Consumer Defensive Sector Looks Fully Valued

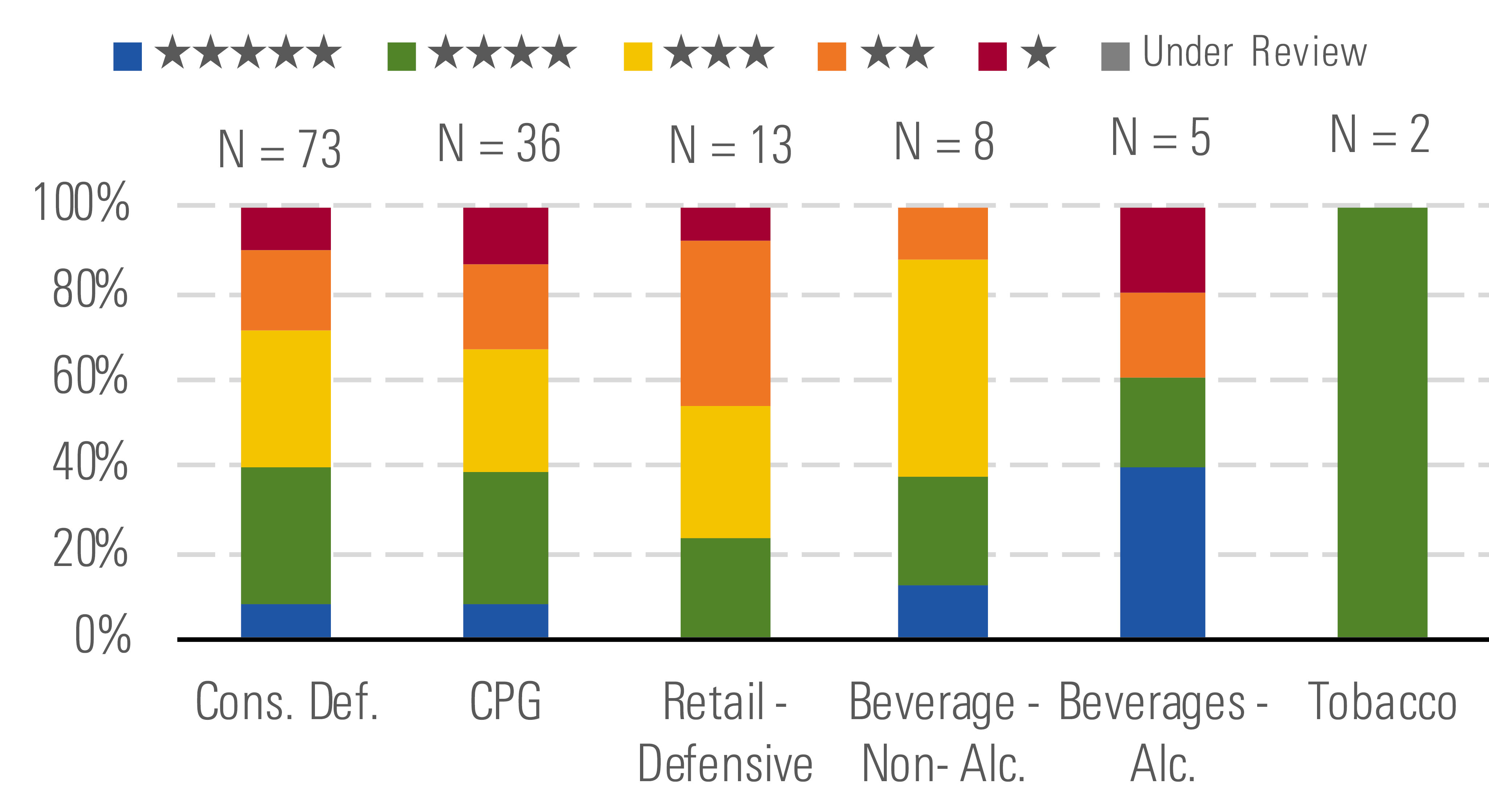

Alcohol and tobacco stocks are trading at the greatest discounts to our fair value estimates.

