-asset income funds with the exception of stocks, comes the closest with an average 12-month yield of 3.75%. The additional income from these multi-asset income funds doesn’t come without additional risk, though.

We've Seen This Film Before, and We Didn't Like the Ending Traditional multi-asset funds, like our 40/60 benchmark, seek to pair riskier assets, like stocks, with safer ones, like high-quality bonds, to provide balance in various market conditions. Stocks tend to do poorly during periods of heightened economic uncertainty. High-quality bonds tend to perform better in those scenarios as investors flock to safety. U.S. Treasuries, for example, have virtually zero risk of defaulting, so investors seek these out as a place to hide while collecting more income than they could with a simple money market fund or other cash instruments.

Most multi-asset income funds lack this balance. The securities they target across stocks and bonds distribute above-average income as compensation for higher risk. The stock portfolios tend to land in the value portion of the Morningstar Style Box, where companies are more likely to pay above-average dividend yields. The fixed-income sectors, like below-investment-grade bonds and emerging-markets debt, tend to follow the same direction as stocks during stress periods. The lower the bond's quality, the higher the risk of default during stressed economic periods. Emerging-markets countries also tend to be more sensitive to commodity prices, like oil, which tend to do poorly in uncertain times.

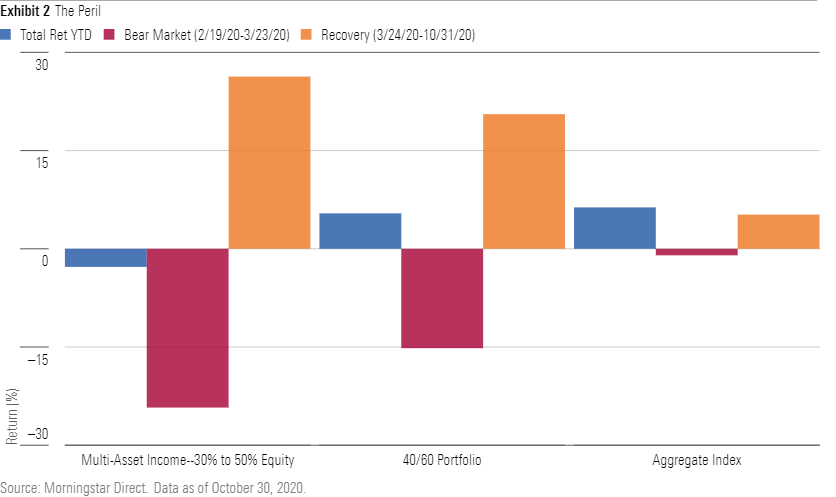

In 2020, we’ve seen the manifestation of these risks in the performance of multi-asset income funds. Exhibit 2 shows the year-to-date returns through October and the bear market and recovery returns for the average multi-asset income fund in the allocation -- 30% to 50% equity category, the 40/60 benchmark, and the low-yielding Aggregate Index.

In the first quarter, when the S&P 500 fell more than 30%, multi-asset income funds had little ballast to offset the steep decline in the equity sleeve of the portfolio. That led to a drawdown of 24% for the average multi-asset income fund. The 40/60 benchmark benefited from the defensive nature of its high-quality bond portfolio, falling 15% over the same period. The Aggregate Index wasn’t immune to the sell-off, largely because even investment-grade corporate bonds lost money. But solid gains by Treasuries helped it register a meager 1% loss, handily outpacing the fixed-income sectors common in multi-asset income funds.

The performance in the first quarter wasn’t an anomaly. Multi-asset income funds experienced similar struggles during the fourth quarter of 2018, when the S&P 500 fell nearly 20%. Indeed, over the past five years, the average multi-asset income fund in the category has captured 140% of the downside of our 40/60 benchmark and only 100% of the upside. Given the exposures in multi-asset income funds, we don’t expect this pattern to meaningfully change in the next downturn; even if one asset class relatively outperforms, like value stocks falling less than growth stocks during the tech bubble, the combination of asset classes is ill-suited for market sell-offs.

Don't Ignore the Warning Signs The additional risk multi-asset income funds court in their pursuit for high yields is clear. However, investors can still make use of these strategies by being thoughtful about how they allocate to them. As these strategies are focused on income, it may be tempting to consider them a substitute for higher-quality bonds. But as we've illustrated above, these funds carry far more downside risk than high-quality bonds. Swapping a lower-risk asset with a higher-risk one will certainly increase the overall risk of a portfolio, without a certainty of improved risk-adjusted performance.

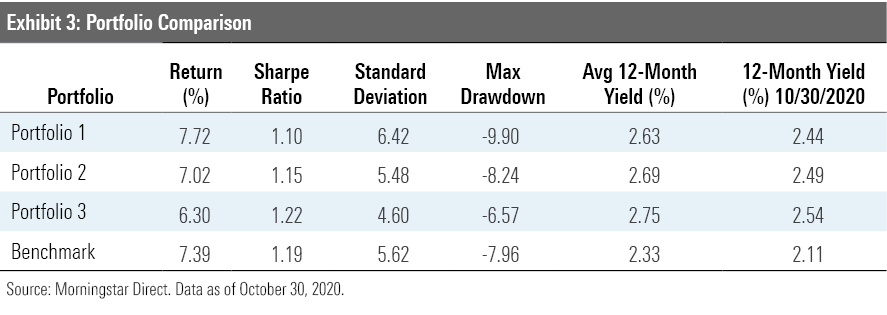

As an example, we built three portfolios based on our 40/60 benchmark. In each portfolio, we added a 15% allocation to BlackRock Multi-Asset Income BIICX, which has a Morningstar Analyst Rating of Silver, but varied whether it was funded from bonds, stocks, or equally from both.

- Portfolio 1 (funded from bonds): 45% Vanguard Total Bond Market ETF BND, 40% Vanguard Total Stock Market ETF VTI, 15% BlackRock Multi-Asset Income

- Portfolio 2 (funded from stocks and bonds equally): 52.5% BND, 32.5% VTI, 15% BlackRock Multi-Asset Income

- Portfolio 3 (funded from stocks): 60% BND, 25% VTI, 15% BlackRock Multi-Asset Income

- Benchmark: 60% BND, 40% VTI

Exhibit 3 shows the annualized return, standard deviation, Sharpe ratio, max drawdown, and average yield over the past 10 years.

BlackRock Multi-Asset Income is one of our highest-conviction multi-asset income funds and it has assembled a strong long-term track record, so these results aren’t necessarily reflective of all multi-asset income funds.

Portfolio 3, which funds the multi-asset income fund from the stock portfolio, not only led to higher average income but also led to the best risk-adjusted returns and lowest max drawdown over the last decade. True, funding the multi-asset income fund from bonds would have led to the highest total return, but investors would have had to stomach nearly 40% more volatility. Its lower Sharpe ratio indicates the additional returns weren’t compensated by the additional risk taken.

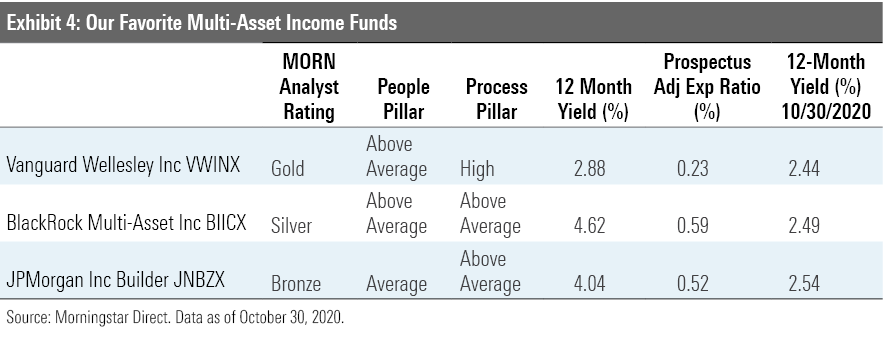

Our Favorite Multi-Asset Income Funds Not all multi-asset income funds will give investors the same warm fuzzy feeling. It's important to understand each fund's risk profile. Exhibit 4 shows three of our top picks for multi-asset income funds in the allocation -- 30% to 50% equity category.

Vanguard Wellesley Income VWINX is the most conservative multi-asset income fund in the category. Its 2.88% yield is lower than the multi-asset income average of 4% in the category. It derives most of its yield from its 35% allocation to dividend-paying stocks; its bond portfolio is limited to investment-grade U.S. bonds, a stark contrast to peers that seek out more adventurous fixed-income sectors.

BlackRock Multi-Asset Income leverages the firm’s strong fixed-income and risk-management capabilities to take a more tactical approach to generating income across a broad universe that includes global high-yield, bank loans, covered-call strategies, and preferred stocks. With a yield of 4.6%, it’s an attractive option for investors looking to boost their portfolio’s income with a risk-aware strategy.

JPMorgan Income Builder JNBZX also employs a tactical process and consistently tilts toward more international stocks, which currently make up about 18% of fund assets versus 8% for the category norm. Management favors international stocks because they tend to have higher dividend payouts than U.S. stocks. The fund’s current yield of 4% is competitive with other multi-asset income funds. Its fixed-income exposure tends to heavily favor below-investment-grade bonds, so it has tended to do a little worse than peers in periods of economic stress.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)