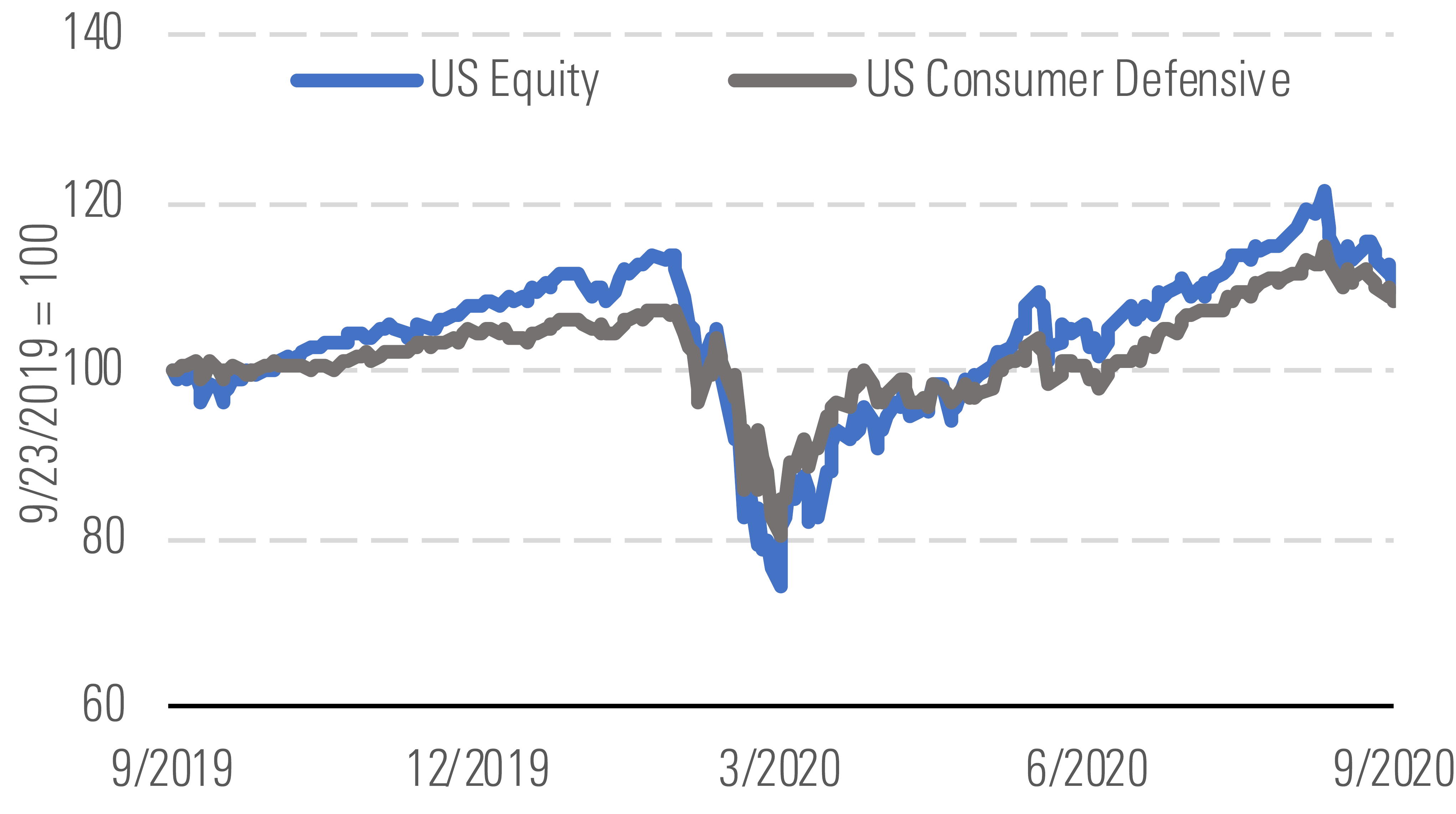

The consumer defensive sector outperformed the broader market in the third quarter, returning 7.6% compared with the market’s 5.1% gain through Sept. 23.

Consumer defensive has beat the broader market. - source: Morningstar

As a whole, we view the sector as fully valued, with the median consumer defensive stock trading at a 2% discount to our intrinsic valuation, comparable to the 1% median discount at the end of June. Increased demand from pantry stocking contributed to impressive second-quarter results buoying performance for consumer packaged goods and defensive retailers, but not enough to justify the rally we've seen. We believe there are value opportunities in alcoholic beverages and tobacco, which have both taken a hit as a result of health concerns and consumers staying home. The subsectors trade at 15% and 26% discounts to our fair value estimates, respectively.

Alcoholic beverages and tobacco still look relatively attractive. - source: Morningstar

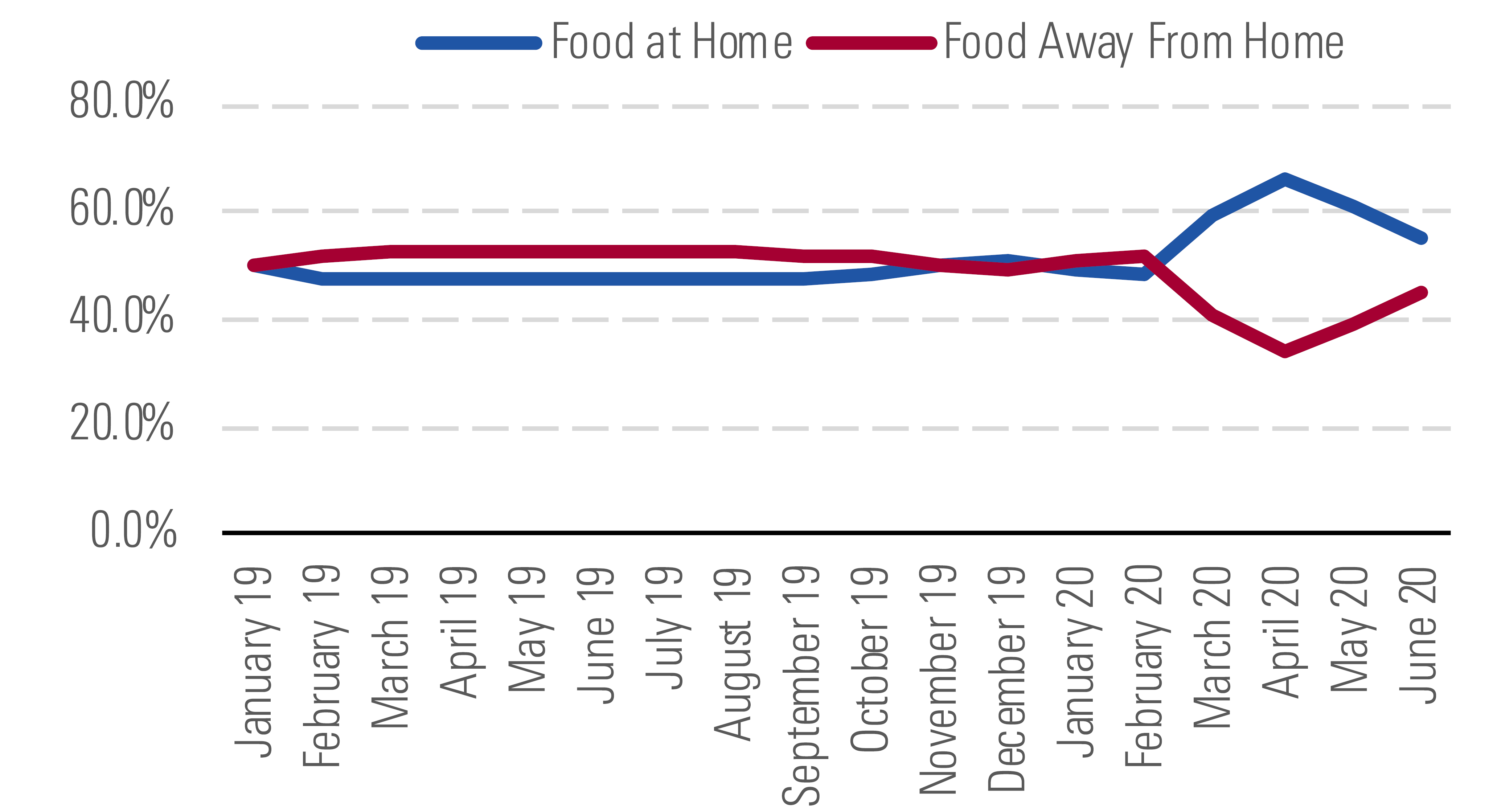

Before the pandemic, wallet share for at-home food consumption and food away from home was about equal, accounting for 49.3% and 50.7% of spending, respectively, in January 2020. But stay-at-home orders tilted the scales to at-home dining, which boosted wallet share to a peak of 66% in April compared with just 34% for food away from home. However, we’ve already seen these levels revert. As such, we think investors are overexaggerating the concern that the pandemic will impair food away-from-home spending longer term. We expect volatility through the remainder of this year and into 2021 but predict food away-from-home spending will return to prepandemic levels by 2022.

Social distancing has buoyed spending on food for at-home consumption. - source: Morningstar

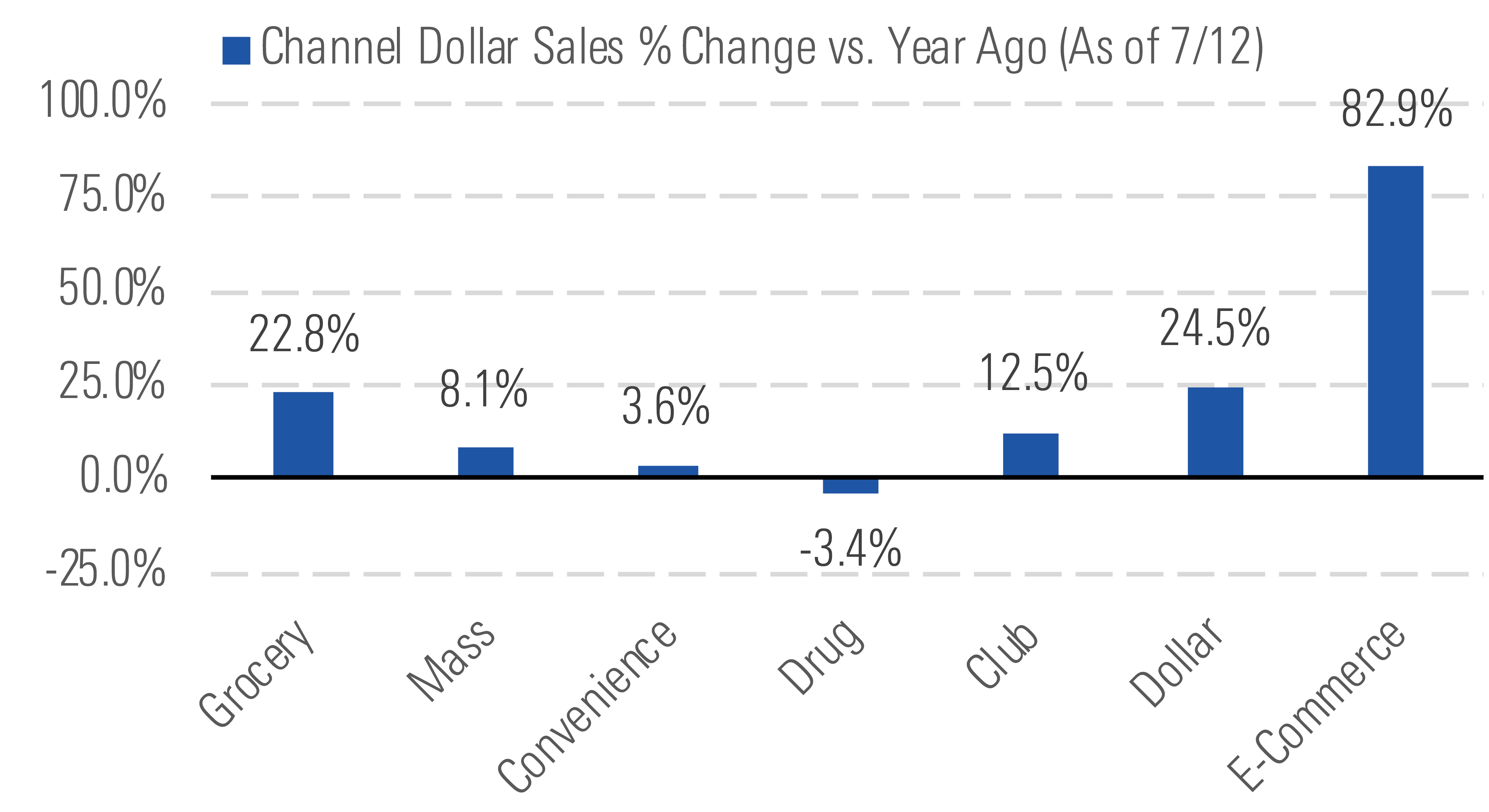

Another secular trend accelerated by the pandemic has been the shift from brick-and-mortar to e-commerce for consumer product purchases. This can be seen in a recent report from market research firm IRI that showed an 83% increase in sales through the e-commerce channel as of July 12, most of which is done through third-party sites (such as Amazon or Walmart). Although shelf space is essentially limitless online, market research firm SMA Marketing cites that 75% of consumers don’t continue beyond the first page of search results. For this reason, we believe it’s essential for companies to continue to spend on marketing behind brands to ensure they are top of mind for customers.

Consumers have quickly adapted to purchasing CPG products online. - source: Morningstar

Top Picks

Anheuser-Busch InBev BUD Star Rating: ★★★★★ Economic Moat Rating: Wide Fair Value Estimate: $96 Fair Value Uncertainty: Medium

We think investors should consider wide-moat Anheuser-Busch InBev, currently trading at a 43% discount to our fair value estimate. Higher-margin on-premises sales have taken a hit during the pandemic, but we expect sales to rebound in 2021 as social distancing guidelines are relaxed and postponed sporting events take place. CEO Carlos Brito plans to step down next year, but we think the firm’s immediate capital allocation priority of debt reduction will remain intact once a replacement is named. We believe the firm is well positioned for the long term with cost advantages and efficient operations that continue to generate value.

Coty COTY Star Rating: ★★★★★ Economic Moat Rating: None Fair Value Estimate: $6.50 Fair Value Uncertainty: High

We think long-term investors should consider no-moat Coty, currently trading at a 52% discount to our fair value estimate. Throughout the pandemic, the luxury beauty market has been especially hard-hit due to the extended closure of department stores and depressed air passenger traffic, which pressured travel retail sales. However, we do not think investors are appreciating the progress in turnaround efforts and improved liquidity from the KKR investment. We are optimistic about the appointment of Sue Nabi as CEO and think her experience in the industry will help lead Coty through its transition and stabilize its brand portfolio.

Molson Coors Beverage TAP Star Rating: ★★★★★ Economic Moat Rating: None Fair Value Estimate: $55 Fair Value Uncertainty: Medium

Shares of no-moat Molson Coors trade at a 39% discount to our valuation. The firm’s legacy brands have proved difficult to parlay into higher-end categories with more propitious growth prospects. Earlier this year, the firm entered the lucrative hard seltzer category with the launch of Vizzy and Coors Seltzer. While we are encouraged by the initial performance of Vizzy, it's possible that Coors Seltzer could divert sales away from its legacy beer products. Nevertheless, with current trading levels implying irreparably impaired brand equity across the major trademarks, we think the margin of safety in the shares is compelling.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)